Annual Report - Central Bank of Ireland

... During 2001, the Central Bank of Ireland continued to be involved in economic policy and financial activities pertaining to its core objectives. These objectives include contributing to the formulation and implementation of monetary policy as well as economic policy generally in order to ensure stab ...

... During 2001, the Central Bank of Ireland continued to be involved in economic policy and financial activities pertaining to its core objectives. These objectives include contributing to the formulation and implementation of monetary policy as well as economic policy generally in order to ensure stab ...

Asset Quality Review results

... The post-JU impact of the Stress Test is 0.2% in the baseline and -3.0% in the adverse Stress test results (post-JU) ...

... The post-JU impact of the Stress Test is 0.2% in the baseline and -3.0% in the adverse Stress test results (post-JU) ...

What Makes a Good ʽBad Bankʼ? The Irish, Spanish and German

... fiscal accounting principles. Since the creation of the AMCs provided impaired asset relief by the state to the affected banks, their establishment also had to be approved under the European Commission’s State-aid rules. These rules were critical for the valuation of the assets transferred to the AM ...

... fiscal accounting principles. Since the creation of the AMCs provided impaired asset relief by the state to the affected banks, their establishment also had to be approved under the European Commission’s State-aid rules. These rules were critical for the valuation of the assets transferred to the AM ...

Migrants and the Irish Economy

... the economy, and to push the potential growth rate higher. For many years immigration was seen as a major opportunity for the economy. But since the recession some commentators have emphasised a cost citing the increasing number of immigrant jobseekers. To date, there is little evidence to show that ...

... the economy, and to push the potential growth rate higher. For many years immigration was seen as a major opportunity for the economy. But since the recession some commentators have emphasised a cost citing the increasing number of immigrant jobseekers. To date, there is little evidence to show that ...

June 2010 - Bank of Ireland

... dividends, the outcome of the current review of the Group’s defined benefit pension schemes, estimates of capital expenditure, discussions with the Irish, European and other regulators and plans and objectives for future operations. Forward looking statements should not be read as a guarantee of fut ...

... dividends, the outcome of the current review of the Group’s defined benefit pension schemes, estimates of capital expenditure, discussions with the Irish, European and other regulators and plans and objectives for future operations. Forward looking statements should not be read as a guarantee of fut ...

Preliminary Debt Investor Presentation

... dividends, the outcome of the current review of the Group’s defined benefit pension schemes, estimates of capital expenditure, discussions with the Irish, European and other regulators and plans and objectives for future operations. Forward looking statements should not be read as a guarantee of fut ...

... dividends, the outcome of the current review of the Group’s defined benefit pension schemes, estimates of capital expenditure, discussions with the Irish, European and other regulators and plans and objectives for future operations. Forward looking statements should not be read as a guarantee of fut ...

Lessons from Its Recovery from the Bank-Sovereign Loop

... insolvency, while, at the same time, both the central bank and the banks worked through changes in their internal structures and staffing. Such changes included the banks establishing collection systems, which had not been needed before the crisis. In practice, not everything can be done at once, so ...

... insolvency, while, at the same time, both the central bank and the banks worked through changes in their internal structures and staffing. Such changes included the banks establishing collection systems, which had not been needed before the crisis. In practice, not everything can be done at once, so ...

197 KB - Danske Bank

... Please go to slide 3 4 Year Plan to tackle Government Finances From last August onwards, there was a surge in the cost of Irish sovereign borrowing, which was largely driven by fears over the scale of losses in the banking sector. While the state had funding until well into 2011, its hand was forced ...

... Please go to slide 3 4 Year Plan to tackle Government Finances From last August onwards, there was a surge in the cost of Irish sovereign borrowing, which was largely driven by fears over the scale of losses in the banking sector. While the state had funding until well into 2011, its hand was forced ...

PDF Download

... delivered what it said on the tin. It provided a safe harbour from which Ireland was able to clarify its ability and determination to deal with the financial problems that had emerged as the property bubble of the first decade of the 21st century burst against the background of recession and financi ...

... delivered what it said on the tin. It provided a safe harbour from which Ireland was able to clarify its ability and determination to deal with the financial problems that had emerged as the property bubble of the first decade of the 21st century burst against the background of recession and financi ...

PDF Download

... The increase in concentration experienced in the Irish banking system in the 2000s took place against a backdrop of a rapidly expanding economy. Seminal research (Greenwood and Jovanovic 1990, Kuznets 1955, Townsend 1973) concludes that intensive economic growth should stimulate further competition ...

