NBER WORKING PAPER SERIES GOLD STERILIZATION AND THE RECESSION OF 1937-38

... prices began to rise briskly in the second half of 1936. By December of that year, they were 4 percent higher than they had been a year before. Meanwhile, gold continued to pour in from abroad and banks continued to accumulate large excess reserves, which Treasury and Federal Reserve officials viewe ...

... prices began to rise briskly in the second half of 1936. By December of that year, they were 4 percent higher than they had been a year before. Meanwhile, gold continued to pour in from abroad and banks continued to accumulate large excess reserves, which Treasury and Federal Reserve officials viewe ...

monetary transmission mechanism in albania

... that monetary policy can only be used to smooth short-term output fluctuations and does not affect long-term real growth. Monetary policy can, however, be an effective tool to achieve price stability, which has been established as the single final objective of many central banks all over the world. ...

... that monetary policy can only be used to smooth short-term output fluctuations and does not affect long-term real growth. Monetary policy can, however, be an effective tool to achieve price stability, which has been established as the single final objective of many central banks all over the world. ...

Interest Rate Risk Management for Commercial

... their risk on the capital market and hence to alter their exposure to interest rate risk via off-balance sheet activities quickly, once a stress situation occurs. An historical example of a banking crisis where interest rate risk played an integral role is the „Savings and Loan Crisis‟ which occurre ...

... their risk on the capital market and hence to alter their exposure to interest rate risk via off-balance sheet activities quickly, once a stress situation occurs. An historical example of a banking crisis where interest rate risk played an integral role is the „Savings and Loan Crisis‟ which occurre ...

The growth of emerging economies and global macroeconomic

... before observing zj,t , both aggregate and idiosyncratic. This implies that the choice of labor is risky. To insure consumption smoothing, entrepreneurs have access to a market for non-contingent bonds at price qt . As we will see, bonds held by entrepreneurs are the liabilities issued by banks. Not ...

... before observing zj,t , both aggregate and idiosyncratic. This implies that the choice of labor is risky. To insure consumption smoothing, entrepreneurs have access to a market for non-contingent bonds at price qt . As we will see, bonds held by entrepreneurs are the liabilities issued by banks. Not ...

Volume 74 No. 1, March 2011 Contents

... inflation-indexed bonds issued by the Federal government are called TIPS (Treasury Inflation Protected Securities). Both the US and UK governments issue indexed bonds at a wide range of maturities. In other countries, the inflationindexed government bond market is less well developed. For example, b ...

... inflation-indexed bonds issued by the Federal government are called TIPS (Treasury Inflation Protected Securities). Both the US and UK governments issue indexed bonds at a wide range of maturities. In other countries, the inflationindexed government bond market is less well developed. For example, b ...

AP Macroeconomics Chapter One p. 3-10

... • Scarcity plays a role in this model because households will only possess a limited amounts of resources to supply to businesses, and hence, their money incomes will be limited. This limits their demand for goods and services. Because resource are scarce, the output of finished goods and services i ...

... • Scarcity plays a role in this model because households will only possess a limited amounts of resources to supply to businesses, and hence, their money incomes will be limited. This limits their demand for goods and services. Because resource are scarce, the output of finished goods and services i ...

assessment of investment portfolios of jordanian banks

... government bonds and equities. Investment portfolios may include other international bonds and equities and equity funds as well. The objectives of the investment portfolios are income generation and capital preservation, considering the risks stemming from other asset and liabilities and those asso ...

... government bonds and equities. Investment portfolios may include other international bonds and equities and equity funds as well. The objectives of the investment portfolios are income generation and capital preservation, considering the risks stemming from other asset and liabilities and those asso ...

Chinese Divisia Monetary Index and GDP Nowcasting William A

... different interest rate returns: three-months, six-months, one-year, two-years, three-years, and fiveyears. This paper assumes that consumers balance their budgets monthly. Despite having six different maturity horizons, we impute the same three-month time deposit interest rate to all of the time d ...

... different interest rate returns: three-months, six-months, one-year, two-years, three-years, and fiveyears. This paper assumes that consumers balance their budgets monthly. Despite having six different maturity horizons, we impute the same three-month time deposit interest rate to all of the time d ...

MERCATUS GRADUATE POLICY ESSAY

... the ―money does not matter‖ opinion prevailed and the emphasis on governmental fiscal action and direct intervention was increased. However, in actuality, the drastic decline in the quantity of money and the occurrence of an unprecedentedly severe banking panic reflected the absence of power on the ...

