Monetary Policy Lessons from the 1990s for Today

... hard-won in the early 1990s. There is also reason to worry that delaying liftoff could fuel an excessive appreciation of equity or real estate prices and cause the economy to overshoot potential as it did in the late 1990s. Yet there are lessons from the 1990s in conjunction with the current shortfa ...

... hard-won in the early 1990s. There is also reason to worry that delaying liftoff could fuel an excessive appreciation of equity or real estate prices and cause the economy to overshoot potential as it did in the late 1990s. Yet there are lessons from the 1990s in conjunction with the current shortfa ...

Parliamentary election cycles and the Turkish banking sector

... banks increase their lending in election years relative to private sector banks. In a similar vein, Brown and Dinç (2005) show that prior to elections, failing banks are less likely to be taken into administration. A recent study by Micco et al. (2007) points out that the performance of stateowned ...

... banks increase their lending in election years relative to private sector banks. In a similar vein, Brown and Dinç (2005) show that prior to elections, failing banks are less likely to be taken into administration. A recent study by Micco et al. (2007) points out that the performance of stateowned ...

Thoughts on the macroeconomic situation: the role of La Caixa presentation

... Questions on economic global recovery arise in USA USA: Housing sales ...

... Questions on economic global recovery arise in USA USA: Housing sales ...

Interest Rate Policy and the Inflation Scare Problem

... been accomplished by changing the level of short rates to set in motion forces slowing the growth of money demand in order to allow a future reduction in money growth and inflation. To view the Federal Reserve’s policy instrument as the federal funds rate is thus to set money to the side, since at a ...

... been accomplished by changing the level of short rates to set in motion forces slowing the growth of money demand in order to allow a future reduction in money growth and inflation. To view the Federal Reserve’s policy instrument as the federal funds rate is thus to set money to the side, since at a ...

Combining active and passive managements in a portfolio

... doing the same the next year. (See Figure below) ...

... doing the same the next year. (See Figure below) ...

Twin Crises in Emerging Markets:

... increases, and as the devaluation is less expected by agents in the economy. We also show that devaluations are in general more contractionary when banks change their strategy (focus of their financial services) in the aftermath of crises. Our paper is also related to the literature that considers ...

... increases, and as the devaluation is less expected by agents in the economy. We also show that devaluations are in general more contractionary when banks change their strategy (focus of their financial services) in the aftermath of crises. Our paper is also related to the literature that considers ...

Document

... Construction of the Spot Rate Curve Several different sets of Treasures can be used to construct a default-free theoretical spot rate curve: On-the-run Treasury: The newest Treasury issues. Bootstrapping used to get the different yields. On-the-run Treasury issues and selected off-the-run Treas ...

... Construction of the Spot Rate Curve Several different sets of Treasures can be used to construct a default-free theoretical spot rate curve: On-the-run Treasury: The newest Treasury issues. Bootstrapping used to get the different yields. On-the-run Treasury issues and selected off-the-run Treas ...

Mark Gertler Bernanke Working

... since we make no distinction between bank owners and bank managers. The notion that bank capital (either inside or outside) is used primarily as a buffer, however, does seem to be realistic (Peltzman, p.1). This assumes that there is no effective sanction against banks who claim "too often" that the ...

... since we make no distinction between bank owners and bank managers. The notion that bank capital (either inside or outside) is used primarily as a buffer, however, does seem to be realistic (Peltzman, p.1). This assumes that there is no effective sanction against banks who claim "too often" that the ...

May 2003 - Banco de España

... Spanish deposit institutions (banks, savings banks and credit co-operatives). The slowdown in economic growth in Spain, difficulties in foreign business, the less favourable interest rate environment, the high degree of competition among institutions, falling stock markets and the substantial deprec ...

... Spanish deposit institutions (banks, savings banks and credit co-operatives). The slowdown in economic growth in Spain, difficulties in foreign business, the less favourable interest rate environment, the high degree of competition among institutions, falling stock markets and the substantial deprec ...

What is an Interest Rate Risk?

... These judgments may not always prove to be accurate and the creditworthiness of a borrower may decline over time due to various factors. Since the clients may be situated in different countries, a major risk that banks face is credit risk or the failure of a counterparty to perform according to a co ...

