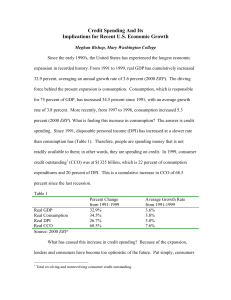

Credit Spending And Its Implications for Recent U.S. Economic Growth

... how much income they earn, how much income they expect to earn, and their accumulated wealth. But recent studies have shown that the MPC out of wealth has decreased since Modigliani’s 1963 study. Poterba (2000) found in his research that there may no longer even be a MPC out of wealth. I hypothesiz ...

... how much income they earn, how much income they expect to earn, and their accumulated wealth. But recent studies have shown that the MPC out of wealth has decreased since Modigliani’s 1963 study. Poterba (2000) found in his research that there may no longer even be a MPC out of wealth. I hypothesiz ...

Paper - CiteSeerX

... is the range that statistical filters target when seeking to distinguish the cyclical from the trend components in GDP. By contrast, the average length of the financial cycle in a sample of seven industrialised countries since the 1960s has been around 16 years. Graph 1, taken from Drehmann et al (2 ...

... is the range that statistical filters target when seeking to distinguish the cyclical from the trend components in GDP. By contrast, the average length of the financial cycle in a sample of seven industrialised countries since the 1960s has been around 16 years. Graph 1, taken from Drehmann et al (2 ...

Money, inflation and interest rates

... gous out of control (hyper-inflations) are economy as money loses value so fast that people stop using money and the entire two components system a)ofthecommercial exchange, that money is supposed to facilitate, breaks down. real return The natural question then is why do governments/ central banks ...

... gous out of control (hyper-inflations) are economy as money loses value so fast that people stop using money and the entire two components system a)ofthecommercial exchange, that money is supposed to facilitate, breaks down. real return The natural question then is why do governments/ central banks ...

What was the primary factor encouraging mainstream economists to

... In his 1986 interview with C-L Samuelson indicated that in the period before World War II, “my friends who were not economists regarded me as very conservative” [C-L, 1996, p. 154]. Samuelson graduated the University of Chicago in June 1935 and, as he explained to Colander and Landreth, were it not ...

... In his 1986 interview with C-L Samuelson indicated that in the period before World War II, “my friends who were not economists regarded me as very conservative” [C-L, 1996, p. 154]. Samuelson graduated the University of Chicago in June 1935 and, as he explained to Colander and Landreth, were it not ...

Principles of Macroeconomics, Case/Fair/Oster, 10e

... supply curve holds that at any given moment, the economy has a clearly defined capacity, or maximum, output. With planned aggregate expenditure of AE1 and aggregate demand of AD1, equilibrium output is Y1. A shift of planned aggregate expenditure to AE2, corresponding to a shift of the AD curve to A ...

... supply curve holds that at any given moment, the economy has a clearly defined capacity, or maximum, output. With planned aggregate expenditure of AE1 and aggregate demand of AD1, equilibrium output is Y1. A shift of planned aggregate expenditure to AE2, corresponding to a shift of the AD curve to A ...

The General Theory After 80 Years

... clear why the mainstream has paid so little attention to dynamics. As Mas-Colell, Whinston, and Green argue, dynamics is much harder, but economists do not always shy away from difficult problems. Difficulties aside, one reason for avoiding these issues is that such theorizing as has been done tends ...

... clear why the mainstream has paid so little attention to dynamics. As Mas-Colell, Whinston, and Green argue, dynamics is much harder, but economists do not always shy away from difficult problems. Difficulties aside, one reason for avoiding these issues is that such theorizing as has been done tends ...

pdf copy of this Policy Study

... Executive Summary Economic theories have dominated the last three centuries of world history, and it is imperative that we understand their development and implications for the future. Starting in 1776 with Adam Smith and his seminal work The Wealth of Nations, early economic theory championed the ...

... Executive Summary Economic theories have dominated the last three centuries of world history, and it is imperative that we understand their development and implications for the future. Starting in 1776 with Adam Smith and his seminal work The Wealth of Nations, early economic theory championed the ...

