Impacting Cancer

... The Scientific Advisory Board of Nextech Invest has a long-term relationship with the management team, a unique partnership with intense, unbiased, frank knowledge exchange between the two sides. The SAB members are exclusive to Nextech Invest and as such do not advise other private equity companies ...

... The Scientific Advisory Board of Nextech Invest has a long-term relationship with the management team, a unique partnership with intense, unbiased, frank knowledge exchange between the two sides. The SAB members are exclusive to Nextech Invest and as such do not advise other private equity companies ...

World Financial Markets, 1900-1925

... I present a new dataset that describes the financial markets of the early twentieth century. Historical data have proven useful to better understand how financial markets operate. Estimation of the equity-premium (e.g. Goetzmann and Ibbotson (2006)), the efficiency of derivatives markets (Moore and J ...

... I present a new dataset that describes the financial markets of the early twentieth century. Historical data have proven useful to better understand how financial markets operate. Estimation of the equity-premium (e.g. Goetzmann and Ibbotson (2006)), the efficiency of derivatives markets (Moore and J ...

Capital Structure Policy for Government Businesses

... consideration of underlying capital structure and future cash flow requirements including a contingency for financial flexibility. Businesses with the financial capacity to pay dividends based on payout ratios above 70 per cent are expected to do so. In determining the annual dividend payment for ea ...

... consideration of underlying capital structure and future cash flow requirements including a contingency for financial flexibility. Businesses with the financial capacity to pay dividends based on payout ratios above 70 per cent are expected to do so. In determining the annual dividend payment for ea ...

The Millennial Market for Financial Advisors

... notice, due to various factors, including opinions or positions. Where data is presented that is prepared by third parties, such information will be cited, and these sources have been deemed to be reliable. However, Capstone Asset Management Company does not warrant the accuracy of this information. ...

... notice, due to various factors, including opinions or positions. Where data is presented that is prepared by third parties, such information will be cited, and these sources have been deemed to be reliable. However, Capstone Asset Management Company does not warrant the accuracy of this information. ...

Rajiv Gandhi Equity Savings Scheme

... (b) any individual who has opened a demat account before the notification of the Scheme but has not made any transactions in the equity segment or the derivative segment till the date of notification of the Scheme, and any individual who is not the first account holder of an existing joint demat acc ...

... (b) any individual who has opened a demat account before the notification of the Scheme but has not made any transactions in the equity segment or the derivative segment till the date of notification of the Scheme, and any individual who is not the first account holder of an existing joint demat acc ...

offering supplement - Active Return Capital

... Before investing in the Sub-Fund, Qualifying Investors must sign the declaration referred to in the Qualifying Investor Declaration Form found as an Appendix to the Offering Supplement stating that they qualify as “Qualifying Investors” and that they have read and understood the risk warnings in the ...

... Before investing in the Sub-Fund, Qualifying Investors must sign the declaration referred to in the Qualifying Investor Declaration Form found as an Appendix to the Offering Supplement stating that they qualify as “Qualifying Investors” and that they have read and understood the risk warnings in the ...

Italian Cooperative Federations: A 10-minute intro

... At present and in the future, the accumulated indivisible reserves are not sufficient for investment in growth. ...

... At present and in the future, the accumulated indivisible reserves are not sufficient for investment in growth. ...

Governed Portfolio 8 - Royal London for advisers

... Governed Portfolio 8 outperformed benchmark over 3 and 5 years to end of March 2016. The existing tactical position applied 02/06/2016 continues. No change required to benchmark asset allocation. We have reduced the exposure to equity (-1.00%), 10 year corporate bonds (-0.07%), 10 year index-linked ...

... Governed Portfolio 8 outperformed benchmark over 3 and 5 years to end of March 2016. The existing tactical position applied 02/06/2016 continues. No change required to benchmark asset allocation. We have reduced the exposure to equity (-1.00%), 10 year corporate bonds (-0.07%), 10 year index-linked ...

The Predictive Ability of the Bond-Stock Earnings Yield Differential

... as well as the results of the strategies in terms of percent of time in the stock market, mean log return, standard deviation, Sharpe ratio, mean excess return, and terminal value. All criteria are compared to actual stock market total returns from 1975–2005 for Strategies 1 to 4 and from 1980–2005 ...

... as well as the results of the strategies in terms of percent of time in the stock market, mean log return, standard deviation, Sharpe ratio, mean excess return, and terminal value. All criteria are compared to actual stock market total returns from 1975–2005 for Strategies 1 to 4 and from 1980–2005 ...

