A Roadmap to Accounting for Income Taxes

... iGAAP material in Appendix G copyright 2016 Deloitte Touche Tohmatsu Limited. ...

... iGAAP material in Appendix G copyright 2016 Deloitte Touche Tohmatsu Limited. ...

Example Disclosure: Accounting for Income Taxes

... points as compared to 20X3. The calculation of our tax liabilities involves dealing with uncertainties in the application of complex tax laws and regulations in a multitude of jurisdictions across our global operations. ASC 740 states that a tax benefit from an uncertain tax position may be recogniz ...

... points as compared to 20X3. The calculation of our tax liabilities involves dealing with uncertainties in the application of complex tax laws and regulations in a multitude of jurisdictions across our global operations. ASC 740 states that a tax benefit from an uncertain tax position may be recogniz ...

Property, plant and equipment

... A municipality’s property, plant and equipment (PPE) are non-current tangible assets that are held for more than one accounting period for its own use, in order to supply goods or services and for administrative purposes. ...

... A municipality’s property, plant and equipment (PPE) are non-current tangible assets that are held for more than one accounting period for its own use, in order to supply goods or services and for administrative purposes. ...

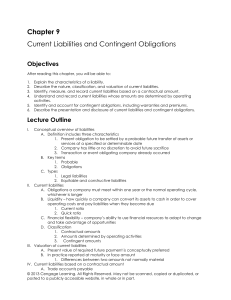

Wahlen_1e_IM_Ch09 (new window)

... required future payments. In practice most current liabilities are measured, recorded, and reported at their maturity or face amount. Usually the difference between present value and maturity value is not material due to the short time period involved. Current Liabilities Based on a Contractual Amou ...

... required future payments. In practice most current liabilities are measured, recorded, and reported at their maturity or face amount. Usually the difference between present value and maturity value is not material due to the short time period involved. Current Liabilities Based on a Contractual Amou ...

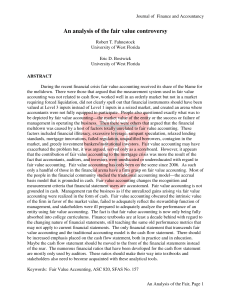

An analysis of the fair value controversy

... placed on hard-to-price assets when the markets for those assets to evaporate as they did in the recent credit crunch (Chasan 2008). Why should accounting rules force banks to take artificial capital reductions without reference to actual loan performance (cash flow)? This accounting treatment affec ...

... placed on hard-to-price assets when the markets for those assets to evaporate as they did in the recent credit crunch (Chasan 2008). Why should accounting rules force banks to take artificial capital reductions without reference to actual loan performance (cash flow)? This accounting treatment affec ...

EASTMAN CHEMICAL CO (Form: 8-K/A, Received

... acquired assets and liabilities of Taminco based upon their estimated fair values as of the acquisition date. The Consideration transferred to complete the Acquisition in excess of the estimated fair values of the assets acquired and liabilities assumed was recognized as goodwill in Eastman's Pro Fo ...

... acquired assets and liabilities of Taminco based upon their estimated fair values as of the acquisition date. The Consideration transferred to complete the Acquisition in excess of the estimated fair values of the assets acquired and liabilities assumed was recognized as goodwill in Eastman's Pro Fo ...

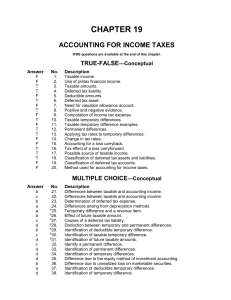

Solution 19-105

... Calculate loss to be reported after NOL carryback. Calculate loss to be reported after NOL carryback. Calculate loss to be reported after NOL carryforward. Determine income tax refund following an NOL carryback. Calculate income tax benefit from an NOL carryback. Calculate income tax payable after N ...

... Calculate loss to be reported after NOL carryback. Calculate loss to be reported after NOL carryback. Calculate loss to be reported after NOL carryforward. Determine income tax refund following an NOL carryback. Calculate income tax benefit from an NOL carryback. Calculate income tax payable after N ...

CHAPTER 10 Capital assets

... Purchase price Closing costs such as title and legal fees Accrued property taxes and other liens on the land assumed by the purchaser Land improvements like: ...

... Purchase price Closing costs such as title and legal fees Accrued property taxes and other liens on the land assumed by the purchaser Land improvements like: ...

Taxing Financial Arrangements: Harmonising Tax and

... promissory notes, as distinct from being in a position that a liability would certainly arise in the future”.16 Australian courts have settled on recognition of gains or losses on a straight-line accruals basis,17 although there had previously been some judicial support for the alternative approache ...

... promissory notes, as distinct from being in a position that a liability would certainly arise in the future”.16 Australian courts have settled on recognition of gains or losses on a straight-line accruals basis,17 although there had previously been some judicial support for the alternative approache ...

Implications of Implementation of IAS 41 about Agriculture on

... IAS 41 is an controversial accounting standard because it uses fair value as the only basis for assessment (not as an option like in fixed assets accounting standards). Fair value can be obtained from active market, but not all of assets have an active market. This standard is not regulating all of ...

... IAS 41 is an controversial accounting standard because it uses fair value as the only basis for assessment (not as an option like in fixed assets accounting standards). Fair value can be obtained from active market, but not all of assets have an active market. This standard is not regulating all of ...

