The Effects of Bank Market Power in Short-Term and Long

... likelihood of bank branches providing bank credit. This result confirms that the nonmonotonic effect of market concentration is robust to controlling for the presence of local credit markets for banks with multiple contacts. Presbitero and Zazzaro (2011) extend their analysis by suggesting that thi ...

... likelihood of bank branches providing bank credit. This result confirms that the nonmonotonic effect of market concentration is robust to controlling for the presence of local credit markets for banks with multiple contacts. Presbitero and Zazzaro (2011) extend their analysis by suggesting that thi ...

dynamics of commodity market impact on indian investment sectors

... Bonds of different types, including medium to long term negotiable debt securities issued by governments, companies, etc. v. Shares and share warrants of companies traded on recognized stock exchanges and Stock Index vi. Short term securities such as T-bills; and vii. Over- the Counter (OTC) money m ...

... Bonds of different types, including medium to long term negotiable debt securities issued by governments, companies, etc. v. Shares and share warrants of companies traded on recognized stock exchanges and Stock Index vi. Short term securities such as T-bills; and vii. Over- the Counter (OTC) money m ...

Municipal Bond Fund Report

... securities from within Illinois offer compelling valuations. In fact, securities in the midst of ratings transitions and where investor opinions about them vary have historically been worth close examination for investment opportunities. As of quarter-end, Illinois had not reached a budget agreement ...

... securities from within Illinois offer compelling valuations. In fact, securities in the midst of ratings transitions and where investor opinions about them vary have historically been worth close examination for investment opportunities. As of quarter-end, Illinois had not reached a budget agreement ...

October 23, 2009 Kazuo Ueda The University of Tokyo

... calculate the vulnerability of financial institutions to changes in land prices. Kumakura (2008) points out that the director of the BOJ’s inspection department warned in 1986 that financial institutions’ lending was too much concentrated in a small number of industries. There is, however, no sign t ...

... calculate the vulnerability of financial institutions to changes in land prices. Kumakura (2008) points out that the director of the BOJ’s inspection department warned in 1986 that financial institutions’ lending was too much concentrated in a small number of industries. There is, however, no sign t ...

IFSL Brunsdon Investment Funds brochure

... The IFSL BRUNSDON CAUTIOUS GROWTH FUND The Cautious mandate is looking to target a LIBOR + 2.5% return per annum on a rolling three year time horizon, while looking to achieve a positive return on any 12 month basis by seeking to find the optimum balance between risk and return using traditional ass ...

... The IFSL BRUNSDON CAUTIOUS GROWTH FUND The Cautious mandate is looking to target a LIBOR + 2.5% return per annum on a rolling three year time horizon, while looking to achieve a positive return on any 12 month basis by seeking to find the optimum balance between risk and return using traditional ass ...

Origins and Measurement of Financial Repression: The

... repudiation and inflation, are viewed as impractical, undesirable, or even impossible for many advanced economies to implement. At the same time, outstanding debts and deficits are large enough that other traditional mechanisms for achieving fiscal balance, such as reductions in government expend ...

... repudiation and inflation, are viewed as impractical, undesirable, or even impossible for many advanced economies to implement. At the same time, outstanding debts and deficits are large enough that other traditional mechanisms for achieving fiscal balance, such as reductions in government expend ...

A Lesson from the Great Depression that the Fed Might have

... We then use quarterly data from 1920-32 to estimate the e¤ects of the open-market operation in a general equilibrium model with segmented markets. Anecdotal evidence suggests that there was a signi…cant degree of market segmentation in the 1930s as the non bank public had limited access to the gover ...

... We then use quarterly data from 1920-32 to estimate the e¤ects of the open-market operation in a general equilibrium model with segmented markets. Anecdotal evidence suggests that there was a signi…cant degree of market segmentation in the 1930s as the non bank public had limited access to the gover ...

fund accounting training

... Since endowment principals are generally kept in perpetuity, cash gifts are generally invested in long‐term instruments. When non‐cash instruments such as stocks or bonds are donated to establish an endowment, the asset is valued at market value as of the gift date. Income earned on endowments i ...

