ace limited - cloudfront.net

... to the merger agreement in accordance with NYSE requirements and ACE’s commitment in its 2014 Proxy Statement not to issue more than 68,000,000 ACE common shares pursuant to Article 6 of its Articles of Association without either providing ACE’s shareholders with the opportunity to exercise preempti ...

... to the merger agreement in accordance with NYSE requirements and ACE’s commitment in its 2014 Proxy Statement not to issue more than 68,000,000 ACE common shares pursuant to Article 6 of its Articles of Association without either providing ACE’s shareholders with the opportunity to exercise preempti ...

Word - corporate

... This Tender Offer Statement on Schedule TO (this “Schedule TO”) relates to the tender offer by Avast Software B.V., a private company with limited liability ( besloten vennootschap met beperkte aansprakelijkheid ) organized under the laws of The Netherlands (“Purchaser”) and a direct wholly owned s ...

... This Tender Offer Statement on Schedule TO (this “Schedule TO”) relates to the tender offer by Avast Software B.V., a private company with limited liability ( besloten vennootschap met beperkte aansprakelijkheid ) organized under the laws of The Netherlands (“Purchaser”) and a direct wholly owned s ...

Form 8-K, 7/1/16

... result from a material breach of such party’s non-solicitation obligations and which such party’s board of directors determines to be, or to be reasonably likely to lead to, a superior proposal, and failure to take such action would reasonably be likely to violate the directors’ fiduciary duties, s ...

... result from a material breach of such party’s non-solicitation obligations and which such party’s board of directors determines to be, or to be reasonably likely to lead to, a superior proposal, and failure to take such action would reasonably be likely to violate the directors’ fiduciary duties, s ...

Form S-4 GENERAL ELECTRIC CO - GE Filed: December 23, 2002

... Osmonics and its shareholders and recommends that you vote "FOR" adoption of the merger agreement and the merger. The merger cannot be completed unless the holders of a majority of the outstanding shares of Osmonics common stock vote to adopt the merger agreement. Whether or not you plan to attend t ...

... Osmonics and its shareholders and recommends that you vote "FOR" adoption of the merger agreement and the merger. The merger cannot be completed unless the holders of a majority of the outstanding shares of Osmonics common stock vote to adopt the merger agreement. Whether or not you plan to attend t ...

BUSINESS CORPORATIONS ACT - Alberta

... (ee) “security” means a share of any class or series of shares or a debt obligation of a corporation and includes a certificate evidencing such a share or debt obligation; (ff) “security interest” means an interest in or charge on property of a corporation to secure payment of a debt or performance ...

... (ee) “security” means a share of any class or series of shares or a debt obligation of a corporation and includes a certificate evidencing such a share or debt obligation; (ff) “security interest” means an interest in or charge on property of a corporation to secure payment of a debt or performance ...

0001193125-14-305022 - Investor Relations

... Sales and maturities of available-for-sale securities Purchase of available-for-sale securities Maturities of held-to-maturity securities Movement in restricted cash and cash equivalents Funding of other investments Redemption of other investments ...

... Sales and maturities of available-for-sale securities Purchase of available-for-sale securities Maturities of held-to-maturity securities Movement in restricted cash and cash equivalents Funding of other investments Redemption of other investments ...

Report of the Company Law Committee 1962 (Jenkins Committee)

... management of their company's business, of which they are the ultimate proprietors. As against this, no company's affairs can be managed properly, or indeed managed at all, otherwise than through a board of directors with a reasonably free hand to do what they think best in the interests of the comp ...

... management of their company's business, of which they are the ultimate proprietors. As against this, no company's affairs can be managed properly, or indeed managed at all, otherwise than through a board of directors with a reasonably free hand to do what they think best in the interests of the comp ...

words - Nasdaq`s INTEL Solutions

... structured as a share for share exchange in which the Company issued 263,048 shares of Common Stock to the two holders of capital stock in NBG and Target in exchange for their equity interests in these companies. At the time of the closing of the transaction, the Common Stock issued by the Company h ...

... structured as a share for share exchange in which the Company issued 263,048 shares of Common Stock to the two holders of capital stock in NBG and Target in exchange for their equity interests in these companies. At the time of the closing of the transaction, the Common Stock issued by the Company h ...

Allen - NYU Law

... right to participate in p-ship profits as stated in K – only interest that can be freely transferred w/o consent of other p-ners – not easy to sell w/o right to mgmt. and assets. ...

... right to participate in p-ship profits as stated in K – only interest that can be freely transferred w/o consent of other p-ners – not easy to sell w/o right to mgmt. and assets. ...

Limited Liability and the Corporation - Chicago Unbound

... that limited liability is necessary for the existence of an organized securities market. If equity investors could be required to contribute additional capital, the value of shares would not be the same to every investor. The greater a particular investor's wealth in relation to that of other invest ...

... that limited liability is necessary for the existence of an organized securities market. If equity investors could be required to contribute additional capital, the value of shares would not be the same to every investor. The greater a particular investor's wealth in relation to that of other invest ...