Chap011

... exactly as we would any other change in estimate. On January 1, 2009, Matrix, Inc., purchased equipment for $400,000. Matrix expected a residual value $40,000, and a service life of 5 years. Matrix uses the double-declining-balance method to depreciate this type of asset. During 2011, the company sw ...

... exactly as we would any other change in estimate. On January 1, 2009, Matrix, Inc., purchased equipment for $400,000. Matrix expected a residual value $40,000, and a service life of 5 years. Matrix uses the double-declining-balance method to depreciate this type of asset. During 2011, the company sw ...

Valuing intangibles companies

... more about how its business was threatened and what it could do to stave off the threat. Through careful research, the company determined that the new information-based environment could offer it numerous new opportunities. For example, since Esselte owned the company that printed Swedish law books, ...

... more about how its business was threatened and what it could do to stave off the threat. Through careful research, the company determined that the new information-based environment could offer it numerous new opportunities. For example, since Esselte owned the company that printed Swedish law books, ...

Illustrative financial audit procedures for a self

... The following suggested procedures are for illustrative purposes only and should be reviewed and adapted for the specific circumstances and audit risks associated with each SMSF audit engagement. The auditor exercises professional judgement to ensure that the procedures adopted are appropriate to th ...

... The following suggested procedures are for illustrative purposes only and should be reviewed and adapted for the specific circumstances and audit risks associated with each SMSF audit engagement. The auditor exercises professional judgement to ensure that the procedures adopted are appropriate to th ...

Survey of the Residual Income, Discounted Cash Flow

... offerings in the stock exchange. Weston and Copeland (1986) offered “discounted cash flow” method to determine the companies’ stock price. They argued that in all companies, cash is an operational symbol. If the company’s future cash is anticipated and discounted based on the risk level, the company ...

... offerings in the stock exchange. Weston and Copeland (1986) offered “discounted cash flow” method to determine the companies’ stock price. They argued that in all companies, cash is an operational symbol. If the company’s future cash is anticipated and discounted based on the risk level, the company ...

Taxation and Investment in Denmark 2015

... The documents must be translated into Danish if required by the Business Authority and Companies Agency, although this requirement normally does not apply to documents in English, Norwegian or Swedish. A registered branch office must have a name that includes the word “filial” (branch office), toget ...

... The documents must be translated into Danish if required by the Business Authority and Companies Agency, although this requirement normally does not apply to documents in English, Norwegian or Swedish. A registered branch office must have a name that includes the word “filial” (branch office), toget ...

Adjustments, Financial Statements, and the Quality of

... On January 1, 2009, Matrix, Inc. paid $3,600 for a 3-year fire insurance policy. They are paying in advance for a resource they will use over a 3-year period. At December 31st, Matrix must recognize the portion of the insurance that has been consumed and becomes an expense. ...

... On January 1, 2009, Matrix, Inc. paid $3,600 for a 3-year fire insurance policy. They are paying in advance for a resource they will use over a 3-year period. At December 31st, Matrix must recognize the portion of the insurance that has been consumed and becomes an expense. ...

income tax computation and property income

... Tax credits on dividends are never repayable. Offset against IT liability first to allow other tax credits to ...

... Tax credits on dividends are never repayable. Offset against IT liability first to allow other tax credits to ...

- Mark E. Moore

... multiples of earnings, book values and dividends of the other firms in the industry. Which valuation comes closest to the actual price? b. List and explain the reservations (problems) you identify in using the multiples. c. All else being equal, would you expect the price of a firm with a high divid ...

... multiples of earnings, book values and dividends of the other firms in the industry. Which valuation comes closest to the actual price? b. List and explain the reservations (problems) you identify in using the multiples. c. All else being equal, would you expect the price of a firm with a high divid ...

Session 17: Revenue Multiples - NYU Stern School of Business

... received to sell the asset or paid to transfer the liability (an exit price), not the price that would be paid to acquire the asset or received to assume the liability (an entry price).” The hierarchy puts “market prices”, if available for an asset, at the top with intrinsic value being accepted onl ...

... received to sell the asset or paid to transfer the liability (an exit price), not the price that would be paid to acquire the asset or received to assume the liability (an entry price).” The hierarchy puts “market prices”, if available for an asset, at the top with intrinsic value being accepted onl ...

... should aim to foster both the development and retention of intellectual property in Australia. Goodwill and other intangible assets are linked to a specific business and therefore the most common method of transferring goodwill/other intangible assets offshore (to a more favourable tax regime) invol ...

Deferred tax

... Imputation system After tax profits earned by company can be: Retained or Distributed Tax paid by company treated as payment of tax on dividend received. Therefore dividends are only taxed once ...

... Imputation system After tax profits earned by company can be: Retained or Distributed Tax paid by company treated as payment of tax on dividend received. Therefore dividends are only taxed once ...

VALUATION

... market value of the firm exceeds the value of its existing capital when investors’ perceive its expected earnings as high or increasing firm can be worth less than its existing capital when its prospects are considered uncertain or low investment in new real capital is profitable if q exceeds one ...

... market value of the firm exceeds the value of its existing capital when investors’ perceive its expected earnings as high or increasing firm can be worth less than its existing capital when its prospects are considered uncertain or low investment in new real capital is profitable if q exceeds one ...

WHAT WOULD HAPPEN? - University of North Texas

... and understating taxable income, then require them to report the same figure to shareholders and the taxing authority and you fix two problems. Not a good idea ...

... and understating taxable income, then require them to report the same figure to shareholders and the taxing authority and you fix two problems. Not a good idea ...