The Impact of Collateral

... impact markets Just as the deregulation of investment banks at the end of the last century had far-reaching effects over the two decades that followed, so today’s re-regulation of capital markets will prove to be yet another defining moment in history. Already, changing market liquidity is signallin ...

... impact markets Just as the deregulation of investment banks at the end of the last century had far-reaching effects over the two decades that followed, so today’s re-regulation of capital markets will prove to be yet another defining moment in history. Already, changing market liquidity is signallin ...

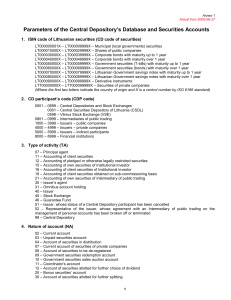

1. ISIN code of Lithuanian securities (CD code of securities)

... LT000030000X – LT000039999X – Corporate bonds with maturity up to 1 year LT000040000X – LT000049999X – Corporate bonds with maturity over 1 year LT000050000X – LT000059999X – Government securities (T-bills) with maturity up to 1 year LT000060000X – LT000069999X – Government securities (bonds) with m ...

... LT000030000X – LT000039999X – Corporate bonds with maturity up to 1 year LT000040000X – LT000049999X – Corporate bonds with maturity over 1 year LT000050000X – LT000059999X – Government securities (T-bills) with maturity up to 1 year LT000060000X – LT000069999X – Government securities (bonds) with m ...

Is Cash still King?

... regulators against a backdrop of reduced supply of eligible securities, creating an imbalance between demand and supply. ...

... regulators against a backdrop of reduced supply of eligible securities, creating an imbalance between demand and supply. ...

Repurchase Agreements – Benefits, Risks and Controls

... If a counterparty defaults, a loss may be realized on the sale of the underlying security to the extent that the proceeds from the sale and accrued interest of the security are less than the resale price, including interest, provided in the repurchase agreement. Moreover, should a counterparty decla ...

... If a counterparty defaults, a loss may be realized on the sale of the underlying security to the extent that the proceeds from the sale and accrued interest of the security are less than the resale price, including interest, provided in the repurchase agreement. Moreover, should a counterparty decla ...

Emerging Market Repo

... are valued at the current market price plus accrued interest to date. The securities can be delivered to the customer or its agent, or they can be safekept by Morgan Stanley. Upon termination of the repo, the securities are returned to the original seller and the cash investor receives back the orig ...

... are valued at the current market price plus accrued interest to date. The securities can be delivered to the customer or its agent, or they can be safekept by Morgan Stanley. Upon termination of the repo, the securities are returned to the original seller and the cash investor receives back the orig ...

Repurchase agreements and the law

... borrower filed for bankruptcy, the lender could retain possession of the securities. In 2000, however, a court ruling in the bankruptcy of Criimi Mae, a publicly held commercial mortage REIT, took market ...

... borrower filed for bankruptcy, the lender could retain possession of the securities. In 2000, however, a court ruling in the bankruptcy of Criimi Mae, a publicly held commercial mortage REIT, took market ...

Slides from the press conference

... Real repo rate Forecast, real repo rate, M PR 2008:2 Forecast, real repo rate, M PU April 2008 Nominal repo rate Forecast, nominal repo rate, M PU April 2008 Forecast, nominal repo rate, M PR 2008:2 ...

... Real repo rate Forecast, real repo rate, M PR 2008:2 Forecast, real repo rate, M PU April 2008 Nominal repo rate Forecast, nominal repo rate, M PU April 2008 Forecast, nominal repo rate, M PR 2008:2 ...

Global Securities Finance Fixed Income Repo

... the repo market, transacting on specific securities either because they have failed to receive securities that they are due to make delivery on - they have deliberately sold a security short and are using the loan to deliver against this position - or they hold securities in high demand. The secur ...

... the repo market, transacting on specific securities either because they have failed to receive securities that they are due to make delivery on - they have deliberately sold a security short and are using the loan to deliver against this position - or they hold securities in high demand. The secur ...