... These judgments may not always prove to be accurate and the creditworthiness of a borrower may decline over time due to various factors. Since the clients may be situated in different countries, a major risk that banks face is credit risk or the failure of a counterparty to perform according to a co ...

Japan: 2008 Article IV Consultation—Staff Report; Staff Statement; and Public

... yen remains market-determined and has appreciated by about 10 percent in real effective terms since mid-2007, but staff estimates suggest that it remains undervalued relative to its longer-term equilibrium. Financial sector policies. Japan was not a major subprime player and the financial system has ...

... yen remains market-determined and has appreciated by about 10 percent in real effective terms since mid-2007, but staff estimates suggest that it remains undervalued relative to its longer-term equilibrium. Financial sector policies. Japan was not a major subprime player and the financial system has ...

Financial Stability Review Contents

... Despite the recent uncertainty associated with the handling of the sovereign bailout of Cyprus, global financial conditions have improved overall since the September Review. In large part, this reflects various policy developments in Europe that had generally strengthened market perceptions of the a ...

... Despite the recent uncertainty associated with the handling of the sovereign bailout of Cyprus, global financial conditions have improved overall since the September Review. In large part, this reflects various policy developments in Europe that had generally strengthened market perceptions of the a ...

two-year interest rate

... A Monetary Expansion and the Stock Market • If the monetary authority adopts on expansionary policy then the LM shifts and interest rates decrease and output increases (Fig.15.7) in the short-run (prices sticky) • But, what happens to the stock market? • Answer: It depends on what participants in t ...

... A Monetary Expansion and the Stock Market • If the monetary authority adopts on expansionary policy then the LM shifts and interest rates decrease and output increases (Fig.15.7) in the short-run (prices sticky) • But, what happens to the stock market? • Answer: It depends on what participants in t ...

Credit booms: implications for the public and private sector

... foreign currency, as in the savings glut hypothesis (Bernanke (2005)), or that nonfinancial firms increase their cash balances fearing liquidity shortages (Pozsar (2011)). In the first case, a foreign investor is at an informational disadvantage relative to local investors and may prefer to invest i ...

... foreign currency, as in the savings glut hypothesis (Bernanke (2005)), or that nonfinancial firms increase their cash balances fearing liquidity shortages (Pozsar (2011)). In the first case, a foreign investor is at an informational disadvantage relative to local investors and may prefer to invest i ...

FCA Smaller Business Practitioner Panel Response to HMT EU

... level. While the ESAs work to date has been good, any move to concentrate greater supervisory or rule-making power at the ESAs risks creating a regulatory environment that is less attuned to the domestic market than one created by a domestic regulator. 8. Does the UK have an appropriate level of inf ...

... level. While the ESAs work to date has been good, any move to concentrate greater supervisory or rule-making power at the ESAs risks creating a regulatory environment that is less attuned to the domestic market than one created by a domestic regulator. 8. Does the UK have an appropriate level of inf ...

Janet L Yellen: Improving the oversight of large financial institutions

... Partly as a result, these firms had trouble retaining the trust of markets and creditors when the financial system came under stress. Doubts quickly mounted about whether these institutions could sustain losses in the value of many assets they held. Further doubts were raised about whether these fir ...

... Partly as a result, these firms had trouble retaining the trust of markets and creditors when the financial system came under stress. Doubts quickly mounted about whether these institutions could sustain losses in the value of many assets they held. Further doubts were raised about whether these fir ...

Stock market crashes, productivity boom busts

... investment expenditures. The sale of stocks to finance those ventures, in addition to gold and silver mines (some real, some fictitious) in Latin America, as well as sovereign government debt propelled a stock market boom fueled by the Bank of England’s easy monetary policy. The stock market boom be ...

... investment expenditures. The sale of stocks to finance those ventures, in addition to gold and silver mines (some real, some fictitious) in Latin America, as well as sovereign government debt propelled a stock market boom fueled by the Bank of England’s easy monetary policy. The stock market boom be ...

