View the presentation slides

... Individuals who are over 75 years old is five times that amount. • As a result, that expenditure has been growing by 10 billion dollars each year. • The debt GDP ratio is 230% now and this number is still rising. ...

... Individuals who are over 75 years old is five times that amount. • As a result, that expenditure has been growing by 10 billion dollars each year. • The debt GDP ratio is 230% now and this number is still rising. ...

Econ 2012: Macroeconomics

... 1. Explain what money is by identifying the functions that it should perform. 2. Explain the "fractional reserve" banking system. (i.e. how do private banks create money.) 3. Explain why a fractional reserve system might lead to financial panics. What could the government do to reduce the probabilit ...

... 1. Explain what money is by identifying the functions that it should perform. 2. Explain the "fractional reserve" banking system. (i.e. how do private banks create money.) 3. Explain why a fractional reserve system might lead to financial panics. What could the government do to reduce the probabilit ...

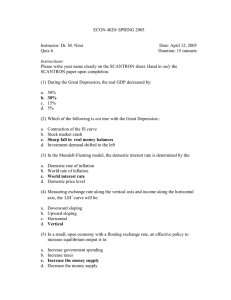

Quiz 6

... (7) Under the fixed-exchange rate system, the central bank of a small open economy must: a. Have a reserve of its own currency, which it must have accumulated in past transactions b. Have a reserve of foreign currency, which it can print c. Allow the money supply to adjust to whatever level will ens ...

... (7) Under the fixed-exchange rate system, the central bank of a small open economy must: a. Have a reserve of its own currency, which it must have accumulated in past transactions b. Have a reserve of foreign currency, which it can print c. Allow the money supply to adjust to whatever level will ens ...

chpt 16

... The Fed will direct Federal Reserve Banks to undertake some combination of the following actions: (1) Sell government securities, (2) increase the legal reserve ratio, (3) increase the discount rate. ...

... The Fed will direct Federal Reserve Banks to undertake some combination of the following actions: (1) Sell government securities, (2) increase the legal reserve ratio, (3) increase the discount rate. ...

Unit #8: Government and the Economy

... A special tax on investments will be used to repay the money borrowed. The government will not be allowed to borrow again for five years. There will be less money available for businesses and individuals to borrow. The Federal Reserve takes control of the bank the money was borrowed from. ...

... A special tax on investments will be used to repay the money borrowed. The government will not be allowed to borrow again for five years. There will be less money available for businesses and individuals to borrow. The Federal Reserve takes control of the bank the money was borrowed from. ...

Money, Monetary Policy, and Fiscal Policy

... congressional and presidential action to change gov. taxing or spending Automatic stabilizers automatically adjust to the ups and downs of the economy. Unemployment insurance is a good example during a down economy, progressive taxing is a good example during an up economy ...

... congressional and presidential action to change gov. taxing or spending Automatic stabilizers automatically adjust to the ups and downs of the economy. Unemployment insurance is a good example during a down economy, progressive taxing is a good example during an up economy ...

Economics for Today 2nd edition Irvin B. Tucker

... 3. Assuming the economy is in a recession, classical economists predict that: a. wages will remain fixed. b. monetary policy will sell government securities. c. higher wages will shift the short-run aggregate supply curve leftward. d. lower wages will shift the short-run aggregate supply curve righ ...

... 3. Assuming the economy is in a recession, classical economists predict that: a. wages will remain fixed. b. monetary policy will sell government securities. c. higher wages will shift the short-run aggregate supply curve leftward. d. lower wages will shift the short-run aggregate supply curve righ ...

What is a Useful Central Bank?

... inflation and the real economy… … but some challenges (e.g., identifying a leverage cycle). Monetary policy is rather blunt; regulations can be more specific towards the financial sector. ...

... inflation and the real economy… … but some challenges (e.g., identifying a leverage cycle). Monetary policy is rather blunt; regulations can be more specific towards the financial sector. ...

It`s Different This Time

... of saving actually results in an increase in purchasing power even without receiving any interest. To the extent that individuals do save, will they pull money out of banks and money market funds in favor of stashing piles of cash in safe deposit boxes? Banks make their money by lending at a higher ...

... of saving actually results in an increase in purchasing power even without receiving any interest. To the extent that individuals do save, will they pull money out of banks and money market funds in favor of stashing piles of cash in safe deposit boxes? Banks make their money by lending at a higher ...

EC307 ECONOMIC POLICY IN THE UK MACROECONOMIC

... ↓ M → ↓ bank deposits → ↓ bank loans → ↓ I → ↓ Y • Banks play a special role in financial system. Some borrowers - e.g. small businesses, households - are heavily dependent on banks as source of finance. Why? Because of pronounced asymmetric info problems with these potential borrowers (large firms ...

... ↓ M → ↓ bank deposits → ↓ bank loans → ↓ I → ↓ Y • Banks play a special role in financial system. Some borrowers - e.g. small businesses, households - are heavily dependent on banks as source of finance. Why? Because of pronounced asymmetric info problems with these potential borrowers (large firms ...

Unit 4- Money, Banking, The Federal Reserve and the

... DC and announces any monetary action taken. Actions of the FOMC affect the country. ...

... DC and announces any monetary action taken. Actions of the FOMC affect the country. ...

Money - University of Wyoming

... President of the United States. ◆ The Chairman of the Board presides, directs, and testifies about Fed policy. ...

... President of the United States. ◆ The Chairman of the Board presides, directs, and testifies about Fed policy. ...

