Article 10

... supply, lowers interest rates, and increases aggregate demand (Amadeo, 2016). Restrictive monetary policy means low money supply in the financial system and that has the opposite effects on the economy unlike the expansionary monetary policy. In this paper main assumption is, when it comes to functi ...

... supply, lowers interest rates, and increases aggregate demand (Amadeo, 2016). Restrictive monetary policy means low money supply in the financial system and that has the opposite effects on the economy unlike the expansionary monetary policy. In this paper main assumption is, when it comes to functi ...

mmi13 Zimmermann 19075478 en

... issue on the supply of equity by households (who also purchase deposits). In our model economy, households have heterogenous asset holdings because of different labor histories and because only some of them qualify to apply for credit as entrepreneurs. (among those, the return on investment is stoch ...

... issue on the supply of equity by households (who also purchase deposits). In our model economy, households have heterogenous asset holdings because of different labor histories and because only some of them qualify to apply for credit as entrepreneurs. (among those, the return on investment is stoch ...

The Broken Bank White Paper_v10

... estate market was valued at $25 trillion, and homeowner’s equity accounted for 52 percent. At the bottom of the crash, the housing market fell to $20.6 trillion, and homeowner’s equity accounted for 28 percent. Homeowners lost nearly half their equity value in less than three years due to reckless b ...

... estate market was valued at $25 trillion, and homeowner’s equity accounted for 52 percent. At the bottom of the crash, the housing market fell to $20.6 trillion, and homeowner’s equity accounted for 28 percent. Homeowners lost nearly half their equity value in less than three years due to reckless b ...

A Primer on Inflation

... The increase in the broad money supply combined with greater velocity results inevitably in greater nominal GDP. In the schematically outlined case above, GDP would increase by approximately 120%. Nominal GDP growth consists of real growth and the rise in the price level. It stands to reason that in ...

... The increase in the broad money supply combined with greater velocity results inevitably in greater nominal GDP. In the schematically outlined case above, GDP would increase by approximately 120%. Nominal GDP growth consists of real growth and the rise in the price level. It stands to reason that in ...

Sterilization of Capital Inflows and Balance of Payments

... 1998) assume that the non-financial public sector deficit was the driver of the currency crisis when, in fact, it was very low in the years preceding the crisis. On the other hand, when international interest rates were low during 1992 and 1993 (see Figure 1), the Central Bank sterilized capital inf ...

... 1998) assume that the non-financial public sector deficit was the driver of the currency crisis when, in fact, it was very low in the years preceding the crisis. On the other hand, when international interest rates were low during 1992 and 1993 (see Figure 1), the Central Bank sterilized capital inf ...

Contents

... It is commonly asserted that New Zealand’s large exchange rate cycles may have contributed to the disappointing aspects of the country’s economic performance noted earlier and that these cycles are being unnecessarily generated by monetary policy. Big swings in the exchange rate do seem likely to im ...

... It is commonly asserted that New Zealand’s large exchange rate cycles may have contributed to the disappointing aspects of the country’s economic performance noted earlier and that these cycles are being unnecessarily generated by monetary policy. Big swings in the exchange rate do seem likely to im ...

Bond Issues

... • Bonds may be issued between interest dates. • Interest, for the period between the issue date and the last interest date, is collected with the issue price of the bonds (accrued interest). • At the specified interest date, interest is paid for the entire interest period (semiannual or annual). • P ...

... • Bonds may be issued between interest dates. • Interest, for the period between the issue date and the last interest date, is collected with the issue price of the bonds (accrued interest). • At the specified interest date, interest is paid for the entire interest period (semiannual or annual). • P ...

Money Demand, the Equilibrium Interest Rate, and Monetary Policy

... C H A P T E R 11: Money Demand, the Equilibrium Interest Rate, and Monetary Policy ...

... C H A P T E R 11: Money Demand, the Equilibrium Interest Rate, and Monetary Policy ...

External Sector

... In the first file (Table ED) there are tree tables: In the first, main table external debt by economic sectors is shown, the second table shows external debt by national and foreign currencies, the third table except of outstanding debt, shows also the details of the debt change during the reporting ...

... In the first file (Table ED) there are tree tables: In the first, main table external debt by economic sectors is shown, the second table shows external debt by national and foreign currencies, the third table except of outstanding debt, shows also the details of the debt change during the reporting ...