... the ―money does not matter‖ opinion prevailed and the emphasis on governmental fiscal action and direct intervention was increased. However, in actuality, the drastic decline in the quantity of money and the occurrence of an unprecedentedly severe banking panic reflected the absence of power on the ...

The Determinants of the Bank`s Excess Liquidity and the Credit Crisis

... granting of medium and long term loans. They must be prepared to meet their withdrawals of deposits at any moment of time. In order to do so, banks hold two types of reserves: required reserves, imposed by the central bank; and excess reserves, demanded by precautionary reasons. Holding reserves ent ...

... granting of medium and long term loans. They must be prepared to meet their withdrawals of deposits at any moment of time. In order to do so, banks hold two types of reserves: required reserves, imposed by the central bank; and excess reserves, demanded by precautionary reasons. Holding reserves ent ...

DP2003/04 Monetary policy transmission mechanisms and currency unions:

... countries could widen the existing cyclical variation and potentially impede the inflation-targeting role of the European Central Bank (ECB).3 The results of studies on Euro-area transmission mechanisms vary considerably. Gerlach and Smets (1995) concluded that the effects of monetary policy shocks ...

... countries could widen the existing cyclical variation and potentially impede the inflation-targeting role of the European Central Bank (ECB).3 The results of studies on Euro-area transmission mechanisms vary considerably. Gerlach and Smets (1995) concluded that the effects of monetary policy shocks ...

Objectives for Chapter 24: Monetarism (Continued) Chapter 24: The

... Notice that both of these are vertical. This is a very important conclusion. It tells us that in the long-run (when people are no longer fooled by inflation), there is no trade-off between inflation and unemployment. In the long-run, the economy will operate at Potential Real GDP (and at the natural ...

... Notice that both of these are vertical. This is a very important conclusion. It tells us that in the long-run (when people are no longer fooled by inflation), there is no trade-off between inflation and unemployment. In the long-run, the economy will operate at Potential Real GDP (and at the natural ...

Objectives for Chapter 24: Monetarism (Continued)

... Notice that both of these are vertical. This is a very important conclusion. It tells us that in the long-run (when people are no longer fooled by inflation), there is no trade-off between inflation and unemployment. In the long-run, the economy will operate at Potential Real GDP (and at the natural ...

... Notice that both of these are vertical. This is a very important conclusion. It tells us that in the long-run (when people are no longer fooled by inflation), there is no trade-off between inflation and unemployment. In the long-run, the economy will operate at Potential Real GDP (and at the natural ...

2 Macroeconomic Variables and Term Structure of Interest

... literature, that the change in yield curve over the business cycle may be associated with recessions, as Dombrosky and Haubrich (1995), Stock and Watson (2001) and Hamilton and Kim (2002). Accordingly, the yield curve may provide information to anticipate recessions (slope from positive to negative) ...

... literature, that the change in yield curve over the business cycle may be associated with recessions, as Dombrosky and Haubrich (1995), Stock and Watson (2001) and Hamilton and Kim (2002). Accordingly, the yield curve may provide information to anticipate recessions (slope from positive to negative) ...

July Massachusetts

... The authors thank Eric S. Rosengren, James A. Wilcox and participants at seminars at the Reserve Bank of Australia and the University of South Carolina Professor Hendershott also thanks the Australian for their helpful comments. Graduate School of Management of the University of New South Wales for ...

... The authors thank Eric S. Rosengren, James A. Wilcox and participants at seminars at the Reserve Bank of Australia and the University of South Carolina Professor Hendershott also thanks the Australian for their helpful comments. Graduate School of Management of the University of New South Wales for ...

G97/2 The Inflation-Output Trade-Off: Is The Phillips Curve

... A range of models suggest that the relationship between inflation (or wageinflation) and output (or unemployment) is asymmetric. For example, Summers’ (1988) efficiency wage model; Greenwald and Stiglitz (1988) who provide an explanation relating cyclical fluctuations to credit shocks; Hall (1988) w ...

... A range of models suggest that the relationship between inflation (or wageinflation) and output (or unemployment) is asymmetric. For example, Summers’ (1988) efficiency wage model; Greenwald and Stiglitz (1988) who provide an explanation relating cyclical fluctuations to credit shocks; Hall (1988) w ...

Monetary Theory and Monetary Policy: Reflections on the

... * This paper has been prepared as a contribution to the Special Issue on “150 years Journal of Economics and Statistics” of the Journal of Economics and Statistics/Jahrbücher für Nationalökonomie und Statistik. We would like to thank Peter Bernholz, Knut Borchardt and Heinz Rieter, the editor, Peter ...