Thursday, April 18

... The Federal Funds Rate By paying interest on reserves, but simultaneously conducGng expansionary open market operaGons to accommodate the increase in bank’s demand for reserves, the Fed has: 1. Allowed ban ...

... The Federal Funds Rate By paying interest on reserves, but simultaneously conducGng expansionary open market operaGons to accommodate the increase in bank’s demand for reserves, the Fed has: 1. Allowed ban ...

Appendix D - Milton Keynes Council

... National Australia Bank Deutsche Bank AG (German) J.P. Morgan Chase Bank (USA) ...

... National Australia Bank Deutsche Bank AG (German) J.P. Morgan Chase Bank (USA) ...

Monetary Policy Rules - Central Web Server 2

... Desk at the Federal Reserve Bank of New York, in consultation with the Chairman and members of the Open Market Committee, to keep the actual funds rate close to the intended rate. The Desk proceeds by buying and selling U.S. government securities for the Federal Reserve’s account, or by engaging in ...

... Desk at the Federal Reserve Bank of New York, in consultation with the Chairman and members of the Open Market Committee, to keep the actual funds rate close to the intended rate. The Desk proceeds by buying and selling U.S. government securities for the Federal Reserve’s account, or by engaging in ...

LIST OF CHARTS

... Rates of Growth of Money Supply (M2), Net Foreign Assets (NFA) and Domestic Credit (DC) Components and Sources of Reserve Money Average Money Multiplier and Income Velocity of Circulation of Money Selected Items of Class A Banks' Assets and Liabilities Deposits with Class A Banks Average Excess Cash ...

... Rates of Growth of Money Supply (M2), Net Foreign Assets (NFA) and Domestic Credit (DC) Components and Sources of Reserve Money Average Money Multiplier and Income Velocity of Circulation of Money Selected Items of Class A Banks' Assets and Liabilities Deposits with Class A Banks Average Excess Cash ...

Fiscal Year

... Problem with Fiscal Policy 1. It is unpopular to raise taxes or cut government spending. So, elected officials worried about re-election rarely do either. Ex. In 1984, Walter Mondale ran for president saying a slight tax increase would help equalize the U.S. economy. Ronald Regan defeated him in on ...

... Problem with Fiscal Policy 1. It is unpopular to raise taxes or cut government spending. So, elected officials worried about re-election rarely do either. Ex. In 1984, Walter Mondale ran for president saying a slight tax increase would help equalize the U.S. economy. Ronald Regan defeated him in on ...

The Art of Crisis Management: Auctions and Swaps

... that’s the federal funds rate. To do this, they manipulate the size of their balance sheet – changing the quantity of securities they hold to adjust the level of reserves they provide to the bank system. In the United States, the Federal Reserve’s Open Market Trading Desk (the “Desk”) does this in t ...

... that’s the federal funds rate. To do this, they manipulate the size of their balance sheet – changing the quantity of securities they hold to adjust the level of reserves they provide to the bank system. In the United States, the Federal Reserve’s Open Market Trading Desk (the “Desk”) does this in t ...

The Fed and The Interest Rates

... RR - increase reserve requirements, reduces excess reserves and the deposit expansion multiplier. Discount rate -- increase the discount rate, reduce the money supply or its growth rate; increase interest rates. ...

... RR - increase reserve requirements, reduces excess reserves and the deposit expansion multiplier. Discount rate -- increase the discount rate, reduce the money supply or its growth rate; increase interest rates. ...

Unintended Consequences of Federal Reserve Policy

... Stocks and bonds have rallied on the Federal Open Market Committee’s (FOMC) decision to continue rolling back the central bank’s bond purchasing program. The FOMC statement sounded reasonably upbeat on economic growth for the rest of the year, yet the Federal Reserve (Fed) sees no immediate inflatio ...

... Stocks and bonds have rallied on the Federal Open Market Committee’s (FOMC) decision to continue rolling back the central bank’s bond purchasing program. The FOMC statement sounded reasonably upbeat on economic growth for the rest of the year, yet the Federal Reserve (Fed) sees no immediate inflatio ...

What Will Fed Tapering Mean for Investors?

... tapering of the current Fed asset purchase program of $85 billion a month. Regardless of the details, a decrease in purchasing signals the market that the Fed has shifted into a tightening mode. Although the Fed may prefer lower interest rates for a longer period of time, market forces may not allow ...

... tapering of the current Fed asset purchase program of $85 billion a month. Regardless of the details, a decrease in purchasing signals the market that the Fed has shifted into a tightening mode. Although the Fed may prefer lower interest rates for a longer period of time, market forces may not allow ...

The Eurozone crisis strikes back Global economy watch – April 2013

... first major central bank to pioneer the policy in 2001. In total, it has bought over ¥80 trillion of assets (equivalent to around 20% of its GDP) and purchases have been extended to commercial paper, corporate bond and ABS markets. Further options on the table may include negative interest rates, pu ...

... first major central bank to pioneer the policy in 2001. In total, it has bought over ¥80 trillion of assets (equivalent to around 20% of its GDP) and purchases have been extended to commercial paper, corporate bond and ABS markets. Further options on the table may include negative interest rates, pu ...

Federal Reserve Monetary Policy

... Balanced Growth Act of 1978 This act required that policymakers pursue policies to achieve full employment and noninflationary economic growth ...

... Balanced Growth Act of 1978 This act required that policymakers pursue policies to achieve full employment and noninflationary economic growth ...