Notes

... over the past 20 years, so the prime rate is no longer very important. - the Fed cannot reliable push mortgage interest rates down 3. Fed impact is asymmetric - by pushing up interest rates a lot (look at the US data for 1979-1981!) the Fed can with certainty make it extraordinarily costly to borrow ...

... over the past 20 years, so the prime rate is no longer very important. - the Fed cannot reliable push mortgage interest rates down 3. Fed impact is asymmetric - by pushing up interest rates a lot (look at the US data for 1979-1981!) the Fed can with certainty make it extraordinarily costly to borrow ...

Practice exam 1A

... in our baseline IS-MP model of an increase in a c where consumption is assumed to be given by Ct = a c Y t where Y t denotes potential output. You should assume that before the change in a c , the economy has been in an equilibrium for some time in which output equals potential output, inflation has ...

... in our baseline IS-MP model of an increase in a c where consumption is assumed to be given by Ct = a c Y t where Y t denotes potential output. You should assume that before the change in a c , the economy has been in an equilibrium for some time in which output equals potential output, inflation has ...

Answers to PS 3

... 1.An expansion of the central bank’s domestic assets leads to an equal fall in its foreign assets, with no change in the bank’s liabilities (or the money supply). The effect on the balance-of-payments accounts is most easily understood by recalling how the fall in foreign reserves comes about. After ...

... 1.An expansion of the central bank’s domestic assets leads to an equal fall in its foreign assets, with no change in the bank’s liabilities (or the money supply). The effect on the balance-of-payments accounts is most easily understood by recalling how the fall in foreign reserves comes about. After ...

Krugman`s Chapter 31 PPT

... decided to stand pat, making no change in its interest rate policy. On September 18, the Fed cut the target federal funds rate “to help forestall some of the adverse effects on the broader economy that might otherwise arise from the disruptions in financial markets.” This was only the first of sever ...

... decided to stand pat, making no change in its interest rate policy. On September 18, the Fed cut the target federal funds rate “to help forestall some of the adverse effects on the broader economy that might otherwise arise from the disruptions in financial markets.” This was only the first of sever ...

Too high expectations cloud strong growth

... The global economy has also slowed. Even though the prospects for the eurozone have improved considerably, this has been offset by an even more dramatic deterioration in the case of the US. A year ago, the consensus was that US growth in 2007 would be 2.9%, now it is 2.3% with opinion split as to wh ...

... The global economy has also slowed. Even though the prospects for the eurozone have improved considerably, this has been offset by an even more dramatic deterioration in the case of the US. A year ago, the consensus was that US growth in 2007 would be 2.9%, now it is 2.3% with opinion split as to wh ...

Ch 4:Determining Interest Rates

... to reduce or eliminate idiosyncratic or asset specific or unsystematic risk. Systematic or market risk, common to all assets in an economy, cannot be diversified. • Some economists see the financial crisis as a black swan – a rare event that has a large impact on the economy – which might affect the ...

... to reduce or eliminate idiosyncratic or asset specific or unsystematic risk. Systematic or market risk, common to all assets in an economy, cannot be diversified. • Some economists see the financial crisis as a black swan – a rare event that has a large impact on the economy – which might affect the ...

MonetaryPolicyPractice

... 28. If Matt Taylor gets his $800 loan from the Paris First National Bank in cash rather than in the form of a new checkable deposit, the: a. Paris First National Bank will get $800 in new reserves. b. Paris First National Bank will not get $800 in new reserves. c. assets of the Paris First National ...

... 28. If Matt Taylor gets his $800 loan from the Paris First National Bank in cash rather than in the form of a new checkable deposit, the: a. Paris First National Bank will get $800 in new reserves. b. Paris First National Bank will not get $800 in new reserves. c. assets of the Paris First National ...

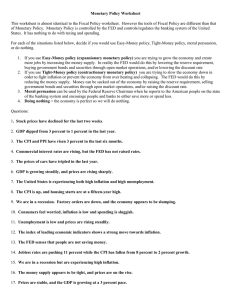

Monetary Policy Worksheet

... economy from over heating and collapsing. The FED would do this by reducing the money supply. Money can be sucked out of the economy by raising the reserve requirement, selling government bonds and securities through open market operations, and/or raising the discount rate. 3. Moral persuasion can b ...

... economy from over heating and collapsing. The FED would do this by reducing the money supply. Money can be sucked out of the economy by raising the reserve requirement, selling government bonds and securities through open market operations, and/or raising the discount rate. 3. Moral persuasion can b ...

FRBSF L CONOMIC

... warrant exceptionally low levels of the federal funds rate for an extended period.” This guidance indicates that the length of the “extended period” depends on the expected path of unemployment and inflation. Similarly, the benchmark policy rule would prescribe an earlier or later increase in the fu ...

... warrant exceptionally low levels of the federal funds rate for an extended period.” This guidance indicates that the length of the “extended period” depends on the expected path of unemployment and inflation. Similarly, the benchmark policy rule would prescribe an earlier or later increase in the fu ...

AP Macro The Quantity Theory of Money

... Assume on average a dollar bill does ten transactions (buying and selling of goods and services) per year. Thus velocity of circulation "V" in this case is 10. Here, a one dollar bill does the equivalent of ten dollars’ worth of transactions. So, M x V=1x10=10 dollars ...

... Assume on average a dollar bill does ten transactions (buying and selling of goods and services) per year. Thus velocity of circulation "V" in this case is 10. Here, a one dollar bill does the equivalent of ten dollars’ worth of transactions. So, M x V=1x10=10 dollars ...