A Neo-Keynedan Vie~ of Monetary Policy

... of households and businesses will be thrown out of equilibrium. The adjustment toward a new equilibrium will take the form of a sale of existing financial assets and the issuance of new debt to acquire real capital and claims thereto. This will raise the price of existing units of real capital-or eq ...

... of households and businesses will be thrown out of equilibrium. The adjustment toward a new equilibrium will take the form of a sale of existing financial assets and the issuance of new debt to acquire real capital and claims thereto. This will raise the price of existing units of real capital-or eq ...

Charles I. Plosser Robert G. King Working Paper No. 853 1050

... and institutions should not be regarded as necessarily endorsing the views expressed in this paper. ...

... and institutions should not be regarded as necessarily endorsing the views expressed in this paper. ...

Principles of Macroeconomics, Case/Fair/Oster, 10e

... or a Decrease in Net Taxes (T) interest sensitivity or insensitivity of planned investment The responsiveness of planned investment spending to changes in the interest rate. Interest sensitivity means that planned investment spending changes a great deal in response to changes in the interest rate; ...

... or a Decrease in Net Taxes (T) interest sensitivity or insensitivity of planned investment The responsiveness of planned investment spending to changes in the interest rate. Interest sensitivity means that planned investment spending changes a great deal in response to changes in the interest rate; ...

Lecture 4 - The Digital Economist

... involved both which are highly sensitive to changes in interest rates. Higher interest rates lead to higher borrowing costs and thus lower net-benefits or profits such that the level of aggregate investment expenditure may be reduced. Maintenance and replacement costs depend on the useful life of an ...

... involved both which are highly sensitive to changes in interest rates. Higher interest rates lead to higher borrowing costs and thus lower net-benefits or profits such that the level of aggregate investment expenditure may be reduced. Maintenance and replacement costs depend on the useful life of an ...

chapter summary

... shifted focus back to interest rates, particularly the federal funds rate. To pursue its main goals of price stability and sustainable economic growth, the Fed adjusts the federal funds rate, raising the rate to prevent higher inflation and lowering the rate to stimulate economic growth. As a result ...

... shifted focus back to interest rates, particularly the federal funds rate. To pursue its main goals of price stability and sustainable economic growth, the Fed adjusts the federal funds rate, raising the rate to prevent higher inflation and lowering the rate to stimulate economic growth. As a result ...

A Primer on Inflation

... detrimental to growth – on the contrary. Average real growth rates have declined both with the changeover to the gold exchange standard, respectively to today's debt based fiat money system. From this one could deduce that the more consistent the gold backing, the lower long-term inflation and the h ...

... detrimental to growth – on the contrary. Average real growth rates have declined both with the changeover to the gold exchange standard, respectively to today's debt based fiat money system. From this one could deduce that the more consistent the gold backing, the lower long-term inflation and the h ...

Lesson 2 - uwcentre

... The Quantity Theory of Money: A First Look at the Link between Money and Prices ...

... The Quantity Theory of Money: A First Look at the Link between Money and Prices ...

Injections and leakages in the circular flow model of the

... Changes in the components in this model can lead to changes in the level of a country’s national income. Consider whether the event that is described will lead either to a change in an injection /leakage and whether the effect will cause an expansion () or a contraction () in national income. Econ ...

... Changes in the components in this model can lead to changes in the level of a country’s national income. Consider whether the event that is described will lead either to a change in an injection /leakage and whether the effect will cause an expansion () or a contraction () in national income. Econ ...

Document

... that “supply creates its own demand” and therefore the Great Depression was impossible. Say’s Law is the belief that the value of production generates an equal amount of income and, in turn, total spending. ...

... that “supply creates its own demand” and therefore the Great Depression was impossible. Say’s Law is the belief that the value of production generates an equal amount of income and, in turn, total spending. ...

Economics for Today 2nd edition Irvin B. Tucker

... • According to the Monetarist, how do we avoid Inflation and Unemployment? • Who is Milton Friedman? • What does Milton Friedman Advocate? • What is Classical Economists? • What is Keynesian Economists? • What is Monetarism? ...

... • According to the Monetarist, how do we avoid Inflation and Unemployment? • Who is Milton Friedman? • What does Milton Friedman Advocate? • What is Classical Economists? • What is Keynesian Economists? • What is Monetarism? ...