... * This paper has been prepared as a contribution to the Special Issue on “150 years Journal of Economics and Statistics” of the Journal of Economics and Statistics/Jahrbücher für Nationalökonomie und Statistik. We would like to thank Peter Bernholz, Knut Borchardt and Heinz Rieter, the editor, Peter ...

Reputation, Renegotiation, and the Choice between Bank Loans

... If a firm is in financial distress, it may reflect, in some cases, the poor quality of its projects; in other cases, it may be due to reasons unrelated to project quality. In the former case the right course is for lenders to liquidate the firm; however, in the latter case it may be optimal for all ...

... If a firm is in financial distress, it may reflect, in some cases, the poor quality of its projects; in other cases, it may be due to reasons unrelated to project quality. In the former case the right course is for lenders to liquidate the firm; however, in the latter case it may be optimal for all ...

The Financial Crisis - Center on Budget and Policy Priorities

... The financial system was under mounting pressure thereafter, with markets experiencing a frightening roller-coaster ride, moving up and down as the ebb and flow of news varied from merely bad to truly horrible. But the world’s financial system might not have collapsed as it subsequently did were it ...

... The financial system was under mounting pressure thereafter, with markets experiencing a frightening roller-coaster ride, moving up and down as the ebb and flow of news varied from merely bad to truly horrible. But the world’s financial system might not have collapsed as it subsequently did were it ...

Bank`s financial market operations and liquidity

... signal of the Bank’s resolve to reinforce its target for the overnight rate. The LVTS is a closed system, which means that the net overall cash position of the entire system should generally be zero. Hence, any LVTS participant with a deficit position knows that there is at least one participant in ...

... signal of the Bank’s resolve to reinforce its target for the overnight rate. The LVTS is a closed system, which means that the net overall cash position of the entire system should generally be zero. Hence, any LVTS participant with a deficit position knows that there is at least one participant in ...

Monetary Velocity in a Systemic

... focusing on the construction of the system and by being aware that it might be better first to understand and adapt the characteristics of the system, we have a reversed view on economics: Currency therefore is seen as an operating system of the economy. It has to be designed optimally to serve the ...

... focusing on the construction of the system and by being aware that it might be better first to understand and adapt the characteristics of the system, we have a reversed view on economics: Currency therefore is seen as an operating system of the economy. It has to be designed optimally to serve the ...

Price-Level Targeting and Relative-Price Shocks

... firms’ desired markup of price over marginal cost. The New Keynesian model is based on two crucial assumptions: (i) firms change prices only periodically, meaning that prices generally remain fixed for more than one period, and (ii) firms form their expectations about the future in a rational way. Since ...

... firms’ desired markup of price over marginal cost. The New Keynesian model is based on two crucial assumptions: (i) firms change prices only periodically, meaning that prices generally remain fixed for more than one period, and (ii) firms form their expectations about the future in a rational way. Since ...

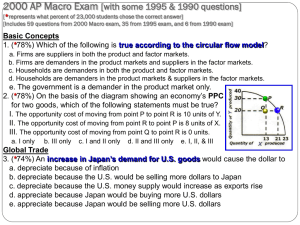

Economics of Money, Banking, and Financial Markets, 8e

... 1) A one-time increase in the price level A) is rarely reported by the news media as inflation, but is nevertheless considered to be inflation by economists. B) is regularly reported by the news media as inflation, but is not considered to be inflation by economists. C) is rarely reported by the new ...

... 1) A one-time increase in the price level A) is rarely reported by the news media as inflation, but is nevertheless considered to be inflation by economists. B) is regularly reported by the news media as inflation, but is not considered to be inflation by economists. C) is rarely reported by the new ...

increase

... a. real investment and the interest rate d. government expenditures & taxes b. real disposable income and unemployment e. imports and exports c. real domestic output(GDP) and the price level 19. (47%) Which of the following would most likely cause the U.S. economy to fall into recession? a. increase ...

... a. real investment and the interest rate d. government expenditures & taxes b. real disposable income and unemployment e. imports and exports c. real domestic output(GDP) and the price level 19. (47%) Which of the following would most likely cause the U.S. economy to fall into recession? a. increase ...

US Treasury Securities

... called the face value, or par value, which is paid back at maturity. With bills, however, your initial investment is less than par. This is known as buying at a discount. At maturity, you’re paid the face value, so the interest you’ve received is equivalent to the discount you got when you first bou ...

... called the face value, or par value, which is paid back at maturity. With bills, however, your initial investment is less than par. This is known as buying at a discount. At maturity, you’re paid the face value, so the interest you’ve received is equivalent to the discount you got when you first bou ...