WHAT HAPPENS WHEN YOU REGULATE RISK?

... for a continuous-time frictionless representative-agent model with log utility and complete markets in which a VaR constraint is imposed upon the investor), and a detailed understanding of these secondary impacts is essential for the effective evaluation of the pros and cons of the chosen regulatory ...

... for a continuous-time frictionless representative-agent model with log utility and complete markets in which a VaR constraint is imposed upon the investor), and a detailed understanding of these secondary impacts is essential for the effective evaluation of the pros and cons of the chosen regulatory ...

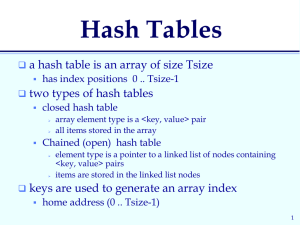

CS-240 Data Structures

... put new item at end (in A[size]) re-establish the heap-order property by moving the new item to where it belongs ...

... put new item at end (in A[size]) re-establish the heap-order property by moving the new item to where it belongs ...

the efficient market hypothesis in developing

... have observed exciting and intriguing behaviour exhibited by stock prices (returns) time series. Such occurrences are sometimes puzzling and potentially difficult to reconcile with market efficiency (Jordan and Miller, 2009). In testing procedures, cases have been observed where some cyclical behavi ...

... have observed exciting and intriguing behaviour exhibited by stock prices (returns) time series. Such occurrences are sometimes puzzling and potentially difficult to reconcile with market efficiency (Jordan and Miller, 2009). In testing procedures, cases have been observed where some cyclical behavi ...

Powerpoint

... ix.remove() removes last element returned by ix.next() throws UnsupportedMethodException if method not implemented throws IllegalStateException if ix.next() not yet called or did not return an element ...

... ix.remove() removes last element returned by ix.next() throws UnsupportedMethodException if method not implemented throws IllegalStateException if ix.next() not yet called or did not return an element ...

Modeling Price Differentials between A Shares and H Shares on the

... The difference in local interest rates, which imply different cost of capital to local investors, is taken into consideration. The inflation rate could also be a possible factor. However, we cannot predict whether it would be positively or negatively related with A-share price premium. To the extent ...

... The difference in local interest rates, which imply different cost of capital to local investors, is taken into consideration. The inflation rate could also be a possible factor. However, we cannot predict whether it would be positively or negatively related with A-share price premium. To the extent ...

Zvi NBER WORKING PAPER SERIES

... Sources: The data on 1 month bills, 20 years bonds, and stocks are from Ibbotson and Sinquefield, Stocks, Bonds, Bills and Inflation, Financial Analysts Research Foundation, 1977, updated by the authors. The Commodity futures series was derived from price data in the Wall Street Journal using a meth ...

... Sources: The data on 1 month bills, 20 years bonds, and stocks are from Ibbotson and Sinquefield, Stocks, Bonds, Bills and Inflation, Financial Analysts Research Foundation, 1977, updated by the authors. The Commodity futures series was derived from price data in the Wall Street Journal using a meth ...

CE221_week_3_Chapter3_ListStackQueuePart1

... Simple Linked Lists - III • If we know where a change is to be made, inserting or removing an item from a linked list involves only a constant number of changes to node links. • The special case of adding to the front or removing the first item is thus a constant-time operation if there exists a li ...

... Simple Linked Lists - III • If we know where a change is to be made, inserting or removing an item from a linked list involves only a constant number of changes to node links. • The special case of adding to the front or removing the first item is thus a constant-time operation if there exists a li ...

CE221_week_3_Chapter3_ListStackQueuePart1

... Simple Linked Lists - III • If we know where a change is to be made, inserting or removing an item from a linked list involves only a constant number of changes to node links. • The special case of adding to the front or removing the first item is thus a constant-time operation if there exists a li ...

... Simple Linked Lists - III • If we know where a change is to be made, inserting or removing an item from a linked list involves only a constant number of changes to node links. • The special case of adding to the front or removing the first item is thus a constant-time operation if there exists a li ...

Determinants of issuance of corporate bonds by

... liquidity relative to other financial assets, expected future interest rates and inflation and government policies. Change in the above factors leads either to rightward or leftward shift in the demand curve at each interest rate or price. A change in relative risk of a bond changes it demand. An in ...

... liquidity relative to other financial assets, expected future interest rates and inflation and government policies. Change in the above factors leads either to rightward or leftward shift in the demand curve at each interest rate or price. A change in relative risk of a bond changes it demand. An in ...

