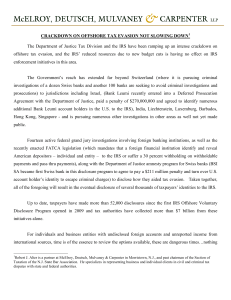

Crackdown on Offshore Tax Evasion Not Slowing Down

... concealment type conduct, a quiet disclosure is more attractive. Nevertheless, if their tax return filings are audited, the chance of leniency on penalties will be significantly compromised. Finally, it should go without saying that any quiet disclosure must be truthful and accurate as to every mate ...

... concealment type conduct, a quiet disclosure is more attractive. Nevertheless, if their tax return filings are audited, the chance of leniency on penalties will be significantly compromised. Finally, it should go without saying that any quiet disclosure must be truthful and accurate as to every mate ...

CRS - RHB

... If there is any change in the information provided to the bank, you are required to inform the bank promptly and provide the Bank with a selfcertification on your tax residency within 30 days of the changes in your circumstances. ...

... If there is any change in the information provided to the bank, you are required to inform the bank promptly and provide the Bank with a selfcertification on your tax residency within 30 days of the changes in your circumstances. ...

Canadian Cross Border issues for US Citizens

... Foreign Account Tax Compliance Act FATCA New US law aimed at requiring Foreign Financial Institutions to provide to the US information on the financial institutions US account holders accounts ...

... Foreign Account Tax Compliance Act FATCA New US law aimed at requiring Foreign Financial Institutions to provide to the US information on the financial institutions US account holders accounts ...

1818 Society Form 8938 and Other Important

... Assets Report – Form 8938 “Specified foreign financial asset” • Any financial account maintained by a foreign financial institution • Any stock or security issued by a foreign person • Any financial instrument/contract – foreign issuer • Any interest in a foreign entity Information statement - Max ...

... Assets Report – Form 8938 “Specified foreign financial asset” • Any financial account maintained by a foreign financial institution • Any stock or security issued by a foreign person • Any financial instrument/contract – foreign issuer • Any interest in a foreign entity Information statement - Max ...

EXTREME PENALTIES, EXPATRIATION

... secret accounts. The plea, in U.S. District Court in Manhattan, marks the death knell for one of Switzerland's most storied banks, whose original European clients pre-date the American Revolution. Wegelin admitted to charges of conspiracy in helping Americans evade taxes on at least $1.2 billion fo ...

... secret accounts. The plea, in U.S. District Court in Manhattan, marks the death knell for one of Switzerland's most storied banks, whose original European clients pre-date the American Revolution. Wegelin admitted to charges of conspiracy in helping Americans evade taxes on at least $1.2 billion fo ...