The effects of US unconventional monetary policies in Latin America

... effects of US unconventional monetary policy on EMEs’ financial assets prices depend on country-specific time-varying characteristics. Comparing the impact of conventional and unconventional measures, Chen et al. (2014) found that unconventional monetary policies had larger spillovers than conventio ...

... effects of US unconventional monetary policy on EMEs’ financial assets prices depend on country-specific time-varying characteristics. Comparing the impact of conventional and unconventional measures, Chen et al. (2014) found that unconventional monetary policies had larger spillovers than conventio ...

Central Asia and Azerbaijan: Regional Mortgage Market

... The main topics of the program: • Improvement of the legislation (due to list); • Create the favorable environment to attract investments; • Improving internal production of the construction materials; • improvement of social and economic situation; • Attract new construction technologies to the bui ...

... The main topics of the program: • Improvement of the legislation (due to list); • Create the favorable environment to attract investments; • Improving internal production of the construction materials; • improvement of social and economic situation; • Attract new construction technologies to the bui ...

Who Holds Municipal Bonds?

... This report, IDs, and passwords are available at www.wellsfargoresearch.com Securities discussed herein may be rated below investment grade and should therefore only be considered for inclusion in accounts qualified for speculative investment. This report is for your information only and is not an o ...

... This report, IDs, and passwords are available at www.wellsfargoresearch.com Securities discussed herein may be rated below investment grade and should therefore only be considered for inclusion in accounts qualified for speculative investment. This report is for your information only and is not an o ...

Bond Valuation - Duke University

... » Can often use industry as approximation The Security Market Line provides an estimate of an appropriate discount rate for the project based upon the project’s beta. » Same company may use different discount rates for different projects This discount rate is used when computing the project’s net pr ...

... » Can often use industry as approximation The Security Market Line provides an estimate of an appropriate discount rate for the project based upon the project’s beta. » Same company may use different discount rates for different projects This discount rate is used when computing the project’s net pr ...

Alberta Tax and Revenue Administration

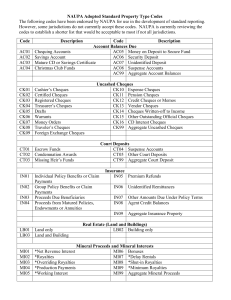

... NAUPA Adopted Standard Property Type Codes The following codes have been endorsed by NAUPA for use in the development of standard reporting. However, some jurisdictions do not currently accept these codes. NAUPA is currently reviewing the codes to establish a shorter list that would be acceptable to ...

... NAUPA Adopted Standard Property Type Codes The following codes have been endorsed by NAUPA for use in the development of standard reporting. However, some jurisdictions do not currently accept these codes. NAUPA is currently reviewing the codes to establish a shorter list that would be acceptable to ...

Repos - LexisNexis UK

... markets have developed around the world and can be found in several economies. These repo markets comprise central bank schemes, similar to the US open market operations (for example, the Bank of England’s open market operations), together with privately negotiated, or overthe-counter (‘OTC’), repo ...

... markets have developed around the world and can be found in several economies. These repo markets comprise central bank schemes, similar to the US open market operations (for example, the Bank of England’s open market operations), together with privately negotiated, or overthe-counter (‘OTC’), repo ...

SP180: Should Monetary Policy Respond to Asset Price Bubbles? Revisiting the Debate

... (1997). Their model is dynamic and explicitly incorporates the notion of asset price misalignments. In their setup, when a bubble develops in equity markets, standard wealth effects drive current inflation up. Importantly, though, expected inflation may not change since there is a probability that t ...

... (1997). Their model is dynamic and explicitly incorporates the notion of asset price misalignments. In their setup, when a bubble develops in equity markets, standard wealth effects drive current inflation up. Importantly, though, expected inflation may not change since there is a probability that t ...