The nested chinese restaurant process and bayesian nonparametric

... For much of its history, computer science has focused on deductive formal methods, allying itself with deductive traditions in areas of mathematics such as set theory, logic, algebra, and combinatorics. There has been accordingly less focus on efforts to develop inductive, empirically based formalis ...

... For much of its history, computer science has focused on deductive formal methods, allying itself with deductive traditions in areas of mathematics such as set theory, logic, algebra, and combinatorics. There has been accordingly less focus on efforts to develop inductive, empirically based formalis ...

PDF

... estimation for each parameter takes a larger number of samples into account and thus they are more robust. Second, the global structure of the directed acyclic graph is a better approximation to the real (in)dependencies in the data. The use of local structure enables the learning procedure to explo ...

... estimation for each parameter takes a larger number of samples into account and thus they are more robust. Second, the global structure of the directed acyclic graph is a better approximation to the real (in)dependencies in the data. The use of local structure enables the learning procedure to explo ...

14. Capital Budgeting Under Uncertainty

... If cash flows show less than perfect correlation, this model is inappropriate and the problem must be handled with a series of conditional probability distributions. In Bonini’s model, cash flow amounts are uncertain but probabilities associated with cash flows in a given period are assumed to be kn ...

... If cash flows show less than perfect correlation, this model is inappropriate and the problem must be handled with a series of conditional probability distributions. In Bonini’s model, cash flow amounts are uncertain but probabilities associated with cash flows in a given period are assumed to be kn ...

NBER WORKING PAPER SERIES MONETARY POLICY IN A FINANCIAL CRISIS Christopher Gust

... this outcome, the currency mismatch between assets and liabilities in the collateral constraint plays the central role. That an expansion outcome is possible is also easy to see. If the nominal interest rate cut succeeds in reducing the real interest rate used to discount future flows, then asset pr ...

... this outcome, the currency mismatch between assets and liabilities in the collateral constraint plays the central role. That an expansion outcome is possible is also easy to see. If the nominal interest rate cut succeeds in reducing the real interest rate used to discount future flows, then asset pr ...

using pls methodology for understanding commodity market

... structural changes following the financial and economic crisis in 2008, sudden and extreme price variations have been observed in the commodities market. “The wide and sudden price variations observed on commodities markets since 2007, in particular on oil and agricultural markets, have made commodi ...

... structural changes following the financial and economic crisis in 2008, sudden and extreme price variations have been observed in the commodities market. “The wide and sudden price variations observed on commodities markets since 2007, in particular on oil and agricultural markets, have made commodi ...

The Pricing and Performance of New Corporate Bonds: TRACE

... by uninformed investors by selling to them. (See also Aggarwal (2003).) This 'flipping potential' hypothesis thus explains the return reversal evidence observed in the IPO market. Moreover, the hypothesis suggests that higher initial post-issuance returns are an indicator of overpricing rather than ...

... by uninformed investors by selling to them. (See also Aggarwal (2003).) This 'flipping potential' hypothesis thus explains the return reversal evidence observed in the IPO market. Moreover, the hypothesis suggests that higher initial post-issuance returns are an indicator of overpricing rather than ...

BREADTH-FIRST SEARCH FOR ZIGBEE TOPOLOGY Qiang Wang

... The aim of this thesis is to do a thorough investigation on the Zigbee protocol and make a method to improve the performance of the Zigbee protocol. Zigbee is a highly reliable wireless connection; Zigbee it uses Carrier Sense Multiple Access Collision Avoidance (CSMA-CA) to increase the reliability ...

... The aim of this thesis is to do a thorough investigation on the Zigbee protocol and make a method to improve the performance of the Zigbee protocol. Zigbee is a highly reliable wireless connection; Zigbee it uses Carrier Sense Multiple Access Collision Avoidance (CSMA-CA) to increase the reliability ...

Lattice model (finance)

For other meanings, see lattice model (disambiguation)In finance, a lattice model [1] is a technique applied to the valuation of derivatives, where, because of path dependence in the payoff, 1) a discretized model is required and 2) Monte Carlo methods fail to account for optimal decisions to terminate the derivative by early exercise. For equity options, a typical example would be pricing an American option, where a decision as to option exercise is required at ""all"" times (any time) before and including maturity. A continuous model, on the other hand, such as Black Scholes, would only allow for the valuation of European options, where exercise is on the option's maturity date. For interest rate derivatives lattices are additionally useful in that they address many of the issues encountered with continuous models, such as pull to par.