MACRO HEDGING OF INTEREST RATE RISK INTRODUCTION

... assets and liabilities that share the same risk to be hedged. Although systems differ, there is general agreement that the hedging process involves identification of notional amounts and repricing dates. As the economic risks of some financial instruments differ from their contractual terms, they ha ...

... assets and liabilities that share the same risk to be hedged. Although systems differ, there is general agreement that the hedging process involves identification of notional amounts and repricing dates. As the economic risks of some financial instruments differ from their contractual terms, they ha ...

Stock Market Crashes, Productivity Boom Busts and Recessions

... investment expenditures. The sale of stocks to finance those ventures, in addition to gold and silver mines (some real, some fictitious) in Latin America, as well as sovereign government debt propelled a stock market boom fueled by the Bank of England’s easy monetary policy. The stock market boom be ...

... investment expenditures. The sale of stocks to finance those ventures, in addition to gold and silver mines (some real, some fictitious) in Latin America, as well as sovereign government debt propelled a stock market boom fueled by the Bank of England’s easy monetary policy. The stock market boom be ...

Banking Crises

... sovereign debt). It is, of course, impossible to completely sever these different aspects of financial crises. A currency crisis caused by panic selling of assets in the belief that a currency devaluation (or substantial depreciation of a currency under a floating exchange rate regime) is imminent m ...

... sovereign debt). It is, of course, impossible to completely sever these different aspects of financial crises. A currency crisis caused by panic selling of assets in the belief that a currency devaluation (or substantial depreciation of a currency under a floating exchange rate regime) is imminent m ...

Interest Rate

... Discount Yield and Investment Yield: The yield on Tbills (and other discounted securities, such as commercial paper) which are selling at a discount of their maturity values. Yield to Maturity: The interest rate that equates the future payments to be received from a financial instrument (coupons plu ...

... Discount Yield and Investment Yield: The yield on Tbills (and other discounted securities, such as commercial paper) which are selling at a discount of their maturity values. Yield to Maturity: The interest rate that equates the future payments to be received from a financial instrument (coupons plu ...

The Framework for the Bank of England`s Operations in the Sterling

... 18 The Bank undertakes to supply, in aggregate, the reserves that banks need to meet their collective targets. It uses its Open Market Operations (‘OMOs’) to achieve that, settled by movements on and off banks’ reserves accounts. But the supply of reserves is affected not only by OMOs but also by ot ...

... 18 The Bank undertakes to supply, in aggregate, the reserves that banks need to meet their collective targets. It uses its Open Market Operations (‘OMOs’) to achieve that, settled by movements on and off banks’ reserves accounts. But the supply of reserves is affected not only by OMOs but also by ot ...

Who Regulates Whom and How? An Overview of U.S. Financial

... exclusive. Banking U.S. banking regulation traditionally focuses on prudence. Banks’ business decisions are regulated for safety and soundness and adequate capital. In addition, banks are given access to a lender of last resort, and some bank creditors are provided guarantees (deposit insurance). Re ...

... exclusive. Banking U.S. banking regulation traditionally focuses on prudence. Banks’ business decisions are regulated for safety and soundness and adequate capital. In addition, banks are given access to a lender of last resort, and some bank creditors are provided guarantees (deposit insurance). Re ...

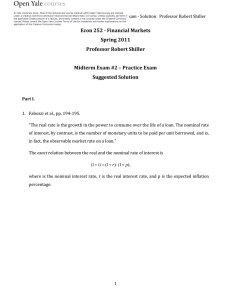

Practice Exam Solutions

... 6. Lecture 12 on “Misbehavior, Crises, Regulation, and Self Regulation.” ...

... 6. Lecture 12 on “Misbehavior, Crises, Regulation, and Self Regulation.” ...

- Munich Personal RePEc Archive

... al. (2011) argue that a reallocation of resources could address China’s serious inefficiency and lead to fast growth over a prolonged transition. However, others maintain that financial distortion cannot be an impediment to China’s economic ...

... al. (2011) argue that a reallocation of resources could address China’s serious inefficiency and lead to fast growth over a prolonged transition. However, others maintain that financial distortion cannot be an impediment to China’s economic ...