Spending your pension as you wish

... growing sense of frustration felt by millions of people that persuaded the Government to introduce genuine freedom over access to pension savings. Although the purchase of an annuity has not been compulsory for some time, the complexities and cost of the alternative was in practice leading to compul ...

... growing sense of frustration felt by millions of people that persuaded the Government to introduce genuine freedom over access to pension savings. Although the purchase of an annuity has not been compulsory for some time, the complexities and cost of the alternative was in practice leading to compul ...

MNL RetireVantage® 10

... The MNL RetireVantage flexible premium fixed index annuity is not an investment in the stock market or in the applicable indices. Rather it is a fixed annuity that allows you to benefit from the advantages that a fixed annuity offers such as: tax-deferral, the potential to avoid probate, potential l ...

... The MNL RetireVantage flexible premium fixed index annuity is not an investment in the stock market or in the applicable indices. Rather it is a fixed annuity that allows you to benefit from the advantages that a fixed annuity offers such as: tax-deferral, the potential to avoid probate, potential l ...

MNL Endeavor® 12 Plus

... performance of the index itself, but rather the index closes (monthly, annually, etc.) are used as a basis for determining what the Interest Credits will be. The MNL Endeavor is unique in that it offers an additional option for growth if index performance remains level or decreases. Change happens o ...

... performance of the index itself, but rather the index closes (monthly, annually, etc.) are used as a basis for determining what the Interest Credits will be. The MNL Endeavor is unique in that it offers an additional option for growth if index performance remains level or decreases. Change happens o ...

Frequently asked questions about TIAA Traditional Annuity

... You put money in while you work. Your savings earns a minimum rate of interest with the potential for additional amounts of interest above the minimum that may be declared periodically by TIAA’s Board of Trustees.1 The total interest crediting rates (minimum guaranteed rate plus any additional amoun ...

... You put money in while you work. Your savings earns a minimum rate of interest with the potential for additional amounts of interest above the minimum that may be declared periodically by TIAA’s Board of Trustees.1 The total interest crediting rates (minimum guaranteed rate plus any additional amoun ...

Living Annuity 3.4MB

... The 10X Top 60 SA Share Index and 10X SA Property Index (the “Indices”) is the property of 10X Investments (Pty) Ltd, which has contracted with S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC) to calculate and maintain the Index. The Indices are not sponsored by S&P Dow Jones Indices or its ...

... The 10X Top 60 SA Share Index and 10X SA Property Index (the “Indices”) is the property of 10X Investments (Pty) Ltd, which has contracted with S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC) to calculate and maintain the Index. The Indices are not sponsored by S&P Dow Jones Indices or its ...

Important Information About Revenue Sharing Agreements

... In the case of variable annuities and fixed-index annuities issued by unaffiliated insurance companies, marketing support payments based on sales can range from 10 basis points (0.10%) to 100 basis points (1.00%) of your total purchase amount. If, for example, you invested $10,000 in an annuity cont ...

... In the case of variable annuities and fixed-index annuities issued by unaffiliated insurance companies, marketing support payments based on sales can range from 10 basis points (0.10%) to 100 basis points (1.00%) of your total purchase amount. If, for example, you invested $10,000 in an annuity cont ...

PRUDENTIAL ANNUITIES LIFE ASSURANCE CORP/CT (Form

... ****Estimated in part. The Investment Managers have voluntarily agreed to waive a portion of their investment management fees and/or reimburse certain expenses for the AST Bond Portfolio 2016 and the AST Bond Portfolio 2020 so that the Portfolio's investment management fees plus other expenses (excl ...

... ****Estimated in part. The Investment Managers have voluntarily agreed to waive a portion of their investment management fees and/or reimburse certain expenses for the AST Bond Portfolio 2016 and the AST Bond Portfolio 2020 so that the Portfolio's investment management fees plus other expenses (excl ...

IOPS COUNTRY PROFILE: CROATIA

... There are therefore both open and closed funds. The state provides an annual subsidy of up to HRK 1,250 and allows a deduction of up to HRK 1,050 per month from personal taxable income. This means that there is a double benefit – state subsidy and tax deduction – for these contributions. Contributio ...

... There are therefore both open and closed funds. The state provides an annual subsidy of up to HRK 1,250 and allows a deduction of up to HRK 1,050 per month from personal taxable income. This means that there is a double benefit – state subsidy and tax deduction – for these contributions. Contributio ...