Interest Rate Swap

... ● In T1: Investment of nominal values of the expired bonds in new bonds with same maturity as the forward swap (if possible), and new coupon rate C1. ● From T1: The company receives a fixed coupon rate C1 and the fixed rate K1 of ...

... ● In T1: Investment of nominal values of the expired bonds in new bonds with same maturity as the forward swap (if possible), and new coupon rate C1. ● From T1: The company receives a fixed coupon rate C1 and the fixed rate K1 of ...

Agent Based-Stock Flow Consistent Macroeconomics: Towards a

... Conversely, legal money is destroyed whenever a private sector agent makes a payment to the government forcing their deposit bank to transfer a portion of her legal reserves to the government. Reserves (or legal money) must be already available when making these payments suggesting that government s ...

... Conversely, legal money is destroyed whenever a private sector agent makes a payment to the government forcing their deposit bank to transfer a portion of her legal reserves to the government. Reserves (or legal money) must be already available when making these payments suggesting that government s ...

The German Banking Crisis of 1931 - University of California, Berkeley

... There were two important changes to the German banking system during the hyperinflation. First, at the end of the war, the real value of monetary aggregates and demand for marks declined and the term structure of deposits shortened. Given the fall in the real value of money, depositors preferred to ...

... There were two important changes to the German banking system during the hyperinflation. First, at the end of the war, the real value of monetary aggregates and demand for marks declined and the term structure of deposits shortened. Given the fall in the real value of money, depositors preferred to ...

Lecture Presentation to accompany Investment Analysis

... f (Business Risk, Financial Risk, Liquidity Risk, Exchange Rate Risk, Country Risk) ...

... f (Business Risk, Financial Risk, Liquidity Risk, Exchange Rate Risk, Country Risk) ...

Indexed Emerging Markets Equity Fund

... may fall as well as rise in value. The performance of contributions in any given year will depend on both the frequency and the duration of the contributions. Income may fluctuate in accordance with the market conditions and taxation arrangements. Simulated performance may not be a reliable guide to ...

... may fall as well as rise in value. The performance of contributions in any given year will depend on both the frequency and the duration of the contributions. Income may fluctuate in accordance with the market conditions and taxation arrangements. Simulated performance may not be a reliable guide to ...

ENDOWMENT TRUSTEES

... is a fund of funds hedge fund manager and reports on a 30 day lag. As such the results you are seeing now are as of April 30, 2011. This asset class gives the portfolio access to areas of investment that ordinarily would not be available to us, while at the same time provide additional stability fro ...

... is a fund of funds hedge fund manager and reports on a 30 day lag. As such the results you are seeing now are as of April 30, 2011. This asset class gives the portfolio access to areas of investment that ordinarily would not be available to us, while at the same time provide additional stability fro ...

optimal bail out policy, conditionality and constructive ambiguity

... is at stake and there are obsesive fears that money will be unavailable, and a pseudo-financial crisis, characterized by a low price for the bank’s assets which generates a loss of wealth but no disruption in the payment system. ...

... is at stake and there are obsesive fears that money will be unavailable, and a pseudo-financial crisis, characterized by a low price for the bank’s assets which generates a loss of wealth but no disruption in the payment system. ...

It`s the Economy Stupid

... and activities of every franchise in the US and beyond—3,000 active franchises across 230 different industries. Now you can use this information to help you meet your development goals this year. You choose your competitors/peers. For each brand we can help you: • Learn about their marketing pr ...

... and activities of every franchise in the US and beyond—3,000 active franchises across 230 different industries. Now you can use this information to help you meet your development goals this year. You choose your competitors/peers. For each brand we can help you: • Learn about their marketing pr ...

DeNovo Q1 FinTech ReCap and Funding ReView - Strategy

... The compounding value creation from shared asset use will require the financial services industry to evolve with new products and services. The one-to-one ratio of owner to asset, or the premise that only two parties are involved in a financial transaction, is an assumption that is rooted in most tr ...

