Competition in Currency The Potential for Private Money Executive Summary

... hundreds of millions of dollars annually in the private currency market. For each unit of private currency withdrawn by a customer, the bank retains one unit of government currency, which can be invested or loaned out to other customers. The bank earns revenue on these investments and loans for as l ...

... hundreds of millions of dollars annually in the private currency market. For each unit of private currency withdrawn by a customer, the bank retains one unit of government currency, which can be invested or loaned out to other customers. The bank earns revenue on these investments and loans for as l ...

Cash, freedom and crime: Use and impact of cash in

... not dramatic, given the size of seasonal surges at year-ends in the range of EUR 20-30 bn. Later on, the growth rate of EUR 500 notes came down again. ...

... not dramatic, given the size of seasonal surges at year-ends in the range of EUR 20-30 bn. Later on, the growth rate of EUR 500 notes came down again. ...

Opinion on limitations of cash payments (CON/2017/27)

... limitation at these levels may make it difficult to implement the limit in practice. In this regard, it should be noted that Directive (EU) 2015/849 of the European Parliament and of the Council14, whilst confirming the vulnerability of large cash payments to money laundering and terrorist financing ...

... limitation at these levels may make it difficult to implement the limit in practice. In this regard, it should be noted that Directive (EU) 2015/849 of the European Parliament and of the Council14, whilst confirming the vulnerability of large cash payments to money laundering and terrorist financing ...

Adam Czerniak, Ph.D. Department of Economics II - E-SGH

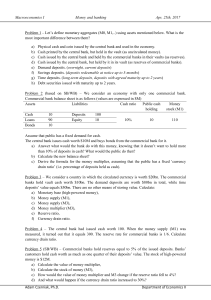

... The central bank issues cash worth $10M and buys bonds from the commercial bank for it. a) Answer what would the bank do with this money, knowing that it doesn’t want to hold more than 10% of deposits in cash? What would the public do then? b) Calculate the new balance sheet? c) Derive the formula f ...

... The central bank issues cash worth $10M and buys bonds from the commercial bank for it. a) Answer what would the bank do with this money, knowing that it doesn’t want to hold more than 10% of deposits in cash? What would the public do then? b) Calculate the new balance sheet? c) Derive the formula f ...