Careers in Mathematics Actuaries` Careers

... • Valuation Actuaries: Insurance companies put aside what they need to pay future claims and expenses. • Pricing Actuaries: Pricing actuaries are responsible for determining how much money a company is likely to make on a product. A product can be life insurance, an annuity, and so forth. ...

... • Valuation Actuaries: Insurance companies put aside what they need to pay future claims and expenses. • Pricing Actuaries: Pricing actuaries are responsible for determining how much money a company is likely to make on a product. A product can be life insurance, an annuity, and so forth. ...

Sample Glossary of Investment-Related Terms for

... Benchmark: An unmanaged group of securities whose performance is used as a standard to measure investment performance. Some well-known benchmarks are the Dow Jones Industrial Average and the S&P 500 Index. Bond: A debt security which represents the borrowing of money by a corporation, government, or ...

... Benchmark: An unmanaged group of securities whose performance is used as a standard to measure investment performance. Some well-known benchmarks are the Dow Jones Industrial Average and the S&P 500 Index. Bond: A debt security which represents the borrowing of money by a corporation, government, or ...

Developing Annuities Markets The Experience of Chile

... This study of the Chilean annuities market consists of seven chapters, two technical annexes, and one statistical annex. It is part of a broader project on annuities coordinated by the Operations Policy Department (OPD) of the World Bank and designed to identify best regulatory practices and institu ...

... This study of the Chilean annuities market consists of seven chapters, two technical annexes, and one statistical annex. It is part of a broader project on annuities coordinated by the Operations Policy Department (OPD) of the World Bank and designed to identify best regulatory practices and institu ...

DOL Fiduciary Rule Q and A - Nevada Independent Insurance

... doing so due to the new compliance requirements, or may establish or increase minimum account balances for clients. Firms may also respond by shifting business into fee-based accounts. Advisory accounts, which typically charge investors a flat fee of assets under management, are not appropriate for ...

... doing so due to the new compliance requirements, or may establish or increase minimum account balances for clients. Firms may also respond by shifting business into fee-based accounts. Advisory accounts, which typically charge investors a flat fee of assets under management, are not appropriate for ...

Nationwide Benefit Options

... exhausted. You may elect to apply the Cost of Living Adjustment (COLA) to your payment amount. COLA rates are declared annually by the federal government and the rate applied to your payment will also update annually. COLA can be 0% for a given year and would not impact your payment amount in this i ...

... exhausted. You may elect to apply the Cost of Living Adjustment (COLA) to your payment amount. COLA rates are declared annually by the federal government and the rate applied to your payment will also update annually. COLA can be 0% for a given year and would not impact your payment amount in this i ...

International Competitor Analysis and Benchmarking

... money for consumers. This is in the context of trends which have significantly increased the cost of annuities. Given growth in the number of defined contribution pension scheme members, this is an increasingly important issue for policy-makers. What is an Annuity? An annuity is a contract between a ...

... money for consumers. This is in the context of trends which have significantly increased the cost of annuities. Given growth in the number of defined contribution pension scheme members, this is an increasingly important issue for policy-makers. What is an Annuity? An annuity is a contract between a ...

LIFE OFFICE PRACTICE DEFINITIONS

... is a fixed amount. The frequency of the payment may be monthly, quarterly, half-yearly or yearly. CPA :- see Compulsory purchase annuity Credibility :- a statistical measure of the weight to be given to a statistic. This often refers to the claims experience for a particular risk (or class) as compa ...

... is a fixed amount. The frequency of the payment may be monthly, quarterly, half-yearly or yearly. CPA :- see Compulsory purchase annuity Credibility :- a statistical measure of the weight to be given to a statistic. This often refers to the claims experience for a particular risk (or class) as compa ...

Challenger - Submission to the Financial System Inquiry. Issues set

... Would deferred lifetime annuities or group self-annuitisation be useful products for Australian retirees? Are there examples of other potentially suitable products? ...

... Would deferred lifetime annuities or group self-annuitisation be useful products for Australian retirees? Are there examples of other potentially suitable products? ...

The Best Solution for Protecting Retirement Portfolios: Put and Call

... The covered call strategy, which generates income by selling annual calls, does better than the put option strategy, both in terms of the average bequest and the loss metric. The costless collar does the best on the loss metric, but with a significant decrease in average bequest. At a given bequest ...