Development Economics – Econ 682

... which the borrower has incentives to invest in projects with high risk where the borrower does well if the project succeeds but the lender bears most of the loss if the project fails. The prospect of “bail out” of failed projects by, for example, the International Monetary Fund and the international ...

... which the borrower has incentives to invest in projects with high risk where the borrower does well if the project succeeds but the lender bears most of the loss if the project fails. The prospect of “bail out” of failed projects by, for example, the International Monetary Fund and the international ...

Interest Rates & Inflation

... – There are short term & long term interest rates • Low interest rates are critical for a healthy economy (GDP) – As interest rates ↑ => cost of borrowing money ↑ => Investment (I) ↓ ...

... – There are short term & long term interest rates • Low interest rates are critical for a healthy economy (GDP) – As interest rates ↑ => cost of borrowing money ↑ => Investment (I) ↓ ...

1 Macroeconomics Final Chapter 13: Fiscal policy – consists of

... Small-denominated (<$100,000) time deposits o ...

... Small-denominated (<$100,000) time deposits o ...

economics (hons) – sem-ii

... In terms of fish, what is the GDP of Gilligan’s Island? What are consumption and investment? What are the incomes of the Professor and Gilligan? ...

... In terms of fish, what is the GDP of Gilligan’s Island? What are consumption and investment? What are the incomes of the Professor and Gilligan? ...

RECESSIONS, DEPRESSIONS, DEFLATION, INFLATION

... growth or contraction in business sectors. Sometimes, other factors have played a role – such as U.S. monetary policy, sudden increases in energy costs, and the end or beginning of a war. In the post-World War II era, recessions have averaged about ...

... growth or contraction in business sectors. Sometimes, other factors have played a role – such as U.S. monetary policy, sudden increases in energy costs, and the end or beginning of a war. In the post-World War II era, recessions have averaged about ...

1) - - Prince Sultan University

... Explain the problem of asymmetric information, adverse selection and moral hazard, and why these problems are important for the financial system (18.33 points). Answer: Asymmetric information is an imbalance of information between two parties to a contract. In financial markets, lenders know less ab ...

... Explain the problem of asymmetric information, adverse selection and moral hazard, and why these problems are important for the financial system (18.33 points). Answer: Asymmetric information is an imbalance of information between two parties to a contract. In financial markets, lenders know less ab ...

Economics for business

... ■ How can the source of growth in the supply of money be identified? In order to control this growth, the monetary authorities need to know where it’s occurring. Which factor is more significant: excessive government borrowing that injects liquid assets into the financial system, or the ability of b ...

... ■ How can the source of growth in the supply of money be identified? In order to control this growth, the monetary authorities need to know where it’s occurring. Which factor is more significant: excessive government borrowing that injects liquid assets into the financial system, or the ability of b ...

The Dust Bowl: action and reaction between

... retail sales up 2.3%. Similarly, industrial production stopped contracting and grew 0.6% yearon-year. China slows but remains within government targets. In China, the economy slowed but growth remained consistent with the government’s objectives: in Q3, GDP grew 7.3% year-on-year (vs. 7.5% previousl ...

... retail sales up 2.3%. Similarly, industrial production stopped contracting and grew 0.6% yearon-year. China slows but remains within government targets. In China, the economy slowed but growth remained consistent with the government’s objectives: in Q3, GDP grew 7.3% year-on-year (vs. 7.5% previousl ...

Thomas M Hoenig: Monetary policy and the role of dissent

... Also, the recently passed fiscal actions, in which Congress and the president extended the Bush-era tax cuts and unemployment insurance, and then also temporarily reduced payroll taxes, will provide a further boost to aggregate demand next year, although not without longer-run risks to the economy. ...

... Also, the recently passed fiscal actions, in which Congress and the president extended the Bush-era tax cuts and unemployment insurance, and then also temporarily reduced payroll taxes, will provide a further boost to aggregate demand next year, although not without longer-run risks to the economy. ...

July 2016 – Gearing for a Stronger Half

... From the start of 2016, the yield on the J.P. Morgan GBI Global index of developed market government bonds has been cut in half from 1.6% to around 0.85%. The German 10-year government bond now yields -0.12% and the Japanese 30-year government bond, one of the best performing assets in 2016, yields ...

... From the start of 2016, the yield on the J.P. Morgan GBI Global index of developed market government bonds has been cut in half from 1.6% to around 0.85%. The German 10-year government bond now yields -0.12% and the Japanese 30-year government bond, one of the best performing assets in 2016, yields ...

Company Name

... Long-term interest rates are interest rates on financial assets that mature a number of years in the future. ...

... Long-term interest rates are interest rates on financial assets that mature a number of years in the future. ...

AP Macroeconomics Unit 4 Review Session Money Market

... a. The central bank adopts an interest target of 5%. Currently the interest rate in the economy is at 8%. Central bank wants to decrease interest rates. It can accomplish this goal by engaging in open-market purchases of T-bills. b. The central bank adopts an inflation target of 3%. Currently the in ...

... a. The central bank adopts an interest target of 5%. Currently the interest rate in the economy is at 8%. Central bank wants to decrease interest rates. It can accomplish this goal by engaging in open-market purchases of T-bills. b. The central bank adopts an inflation target of 3%. Currently the in ...

Investors Turn Finicky on Corporate Bonds

... The central bank created them. In normal times (and it has been a long time since we’ve seen normal times,) banks collectively more or less hold just the reserves they need, and they borrow and lend reserves among themselves. The ECB’s deposit facility, the one now subject to negative rates, had pra ...

... The central bank created them. In normal times (and it has been a long time since we’ve seen normal times,) banks collectively more or less hold just the reserves they need, and they borrow and lend reserves among themselves. The ECB’s deposit facility, the one now subject to negative rates, had pra ...