Monetary Policy in the 2008-2009 Recession

... exercise systematic or predictable control over real variables (the natural-rate hypothesis). Nevertheless, monetary instability, which Friedman measured using fluctuations in the money stock relative to steady growth, destabilizes real output. These empirical generalizations require reformulation f ...

... exercise systematic or predictable control over real variables (the natural-rate hypothesis). Nevertheless, monetary instability, which Friedman measured using fluctuations in the money stock relative to steady growth, destabilizes real output. These empirical generalizations require reformulation f ...

Monetary Policy in the 2008–2009 Recession

... exercise systematic or predictable control over real variables (the natural-rate hypothesis). Nevertheless, monetary instability, which Friedman measured using fluctuations in the money stock relative to steady growth, destabilizes real output. These empirical generalizations require reformulation f ...

... exercise systematic or predictable control over real variables (the natural-rate hypothesis). Nevertheless, monetary instability, which Friedman measured using fluctuations in the money stock relative to steady growth, destabilizes real output. These empirical generalizations require reformulation f ...

NBER WORKING PAPER SERIES BOOM-BUSTS IN ASSET PRICES, ECONOMIC INSTABILITY,

... Another, more difficult question is whether (and when) the conditions for a proactive monetary policy are met in the real world. We view this question as very much open and deserving further empirical research. In the meantime, we present in this paper some stylized facts on asset booms and busts th ...

... Another, more difficult question is whether (and when) the conditions for a proactive monetary policy are met in the real world. We view this question as very much open and deserving further empirical research. In the meantime, we present in this paper some stylized facts on asset booms and busts th ...

NBER WORKING PAPER SERIES DEPRESSION Peter F. Basile

... view it was clear that "In fact, the United States during the thirties (especially from 1934 on) was a good example [of a liquidity trap]." American Keynesians were aware, of course, that there was a broad spectrum of rates beyond short-term government rates, but they believed that these rates had b ...

... view it was clear that "In fact, the United States during the thirties (especially from 1934 on) was a good example [of a liquidity trap]." American Keynesians were aware, of course, that there was a broad spectrum of rates beyond short-term government rates, but they believed that these rates had b ...

Chapter 26

... argument supporting this Keynesian view is that the a. money demand curve is horizontal at any interest rate. b. aggregate demand curve is nearly flat. c. investment demand curve is nearly vertical. d. money demand curve is vertical. C. If the investment demand curve is nearly vertical, changes in m ...

... argument supporting this Keynesian view is that the a. money demand curve is horizontal at any interest rate. b. aggregate demand curve is nearly flat. c. investment demand curve is nearly vertical. d. money demand curve is vertical. C. If the investment demand curve is nearly vertical, changes in m ...

The characteristics of a monetary economy: a Keynes

... alter the structure of the economic system, or to changes triggered by extra-social factors such as natural conditions, or by extra-economic social factors such as wars, or by consumer tastes; it is an economy in which the production decisions are influenced by consumers’ preferences and in which th ...

... alter the structure of the economic system, or to changes triggered by extra-social factors such as natural conditions, or by extra-economic social factors such as wars, or by consumer tastes; it is an economy in which the production decisions are influenced by consumers’ preferences and in which th ...

Business Cycles and the Bible

... rebalancing of their portfolios away from risky assets toward safer ones will be complemented by a reduction on goods and services spending as an additional way to increase their money holdings. Now if everyone begins selling off assets a fire sale will emerge and cause asset values to plunge. This ...

... rebalancing of their portfolios away from risky assets toward safer ones will be complemented by a reduction on goods and services spending as an additional way to increase their money holdings. Now if everyone begins selling off assets a fire sale will emerge and cause asset values to plunge. This ...

Grad7

... Keynes noted that investment would be induced when the marginal efficiency of capital exceeds the real rate of interest. As such investment occurs, the marginal efficiency of capital decreases, either because of to diminishing returns to capital or because of an increase in the prices of investment ...

... Keynes noted that investment would be induced when the marginal efficiency of capital exceeds the real rate of interest. As such investment occurs, the marginal efficiency of capital decreases, either because of to diminishing returns to capital or because of an increase in the prices of investment ...