Market Commentary July 5, 2011

... With the first half of 2011 now history, here are a few things that made the headlines and may affect the markets over the second half of the year, according to The Wall Street Journal: ...

... With the first half of 2011 now history, here are a few things that made the headlines and may affect the markets over the second half of the year, according to The Wall Street Journal: ...

As Interest Rates Rise, Muni Bonds` Unique Characteristics Matter

... The comments provided herein are a general market overview and do not constitute investment advice, are not predictive of any future market performance, are not provided as a sales or advertising communication, and do not represent an offer to sell or a solicitation of an offer to buy any security. ...

... The comments provided herein are a general market overview and do not constitute investment advice, are not predictive of any future market performance, are not provided as a sales or advertising communication, and do not represent an offer to sell or a solicitation of an offer to buy any security. ...

CHAPTER 7

... any, Callable, Sinking Fund required Insurance Cos are principal buyers of corporate bonds w/ households second Sold through public offerings; About half are privately-placed Proceeds may be used to fund expansion, finance acquisitions or LBO or to refund maturing bond issues or to refund higher int ...

... any, Callable, Sinking Fund required Insurance Cos are principal buyers of corporate bonds w/ households second Sold through public offerings; About half are privately-placed Proceeds may be used to fund expansion, finance acquisitions or LBO or to refund maturing bond issues or to refund higher int ...

investing in swaziland government treasury bills

... on behalf of the Government of Swaziland. When Tbills are bought, one cannot cash them before maturity but one can sell them in the secondary market either to a primary dealer or the Central Bank of Swaziland. Because they are government-backed securities, they can be and are recognized as collatera ...

... on behalf of the Government of Swaziland. When Tbills are bought, one cannot cash them before maturity but one can sell them in the secondary market either to a primary dealer or the Central Bank of Swaziland. Because they are government-backed securities, they can be and are recognized as collatera ...

Key

... 6. When the Fed sells bonds to the public, it increases the supply of bonds, thus shifting the supply curve B s (S1 in the figure) to the right. At the old equilibrium price, P1, there is now excess supply of bonds measured by the distance AB= Q’’-Q1, in the figure below. An excess supply of bonds c ...

... 6. When the Fed sells bonds to the public, it increases the supply of bonds, thus shifting the supply curve B s (S1 in the figure) to the right. At the old equilibrium price, P1, there is now excess supply of bonds measured by the distance AB= Q’’-Q1, in the figure below. An excess supply of bonds c ...

Finance - Aberdeenshire Council

... discount is paid or received from the PWLB. These payments or receipts represent the difference between the interest rate of the loan repaid and the current PWLB interest rate for a loan lent for the same period. Discounts totalling £886,000 (General Fund £630,000, HRA £256,000), have been reported ...

... discount is paid or received from the PWLB. These payments or receipts represent the difference between the interest rate of the loan repaid and the current PWLB interest rate for a loan lent for the same period. Discounts totalling £886,000 (General Fund £630,000, HRA £256,000), have been reported ...

im08

... Dealers market the coupons and the principal of the security separately as zero-coupon securities. The yield on each of them comes from the difference between their market-determined price and their face value that is paid out on a stated date in the future. ...

... Dealers market the coupons and the principal of the security separately as zero-coupon securities. The yield on each of them comes from the difference between their market-determined price and their face value that is paid out on a stated date in the future. ...

mshdamml lh - Michigan Municipal League

... primary financing mechanism for state and local infrastructure projects, with three-quarters of the infrastructure projects in the U.S. built by state and local governments, and with over $3.7 trillion in outstanding tax exempt bonds, issued by 30,000 separate government units. Local governments sav ...

... primary financing mechanism for state and local infrastructure projects, with three-quarters of the infrastructure projects in the U.S. built by state and local governments, and with over $3.7 trillion in outstanding tax exempt bonds, issued by 30,000 separate government units. Local governments sav ...

View as DOC (2) 248 KB

... Lending" and government support for the housing market appear to be the corner stones of improving UK statistics. The interbank funding market which had remained very sticky since 2009 has seen substantial falls in funding costs and increases in activity volume and whilst UK banks still have a lot o ...

... Lending" and government support for the housing market appear to be the corner stones of improving UK statistics. The interbank funding market which had remained very sticky since 2009 has seen substantial falls in funding costs and increases in activity volume and whilst UK banks still have a lot o ...

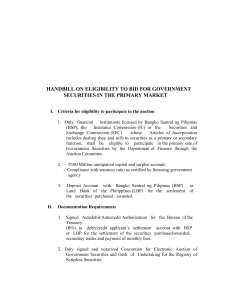

handbill on eligibility to bid for government securities in the primary

... accounts of a financial institution. CAPITAL means the paid-in capital and surplus account. SURPLUS means the excess of the assets over the liabilities and paid-in capital of the financial institutions but excluding the reserves set aside for valuation purposes and reserves for liabilities and defer ...

... accounts of a financial institution. CAPITAL means the paid-in capital and surplus account. SURPLUS means the excess of the assets over the liabilities and paid-in capital of the financial institutions but excluding the reserves set aside for valuation purposes and reserves for liabilities and defer ...

CHAPTER 13:Financial Instruments: Long Term Debt

... investors will be willing to pay more than the face value (a premium) to acquire the bond. A bond may offer an interest rate different from the market rate, as the bond terms are set in advance of the actual issue date. For a bond to sell at par, the effective rate and the nominal rate must be the s ...

