GST - Surya Roshni

... United Kingdom: includes all forms of supply, but not anything done otherwise than for a consideration ...

... United Kingdom: includes all forms of supply, but not anything done otherwise than for a consideration ...

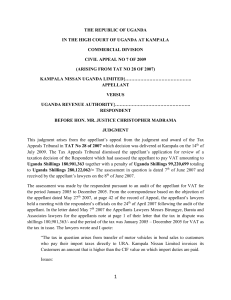

high-court-2011-139

... record of appeal on the 29th of March 2011 which record was accepted. On the 12th of April 2011 the court extended time for the respondent to put in its written submissions. The respondent eventually filed its written submissions on the 11th of May 2011 after further delay. I have carefully conside ...

... record of appeal on the 29th of March 2011 which record was accepted. On the 12th of April 2011 the court extended time for the respondent to put in its written submissions. The respondent eventually filed its written submissions on the 11th of May 2011 after further delay. I have carefully conside ...

Negative List based Taxation of Services

... Treated as Works Contracts under IT Law but not under Service Tax or VAT Law Construction Work undertaken on labour job basis without any transfer of material ...

... Treated as Works Contracts under IT Law but not under Service Tax or VAT Law Construction Work undertaken on labour job basis without any transfer of material ...

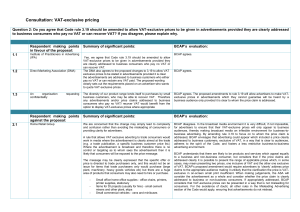

Consultation: VAT-exclusive pricing

... consider the advertisement as a whole and consider whether the price claim is clearly addressed to business or non-business consumers. If appropriately addressed, BCAP considers that VAT-exclusive prices can be presented in a way that is not misleading for consumers. For the avoidance of doubt, all ...

... consider the advertisement as a whole and consider whether the price claim is clearly addressed to business or non-business consumers. If appropriately addressed, BCAP considers that VAT-exclusive prices can be presented in a way that is not misleading for consumers. For the avoidance of doubt, all ...