C`(q)

... approximations. True functions in economics jump from value to value. However, because the jumps are small, we can approximate with continuous functions. ...

... approximations. True functions in economics jump from value to value. However, because the jumps are small, we can approximate with continuous functions. ...

Revised Chapter 5 slides

... Tariffs and Export Subsidies: Simultaneous Shifts in RS and RD Effects of an Export Subsidy • Tariffs and export subsidies are often treated as similar policies but they have opposite effects on the terms of trade. – Example: Suppose that Home offers 20% subsidy on the value of cloth exported: – ...

... Tariffs and Export Subsidies: Simultaneous Shifts in RS and RD Effects of an Export Subsidy • Tariffs and export subsidies are often treated as similar policies but they have opposite effects on the terms of trade. – Example: Suppose that Home offers 20% subsidy on the value of cloth exported: – ...

Chapter 10 - Pegasus @ UCF

... In essence, we will assume that the firm’s goal is to maximize output subject to a cost constraint. We will see that this is the same as minimizing the cost of producing a given level of output. Keep in mind that all inputs are variable in the LR – plant size can be changed, – new locations can ...

... In essence, we will assume that the firm’s goal is to maximize output subject to a cost constraint. We will see that this is the same as minimizing the cost of producing a given level of output. Keep in mind that all inputs are variable in the LR – plant size can be changed, – new locations can ...

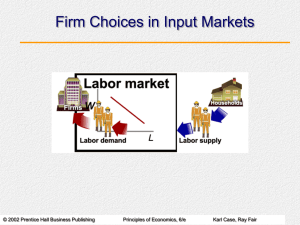

Ch19

... The equilibrium quantity of capital is ________. A. determined by only the supply of capital because the supply is perfectly inelastic B. determined by only the demand for capital because the demand is perfectly inelastic C. expected to increase at the same rate as the interest rate D. determined by ...

... The equilibrium quantity of capital is ________. A. determined by only the supply of capital because the supply is perfectly inelastic B. determined by only the demand for capital because the demand is perfectly inelastic C. expected to increase at the same rate as the interest rate D. determined by ...

Chapter 8 - Monopoly and Imperfect Competition

... Without knowing in advance what the other will do No matter what Filip does, Gus’s best move is to charge a low price—his dominant strategy A similar analysis from Filip’s point of view, would tell us that his dominant strategy is the same: a low price ...

... Without knowing in advance what the other will do No matter what Filip does, Gus’s best move is to charge a low price—his dominant strategy A similar analysis from Filip’s point of view, would tell us that his dominant strategy is the same: a low price ...

Brander–Spencer model

The Brander–Spencer model is an economic model in international trade originally developed by James Brander and Barbara Spencer in the early 1980s. The model illustrates a situation where, under certain assumptions, a government can subsidize domestic firms to help them in their competition against foreign producers and in doing so enhances national welfare. This conclusion stands in contrast to results from most international trade models, in which government non-interference is socially optimal.The basic model is a variation on the Stackelberg–Cournot ""leader and follower"" duopoly game. Alternatively, the model can be portrayed in game theoretic terms as initially a game with multiple Nash equilibria, with government having the capability of affecting the payoffs to switch to a game with just one equilibrium. Although it is possible for the national government to increase a country's welfare in the model through export subsidies, the policy is of beggar thy neighbor type. This also means that if all governments simultaneously attempt to follow the policy prescription of the model, all countries would wind up worse off.The model was part of the ""New Trade Theory"" that was developed in the late 1970s and early 1980s, which incorporated then recent developments from literature on industrial organization into theories of international trade. In particular, like in many other New Trade Theory models, economies of scale (in this case, in the form of fixed entry costs) play an important role in the Brander–Spencer model.