Public Sector Accounting

... Bolivia, Brazil, Columbia, El Salvador, Paraguay and Peru. Uruguay has a mixed system. Three others have accrual information only for public corporations: Chile, Ecuador and Honduras. Three others are considering accrual accounting: Dominican Republic, Mexico and Venezuela. Australia and New Zealand ...

... Bolivia, Brazil, Columbia, El Salvador, Paraguay and Peru. Uruguay has a mixed system. Three others have accrual information only for public corporations: Chile, Ecuador and Honduras. Three others are considering accrual accounting: Dominican Republic, Mexico and Venezuela. Australia and New Zealand ...

Submission to Joint Committee on Jobs, Enterprise and Innovation

... It is recognized that the large size of public contracts is often a disincentive for SME participation in the procurement process. Four mechanisms have been set out that could be considered by large contracting authorities in order to encourage SME participation regardless of the large size of the c ...

... It is recognized that the large size of public contracts is often a disincentive for SME participation in the procurement process. Four mechanisms have been set out that could be considered by large contracting authorities in order to encourage SME participation regardless of the large size of the c ...

A Review of Success Factors and Challenges of Public Sector BPR

... first step to investigating the differences between public and private organizations, we analyzed the existent literature of BPR success factors. We focused on literature pertaining to business processes, business process change methods (in particular BPR) and the differentiation between the public ...

... first step to investigating the differences between public and private organizations, we analyzed the existent literature of BPR success factors. We focused on literature pertaining to business processes, business process change methods (in particular BPR) and the differentiation between the public ...

IOSR Journal Of Humanities And Social Science (IOSR-JHSS)

... approach was in line with that described in A Modern Regional Policy for the United Kingdom (HM Treasury, 2003)1.Since there is a disparity in progress among different regions, there are a number of different ways in which regional development problems can be conceptualized but in its National Strat ...

... approach was in line with that described in A Modern Regional Policy for the United Kingdom (HM Treasury, 2003)1.Since there is a disparity in progress among different regions, there are a number of different ways in which regional development problems can be conceptualized but in its National Strat ...

Public and Private Production in a Two-Sector Economy

... Futagami, Murata, and Shibata (1993), Fisher and Turnovsky (1998), Turnovsky (2003). This implicitly assumes that all production occurs in the private sector. The government then enters the private market and makes its purchases, in competition with private agents, using the resources it generates f ...

... Futagami, Murata, and Shibata (1993), Fisher and Turnovsky (1998), Turnovsky (2003). This implicitly assumes that all production occurs in the private sector. The government then enters the private market and makes its purchases, in competition with private agents, using the resources it generates f ...

Text consolidated by Valsts valodas centrs (State Language Centre

... improving its activity with similar methods as a private partner shall be evaluated, and the assumptions based on the referred to principle shall be utilised in the comparative analysis of the alternative finances for implementing the project. [22 March 2011] 8. The comparison of the alternative fin ...

... improving its activity with similar methods as a private partner shall be evaluated, and the assumptions based on the referred to principle shall be utilised in the comparative analysis of the alternative finances for implementing the project. [22 March 2011] 8. The comparison of the alternative fin ...

del11 Philippopoulos 16784773 en

... are aware that actually some public services have been contracted out to private suppliers already. At the other end, in the reformed economy, we assume that there are private providers only with the government financing their costs. But we are aware that some public production is always desirable ( ...

... are aware that actually some public services have been contracted out to private suppliers already. At the other end, in the reformed economy, we assume that there are private providers only with the government financing their costs. But we are aware that some public production is always desirable ( ...

The effects of fiscal policy on economic activity in Finland

... The motivation behind this research is to find out whether fiscal policy decisions have real effects on the economy of Finland, and if they do, what are the strength and durations of the effects. In economics there is an ongoing debate whether government can actually influence real economic performa ...

... The motivation behind this research is to find out whether fiscal policy decisions have real effects on the economy of Finland, and if they do, what are the strength and durations of the effects. In economics there is an ongoing debate whether government can actually influence real economic performa ...

IOSR Journal of Business and Management (IOSR-JBM)

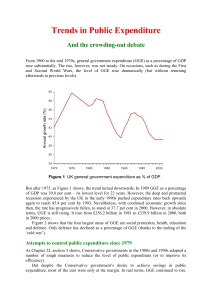

... public sector deficits affect private sector through two main channels. First, high public deficit financed by domestic sources can crowd-out the private sector because it will raise real interest rate for the private sector. Second, direct credit control that allocates more money to the government ...

... public sector deficits affect private sector through two main channels. First, high public deficit financed by domestic sources can crowd-out the private sector because it will raise real interest rate for the private sector. Second, direct credit control that allocates more money to the government ...

Leveraged Funds: Section three (opens in new window)

... Governments also need to reinforce the wider climate change policy framework, and find ways to leverage private finance in the short-term. In this respect, the immediate challenge for Governments is to raise private finance at a sufficient scale, using public funds as efficiently as possible. There ...

... Governments also need to reinforce the wider climate change policy framework, and find ways to leverage private finance in the short-term. In this respect, the immediate challenge for Governments is to raise private finance at a sufficient scale, using public funds as efficiently as possible. There ...

Download (PDF)

... sectors), allows a rise in the net income and consumption levels of capitalists and private workers without hurting the net income and consumption level of public employees relative to the status quo. The latter get, of course, worse off in terms of utility but this happens simply because they have ...