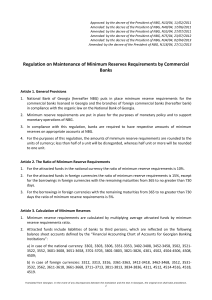

Regulation on Maintenance of Minimum Reserves Requirements by

... b) subordinated debt, which satisfies the requirements of the regulatory capital and is recognized as such by NBG, regardless of whether or not it is included in the calculation of the regulatory capital. c) such liabilities on the balance sheet which are not related to the movement of cash flows. d ...

... b) subordinated debt, which satisfies the requirements of the regulatory capital and is recognized as such by NBG, regardless of whether or not it is included in the calculation of the regulatory capital. c) such liabilities on the balance sheet which are not related to the movement of cash flows. d ...

Monetary and Credit Targets in an Open Economy

... monetary policy taking the form of achieving target paths for the stock of money or exchange rates.8 Two notable exceptions are the studies of Black (1982b) and Rozwadowski (1983). Black used an extended ModiglianiPapademos (1980) model to suggest the existence of a relationship between the choice o ...

... monetary policy taking the form of achieving target paths for the stock of money or exchange rates.8 Two notable exceptions are the studies of Black (1982b) and Rozwadowski (1983). Black used an extended ModiglianiPapademos (1980) model to suggest the existence of a relationship between the choice o ...

paper - Buffalo State College Faculty and Staff Web Server

... The tables and charts in this section look at the reserves position of depository institutions in the US at the Federal Reserve and then in the FDIC’s annual time series format. First, Table 1 provides short term monthly data on total reserves (TR), required reserves (RR) and excess reserves (ER), m ...

... The tables and charts in this section look at the reserves position of depository institutions in the US at the Federal Reserve and then in the FDIC’s annual time series format. First, Table 1 provides short term monthly data on total reserves (TR), required reserves (RR) and excess reserves (ER), m ...

Twin-Targeting Analytics of a Financial CGE Model ∗

... After a long history of failed stabilization attempts, Turkey signed a Staff Monitoring Program with the International Monetary Fund (IMF). The Program currently sets the macroeconomic policy agenda in Turkey and relies mainly on fiscal austerity with specific primary budget targets and a contractio ...

... After a long history of failed stabilization attempts, Turkey signed a Staff Monitoring Program with the International Monetary Fund (IMF). The Program currently sets the macroeconomic policy agenda in Turkey and relies mainly on fiscal austerity with specific primary budget targets and a contractio ...

Econ 181 Midterm

... Consider a rise of ΔΠ in the future rate of U.S. money supply growth (i.e. an increase in the expected rate of inflation). The Key Point: The rise in expected future inflation generates expectations of more rapid currency depreciation in the future. Under PPP the dollar now depreciates at a rate of ...

... Consider a rise of ΔΠ in the future rate of U.S. money supply growth (i.e. an increase in the expected rate of inflation). The Key Point: The rise in expected future inflation generates expectations of more rapid currency depreciation in the future. Under PPP the dollar now depreciates at a rate of ...

18-12 Fixed Exchange Rates

... • Because most countries maintained fixed exchange rates by trading dollar-denominated (foreign) assets, they had ineffective monetary policies. • The Federal Reserve, however, did not have to intervene in foreign exchange markets, so it could conduct monetary policy to influence aggregate demand, o ...

... • Because most countries maintained fixed exchange rates by trading dollar-denominated (foreign) assets, they had ineffective monetary policies. • The Federal Reserve, however, did not have to intervene in foreign exchange markets, so it could conduct monetary policy to influence aggregate demand, o ...

Does a Less Active Central Bank Lead to Greater Economic Stability

... On January 1, 1999 eleven European countries gave up the independence of their monetary policy by joining the European Monetary Union (EMU). Since that time, these countries have shared a common currency, the Euro, and more importantly are all now under the direction of a common European Central Ban ...

... On January 1, 1999 eleven European countries gave up the independence of their monetary policy by joining the European Monetary Union (EMU). Since that time, these countries have shared a common currency, the Euro, and more importantly are all now under the direction of a common European Central Ban ...

IS-LM Model 01 File

... banks ↑, naturally firms reduce their spending for new capital goods). e represents the amount of investment spending which depends on other factors such as business optimism about the future profits, technology and others. ...