... The covered call strategy, which generates income by selling annual calls, does better than the put option strategy, both in terms of the average bequest and the loss metric. The costless collar does the best on the loss metric, but with a significant decrease in average bequest. At a given bequest ...

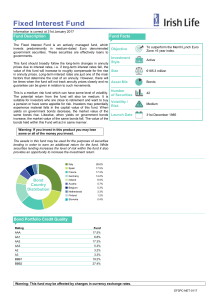

Fixed Interest Fund - Irish Life Corporate Business

... prices due to interest rates, i.e. if long-term interest rates fall, the value of this fund will increase to roughly compensate for the rise Size in annuity prices. Long-term interest rates are just one of the main factors that determine the cost of an annuity. However, there will be times when the ...

... prices due to interest rates, i.e. if long-term interest rates fall, the value of this fund will increase to roughly compensate for the rise Size in annuity prices. Long-term interest rates are just one of the main factors that determine the cost of an annuity. However, there will be times when the ...

879_Paula Lopez Paper

... and Assets” module. After collecting information about the amounts of state pensions and private pensions from personal or employer pension schemes a household received during the year before the interview, the survey proceeds requesting information about the amount of received annuity income. The q ...

... and Assets” module. After collecting information about the amounts of state pensions and private pensions from personal or employer pension schemes a household received during the year before the interview, the survey proceeds requesting information about the amount of received annuity income. The q ...

Capacity for loss and appetite for risk: drawdown`s

... When asked how much risk they want to take with their pension funds, many people might say “none at all” or “as little as possible”. However, the truth of the matter might be different: once they’ve agreed their financial objectives – for example, keeping hold of their assets to pass on to their fam ...

... When asked how much risk they want to take with their pension funds, many people might say “none at all” or “as little as possible”. However, the truth of the matter might be different: once they’ve agreed their financial objectives – for example, keeping hold of their assets to pass on to their fam ...

How Deep is the Annuity Market Participation Puzzle

... Why are annuities not voluntarily taken up by a larger number of retirees? In the individual consumption/savings-portfolio choice literature, a very important participation puzzle arises from the revealed preference of households not to voluntarily buy annuities at retirement, despite the strong the ...

... Why are annuities not voluntarily taken up by a larger number of retirees? In the individual consumption/savings-portfolio choice literature, a very important participation puzzle arises from the revealed preference of households not to voluntarily buy annuities at retirement, despite the strong the ...

Forms of Benefit Payment at Retirement

... The growing importance of occupational defined contribution (DC) pension plans and personal retirement savings has caused increased attention to be focused on the forms of payment that should be allowed and/or encouraged under such plans at retirement. Many of the newly created defined contribution ...

... The growing importance of occupational defined contribution (DC) pension plans and personal retirement savings has caused increased attention to be focused on the forms of payment that should be allowed and/or encouraged under such plans at retirement. Many of the newly created defined contribution ...

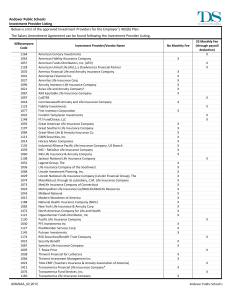

SALARY REDUCTION AGREEMENT (SRA) 403(b)

... the annuity and/or custodial account; it’s terms; the selection of Investment Provider; the solvency of, operation of, or benefits provided by said Investment Provider; or his/her selection and purchase of annuity contracts and/or shares of regulated investments from an Investment Provider. It is un ...

... the annuity and/or custodial account; it’s terms; the selection of Investment Provider; the solvency of, operation of, or benefits provided by said Investment Provider; or his/her selection and purchase of annuity contracts and/or shares of regulated investments from an Investment Provider. It is un ...

The Only Spending Rule Article You Will Ever Need

... assets. These reasons alone have likely kept investors from taking advantage of the annuity concept (nor do they often set up a literal consumption hedge, a closely related strategy). So, in light of the fact that most people are going to hold mixed portfolios earning volatile returns, how can we th ...

... assets. These reasons alone have likely kept investors from taking advantage of the annuity concept (nor do they often set up a literal consumption hedge, a closely related strategy). So, in light of the fact that most people are going to hold mixed portfolios earning volatile returns, how can we th ...