Upton Sinclair

... Guarantee Program. Through December 31, 2009, all of your noninterest and interest bearing checking deposit account balances are fully guaranteed by the FDIC for the entire amount in your account. * And as a reminder, in October the FDIC increased the amount of insurance on eligible savings accounts ...

... Guarantee Program. Through December 31, 2009, all of your noninterest and interest bearing checking deposit account balances are fully guaranteed by the FDIC for the entire amount in your account. * And as a reminder, in October the FDIC increased the amount of insurance on eligible savings accounts ...

Ch. 10

... century by providing credit to the financial markets. In order to disperse power 12 regional Federal Reserve Banks were formed. The seven members of the Board of Governors are appointed by the President for 14-year terms every other year. ...

... century by providing credit to the financial markets. In order to disperse power 12 regional Federal Reserve Banks were formed. The seven members of the Board of Governors are appointed by the President for 14-year terms every other year. ...

Money as gold versus money as water

... One of the questions concerns the design of a European system of deposit insurance. A modern economy relies on a system of payments, in which one must make sure that the money doesn’t disappear because of some bankruptcy. This is a public service. It is logical that this system of payments falls und ...

... One of the questions concerns the design of a European system of deposit insurance. A modern economy relies on a system of payments, in which one must make sure that the money doesn’t disappear because of some bankruptcy. This is a public service. It is logical that this system of payments falls und ...

- Glenmede

... For holders of fixed-income securities, any rise in inflation is not good. In the best-case scenario, even a mid-single-digit rise could lead to negative real yields. At relatively low inflation of 2 percent, for example, many Treasury bonds would offer zero or even negative yields. Those awaiting a ...

... For holders of fixed-income securities, any rise in inflation is not good. In the best-case scenario, even a mid-single-digit rise could lead to negative real yields. At relatively low inflation of 2 percent, for example, many Treasury bonds would offer zero or even negative yields. Those awaiting a ...

Topic 2.6.2 and 2.6.3 student version

... If the economy is in a recession or a period of below trend GDP, so that there is spare capacity, (n_______ output gap) then demand side policies can increase the rate of economic growth. However, if the economy is already close to full capacity (trend rate of GDP) a further increase in AD will ...

... If the economy is in a recession or a period of below trend GDP, so that there is spare capacity, (n_______ output gap) then demand side policies can increase the rate of economic growth. However, if the economy is already close to full capacity (trend rate of GDP) a further increase in AD will ...

Make your dollars stretch farther in tighter times

... accounts. "It's better to put a few grand in the bank than have the IRS take it," says Steve Doucette, the Wellesley financial planner. Doucette also said people should not just park their savings in bank accounts that earn only 1 or 2 percent in interest. Money market funds earn 3 to 5 percent, and ...

... accounts. "It's better to put a few grand in the bank than have the IRS take it," says Steve Doucette, the Wellesley financial planner. Doucette also said people should not just park their savings in bank accounts that earn only 1 or 2 percent in interest. Money market funds earn 3 to 5 percent, and ...

1 - JustAnswer

... The opening of new international markets to the U.S. can be attributed to: a. acceptance of a free market system by third world countries. b. regulation of U.S. industries. c. increase in information technology. d. a and c. e. all of the above. ...

... The opening of new international markets to the U.S. can be attributed to: a. acceptance of a free market system by third world countries. b. regulation of U.S. industries. c. increase in information technology. d. a and c. e. all of the above. ...

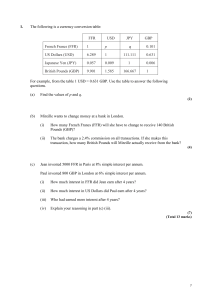

Financial Maths Questions File

... The total deductions after 20 months is $1540 and after 30 months it is $2140. (d) ...

... The total deductions after 20 months is $1540 and after 30 months it is $2140. (d) ...