... sectors), allows a rise in the net income and consumption levels of capitalists and private workers without hurting the net income and consumption level of public employees relative to the status quo. The latter get, of course, worse off in terms of utility but this happens simply because they have ...

Introduction - World Bank Group

... The biggest problem facing selection of items for pricing is the conflict between comparability and representativeness. Items that are representative in a country may not be comparable, and comparable items may not be representative. If items are not comparable, comparisons cannot be made; if they a ...

... The biggest problem facing selection of items for pricing is the conflict between comparability and representativeness. Items that are representative in a country may not be comparable, and comparable items may not be representative. If items are not comparable, comparisons cannot be made; if they a ...

Introduction - World Bank Group

... frame that yields observations for volume seller items at the most frequented outlets. In practice, surveys are generally conducted over a few months in the year and in urban centers, usually the capital city. Two types of adjustments are made to observed data: -time-to-time and place-to-place -- to ...

... frame that yields observations for volume seller items at the most frequented outlets. In practice, surveys are generally conducted over a few months in the year and in urban centers, usually the capital city. Two types of adjustments are made to observed data: -time-to-time and place-to-place -- to ...

Cons - Climate Change Finance and Development Effectiveness

... helping 2 m urban poor by improving integrating cc into city planning processes, investing in practical measures and in mobilising domestic/international finance for resilient infrastructure projects in 25 cities in 6 countries in Asia. Blending issues – Capacity and governance of municipalities, ho ...

... helping 2 m urban poor by improving integrating cc into city planning processes, investing in practical measures and in mobilising domestic/international finance for resilient infrastructure projects in 25 cities in 6 countries in Asia. Blending issues – Capacity and governance of municipalities, ho ...

The Interdependence of Markets

... If increased government expenditure is used to stimulate output and employment, will the effect be neutralised by crowding out? Will, for example, a programme of public works to bring the economy out of recession merely lead to a reduction in private expenditure? To answer this, it is important to d ...

... If increased government expenditure is used to stimulate output and employment, will the effect be neutralised by crowding out? Will, for example, a programme of public works to bring the economy out of recession merely lead to a reduction in private expenditure? To answer this, it is important to d ...

Commissioners performs mixed functions and play interrelated roles

... themselves to be “public” in some circumstances but “private” in others”(Alasdair Roberts, ,”Structural pluralism and the right of information”, University of Toronto Law Jornal,vol.1,nº3,2003.). Legislative reactions to this new structural pluralism are not homogeneus . What about government –owned ...

... themselves to be “public” in some circumstances but “private” in others”(Alasdair Roberts, ,”Structural pluralism and the right of information”, University of Toronto Law Jornal,vol.1,nº3,2003.). Legislative reactions to this new structural pluralism are not homogeneus . What about government –owned ...

Kibira Denis - Stop Stock

... duration of stock-outs in these facilities in 2007-8 averaged 2.5months per year Medicines are free in the public sector; in the private sector they cost 3-5 times more than international reference prices ...

... duration of stock-outs in these facilities in 2007-8 averaged 2.5months per year Medicines are free in the public sector; in the private sector they cost 3-5 times more than international reference prices ...

Read a transcript of Marie`s contribution here

... television corporations chomping at the bit, and to those semi states that actually do generate substantial profits, the charge is made that revenues are inflated by the regulatory system and that these in turn have cross subsidised international activity. In fact, because of Government policy to op ...

... television corporations chomping at the bit, and to those semi states that actually do generate substantial profits, the charge is made that revenues are inflated by the regulatory system and that these in turn have cross subsidised international activity. In fact, because of Government policy to op ...

financing of the local government capital investments

... as possible, not only to build new infrastructure but to refurbish existing infrastructure. Borrowing for capital expenditure can make this possible. Borrowing can provide large capital sums for immediate use, and the resulting longer term debt can be serviced from a regular stream of local governme ...

... as possible, not only to build new infrastructure but to refurbish existing infrastructure. Borrowing for capital expenditure can make this possible. Borrowing can provide large capital sums for immediate use, and the resulting longer term debt can be serviced from a regular stream of local governme ...

IGCSE nationalised industries and privatisation

... Within a mixed economy: private and public ownership exists. ...

... Within a mixed economy: private and public ownership exists. ...

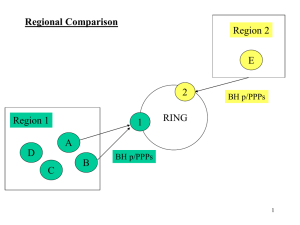

Regional Comparison

... Shoes+Fruit Region 1 country A country B country C country D Region 2 country E ...

... Shoes+Fruit Region 1 country A country B country C country D Region 2 country E ...

The 2002/03 Budget

... Can Business Provide Public Goods? • Imagine a private business that tried to provide national defence, roads, street lights, knowledge • Provision of the “right amount” of public goods harder than private goods ...

... Can Business Provide Public Goods? • Imagine a private business that tried to provide national defence, roads, street lights, knowledge • Provision of the “right amount” of public goods harder than private goods ...

Commercialization and Competitive Outsourcing

... shared with other customers. The commercialization of the polar network of earth stations is an example. In this cases, the government still retains the responsibility for the function of providing services to its customers but does so by employing firms in the private sector that are willing to red ...

... shared with other customers. The commercialization of the polar network of earth stations is an example. In this cases, the government still retains the responsibility for the function of providing services to its customers but does so by employing firms in the private sector that are willing to red ...