Fiduciary Obligations of Directors of a Target Company in Resisting

... takeover area, it is apparent that Canadian judges are looking to American case law for assistance.13 This article examines the fiduciary obligations of directors of a corporation that is the subject of an unsolicited takeover bid. An attempt is made in this article to avoid the emotion-charged term ...

... takeover area, it is apparent that Canadian judges are looking to American case law for assistance.13 This article examines the fiduciary obligations of directors of a corporation that is the subject of an unsolicited takeover bid. An attempt is made in this article to avoid the emotion-charged term ...

From Enactment to Mariner: Does the Statutory Business Judgment

... Since the control rights over corporations are centralized and delegated, directors’ duties broadly correspond with the two main risks faced by the legal entity and those who contributed specific investments: foolish and knavish management.12 Shareholders and other specific-investors relinquish thei ...

... Since the control rights over corporations are centralized and delegated, directors’ duties broadly correspond with the two main risks faced by the legal entity and those who contributed specific investments: foolish and knavish management.12 Shareholders and other specific-investors relinquish thei ...

The Role of Corporate Law in French Corporate Governance

... to the alignment of shareholder and managerial interests. The second assumption is that, to date, there has not been one economically superior answer to the agency problem. At any specified time, in different countries, and even within the same country, numerous solutions to the problem of ensuring ...

... to the alignment of shareholder and managerial interests. The second assumption is that, to date, there has not been one economically superior answer to the agency problem. At any specified time, in different countries, and even within the same country, numerous solutions to the problem of ensuring ...

A review of Israel`s Capital market:

... company‖). The majority of the provisions of the law apply to all kinds of companies, although there are some special provisions that apply only to public companies, and it is expressly provided that companies may not stipulate alternate provisions with respect to these particular statutory provisio ...

... company‖). The majority of the provisions of the law apply to all kinds of companies, although there are some special provisions that apply only to public companies, and it is expressly provided that companies may not stipulate alternate provisions with respect to these particular statutory provisio ...

Defenders of the Corporate Bastion in Revlon Zone: Paramount

... judgment rule to require a showing by directors that a threat to the corporation's interests existed.6 The target corporation's board generally considers takeovers hostile to its interests because a takeover usually results in a loss of the board's control of the corporation and a subsequent change ...

... judgment rule to require a showing by directors that a threat to the corporation's interests existed.6 The target corporation's board generally considers takeovers hostile to its interests because a takeover usually results in a loss of the board's control of the corporation and a subsequent change ...

hostile takeovers and defensive mechanisms in the united kingdom

... increased output. Moreover, the combined enterprise will be able to obtain funds from banks or the capital markets more cheaply due to its size and strength. Another possible motive behind takeovers is the need for diversification. Accordingly, an acquisition of another company is seen as a means of ...

... increased output. Moreover, the combined enterprise will be able to obtain funds from banks or the capital markets more cheaply due to its size and strength. Another possible motive behind takeovers is the need for diversification. Accordingly, an acquisition of another company is seen as a means of ...

A Contractarian Defense of Corporate

... (the “corporation”) controlled by a relatively unconstrained hierarchy? Since they do so freely when they enter into their relationship with the corporation, it seems reasonable to presume that they do so because they believe they will gain more than they will lose. In other words, they believe that ...

... (the “corporation”) controlled by a relatively unconstrained hierarchy? Since they do so freely when they enter into their relationship with the corporation, it seems reasonable to presume that they do so because they believe they will gain more than they will lose. In other words, they believe that ...

Corporations I - Phi Delta Phi

... (d) Freezeout – taking advantage of majority shareholder position to force the minority shareholder out of corporate offices and employment. P641Case (6) Tender Offer – offer to buy out shareholders in a proportionate amount. Way to get control over a company without dealing with the management. (7) ...

... (d) Freezeout – taking advantage of majority shareholder position to force the minority shareholder out of corporate offices and employment. P641Case (6) Tender Offer – offer to buy out shareholders in a proportionate amount. Way to get control over a company without dealing with the management. (7) ...

memorandum

... In today’s investment environment, the corporate opportunity doctrine can be an impediment to venture capital funds or private equity groups investing in corporations. These investors typically have multiple investments in the same area of activity. They are generally willing to invest significant s ...

... In today’s investment environment, the corporate opportunity doctrine can be an impediment to venture capital funds or private equity groups investing in corporations. These investors typically have multiple investments in the same area of activity. They are generally willing to invest significant s ...

Recent Developments in Oklahoma Business and Corporate Law

... acting as an unregistered broker-dealer by facilitating the offer and sale of securities.17 The JOBS Act unknotted the conundrum by exempting crowdfunding offerings providing a regulatory framework for the broker-dealers and “funding portals”.18 The exemption permits companies to raise up to $1.0 mi ...

