Document

... IS-LM and AD-AS Models. Assume that the economy is in general equilibrium, that Ricardian equivalence does NOT hold, and that any adjustment to long-term equilibrium takes 4 years. Suppose that the government then reduces income taxes while the central bank increases the money supply and that the ef ...

... IS-LM and AD-AS Models. Assume that the economy is in general equilibrium, that Ricardian equivalence does NOT hold, and that any adjustment to long-term equilibrium takes 4 years. Suppose that the government then reduces income taxes while the central bank increases the money supply and that the ef ...

Economic Outlook and Policy Responses in the United States

... The FOMC instituted two QE programs with fixed amounts of security purchases in 2008 and 2010. Last September it took a more significant step when it announced that it would purchase $85 billion of securities each month until further notice. These programs have significantly increased the monetary b ...

... The FOMC instituted two QE programs with fixed amounts of security purchases in 2008 and 2010. Last September it took a more significant step when it announced that it would purchase $85 billion of securities each month until further notice. These programs have significantly increased the monetary b ...

Chapter 4 - A simple stock-flow consistent model with porfolio choice

... The impact of a rise in interest rates is still positive in the long run even when higher interest rates have a short-run negative impact on income, Because they are assumed to induce lower propensities to consume ...

... The impact of a rise in interest rates is still positive in the long run even when higher interest rates have a short-run negative impact on income, Because they are assumed to induce lower propensities to consume ...

FRBSF L CONOMIC

... first, allowing LSAPs to affect the spread between short- and long-term yields, and, second, allowing changes in that spread to affect economic activity and inflation. The first feature involves LSAP effects on financial markets. An investor can buy either a short-term bond and reinvest proceeds unt ...

... first, allowing LSAPs to affect the spread between short- and long-term yields, and, second, allowing changes in that spread to affect economic activity and inflation. The first feature involves LSAP effects on financial markets. An investor can buy either a short-term bond and reinvest proceeds unt ...

Version A Exam 2 SAMPLE Problems FINAN420

... c. (4 pts.) Using the duration methodology, calculate the estimated change in the portfolio’s value if interest rates increase by 2 percentage points. ___________________ ...

... c. (4 pts.) Using the duration methodology, calculate the estimated change in the portfolio’s value if interest rates increase by 2 percentage points. ___________________ ...

Full article - Ashmore Group

... Like the Bank of Japan, the ECB is increasingly desperate for inflation. There are good reasons for concern. Saddled with unsustainable levels of debt and entirely unable to raise trend growth rates through reforms due to short-sightedness of their politicians the central bankers in both Japan and E ...

... Like the Bank of Japan, the ECB is increasingly desperate for inflation. There are good reasons for concern. Saddled with unsustainable levels of debt and entirely unable to raise trend growth rates through reforms due to short-sightedness of their politicians the central bankers in both Japan and E ...

Interactive Tool

... economy. The Federal Reserve can change the amount of money that banks are holding in reserves by buying or selling existing U.S. Treasury bonds. When the Federal Reserve buys a bond, the seller deposits the Federal Reserves' check in her bank account. As a bank’s reserves increase, it has an increa ...

... economy. The Federal Reserve can change the amount of money that banks are holding in reserves by buying or selling existing U.S. Treasury bonds. When the Federal Reserve buys a bond, the seller deposits the Federal Reserves' check in her bank account. As a bank’s reserves increase, it has an increa ...

the 9-letter dirty word - global plains advisory group

... Currently, our inflation rates have remained low since the “Great Recession” and have averaged between 1 to 3 percent per year since 2008. Why? Because interest rates and inflation are linked. In general, as interest rates are lowered, more people are able to borrow money resulting in more consumer ...

... Currently, our inflation rates have remained low since the “Great Recession” and have averaged between 1 to 3 percent per year since 2008. Why? Because interest rates and inflation are linked. In general, as interest rates are lowered, more people are able to borrow money resulting in more consumer ...

solutions

... 6. Is it possible for a pension fund to achieve perfect insurance against interest rate risk? If yes, how? This can be done using the cash flow matching strategy: each period, the payments from assets exactly match those at the liability side. 7. The holders of mortgage bonds typically have a right ...

