I. What is the Goal of Management?

... 1. The exposure—Lufthansa agreed to pay Boeing $500 million a year later and if the deutschemark continued to fall that would end up being more money to pay in one year 2. The management strategy—decided to use forward contracts to cover half the exposure 3. The outcome—since the dollar fell dramati ...

... 1. The exposure—Lufthansa agreed to pay Boeing $500 million a year later and if the deutschemark continued to fall that would end up being more money to pay in one year 2. The management strategy—decided to use forward contracts to cover half the exposure 3. The outcome—since the dollar fell dramati ...

A firm`s current balance sheet is as follows: Assets

... Since the firm is currently using only 10% debt financing, it is not at its optimal capital structure and should substitute some debt for equity. c. The cost of capital initially declines because the effective cost of debt is less than the cost of equity. d. As the firm continues to substitute debt ...

... Since the firm is currently using only 10% debt financing, it is not at its optimal capital structure and should substitute some debt for equity. c. The cost of capital initially declines because the effective cost of debt is less than the cost of equity. d. As the firm continues to substitute debt ...

Oligopoly File

... • Formal conclusion takes place when firms openly agree on the price that they will all charge, although sometimes it may be agreement on market share or an marketing cartel. This type of collusion is called cartel. • Since this results in higher prices and less output for consumers, this is usually ...

... • Formal conclusion takes place when firms openly agree on the price that they will all charge, although sometimes it may be agreement on market share or an marketing cartel. This type of collusion is called cartel. • Since this results in higher prices and less output for consumers, this is usually ...

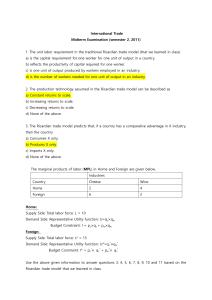

Problem Set 1

... c. If the firm wants to maximize its dollar sales volume, what price should it charge? (Answer: P = $1500) 2. Suppose: (1) the demand function of good 1 is linear, i.e. Q1 40 0.5P1 ; (2) the demand function of good 2 is also linear; (3) the demand curve of good1 crosses the demand curve of good2 ...

... c. If the firm wants to maximize its dollar sales volume, what price should it charge? (Answer: P = $1500) 2. Suppose: (1) the demand function of good 1 is linear, i.e. Q1 40 0.5P1 ; (2) the demand function of good 2 is also linear; (3) the demand curve of good1 crosses the demand curve of good2 ...

Perfect Competition

... scale of their operations: there is no distinction between fixed and variable cost because all resources under the firm’s control are variable Short-run economic profit will in the long run encourage new firms to enter the market and may prompt existing firms to expand the scale of their operation ...

... scale of their operations: there is no distinction between fixed and variable cost because all resources under the firm’s control are variable Short-run economic profit will in the long run encourage new firms to enter the market and may prompt existing firms to expand the scale of their operation ...

Market Structures

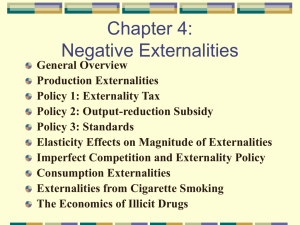

... sometimes have negative effects on consumers and our whole economy. Markets dominated by only a few large firms tend to have higher prices and lower output than markets with many sellers. A firm with monopoly power can use predatory pricing. Predatory pricing is the practice of setting the market ...

... sometimes have negative effects on consumers and our whole economy. Markets dominated by only a few large firms tend to have higher prices and lower output than markets with many sellers. A firm with monopoly power can use predatory pricing. Predatory pricing is the practice of setting the market ...

Technological Change and Dynamic Equilibrium

... world that the static model describes is one in which changes are discrete events and the expected normal state to which the economy moves is one in which prices and quantities remain constant at their equilibrium levels. But we live in a dynamic economy that is constantly in flux, rather more like ...

... world that the static model describes is one in which changes are discrete events and the expected normal state to which the economy moves is one in which prices and quantities remain constant at their equilibrium levels. But we live in a dynamic economy that is constantly in flux, rather more like ...

Brander–Spencer model

The Brander–Spencer model is an economic model in international trade originally developed by James Brander and Barbara Spencer in the early 1980s. The model illustrates a situation where, under certain assumptions, a government can subsidize domestic firms to help them in their competition against foreign producers and in doing so enhances national welfare. This conclusion stands in contrast to results from most international trade models, in which government non-interference is socially optimal.The basic model is a variation on the Stackelberg–Cournot ""leader and follower"" duopoly game. Alternatively, the model can be portrayed in game theoretic terms as initially a game with multiple Nash equilibria, with government having the capability of affecting the payoffs to switch to a game with just one equilibrium. Although it is possible for the national government to increase a country's welfare in the model through export subsidies, the policy is of beggar thy neighbor type. This also means that if all governments simultaneously attempt to follow the policy prescription of the model, all countries would wind up worse off.The model was part of the ""New Trade Theory"" that was developed in the late 1970s and early 1980s, which incorporated then recent developments from literature on industrial organization into theories of international trade. In particular, like in many other New Trade Theory models, economies of scale (in this case, in the form of fixed entry costs) play an important role in the Brander–Spencer model.