... Since endowment principals are generally kept in perpetuity, cash gifts are generally invested in long‐term instruments. When non‐cash instruments such as stocks or bonds are donated to establish an endowment, the asset is valued at market value as of the gift date. Income earned on endowments i ...

determining the risk free rate for regulated companies

... To summarise, the use of an interest rate of longer term than the regulatory period for setting output prices leads to two problems in a presence of a non-flat term structure. If the non-flat term structure is due to a liquidity premium, and therefore unpredictability in future spot rates, the use o ...

... To summarise, the use of an interest rate of longer term than the regulatory period for setting output prices leads to two problems in a presence of a non-flat term structure. If the non-flat term structure is due to a liquidity premium, and therefore unpredictability in future spot rates, the use o ...

File - Ms. Pena`s History Class

... market by paying 10% of the stocks’ total cost and borrowing the rest from your stock broker. Wealthy investors- You have invested $ in the stock market by paying 100% of the stocks’ cost. Stock Brokers- you invest $ for investors. For non-wealthy investors, you take out loans from he bank to cover ...

... market by paying 10% of the stocks’ total cost and borrowing the rest from your stock broker. Wealthy investors- You have invested $ in the stock market by paying 100% of the stocks’ cost. Stock Brokers- you invest $ for investors. For non-wealthy investors, you take out loans from he bank to cover ...

New Zealand’s economic reforms after 1984 L. Christopher Plantier

... various risk factors can affect the actual real rates that country faces.6 In particular, large and permanent net government debt positions can create a permanent wedge between the world real rate and a particular country’s real rate. Even in this analysis, however, there is still quite a bit of jud ...

... various risk factors can affect the actual real rates that country faces.6 In particular, large and permanent net government debt positions can create a permanent wedge between the world real rate and a particular country’s real rate. Even in this analysis, however, there is still quite a bit of jud ...

Strengthening the capacity of EU capital markets

... consultation on the CMU Mid-term Review6 confirmed the more specific challenges that CMU has to address (see the box below for an overview of the consultation feedback). European start-up and scale-up firms need more risk finance to invest in innovation and growth. There is a need to develop and ...

... consultation on the CMU Mid-term Review6 confirmed the more specific challenges that CMU has to address (see the box below for an overview of the consultation feedback). European start-up and scale-up firms need more risk finance to invest in innovation and growth. There is a need to develop and ...

Download attachment

... (commercial according to Bank-Scope) or Islamic, were excluded from the data set. Some other researches categorized these two types of banks such as commercial and Islamic banks. However, an Islamic bank is a commercial bank based on Shariah-complaint banking. So, it is preferred to refer to commerc ...

... (commercial according to Bank-Scope) or Islamic, were excluded from the data set. Some other researches categorized these two types of banks such as commercial and Islamic banks. However, an Islamic bank is a commercial bank based on Shariah-complaint banking. So, it is preferred to refer to commerc ...

the strategic role and contribution of the risk capital market

... Historically, due to the relatively high risks and costs involved, the banking system has proven reluctant to support the start-up and early-stage development of young technology ventures through debt finance. Going forward, the role of the banking system in Scotland and the UK is likely to diminish ...

... Historically, due to the relatively high risks and costs involved, the banking system has proven reluctant to support the start-up and early-stage development of young technology ventures through debt finance. Going forward, the role of the banking system in Scotland and the UK is likely to diminish ...

HSBC World Selection Personal Pension

... You may change the funds in which your pension investment is currently invested and/or redirect future contributions to new funds. We make no charge for switching or redirecting future contributions between funds. If you wish to switch or redirect your future contributions into your existing portfol ...

... You may change the funds in which your pension investment is currently invested and/or redirect future contributions to new funds. We make no charge for switching or redirecting future contributions between funds. If you wish to switch or redirect your future contributions into your existing portfol ...

February 2016 | No. 105 SYSTEMIC RISK IN DANISH BANKS

... If one were to focus on a specific source of risk, a potentially relevant index to use as the market could be the one for European banks (EURO STOXX Banks). The interpretation of SRISK would then be the expected capital shortfall of Danish banks conditional on an European banking crisis. A relevant ...

... If one were to focus on a specific source of risk, a potentially relevant index to use as the market could be the one for European banks (EURO STOXX Banks). The interpretation of SRISK would then be the expected capital shortfall of Danish banks conditional on an European banking crisis. A relevant ...