... banks ↑, naturally firms reduce their spending for new capital goods). e represents the amount of investment spending which depends on other factors such as business optimism about the future profits, technology and others. ...

2002 Japan Conference: A Summary of the Papers

... more flexibility and support than would be available in a more market-driven credit allocation process. However, the reality of banks placing relationships ahead of sound business practices that rely on credit risk analysis has contributed significantly to the lending policies that have resulted in ...

... more flexibility and support than would be available in a more market-driven credit allocation process. However, the reality of banks placing relationships ahead of sound business practices that rely on credit risk analysis has contributed significantly to the lending policies that have resulted in ...

Bank Runs, Welfare and Policy Implications

... Since the banking sector is competitive, a representative bank must earn a zero profit in equilibrium. Combined with the contract implementation rule, if a bank’s own investment is zero (i.e., deposits make up 100% of the liabilities in the bank’s balance sheet), it would choose a demand deposit con ...

... Since the banking sector is competitive, a representative bank must earn a zero profit in equilibrium. Combined with the contract implementation rule, if a bank’s own investment is zero (i.e., deposits make up 100% of the liabilities in the bank’s balance sheet), it would choose a demand deposit con ...

Document

... b. through the use of open market operations c. by adjusting government spending and taxes d. Both a and b ANSWER: d 37. Which of the following is considered to be the Fed's main policy tool? a. The rediscount rate b. The reserve ratio c. Raising taxes d. Open market operations ANSWER: d 38. The tim ...

... b. through the use of open market operations c. by adjusting government spending and taxes d. Both a and b ANSWER: d 37. Which of the following is considered to be the Fed's main policy tool? a. The rediscount rate b. The reserve ratio c. Raising taxes d. Open market operations ANSWER: d 38. The tim ...

slides - Andrei Simonov

... 2009-2014 originally issued Aug. 15, 1984, and due Aug. 15, 2014. According to Wednesday's announcement, securities not redeemed on Aug. 15, will stop earning interest. In general, when Treasury "calls" a bond, it stops paying interest on the date of the call -- before the maturity date. The Treasur ...

... 2009-2014 originally issued Aug. 15, 1984, and due Aug. 15, 2014. According to Wednesday's announcement, securities not redeemed on Aug. 15, will stop earning interest. In general, when Treasury "calls" a bond, it stops paying interest on the date of the call -- before the maturity date. The Treasur ...

Acc. Management

... list of accounts follows giving more commonly used names. The general ledger is sectioned into five basic account groupings. Assets, Liabilities, Proprietorship, Revenue and Expense. A basic description of each and some examples of each follow: ...

... list of accounts follows giving more commonly used names. The general ledger is sectioned into five basic account groupings. Assets, Liabilities, Proprietorship, Revenue and Expense. A basic description of each and some examples of each follow: ...

Inflation-Linked Pricing in the Presence of a Central Bank Reaction

... We propose a pricing model for inflation-linked derivatives based on the premise that, to be successful, an inflation model has to take into account the central bank reaction function to explain the co-movement of interest rates and inflation. To achieve this, we adapt elements of a mainstream macro ...

... We propose a pricing model for inflation-linked derivatives based on the premise that, to be successful, an inflation model has to take into account the central bank reaction function to explain the co-movement of interest rates and inflation. To achieve this, we adapt elements of a mainstream macro ...

Progress of the Plan for Removal of Capital Controls

... parties could amount to as much as 25% of GDP, or around ISK 500 billion. It points out, however, that this depends upon various factors, such as investors' attitude at any given time to domestic and foreign investment options and credibility in removal of capital controls. 3 Actions for removal of ...

... parties could amount to as much as 25% of GDP, or around ISK 500 billion. It points out, however, that this depends upon various factors, such as investors' attitude at any given time to domestic and foreign investment options and credibility in removal of capital controls. 3 Actions for removal of ...

16.3 Money, Near Money, and Credit Cards

... Money in bank vaults or on deposit at the Fed is not in circulation as a medium of exchange and so is not counted in the money supply. Currency makes up about half of M1. ...

... Money in bank vaults or on deposit at the Fed is not in circulation as a medium of exchange and so is not counted in the money supply. Currency makes up about half of M1. ...