The crisis and monetary policy: what we learned and

... to the monetary policy task by limiting the banks’ ability to fuel credit growth using cheap and plentiful short-term wholesale funding during boom periods, as was the case from 2003 to 2007. In this respect, the Core Funding Ratio could potentially act as an automatic stabiliser and reduce the requ ...

... to the monetary policy task by limiting the banks’ ability to fuel credit growth using cheap and plentiful short-term wholesale funding during boom periods, as was the case from 2003 to 2007. In this respect, the Core Funding Ratio could potentially act as an automatic stabiliser and reduce the requ ...

Central-Bank Communication and Stabilization Policy

... A key aspect of the target criterion for all of these central banks is the requirement that a certain measure of inflation be projected to converge to a specified medium-run target value, over a specified horizon (usually two to three years in the future). It is because of this emphasis on the infl ...

... A key aspect of the target criterion for all of these central banks is the requirement that a certain measure of inflation be projected to converge to a specified medium-run target value, over a specified horizon (usually two to three years in the future). It is because of this emphasis on the infl ...

Section 2A – The Great Depression

... drop in prices as well (deflation) Slide 12: Contraction of the Money Supply (3) Remember that allowing interest rates to fluctuate naturally and low and stable price changes are two of the sources of economic progress. As we can see in this graph, through the manipulation of interest rates and ...

... drop in prices as well (deflation) Slide 12: Contraction of the Money Supply (3) Remember that allowing interest rates to fluctuate naturally and low and stable price changes are two of the sources of economic progress. As we can see in this graph, through the manipulation of interest rates and ...

Chapter 1 - Practice Questions 1. Financial assets

... C) contribute to the country's productive capacity both directly and indirectly D) do not contribute to the country's productive capacity either directly or indirectly E) are of no value to anyone 2. The net wealth of the aggregate economy is equal to the sum of _________. A) all financial assets B) ...

... C) contribute to the country's productive capacity both directly and indirectly D) do not contribute to the country's productive capacity either directly or indirectly E) are of no value to anyone 2. The net wealth of the aggregate economy is equal to the sum of _________. A) all financial assets B) ...

Review of the Theories of Financial Crises

... mobility, but faces conflicting policy needs, such as fiscal imbalances or fragile financial sector, that need to be resolved by independent monetary policy, and effectively shift the regime from the first solution of the tri-lemma described above to the second solution and the tri-lemma. ...

... mobility, but faces conflicting policy needs, such as fiscal imbalances or fragile financial sector, that need to be resolved by independent monetary policy, and effectively shift the regime from the first solution of the tri-lemma described above to the second solution and the tri-lemma. ...

www.thegeographeronline.net

... some investment banks had little in deposits; no secure retail funding, so some collapsed quickly and dramatically. ...

... some investment banks had little in deposits; no secure retail funding, so some collapsed quickly and dramatically. ...

Meaning of Monetary Policy

... suffers from the Disequilibrium in the BOP. The Reserve Bank of India through its monetary policy tries to maintain equilibrium in the balance of payments. The BOP has two aspects i.e. the 'BOP Surplus' and the 'BOP Deficit'. The former reflects an excess money supply in the domestic economy, while ...

... suffers from the Disequilibrium in the BOP. The Reserve Bank of India through its monetary policy tries to maintain equilibrium in the balance of payments. The BOP has two aspects i.e. the 'BOP Surplus' and the 'BOP Deficit'. The former reflects an excess money supply in the domestic economy, while ...

Why the US Economy Is Not Depression-Proof

... which was quickly deregulated in the early 1980s and appears to have achieved relative stability by the late 1980s. Part of the responsibility may also rest with federal insurance itself. Under current law, checking and savings deposits are guaranteed up to $100,000 per account by a federal agency. ...

... which was quickly deregulated in the early 1980s and appears to have achieved relative stability by the late 1980s. Part of the responsibility may also rest with federal insurance itself. Under current law, checking and savings deposits are guaranteed up to $100,000 per account by a federal agency. ...