... acting as an unregistered broker-dealer by facilitating the offer and sale of securities.17 The JOBS Act unknotted the conundrum by exempting crowdfunding offerings providing a regulatory framework for the broker-dealers and “funding portals”.18 The exemption permits companies to raise up to $1.0 mi ...

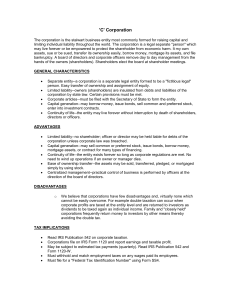

`C` Corporation

... which have a small number of stock holders usually having ties to one another through family relationships or friends and business partners. Close corporations are special cases of regular business corporations electing to operate in a more informal manner likened to partnerships. Regular business c ...

... which have a small number of stock holders usually having ties to one another through family relationships or friends and business partners. Close corporations are special cases of regular business corporations electing to operate in a more informal manner likened to partnerships. Regular business c ...

Download Beat the Teacher - Legal Structures (Worksheet)

... A partnership is a form of business in which at least three people agree to work together, sharing the profits of the partnership. Like sole traders, partners normally have unlimited liability. The rights and responsibilities of the partners are set out in the partnership agreement, covering areas s ...

... A partnership is a form of business in which at least three people agree to work together, sharing the profits of the partnership. Like sole traders, partners normally have unlimited liability. The rights and responsibilities of the partners are set out in the partnership agreement, covering areas s ...

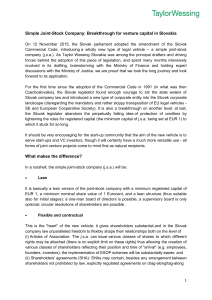

Simple Joint-Stock Company: Breakthrough for

... rights may be attached) and preferred stock (priority shares); however, preferred stock only enjoys priority rights concerning the distribution of profit (off-set by elimination of voting rights). It is obvious that this framework does not allow shareholders to shape the company according to their n ...

... rights may be attached) and preferred stock (priority shares); however, preferred stock only enjoys priority rights concerning the distribution of profit (off-set by elimination of voting rights). It is obvious that this framework does not allow shareholders to shape the company according to their n ...

United Kingdom company law

United Kingdom company law regulates corporations formed under the Companies Act 2006. Also governed by the Insolvency Act 1986, the UK Corporate Governance Code, European Union Directives and court cases, the company is the primary legal vehicle to organise and run business. Tracing their modern history to the late Industrial Revolution, public companies now employ more people and generate more of wealth in the United Kingdom economy than any other form of organisation. The United Kingdom was the first country to draft modern corporation statutes, where through a simple registration procedure any investors could incorporate, limit liability to their commercial creditors in the event of business insolvency, and where management was delegated to a centralised board of directors. An influential model within Europe, the Commonwealth and as an international standard setter, UK law has always given people broad freedom to design the internal company rules, so long as the mandatory minimum rights of investors under its legislation are complied with.Company law, or corporate law, can be broken down into two main fields. Corporate governance in the UK mediates the rights and duties among shareholders, employees, creditors and directors. Since the board of directors habitually possesses the power to manage the business under a company constitution, a central theme is what mechanisms exist to ensure directors' accountability. UK law is ""shareholder friendly"" in that shareholders, to the exclusion of employees, typically exercise sole voting rights in the general meeting. The general meeting holds a series of minimum rights to change the company constitution, issue resolutions and remove members of the board. In turn, directors owe a set of duties to their companies. Directors must carry out their responsibilities with competence, in good faith and undivided loyalty to the enterprise. If the mechanisms of voting do not prove enough, particularly for minority shareholders, directors' duties and other member rights may be vindicated in court. Of central importance in public and listed companies is the securities market, typified by the London Stock Exchange. Through the Takeover Code the UK strongly protects the right of shareholders to be treated equally and freely trade their shares.Corporate finance concerns the two money raising options for limited companies. Equity finance involves the traditional method of issuing shares to build up a company's capital. Shares can contain any rights the company and purchaser wish to contract for, but generally grant the right to participate in dividends after a company earns profits and the right to vote in company affairs. A purchaser of shares is helped to make an informed decision directly by prospectus requirements of full disclosure, and indirectly through restrictions on financial assistance by companies for purchase of their own shares. Debt finance means getting loans, usually for the price of a fixed annual interest repayment. Sophisticated lenders, such as banks typically contract for a security interest over the assets of a company, so that in the event of default on loan repayments they may seize the company's property directly to satisfy debts. Creditors are also, to some extent, protected by courts' power to set aside unfair transactions before a company goes under, or recoup money from negligent directors engaged in wrongful trading. If a company is unable to pay its debts as they fall due, UK insolvency law requires an administrator to attempt a rescue of the company (if the company itself has the assets to pay for this). If rescue proves impossible, a company's life ends when its assets are liquidated, distributed to creditors and the company is struck off the register. If a company becomes insolvent with no assets it can be wound up by a creditor, for a fee (not that common), or more commonly by the tax creditor (HMRC).