Download attachment

... the first seller. For example, a purchaser buys a refrigerator or washer on deferred basis, and he sells that refrigerator to a third party (not to the first seller), at a lesser price (in cash), in order to get liquidity to cover his needs. Tawriq Tawriq is what is practised between conventional ba ...

... the first seller. For example, a purchaser buys a refrigerator or washer on deferred basis, and he sells that refrigerator to a third party (not to the first seller), at a lesser price (in cash), in order to get liquidity to cover his needs. Tawriq Tawriq is what is practised between conventional ba ...

Moody`s continues to rate Banco del Estado de Chile`s Japanese

... To the extent permitted by law, MOODY’S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability to any person or entity for any indirect, special, consequential, or incidental losses or damages whatsoever arising from or in connection with the info ...

... To the extent permitted by law, MOODY’S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability to any person or entity for any indirect, special, consequential, or incidental losses or damages whatsoever arising from or in connection with the info ...

Prestigious Stock Exchanges - Federal Reserve Bank of New York

... studies have shown that the Eurobond market has become the world’s largest bond market in recent years (Peristiani 2007; Peristiani and Santos 2008). As for equity markets, the more competitive European and emerging-market stock exchanges have in fact become better able to retain their home base, wh ...

... studies have shown that the Eurobond market has become the world’s largest bond market in recent years (Peristiani 2007; Peristiani and Santos 2008). As for equity markets, the more competitive European and emerging-market stock exchanges have in fact become better able to retain their home base, wh ...

Weak rupee: Is it good, or is it bad for the economy?

... The rupee’s weakness may make foreign investors think twice before investing. Foreign capital inflows are typically at risk when the local currency weakens. Portfolio flows into both debt and equity will taper, with investors subscribing to the view that the local currency could depreciate further. ...

... The rupee’s weakness may make foreign investors think twice before investing. Foreign capital inflows are typically at risk when the local currency weakens. Portfolio flows into both debt and equity will taper, with investors subscribing to the view that the local currency could depreciate further. ...

Does Financial Constraint Affect Shareholder Taxes and the Cost of

... on shares outstanding and shares owned by different types of institutional investors. The data on the institutional investors’ ownership are obtained from their quarterly filings with the U.S. Securities and Exchange Commission (known as Form 13F) compiled by Thomson’s Financial. This control is imp ...

... on shares outstanding and shares owned by different types of institutional investors. The data on the institutional investors’ ownership are obtained from their quarterly filings with the U.S. Securities and Exchange Commission (known as Form 13F) compiled by Thomson’s Financial. This control is imp ...

Venture Capital Fund

... These materials provided by WithumSmith+Brown, PC (“Withum”) are intended to provide general information on a particular subject or subjects and are not to be considered an authoritative or necessarily an exhaustive treatment of such subject(s) and are not intended to be a substitute for reading the ...

... These materials provided by WithumSmith+Brown, PC (“Withum”) are intended to provide general information on a particular subject or subjects and are not to be considered an authoritative or necessarily an exhaustive treatment of such subject(s) and are not intended to be a substitute for reading the ...

GOLDMAN SACHS - Follow the “money” in China... to measure credit

... greater data challenge. In listed banks’ balance sheets, investment assets have been rising rapidly. Media reports (e.g., here and here) and disclosures by individual banks indicate that banks have embedded some of their loans to corporates in these assets, driven by regulatory arbitrage (our Banks ...

... greater data challenge. In listed banks’ balance sheets, investment assets have been rising rapidly. Media reports (e.g., here and here) and disclosures by individual banks indicate that banks have embedded some of their loans to corporates in these assets, driven by regulatory arbitrage (our Banks ...

The Case for Dividend Growers in Volatile Markets

... (“dividend growers”) have historically held up relatively better than the overall market as measured by the S&P 500® Index during market drawdowns, while also providing an income cushion. Therefore, investors worried about volatility, but who want to remain invested in equities while generating some ...

... (“dividend growers”) have historically held up relatively better than the overall market as measured by the S&P 500® Index during market drawdowns, while also providing an income cushion. Therefore, investors worried about volatility, but who want to remain invested in equities while generating some ...

Corporate Governance and Investment in the 20th Century Japan: A

... the top management through the exit (selling stocks), when stock price declined. Furthermore, the individual shareholders still had the strong preference on the dividend at least by the early 1960s when the “dividend yield revolution” was emphasized. The dividend yield was still high comparing to th ...

... the top management through the exit (selling stocks), when stock price declined. Furthermore, the individual shareholders still had the strong preference on the dividend at least by the early 1960s when the “dividend yield revolution” was emphasized. The dividend yield was still high comparing to th ...

