Eichner`s monetary economics Ahead of its time

... • “It is the demand for credit rather than the demand for money that is the necessary starting point for analyzing the role played by monetary factors in determining the level of real economic activity” (Eichner 1985, 99) • “Eliminating the money stock from the model has the further advantage that i ...

... • “It is the demand for credit rather than the demand for money that is the necessary starting point for analyzing the role played by monetary factors in determining the level of real economic activity” (Eichner 1985, 99) • “Eliminating the money stock from the model has the further advantage that i ...

Blanchard, Oliver, 2000. What do we know about macroeconomics

... rate of interest 共the rate of return on capital兲 and the money rate of interest 共the interest rate on bonds兲. This would become a crucial key in allowing for the eventual integration of goods markets 共where the natural rate is determined兲 and financial markets 共where the money rate is determined兲. I ...

... rate of interest 共the rate of return on capital兲 and the money rate of interest 共the interest rate on bonds兲. This would become a crucial key in allowing for the eventual integration of goods markets 共where the natural rate is determined兲 and financial markets 共where the money rate is determined兲. I ...

The Quantity Theory of Money and Its Long Run Implications

... Equation (1) is an identity since it is derived solely from identities. It is valid under any set of circumstances whatever since it can be reduced to the statement: in a given period, by a given group of people, expenditures equal expenditures, with only a difference in the computational method bet ...

... Equation (1) is an identity since it is derived solely from identities. It is valid under any set of circumstances whatever since it can be reduced to the statement: in a given period, by a given group of people, expenditures equal expenditures, with only a difference in the computational method bet ...

Macroeconomics - Mr. Fenn

... traditional Keynesian economic theories. While New Keynesians do accept that households and firms operate on the basis of rational expectations, they still maintain that there are a variety of market failures, including sticky prices and wages. Because of this “stickiness”, the government can improv ...

... traditional Keynesian economic theories. While New Keynesians do accept that households and firms operate on the basis of rational expectations, they still maintain that there are a variety of market failures, including sticky prices and wages. Because of this “stickiness”, the government can improv ...

Modern Perspectives on Keynesian Stabilization Policies

... The present paper describes recent research on two central themes of Keynes’ General Theory: (i) the social waste associated with recessions, and (ii) the effectiveness of fiscal policy as a stabilization tool. The paper also discusses some evidence on the extent to which fiscal policy has been used ...

... The present paper describes recent research on two central themes of Keynes’ General Theory: (i) the social waste associated with recessions, and (ii) the effectiveness of fiscal policy as a stabilization tool. The paper also discusses some evidence on the extent to which fiscal policy has been used ...

Preface for the Student

... elements of their ethical considerations into their analysis. But those we call “religious economists” integrate the ethical and normative issues into economic analysis in more complex ways than the ways presented in the text. Religiously oriented economists have a diversity of views; some believe t ...

... elements of their ethical considerations into their analysis. But those we call “religious economists” integrate the ethical and normative issues into economic analysis in more complex ways than the ways presented in the text. Religiously oriented economists have a diversity of views; some believe t ...

Advanced Topics in Economic Analysis# This is a special course at

... and expectations. Optimal monetary policy design and the monetary transmission mechanism will also be covered. Money and Banking This is a course in money and banking at the masters or first-year graduate level. It discusses the role of money and the banking system in the economy and how they affect ...

... and expectations. Optimal monetary policy design and the monetary transmission mechanism will also be covered. Money and Banking This is a course in money and banking at the masters or first-year graduate level. It discusses the role of money and the banking system in the economy and how they affect ...

Economics for Today 2nd edition Irvin B. Tucker

... Given this assumption, changes in the money supply yield proportionate changes in the price level. ...

... Given this assumption, changes in the money supply yield proportionate changes in the price level. ...

DISCUSSION Keynes` Theory on America`s Great Depression: An

... the competition among banks in supplying credit. Such expansion complements - and thus amplifies - the results of multiplier-accelerator interaction and other reasonable mainstream explanations of instability. This regularly leads to aggregate over-investment and crisis ending a boom (Devine, 1994) ...

