Competitive markets and perfect competition

... Firms operating under conditions of competition have to remain price competitive and will try to improve the quality of their product/service to stay ahead of their competitors Perfect competition is an extreme form of competition and is based on the following assumptions Large number of buyers a ...

... Firms operating under conditions of competition have to remain price competitive and will try to improve the quality of their product/service to stay ahead of their competitors Perfect competition is an extreme form of competition and is based on the following assumptions Large number of buyers a ...

Chapter 14: Monopolistic Competition and Oligopoly

... • Since in long-run, the monopolistically competitive firm produces on the downward sloping portion of ATC, MC is below ATC. Since P=ATC in long-run, MC < ATC = P and thus MC < P. Monopolistic competition and the welfare of society Is monopolistic competition desirable from the standpoint of society ...

... • Since in long-run, the monopolistically competitive firm produces on the downward sloping portion of ATC, MC is below ATC. Since P=ATC in long-run, MC < ATC = P and thus MC < P. Monopolistic competition and the welfare of society Is monopolistic competition desirable from the standpoint of society ...

cm24e perfect competition

... changing the quantity demanded. (In the formal Arrow-Debreu model each transactor, each firm and household, is so tiny that they are represented as points on a line.) (3) The good or service is homogeneous (and in the ArrowDebreu model the commodity is infinitely divisible), every unit of the good o ...

... changing the quantity demanded. (In the formal Arrow-Debreu model each transactor, each firm and household, is so tiny that they are represented as points on a line.) (3) The good or service is homogeneous (and in the ArrowDebreu model the commodity is infinitely divisible), every unit of the good o ...

Chapter 8: Competitive Firms and Markets

... Competitive Firms and Markets • We learned firms’ production and cost functions. • In this chapter, we study how firms use those information to reach the most efficient outcome and how market equilibrium is determined. ...

... Competitive Firms and Markets • We learned firms’ production and cost functions. • In this chapter, we study how firms use those information to reach the most efficient outcome and how market equilibrium is determined. ...

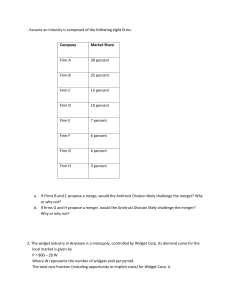

Fall 2010

... There are 2 alternative technologies that can be used by any firm. Techology one has production function sf (n) , where s represents span of control and n employment. Technology two has production function θsf (n) where θ > 1 but requires in addition an addition f workers (as fixed cost.) The distri ...

... There are 2 alternative technologies that can be used by any firm. Techology one has production function sf (n) , where s represents span of control and n employment. Technology two has production function θsf (n) where θ > 1 but requires in addition an addition f workers (as fixed cost.) The distri ...

Brander–Spencer model

The Brander–Spencer model is an economic model in international trade originally developed by James Brander and Barbara Spencer in the early 1980s. The model illustrates a situation where, under certain assumptions, a government can subsidize domestic firms to help them in their competition against foreign producers and in doing so enhances national welfare. This conclusion stands in contrast to results from most international trade models, in which government non-interference is socially optimal.The basic model is a variation on the Stackelberg–Cournot ""leader and follower"" duopoly game. Alternatively, the model can be portrayed in game theoretic terms as initially a game with multiple Nash equilibria, with government having the capability of affecting the payoffs to switch to a game with just one equilibrium. Although it is possible for the national government to increase a country's welfare in the model through export subsidies, the policy is of beggar thy neighbor type. This also means that if all governments simultaneously attempt to follow the policy prescription of the model, all countries would wind up worse off.The model was part of the ""New Trade Theory"" that was developed in the late 1970s and early 1980s, which incorporated then recent developments from literature on industrial organization into theories of international trade. In particular, like in many other New Trade Theory models, economies of scale (in this case, in the form of fixed entry costs) play an important role in the Brander–Spencer model.