The Anatomy of a Stock Market Winner

... This article analyzes characteristics of past stock market winners to see whether they may yield some insights into successful investment strategies. Earlierresearch has isolated a particular attribute (such as P/E or size) and then investigated its associated return behavior; we take the opposite t ...

... This article analyzes characteristics of past stock market winners to see whether they may yield some insights into successful investment strategies. Earlierresearch has isolated a particular attribute (such as P/E or size) and then investigated its associated return behavior; we take the opposite t ...

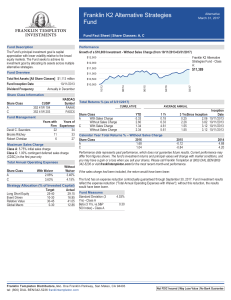

Franklin K2 Alternative Strategies Fund Fact Sheet

... The Fund may shift allocations among strategies at any time. Further, K2 may determine in its sole discretion to not allocate to one or more of the strategies and/or to add new strategies. Accordingly the above target allocations are presented for illustrative purposes only, and should not be viewed ...

... The Fund may shift allocations among strategies at any time. Further, K2 may determine in its sole discretion to not allocate to one or more of the strategies and/or to add new strategies. Accordingly the above target allocations are presented for illustrative purposes only, and should not be viewed ...

Capital Structure and the Corporation`s Product Market Environment

... corporations are subject to pressure from both product and capital market sources. External product market pressures operate directly on profitability and on returns to investment. Capital markets, through withholding investment funds by bidding down the price of the equity or through takeovers, may ...

... corporations are subject to pressure from both product and capital market sources. External product market pressures operate directly on profitability and on returns to investment. Capital markets, through withholding investment funds by bidding down the price of the equity or through takeovers, may ...

Abu Dhabi Commercial Bank PJSC

... beyond ADCB‟s control and have been made based upon management‟s expectations and beliefs concerning future developments and their potential effect upon ADCB. By their nature, these forward-looking statements involve risk and uncertainty because they relate to future events and circumstances which a ...

... beyond ADCB‟s control and have been made based upon management‟s expectations and beliefs concerning future developments and their potential effect upon ADCB. By their nature, these forward-looking statements involve risk and uncertainty because they relate to future events and circumstances which a ...

Q1 - 2017 Commentary - The Canadian ETF Association

... $122.9 billion in assets. A favourable combination of positive market returns and record sales fuelled the growth of Canadian-listed ETFs. The majority of the growth can be attributed to strong inflows of $6.5 billion in Q1 2017. This figure represents the highest quarterly total on record, breaking ...

... $122.9 billion in assets. A favourable combination of positive market returns and record sales fuelled the growth of Canadian-listed ETFs. The majority of the growth can be attributed to strong inflows of $6.5 billion in Q1 2017. This figure represents the highest quarterly total on record, breaking ...

Moody`s Credit Opinion - Together Housing Group

... from each original housing group and, (3) access wider range of funding options and development projects. While the consolidation process has been progressing well so far and many important milestones successfully reached, some implementation risk still exists and uncertainty remains as to whether a ...

... from each original housing group and, (3) access wider range of funding options and development projects. While the consolidation process has been progressing well so far and many important milestones successfully reached, some implementation risk still exists and uncertainty remains as to whether a ...

Leveraged buyout

A leveraged buyout (LBO) is a transaction when a company or single asset (e.g., a real estate property) is purchased with a combination of equity and significant amounts of borrowed money, structured in such a way that the target's cash flows or assets are used as the collateral (or ""leverage"") to secure and repay the borrowed money. Since the debt (be it senior or mezzanine) has a lower cost of capital (until bankruptcy risk reaches a level threatening to the lender[s]) than the equity, the returns on the equity increase as the amount of borrowed money does until the perfect capital structure is reached. As a result, the debt effectively serves as a lever to increase returns-on-investment.The term LBO is usually employed when a financial sponsor acquires a company. However, many corporate transactions are partially funded by bank debt, thus effectively also representing an LBO. LBOs can have many different forms such as management buyout (MBO), management buy-in (MBI), secondary buyout and tertiary buyout, among others, and can occur in growth situations, restructuring situations, and insolvencies. LBOs mostly occur in private companies, but can also be employed with public companies (in a so-called PtP transaction – Public to Private).As financial sponsors increase their returns by employing a very high leverage (i.e., a high ratio of debt to equity), they have an incentive to employ as much debt as possible to finance an acquisition. This has, in many cases, led to situations, in which companies were ""over-leveraged"", meaning that they did not generate sufficient cash flows to service their debt, which in turn led to insolvency or to debt-to-equity swaps in which the equity owners lose control over the business and the debt providers assume the equity.