... the competition among banks in supplying credit. Such expansion complements - and thus amplifies - the results of multiplier-accelerator interaction and other reasonable mainstream explanations of instability. This regularly leads to aggregate over-investment and crisis ending a boom (Devine, 1994) ...

View/Open

... to offset fiscal polIcy wIth monetary polIcy was to pay for the VIetnam War with mflatlOn In the subsequent decade, monetary and fiscal actlVltles continued to be reflected m larger defiCits and higher Interest rates The net result was to hold aggregate demand below productive capacity, allow more u ...

... to offset fiscal polIcy wIth monetary polIcy was to pay for the VIetnam War with mflatlOn In the subsequent decade, monetary and fiscal actlVltles continued to be reflected m larger defiCits and higher Interest rates The net result was to hold aggregate demand below productive capacity, allow more u ...

The Business Cycle Approach to Equity Sector Investing

... the pickup in demand in an environment of sustained and more predictable economic growth. From an underperformance perspective, the utilities and materials sectors have lagged by the greatest magnitude. Due to the lack of clear sector leadership, the mid-cycle phase is a market environment in which ...

... the pickup in demand in an environment of sustained and more predictable economic growth. From an underperformance perspective, the utilities and materials sectors have lagged by the greatest magnitude. Due to the lack of clear sector leadership, the mid-cycle phase is a market environment in which ...

0620 L M AW AND

... Unemployment is central because it is harder to explain or correct than inflation and balance of payments problems. The basic causes and cures of the last two were established by the eighteenth century (as in David Hume’s essays that relate to economics). In contrast, neither what causes unemploymen ...

... Unemployment is central because it is harder to explain or correct than inflation and balance of payments problems. The basic causes and cures of the last two were established by the eighteenth century (as in David Hume’s essays that relate to economics). In contrast, neither what causes unemploymen ...

The quantity theory of money and Friedmanian monetary

... acterized by the use of a variety of prior assumptions. The validity of these remains untested, but is essential for the overall validity of the empirical results. The assumptions include various specifications of a New Keynesian model including the highly questionable assumption of a representativ ...

... acterized by the use of a variety of prior assumptions. The validity of these remains untested, but is essential for the overall validity of the empirical results. The assumptions include various specifications of a New Keynesian model including the highly questionable assumption of a representativ ...

A Simple Model of Income, Aggregate Demand, and the Process of

... (2009) - but they also seemed incapable of properly comprehending its mechanisms and helping policy-makers to deal with sluggish economic activity, high unemployment and soaring deficit levels. This shouldn't come as a surprise. For long decades the tendency of conventional economic theory has indee ...

... (2009) - but they also seemed incapable of properly comprehending its mechanisms and helping policy-makers to deal with sluggish economic activity, high unemployment and soaring deficit levels. This shouldn't come as a surprise. For long decades the tendency of conventional economic theory has indee ...

Document

... What is the difference between the demand for money and the quantity demanded of money? The demand for money is amount of money that will be demanded at various interest rates. In other words, it is the entire set of interest rate -quantity demanded combinations as represented by a downward-sloping ...

... What is the difference between the demand for money and the quantity demanded of money? The demand for money is amount of money that will be demanded at various interest rates. In other words, it is the entire set of interest rate -quantity demanded combinations as represented by a downward-sloping ...

ABM 7101 BUSINESS ECONOMICS

... Micro-level investment decisions. Macroeconomic theory, national income (GDP). An outline of Keynesian analysis. Determination of level and changes in income and employment. Marginal propensity to consume and save. The multiplier, the accelerator, determination of level of investment, liquidity pref ...

... Micro-level investment decisions. Macroeconomic theory, national income (GDP). An outline of Keynesian analysis. Determination of level and changes in income and employment. Marginal propensity to consume and save. The multiplier, the accelerator, determination of level of investment, liquidity pref ...

The use of money and credit measures in contemporary monetary

... discussion, as the major central bank that has given its analysis of money and credit most prominence. Its approach to monetary policy formulation has two ‘pillars’ – ‘monetary analysis’ and ‘economic analysis’. The ‘economic analysis’ pillar is an approach to assessing the relevance of current econ ...