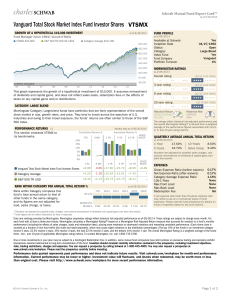

Vanguard Total Stock Market Index Fund Investor Shares

... This Mutual Fund Report Card is informational in nature and is not a recommendation or solicitation for any person to buy, sell or hold any particular security; nor is it intended to address any individual's investment objectives, financial situation or personal circumstances. We recommend that inve ...

... This Mutual Fund Report Card is informational in nature and is not a recommendation or solicitation for any person to buy, sell or hold any particular security; nor is it intended to address any individual's investment objectives, financial situation or personal circumstances. We recommend that inve ...

NBER WORKING PAPER SERIES COUNTRY RISK, FOREIGN BORROWING AND SOCIAL DISCOUNT RATE IN

... equation (9), it is necessary to carefully analyze the meanings of weights ...

... equation (9), it is necessary to carefully analyze the meanings of weights ...

the effect of interest rate spread on financial

... hence making it necessary for them to set competitive spread on the borrowed money. Money borrowed from the central bank is expected to be repaid on profit. This help the government generate more profit as it serves the interest of the people. It is out of this concept that makes the interest rate a ...

... hence making it necessary for them to set competitive spread on the borrowed money. Money borrowed from the central bank is expected to be repaid on profit. This help the government generate more profit as it serves the interest of the people. It is out of this concept that makes the interest rate a ...

Financial Stability Report May 2011 Contents

... Stability Reports twice a year. These documents must financial system. report on the soundness and efficiency of the financial Despite a number of technical incidents that have sector and the measures undertaken by the Reserve Bank disrupted the normal operation of some systems, New to achieve its s ...

... Stability Reports twice a year. These documents must financial system. report on the soundness and efficiency of the financial Despite a number of technical incidents that have sector and the measures undertaken by the Reserve Bank disrupted the normal operation of some systems, New to achieve its s ...

Credit History and the Performance of Prime and Nonprime Mortgages

... responsive to decreasing interest rates due to their higher cost of debt servicing, or (iii) subprime borrowers are more likely to experience financial hardship and use homeowner equity through cash out refinancing to help smooth consumption patterns. ...

... responsive to decreasing interest rates due to their higher cost of debt servicing, or (iii) subprime borrowers are more likely to experience financial hardship and use homeowner equity through cash out refinancing to help smooth consumption patterns. ...

Why are Banks Highly Interconnected?

... none of these papers permits renegotiation of contracts in the systemic transmission between banks, which as we show not only affects the optimal amount of interconnection desired by banks but also the measurement of the likelihood of systemic spillovers and liquidation correlation. Our paper also c ...

... none of these papers permits renegotiation of contracts in the systemic transmission between banks, which as we show not only affects the optimal amount of interconnection desired by banks but also the measurement of the likelihood of systemic spillovers and liquidation correlation. Our paper also c ...

The Effect of Change in Base Lending Rate on

... primary credit (the primary credit rate) is set above the usual level of short-term market interest rates. This is because primary credit is the Federal Reserve's main discount window program; the Federal Reserve at times uses the term "discount rate" to mean the primary credit rate. The discount ra ...

... primary credit (the primary credit rate) is set above the usual level of short-term market interest rates. This is because primary credit is the Federal Reserve's main discount window program; the Federal Reserve at times uses the term "discount rate" to mean the primary credit rate. The discount ra ...

For investors who prefer a simple and accessible approach to

... balance over time as market conditions change. Underlying investments may include low-cost exchange-traded funds (ETFs) that track certain markets (asset classes), as well as actively managed funds with a diverse set of strategies and investments, including alternatives (such as commodities, real es ...

... balance over time as market conditions change. Underlying investments may include low-cost exchange-traded funds (ETFs) that track certain markets (asset classes), as well as actively managed funds with a diverse set of strategies and investments, including alternatives (such as commodities, real es ...

Chapter Twenty

... Personal Finances and Investments © 2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. ...

... Personal Finances and Investments © 2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. ...