May 2007 by Alexander J. Field*

... during which the trend growth rate of TFP was quite different. These conclusions are robust to substituting the pre-1948 unemployment series generated by Weir (1992) for the Lebergott numbers which continue to be used by most researchers. This finding is important in explaining and forecasting short ...

... during which the trend growth rate of TFP was quite different. These conclusions are robust to substituting the pre-1948 unemployment series generated by Weir (1992) for the Lebergott numbers which continue to be used by most researchers. This finding is important in explaining and forecasting short ...

3312-11547-1-SP

... In Nigeria today, exchange rates and its constant movement is of great importance to the general public because one way or the other its fluctuation has an effect on the competence of the economy to attain optimal productive capacity. This is alarming given its macro-economic importance specifically ...

... In Nigeria today, exchange rates and its constant movement is of great importance to the general public because one way or the other its fluctuation has an effect on the competence of the economy to attain optimal productive capacity. This is alarming given its macro-economic importance specifically ...

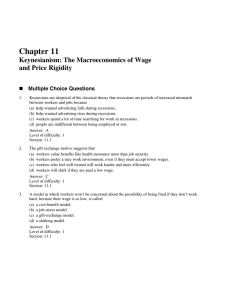

Unemployment and Inflation

... when there are more people seeking jobs in a labor market than there are jobs available at the current wage rate. 2. The minimum wage may be binding for less skilled workers. It affects the wages that people are actually paid and can lead to structural unemployment. 3. By bargaining collectively, la ...

... when there are more people seeking jobs in a labor market than there are jobs available at the current wage rate. 2. The minimum wage may be binding for less skilled workers. It affects the wages that people are actually paid and can lead to structural unemployment. 3. By bargaining collectively, la ...

exemplars and commentary

... less workers are needed and some lose their jobs. This decreases their disposable income (because they are unwilling to spend and save instead), which decreases consumption spending (C). This decreases AD and AD shifts inwards towards AD1, lowering the Real GDP towards Y1 and PL to PL1. A firm’s com ...

... less workers are needed and some lose their jobs. This decreases their disposable income (because they are unwilling to spend and save instead), which decreases consumption spending (C). This decreases AD and AD shifts inwards towards AD1, lowering the Real GDP towards Y1 and PL to PL1. A firm’s com ...

Essay Questions

... foreign products. Due to this, exports increase as foreigners demand more domestic exports. The change in imports is ambiguous because fewer units of imports are purchased (the volume effect), but each foreign unit is now more expensive (the value effect). Remember: exports and imports are measured ...

... foreign products. Due to this, exports increase as foreigners demand more domestic exports. The change in imports is ambiguous because fewer units of imports are purchased (the volume effect), but each foreign unit is now more expensive (the value effect). Remember: exports and imports are measured ...

ExamView Pro - EC1001 Exam 2007.tst

... Most spells of unemployment are short, and most unemployment observed at any given time is long term. How can this be? ...

... Most spells of unemployment are short, and most unemployment observed at any given time is long term. How can this be? ...

Principles of Economics, Case and Fair,9e

... Expansionary Fiscal Policy: An Increase in Government Purchases (G) or a Decrease in Net Taxes (T) interest sensitivity or insensitivity of planned investment The responsiveness of planned investment spending to changes in the interest rate. Interest sensitivity means that planned investment spendin ...

... Expansionary Fiscal Policy: An Increase in Government Purchases (G) or a Decrease in Net Taxes (T) interest sensitivity or insensitivity of planned investment The responsiveness of planned investment spending to changes in the interest rate. Interest sensitivity means that planned investment spendin ...

Government Spending Effects in a Small Open Economy

... domestic and foreign goods matter? I explore the above questions without changing preferences or assuming imperfect asset market. Here the different policy regime between monetary and fiscal policy will be considered. Especially active monetary/passive fiscal and passive monetary/active fiscal regim ...

... domestic and foreign goods matter? I explore the above questions without changing preferences or assuming imperfect asset market. Here the different policy regime between monetary and fiscal policy will be considered. Especially active monetary/passive fiscal and passive monetary/active fiscal regim ...

NBER WORKING PAPER SERIES THE INEFFICIENCY OF MARGINAL-COST

... stabilize wages without necessarily creating an inefficient allocation of labor. ...

... stabilize wages without necessarily creating an inefficient allocation of labor. ...

A simple framework for international monetary policy analysis

... augment it by allowing for a short run tradeoff in a way that does not sacrifice tractability. Thus, we are able to investigate qualitatively the implications of international considerations for monetary policy management without having to abstract from the central problem that the tradeoff poses. Ou ...

... augment it by allowing for a short run tradeoff in a way that does not sacrifice tractability. Thus, we are able to investigate qualitatively the implications of international considerations for monetary policy management without having to abstract from the central problem that the tradeoff poses. Ou ...

Euro/Dollar Exchange Rates: A Multi-Country Structural

... Variations of TOT has uncertain effects on Q depending on what forces are prevailing both in the domestic and in the foreign economy. Changes in the real price of oil can also have an effect on the relative price of traded goods, usually through their effect on the terms of trade described above. In ...

... Variations of TOT has uncertain effects on Q depending on what forces are prevailing both in the domestic and in the foreign economy. Changes in the real price of oil can also have an effect on the relative price of traded goods, usually through their effect on the terms of trade described above. In ...

32.1 the short-run phillips curve

... 32.2 SHORT-RUN AND LONG-RUN ... But if aggregate demand increases to AD2 and aggregate supply changes to AS2, the price level rises by 7 percent to 107. In both cases, real GDP remains at $10 trillion, and because the economy is at full employment, unemployment remains at the natural unemployment r ...

... 32.2 SHORT-RUN AND LONG-RUN ... But if aggregate demand increases to AD2 and aggregate supply changes to AS2, the price level rises by 7 percent to 107. In both cases, real GDP remains at $10 trillion, and because the economy is at full employment, unemployment remains at the natural unemployment r ...

Ch30-7e-lecture

... monetary base respond to the long-term average growth rate of real GDP and medium-term changes in the velocity of circulation of the monetary base. The rule is based on the quantity theory of money. The McCallum rule does not need an estimate of either the real interest rate or the output gap. The M ...

... monetary base respond to the long-term average growth rate of real GDP and medium-term changes in the velocity of circulation of the monetary base. The rule is based on the quantity theory of money. The McCallum rule does not need an estimate of either the real interest rate or the output gap. The M ...

PDF

... A. Choice of Variables, Variable Description, and Data Sources Economic theory and previous studies suggest a number of economic influences and particular variables that may influence current values of farmland. The revenue generating aspects of farmland are well recognized as being important factor ...

... A. Choice of Variables, Variable Description, and Data Sources Economic theory and previous studies suggest a number of economic influences and particular variables that may influence current values of farmland. The revenue generating aspects of farmland are well recognized as being important factor ...