... 6. Is it possible for a pension fund to achieve perfect insurance against interest rate risk? If yes, how? This can be done using the cash flow matching strategy: each period, the payments from assets exactly match those at the liability side. 7. The holders of mortgage bonds typically have a right ...

U.S. Monetary Policy: An Introduction

... inflation is very close to zero, there’s a bigger risk of deflation. What’s so bad about deflation? First, let’s talk about the difference between disinflation and deflation. Disinflation just means that the rate of inflation is slowing—say, from 3% a year to 2% a year. Deflation, in contrast, means ...

... inflation is very close to zero, there’s a bigger risk of deflation. What’s so bad about deflation? First, let’s talk about the difference between disinflation and deflation. Disinflation just means that the rate of inflation is slowing—say, from 3% a year to 2% a year. Deflation, in contrast, means ...

Quiz 1: Fall 2011

... 2. Explain why chain weighting is a preferable way of constructing macroeconomic time series. What problem does chain weighting help address? (5 pts) ...

... 2. Explain why chain weighting is a preferable way of constructing macroeconomic time series. What problem does chain weighting help address? (5 pts) ...

How to get growth in Japan

... Policies that Could Not Work The policies that could not possibly work to stimulate the economy were fiscal policy, interest reductions, expansion of high powered money and increases in arbitrary deposit aggregates: The credit crunch and consequent lack of new purchasing power in the economy shrank ...

... Policies that Could Not Work The policies that could not possibly work to stimulate the economy were fiscal policy, interest reductions, expansion of high powered money and increases in arbitrary deposit aggregates: The credit crunch and consequent lack of new purchasing power in the economy shrank ...

Read More - Prudent Management Associates

... cash to fund capital needs. Further, advances in technology have made capital investment more efficient, so that less capital is required today to support the same level of GDP growth as in the past. In comparison to 2005, the reductions in current yields are most pronounced at the shorter end of th ...

... cash to fund capital needs. Further, advances in technology have made capital investment more efficient, so that less capital is required today to support the same level of GDP growth as in the past. In comparison to 2005, the reductions in current yields are most pronounced at the shorter end of th ...

A rise in the price of oil imports has resulted in a decrease of short

... a. How greatly increasing the money supply does not increase AD when people’s preferences to buy goods has gone to zero. b. How the federal government can not increase its own spending when there is zero money left in the treasury from tax revenue. c. How the fed can not increase the money supply fu ...

... a. How greatly increasing the money supply does not increase AD when people’s preferences to buy goods has gone to zero. b. How the federal government can not increase its own spending when there is zero money left in the treasury from tax revenue. c. How the fed can not increase the money supply fu ...

Exiting from Low Interest Rates to Normality

... Source: FRED - Federal Reserve Bank of St. Louis ...

... Source: FRED - Federal Reserve Bank of St. Louis ...

2017 Crowell Prize Call For Submissions

... PanAgora Asset Management’s Quantitative Research Institute announces the 2017 Dr. Richard A. Crowell Memorial Prize paper competition. A first prize of $5000, 2nd place prize of $3000, and 3rd place prize of $2000 will be awarded to the best submissions. Up to 10 finalists will be invited to presen ...

... PanAgora Asset Management’s Quantitative Research Institute announces the 2017 Dr. Richard A. Crowell Memorial Prize paper competition. A first prize of $5000, 2nd place prize of $3000, and 3rd place prize of $2000 will be awarded to the best submissions. Up to 10 finalists will be invited to presen ...

dpam l bonds emerging markets sustainable - f

... Information Document (KIID), the prospectus and the latest available annual and semi-annual reports. These documents can be obtained free of charge at Degroof Petercam Asset Management sa or on the website funds.degroofpetercam.com. All opinions and financial estimates herein reflect a situation at ...