... discussion, as the major central bank that has given its analysis of money and credit most prominence. Its approach to monetary policy formulation has two ‘pillars’ – ‘monetary analysis’ and ‘economic analysis’. The ‘economic analysis’ pillar is an approach to assessing the relevance of current econ ...

МУ для выполнения контрольной работы №2 по английскому языку

... 4. Macroeconomic analysis shows the development of the economic theory. 5. Inflation could not be eliminated without some negative changes in economics. ...

... 4. Macroeconomic analysis shows the development of the economic theory. 5. Inflation could not be eliminated without some negative changes in economics. ...

The liquidity effect

... The reason the nominal interest rate enters into the labour demand condition is that labour is a cash in advance good, and so a borrowing cost is incurred for every person hired. Therefore when the nominal interest rate falls, hiring costs decline and so the firm is prepared to recruit more workers, ...

... The reason the nominal interest rate enters into the labour demand condition is that labour is a cash in advance good, and so a borrowing cost is incurred for every person hired. Therefore when the nominal interest rate falls, hiring costs decline and so the firm is prepared to recruit more workers, ...

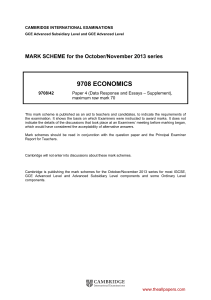

9708 economics

... It has an aim of doubling its size. This might indicate that it hopes to achieve economies of scale. However, elements of their business would seem to be towards perfect competition and against the idea of larger size as they wish to deal with 500 000 small farmers. It also had a policy of improving ...

... It has an aim of doubling its size. This might indicate that it hopes to achieve economies of scale. However, elements of their business would seem to be towards perfect competition and against the idea of larger size as they wish to deal with 500 000 small farmers. It also had a policy of improving ...

Homework 3

... multiplier. Calculate the cash to deposit ratio and the reserve to deposit ratio. Calculate the multiplier if the bank regulator imposes a required reserve ratio of 20% assuming the the reserve deoposit ratio goes to zero and the cash to deposit ratio remains unchanged. The monetary base is cash + b ...

... multiplier. Calculate the cash to deposit ratio and the reserve to deposit ratio. Calculate the multiplier if the bank regulator imposes a required reserve ratio of 20% assuming the the reserve deoposit ratio goes to zero and the cash to deposit ratio remains unchanged. The monetary base is cash + b ...

... interest. Keynes also elaborated on the notion of effective demand, which in his view includes two concepts; "investment-expenditure" and "consumption expenditure", which depended on the level of income, people's propensity to spend and expectations about the future as well as the interest rate (ibi ...

here

... works of the “Austrian” economists. This school of economic thought calls credit expansion as the issue of “fiduciary media” – i.e. fiat money (Mises, 1998). In fact, monetary base does not set the money supply but put only certain limit on credit expansion in this theory. Therefore the money multip ...

... works of the “Austrian” economists. This school of economic thought calls credit expansion as the issue of “fiduciary media” – i.e. fiat money (Mises, 1998). In fact, monetary base does not set the money supply but put only certain limit on credit expansion in this theory. Therefore the money multip ...

Beyond the liquidity trap: ineffectiveness of monetary policy as an

... pressures is typically related to the concept of liquidity trap. This traditional concept asserts that monetary policy is ineffective in a situation when increase in money supply does not result in falling interest rate but merely in growth of idle balances; the interest rate elasticity of demand fo ...

... pressures is typically related to the concept of liquidity trap. This traditional concept asserts that monetary policy is ineffective in a situation when increase in money supply does not result in falling interest rate but merely in growth of idle balances; the interest rate elasticity of demand fo ...

The “Natural” Interest Rate and Secular Stagnation: Loanable Funds

... save less and firms seek to invest more. The supply of loanable funds will go down and demand up, until the two flows equalize with the interest rate at its “natural” level. In New Keynesian thinking, demand for investment can be so weak and the desire to save so strong that the natural rate lies be ...

... save less and firms seek to invest more. The supply of loanable funds will go down and demand up, until the two flows equalize with the interest rate at its “natural” level. In New Keynesian thinking, demand for investment can be so weak and the desire to save so strong that the natural rate lies be ...