Form AUT – PFS Public Fund supplement

... before carrying out a Fund Manager’s instructions, that those instructions comply with the requirements of CIR 7.1.3. PF16. Please advise of the arrangements that the Trustee / Custody Provider will implement to ensure that the Fund’s unitholder register is maintained in accordance with CIR 8.7. and ...

... before carrying out a Fund Manager’s instructions, that those instructions comply with the requirements of CIR 7.1.3. PF16. Please advise of the arrangements that the Trustee / Custody Provider will implement to ensure that the Fund’s unitholder register is maintained in accordance with CIR 8.7. and ...

Sound Practice Guidelines

... b) Subscription, transfer and redemption procedures. Cut off times for redemption notice and deadlines for receipt of subscription application forms and monies should be clearly stated. c) Anti Money laundering (AML), ‘Know Your Customer’ (KYC) and all other regulatory issues. AML and KYC procedure ...

... b) Subscription, transfer and redemption procedures. Cut off times for redemption notice and deadlines for receipt of subscription application forms and monies should be clearly stated. c) Anti Money laundering (AML), ‘Know Your Customer’ (KYC) and all other regulatory issues. AML and KYC procedure ...

The Impact of Leverage on Hedge Fund Performance

... Table 1 presents summary statistics of leverage use across various hedge fund strategies. The information is based on the TASS database as of April 2016, and it shows frequency of leverage use for each strategy. Among 12 strategies in both the graveyard and live databases, 9 strategies contain more ...

... Table 1 presents summary statistics of leverage use across various hedge fund strategies. The information is based on the TASS database as of April 2016, and it shows frequency of leverage use for each strategy. Among 12 strategies in both the graveyard and live databases, 9 strategies contain more ...

Financial Accounting and Accounting Standards

... 3. Fixed assets are only reported on government-wide statement. 4. Depreciation is not recorded. ...

... 3. Fixed assets are only reported on government-wide statement. 4. Depreciation is not recorded. ...

Nov 2012 Visitors Program_v3

... • The Mayer Fund is a studentmanaged investment fund with over $3 million under management History • Started in 1993 by William Mayer, the then Dean of the business school, with $250,000 • Grown over the years through capital appreciation and outside contributions. Bill Mayer is one of the contribut ...

... • The Mayer Fund is a studentmanaged investment fund with over $3 million under management History • Started in 1993 by William Mayer, the then Dean of the business school, with $250,000 • Grown over the years through capital appreciation and outside contributions. Bill Mayer is one of the contribut ...

Automatic Account Rebalancing

... place – your account can be rebalanced quarterly, semi-annually or annually. Be sure to carefully review your current investment allocation designations for new contributions as well as your existing balances in your account. ...

... place – your account can be rebalanced quarterly, semi-annually or annually. Be sure to carefully review your current investment allocation designations for new contributions as well as your existing balances in your account. ...

Important Information about Hedge Funds

... many strategies have to traditional investments. While past performance is not indicative of future results, hedge fund strategies historically offer returns independent from the performance of stock and bond markets. Adding hedge funds to a balanced portfolio of stocks and bonds provides diversific ...

... many strategies have to traditional investments. While past performance is not indicative of future results, hedge fund strategies historically offer returns independent from the performance of stock and bond markets. Adding hedge funds to a balanced portfolio of stocks and bonds provides diversific ...

Why Hedge Funds? - CFA Institute Publications

... This piece reflects the views of the author and does not represent the official views of the Financial Analysts Journal or CFA Institute. ...

... This piece reflects the views of the author and does not represent the official views of the Financial Analysts Journal or CFA Institute. ...

key investor information

... accumulated. Other share classes of the Fund may distribute income. The Fund will only use a limited number of simple derivative instruments for non-complex investment purposes and/or efficient portfolio management purposes. Although the use of derivatives may give rise to an additional exposure ...