More

... 8. Government can best control the health of the economy by regulating banks and manipulating interest rates. Monetary 9. If you need to help the economy, have the government kick off a low level of inflation by increasing the overall demand for goods and services. Keynesian 10. You can best help th ...

... 8. Government can best control the health of the economy by regulating banks and manipulating interest rates. Monetary 9. If you need to help the economy, have the government kick off a low level of inflation by increasing the overall demand for goods and services. Keynesian 10. You can best help th ...

1. Janus

... the effects of certain policy, referring to economic agents’ expectations only. The attention is drawn to the differences between the theoretical assumptions of the model and the empirical results (Farmer, 2012). The number of transmission channels that are used in different studies varies between t ...

... the effects of certain policy, referring to economic agents’ expectations only. The attention is drawn to the differences between the theoretical assumptions of the model and the empirical results (Farmer, 2012). The number of transmission channels that are used in different studies varies between t ...

Why Has Nominal Income Growth Been So Slow?

... tools necessary to produce faster money growth that would have supported a stronger recovery. And yet, for reasons unknown, it did not use them. Second, quantitative easing as it was actually implemented and described by Federal Reserve officials often resembled a set of credit market interventions ...

... tools necessary to produce faster money growth that would have supported a stronger recovery. And yet, for reasons unknown, it did not use them. Second, quantitative easing as it was actually implemented and described by Federal Reserve officials often resembled a set of credit market interventions ...

Chapter 11 Money and Monetary Policy

... deposits at the Fed are called ________________. 4. When the Federal Open Market Committee (FOMC) directs the Federal Reserve Bank in New York to buy or sell government bonds on the open market, it is conducting ____________. 5. Suppose the Fed buys bonds on the open market. By doing so, it is incre ...

... deposits at the Fed are called ________________. 4. When the Federal Open Market Committee (FOMC) directs the Federal Reserve Bank in New York to buy or sell government bonds on the open market, it is conducting ____________. 5. Suppose the Fed buys bonds on the open market. By doing so, it is incre ...

Discussion - Norges Bank

... variables of monetary policy or omission of important persistent influences on actual setting of policy, i.e. extrinsic persistence of the policy rate • Difference is important: “For example, when faced with a surprising economic recession or a jump in inflation, the inertial policymaker slowly chan ...

... variables of monetary policy or omission of important persistent influences on actual setting of policy, i.e. extrinsic persistence of the policy rate • Difference is important: “For example, when faced with a surprising economic recession or a jump in inflation, the inertial policymaker slowly chan ...

Monetary Policy in the Euro-zone Does `one size fit all`? (This case

... Member countries respond differently to interest rate changes Exchange rate effects Countries with a low proportion of external trade will be less concerned about the impact on the euro exchange rate with other world currencies: this reflects partly geography and history. Ireland has 34 per cent ...

... Member countries respond differently to interest rate changes Exchange rate effects Countries with a low proportion of external trade will be less concerned about the impact on the euro exchange rate with other world currencies: this reflects partly geography and history. Ireland has 34 per cent ...

of monetary policy

... aggressive and creative policy actions, many of which are reflected in the size and composition of the Fed's balance sheet. So, I thought that a brief guided tour of our balance sheet might be an instructive way to discuss the Fed's policy strategy and some related issues. As I will discuss, we no l ...

... aggressive and creative policy actions, many of which are reflected in the size and composition of the Fed's balance sheet. So, I thought that a brief guided tour of our balance sheet might be an instructive way to discuss the Fed's policy strategy and some related issues. As I will discuss, we no l ...

Macroeconomics

... Relative decline of banks & thrifts Consolidation among banks & thrifts Convergence of services provided by financial institutions Globalization of financial markets ...

... Relative decline of banks & thrifts Consolidation among banks & thrifts Convergence of services provided by financial institutions Globalization of financial markets ...

msc macro lecture slides

... • income transfers (pensions, welfare) Monetary policy • interest rates ...

... • income transfers (pensions, welfare) Monetary policy • interest rates ...