... investors will be willing to pay more than the face value (a premium) to acquire the bond. A bond may offer an interest rate different from the market rate, as the bond terms are set in advance of the actual issue date. For a bond to sell at par, the effective rate and the nominal rate must be the s ...

Unnecessary Fears and the Resilience of Bond Markets

... negative bond returns. Some returns during rising rate periods have been positive. During the recent rate increase, municipals gained while taxable bonds only lost 0.2 percent on an annualized basis. As you can see, the popular belief that fixed income is in dire straits is not an accurate one. ...

... negative bond returns. Some returns during rising rate periods have been positive. During the recent rate increase, municipals gained while taxable bonds only lost 0.2 percent on an annualized basis. As you can see, the popular belief that fixed income is in dire straits is not an accurate one. ...

Financial Markets

... A market for short-term instruments such as T-bills, commercial paper, banker’s acceptance, etc A subsector of fixed-income securities Money market instruments are highly marketable, offer low-return, posses low-risk Trade in large denominations, so are out of the reach of small investors ...

... A market for short-term instruments such as T-bills, commercial paper, banker’s acceptance, etc A subsector of fixed-income securities Money market instruments are highly marketable, offer low-return, posses low-risk Trade in large denominations, so are out of the reach of small investors ...

Issues in Islamic Liquidity Management

... Lack of liquidity in such placements. Reciprocal arrangements through reverse ...

... Lack of liquidity in such placements. Reciprocal arrangements through reverse ...

Agenda

... As part of its continuing education program, CDIAC will begin offering training webinars to provide information on municipal debt and public investments. In addition, CDIAC plans to use the webinar format to provide exposure to current topics in municipal finance. These webinars are not intended to ...

... As part of its continuing education program, CDIAC will begin offering training webinars to provide information on municipal debt and public investments. In addition, CDIAC plans to use the webinar format to provide exposure to current topics in municipal finance. These webinars are not intended to ...

YEARNING FOR YIELD

... While a Fed rate hike during the June 13 – 14, 2017 meeting has been largely priced in by the markets, a subtle shift has been occurring over the last month within the fed funds market. While the number of rate hikes implied by the fed funds market for the remainder of 2017 has been fairly consisten ...

... While a Fed rate hike during the June 13 – 14, 2017 meeting has been largely priced in by the markets, a subtle shift has been occurring over the last month within the fed funds market. While the number of rate hikes implied by the fed funds market for the remainder of 2017 has been fairly consisten ...

The Stock Exchange Corner

... Bonds – which are documents acknowledging a debt by the issuer of the bonds to the holders of the bonds - are valued by reference to the rate of interest paid to the holders of the bonds. The Government can raise money at the lowest rate of interest; publicly owned bodies may have to pay a little mo ...

... Bonds – which are documents acknowledging a debt by the issuer of the bonds to the holders of the bonds - are valued by reference to the rate of interest paid to the holders of the bonds. The Government can raise money at the lowest rate of interest; publicly owned bodies may have to pay a little mo ...

Treasury Management Strategy

... updated in the next few months and if so the strategy will be reviewed and brought back to the Board. ...

... updated in the next few months and if so the strategy will be reviewed and brought back to the Board. ...

Allianz US Short Duration High Income Bond

... conditions may affect these risks, with a negative impact on the value of the investments. In periods of rising nominal interest rates, the value of fixed-income securities (including short positions on fixed-income securities) is generally expected to fall. Conversely, in periods of falling nominal ...

... conditions may affect these risks, with a negative impact on the value of the investments. In periods of rising nominal interest rates, the value of fixed-income securities (including short positions on fixed-income securities) is generally expected to fall. Conversely, in periods of falling nominal ...

Bonds

... Why Buy Bonds? Interest Income Capital Gains When interest rates fall, bond prices rise When interest rates rise, bond prices fall Example: Exxon 5% due 4/5/2023…at 5% yield bond price =100. At 4% yield bond price = 110. Why? 5% coupon is reduced by capital loss of 10% over ten years, or 1% per year ...

... Why Buy Bonds? Interest Income Capital Gains When interest rates fall, bond prices rise When interest rates rise, bond prices fall Example: Exxon 5% due 4/5/2023…at 5% yield bond price =100. At 4% yield bond price = 110. Why? 5% coupon is reduced by capital loss of 10% over ten years, or 1% per year ...

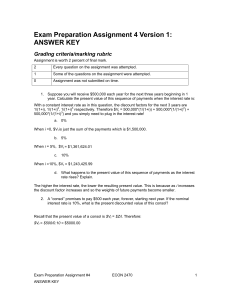

Exam Preparation Assignment 4 Version 1: ANSWER KEY

... The higher the interest rate, the lower the resulting present value. This is because as i increases the discount factor increases and so the weights of future payments become smaller. 2. A “consol” promises to pay $500 each year, forever, starting next year. If the nominal interest rate is 10%, what ...

... The higher the interest rate, the lower the resulting present value. This is because as i increases the discount factor increases and so the weights of future payments become smaller. 2. A “consol” promises to pay $500 each year, forever, starting next year. If the nominal interest rate is 10%, what ...

Savings and Investment

... Reading a Stock Quotation Table PE – (Price/Earnings ratio, comparing the price of the stock with earnings per share). Volume – Number of shares traded. High – Highest price during the day. Low – Lowest price during the day. Close – Closing price for the day. Net Change – Change in the c ...

... Reading a Stock Quotation Table PE – (Price/Earnings ratio, comparing the price of the stock with earnings per share). Volume – Number of shares traded. High – Highest price during the day. Low – Lowest price during the day. Close – Closing price for the day. Net Change – Change in the c ...