... accumulated. Other share classes of the Fund may distribute income. The Fund will only use a limited number of simple derivative instruments for non-complex investment purposes and/or efficient portfolio management purposes. Although the use of derivatives may give rise to an additional exposure ...

how hedge funds are structured

... Funds must secure their loans with collateral to gain margin and execute trades. In turn, each broker (usually a large securities firm) uses its own risk matrix to determine how much to lend to each of its clients. Brokers are also subject to federal regulations, which act as indirect regulations on ...

... Funds must secure their loans with collateral to gain margin and execute trades. In turn, each broker (usually a large securities firm) uses its own risk matrix to determine how much to lend to each of its clients. Brokers are also subject to federal regulations, which act as indirect regulations on ...

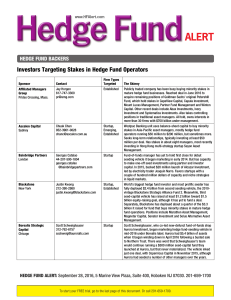

Hedge Fund Backers

... that seeks to acquire stakes in new and emerging alternativeinvestment businesses including hedge fund managers and commodity-trading advisors. In 2014, reached deal with former SAC Capital executive Sol Kumin to seed his Folger Hill Asset Management with $400 million, on condition that it raised at ...

... that seeks to acquire stakes in new and emerging alternativeinvestment businesses including hedge fund managers and commodity-trading advisors. In 2014, reached deal with former SAC Capital executive Sol Kumin to seed his Folger Hill Asset Management with $400 million, on condition that it raised at ...

Renuka Ramnath-led Multiples PE`s AUM cross $1

... quick exits in the past without sticking to the four to five year holding period for a PE firm. The fund marked its first full exit activity by selling its remaining stake in South Indian Bank in January 2015. This was its first full exit and it made Rs 235 crore against investment of Rs 165 crore. ...

... quick exits in the past without sticking to the four to five year holding period for a PE firm. The fund marked its first full exit activity by selling its remaining stake in South Indian Bank in January 2015. This was its first full exit and it made Rs 235 crore against investment of Rs 165 crore. ...

Hedge Fund Vs Mutual Fund

... Meant for those who are already rich. Hedge funds are open only to 'accredited investors' defined as those with net worth of more than $1.5 million, or income in excess of $200,000 in each of the past two years. The good ones demand $1 million or more of investment. ...

... Meant for those who are already rich. Hedge funds are open only to 'accredited investors' defined as those with net worth of more than $1.5 million, or income in excess of $200,000 in each of the past two years. The good ones demand $1 million or more of investment. ...

United Emerging Markets Bond Fund

... A prospectus for the fund(s) (the "Fund(s)") may be obtained from the Manager or any of its appointed distributors. Investors should read the prospectus before deciding whether to subscribe for or purchase units in the Fund(s) ("Units"). All applications for Units must be made on application forms a ...

... A prospectus for the fund(s) (the "Fund(s)") may be obtained from the Manager or any of its appointed distributors. Investors should read the prospectus before deciding whether to subscribe for or purchase units in the Fund(s) ("Units"). All applications for Units must be made on application forms a ...

Organs Transplantation from a Theravada Buddhist Perspective

... But when the person is a well known personality, such as a teenage singer, or most importantly their own loved ones, then he or she starts to think otherwise. However, when the person lies in the comatose stage for a long period of time, then the people start to change their minds. ...

... But when the person is a well known personality, such as a teenage singer, or most importantly their own loved ones, then he or she starts to think otherwise. However, when the person lies in the comatose stage for a long period of time, then the people start to change their minds. ...

Paul Singer (businessman)

Paul Elliott Singer (born August 22, 1944) is an American hedge fund manager, investor, philanthropist, and political activist. He is the founder and CEO of hedge fund Elliott Management Corporation, a political activist and activist investor, and (via his Paul E. Singer Foundation) a prominent New York based philanthropist. In 2014, Forbes rated Singer's net worth as $1.9 billion. Singer's aggressive business practices have been criticized by a number of politicians, journalists, business people and NGOs as having the traits of a vulture fund.