... The compounding value creation from shared asset use will require the financial services industry to evolve with new products and services. The one-to-one ratio of owner to asset, or the premise that only two parties are involved in a financial transaction, is an assumption that is rooted in most tr ...

Main title Subtitle

... Disclaimer This document was produced by and the opinions expressed are those of Credit Suisse as of the date of writing and are subject to change. It has been prepared solely for information purposes and for the use of the recipient. It does not constitute an offer or an invitation by or on behalf ...

... Disclaimer This document was produced by and the opinions expressed are those of Credit Suisse as of the date of writing and are subject to change. It has been prepared solely for information purposes and for the use of the recipient. It does not constitute an offer or an invitation by or on behalf ...

DOC - Europa.eu

... transparency and integrity in the electricity and gas markets. However, there are many quite specific elements in the REMIT which build on past legislation developed exclusively for the energy sector. At the same time, there are many other sectors covered by the EU ETS – the application of energy ma ...

... transparency and integrity in the electricity and gas markets. However, there are many quite specific elements in the REMIT which build on past legislation developed exclusively for the energy sector. At the same time, there are many other sectors covered by the EU ETS – the application of energy ma ...

Current IASB Position Participating Contracts

... • Determined at outset absorbing any initial profit • Released evenly over the coverage period with accretion of interest • Adjusted for (as long as remaining positive) • changes in the (estimated) expected value of future c/f cash flows as far as reflecting future services • changes in the (estimat ...

... • Determined at outset absorbing any initial profit • Released evenly over the coverage period with accretion of interest • Adjusted for (as long as remaining positive) • changes in the (estimated) expected value of future c/f cash flows as far as reflecting future services • changes in the (estimat ...

Fundamentals of Central Banking – Lessons from the

... Collectively, central bank policies since the outbreak of the crisis have made a crucial contribution to restoring financial stability. In 2015, eight years on since the eruption of the crisis, the central banking community still faces many difficulties and challenges as it surveys possible exit str ...

... Collectively, central bank policies since the outbreak of the crisis have made a crucial contribution to restoring financial stability. In 2015, eight years on since the eruption of the crisis, the central banking community still faces many difficulties and challenges as it surveys possible exit str ...

2016 Capital Market Projections

... Callan’s projections consist of three primary figures for each asset class: a mean rate Multiple elements of the capital markets influence the projections: returns relative of return, a corresponding range defined by standard deviation, and the correlations to to inflation, equity valuations, risk p ...

... Callan’s projections consist of three primary figures for each asset class: a mean rate Multiple elements of the capital markets influence the projections: returns relative of return, a corresponding range defined by standard deviation, and the correlations to to inflation, equity valuations, risk p ...

CHAPTER 1

... 14. It is possible with a unit of account to do which of the following? a. Compare relative values of various goods and services b. Keep records about prices and debts c. Simplify actual transactions throughout the economy d. All of the above ANSWER: d 15. The development of money facilitates all of ...

... 14. It is possible with a unit of account to do which of the following? a. Compare relative values of various goods and services b. Keep records about prices and debts c. Simplify actual transactions throughout the economy d. All of the above ANSWER: d 15. The development of money facilitates all of ...

The Zero Lower Bound, ECB Interest Rate Policy and the

... Institute for Monetary and Financial Stability Goethe University of Frankfurt and CEPR ...

... Institute for Monetary and Financial Stability Goethe University of Frankfurt and CEPR ...

CGAP

... 3 Loans with any payment overdue more than a year should probably be treated as losses for this purpose, whether or not they have been formally written off. 4 In the absence of any other basis for projecting, assume liquid assets totaling 25% of loan portfolio, or higher if necessary to accommodate ...

... 3 Loans with any payment overdue more than a year should probably be treated as losses for this purpose, whether or not they have been formally written off. 4 In the absence of any other basis for projecting, assume liquid assets totaling 25% of loan portfolio, or higher if necessary to accommodate ...