... Information Document (KIID), the prospectus and the latest available annual and semi-annual reports. These documents can be obtained free of charge at Degroof Petercam Asset Management sa or on the website funds.degroofpetercam.com. All opinions and financial estimates herein reflect a situation at ...

Main objective of the research - Jedenaste Warsztaty Doktorskie

... As to the first question, regarding the optimal targeting horizon, the literature is vast. Several theoretical studies have been conducted, analyzing the performance of monetary policy rules with various horizons. Batini and Haldane (1999) estimated the optimal forecast horizon (according to their d ...

... As to the first question, regarding the optimal targeting horizon, the literature is vast. Several theoretical studies have been conducted, analyzing the performance of monetary policy rules with various horizons. Batini and Haldane (1999) estimated the optimal forecast horizon (according to their d ...

Homework #5, Due Tuesday, Nov 14

... You withdraw $2,000 from your account. Your bank has a desired reserve ratio of 20 percent. This transaction, by itself, will directly reduce the quantity of money by $1,600. deposits by $1,600. the quantity of money by $2,000. deposits by $2,000. ...

... You withdraw $2,000 from your account. Your bank has a desired reserve ratio of 20 percent. This transaction, by itself, will directly reduce the quantity of money by $1,600. deposits by $1,600. the quantity of money by $2,000. deposits by $2,000. ...

Slide 1

... Despite lower interest rates and increased demand for investment, banks may be unwilling to make the loans necessary for the investment purchases This leads to a break down in the transmission mechanism If banks made prior bad loans that are not repaid, they may become reluctant to make more, despit ...

... Despite lower interest rates and increased demand for investment, banks may be unwilling to make the loans necessary for the investment purchases This leads to a break down in the transmission mechanism If banks made prior bad loans that are not repaid, they may become reluctant to make more, despit ...

The Fed`s Monetary Policy during the 1930`s: A Critical Evaluation

... interest on reserves,( when the federal funds rate was close to zero), as the mechanism to get banks to hold them. Were the Fed to wish to tighten it can separate its monetary policy operations from its liquidity policy by changing the spread between the funds rate and the IOR. (Goodfriend 2009). Un ...

... interest on reserves,( when the federal funds rate was close to zero), as the mechanism to get banks to hold them. Were the Fed to wish to tighten it can separate its monetary policy operations from its liquidity policy by changing the spread between the funds rate and the IOR. (Goodfriend 2009). Un ...

Social and Structural Implications of the Crisis

... Poverty will rise by almost 15 million instead of falling by 15 million in 2009 ...

... Poverty will rise by almost 15 million instead of falling by 15 million in 2009 ...

Monetary policy summary - March 2016

... Set against that, there appears to be increased uncertainty surrounding the forthcoming referendum on UK membership of the European Union. That uncertainty is likely to have been a significant driver of the decline in sterling. It may also delay some spending decisions and depress growth of aggregat ...

... Set against that, there appears to be increased uncertainty surrounding the forthcoming referendum on UK membership of the European Union. That uncertainty is likely to have been a significant driver of the decline in sterling. It may also delay some spending decisions and depress growth of aggregat ...

Document

... Money Supply assumed exogenous, determined by Central Bank Money Demand determined by a) price level, b) level of Y and c) interest rate (r) Equilibrium condition: Ms = Md This maps into upward sloping LM curve, with r on vertical axis and Y on horizontal T axis LM is upward sloping because ...

... Money Supply assumed exogenous, determined by Central Bank Money Demand determined by a) price level, b) level of Y and c) interest rate (r) Equilibrium condition: Ms = Md This maps into upward sloping LM curve, with r on vertical axis and Y on horizontal T axis LM is upward sloping because ...

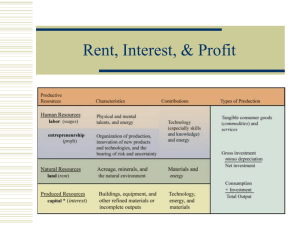

Rent, Interest, and Profit

... Usually closest to long-term, near riskless securities and bonds ...

... Usually closest to long-term, near riskless securities and bonds ...