... The increase in concentration experienced in the Irish banking system in the 2000s took place against a backdrop of a rapidly expanding economy. Seminal research (Greenwood and Jovanovic 1990, Kuznets 1955, Townsend 1973) concludes that intensive economic growth should stimulate further competition ...

Outlook

... Seven years after the beginning of the financial crisis, Q4/14 should mark a significant juncture in the global economic recovery. In the coming weeks we expect the US Federal Reserve to complete the final reduction of its asset purchase programme. This will conclude the third in a series of similar ...

... Seven years after the beginning of the financial crisis, Q4/14 should mark a significant juncture in the global economic recovery. In the coming weeks we expect the US Federal Reserve to complete the final reduction of its asset purchase programme. This will conclude the third in a series of similar ...

s - Research Portal

... capital value of bank Promissory Notes which drove the deficit in 2010 to 32% of GDP). The debt-to-GDP ratio is estimated to fall to 97% of GDP this year, reflecting a 23 percentage point improvement compared to the 2012 peak, and compares with a forecast made a year ago for a debt ratio of 108.5%. ...

... capital value of bank Promissory Notes which drove the deficit in 2010 to 32% of GDP). The debt-to-GDP ratio is estimated to fall to 97% of GDP this year, reflecting a 23 percentage point improvement compared to the 2012 peak, and compares with a forecast made a year ago for a debt ratio of 108.5%. ...

Krajowe Stowarzyszenie Funduszy Poręczeniowych

... Commission Notice on the application of art. 87 and 88 EC Treaty to State aid in the form of guarantees (OJ. C 155/02 of 06.20.2008 issued) and the European Commission Communication on the revision of the method for setting reference and discount rates (OJ. C 14 of 19.1. 2008). 4) Surety shall not b ...

... Commission Notice on the application of art. 87 and 88 EC Treaty to State aid in the form of guarantees (OJ. C 155/02 of 06.20.2008 issued) and the European Commission Communication on the revision of the method for setting reference and discount rates (OJ. C 14 of 19.1. 2008). 4) Surety shall not b ...

Document

... sector and the amounts governments committed in order to save their banks by July 2009, although governments tend to intervene when their sector is hit.5 Other indicators, such as the relative performance of share indices of banks in the fourth quarter of 2008 (Weber and Schmitz 2011), confirm that ...

... sector and the amounts governments committed in order to save their banks by July 2009, although governments tend to intervene when their sector is hit.5 Other indicators, such as the relative performance of share indices of banks in the fourth quarter of 2008 (Weber and Schmitz 2011), confirm that ...

Saving the Banks: The Political Economy of Bailouts

... those sectors may successfully water down strict conditions attached to bailout. Therefore, an alternative measure of the influence of one particular group over policy design is proposed by Bø Rothstein (2011): quality of government. Trying to measure the impartiality of public policy production by ...

... those sectors may successfully water down strict conditions attached to bailout. Therefore, an alternative measure of the influence of one particular group over policy design is proposed by Bø Rothstein (2011): quality of government. Trying to measure the impartiality of public policy production by ...

Saving the Banks: The Political Economy of Bailouts

... but those were not necessarily taken up. The United Kingdom or the Netherlands, for example, committed between 40% and 50% of their GDP, but only spent around 25%. Denmark is particularly striking, since it committed 259% of its GDP, but actually only spent 0,5% in the first year of the crisis.6 Mor ...

... but those were not necessarily taken up. The United Kingdom or the Netherlands, for example, committed between 40% and 50% of their GDP, but only spent around 25%. Denmark is particularly striking, since it committed 259% of its GDP, but actually only spent 0,5% in the first year of the crisis.6 Mor ...

- Maynooth University ePrints and eTheses Archive

... and aggressively courting foreign direct investment (FDI) in the form of (primarily) US multinationals (O’Hearn, 1998; O’Riain, 2004). In 1985, Ireland had the third worst level of poverty in the EU. In 1994–2004, the average income in Ireland reached one of the highest of any developed nation, whil ...

... and aggressively courting foreign direct investment (FDI) in the form of (primarily) US multinationals (O’Hearn, 1998; O’Riain, 2004). In 1985, Ireland had the third worst level of poverty in the EU. In 1994–2004, the average income in Ireland reached one of the highest of any developed nation, whil ...

Proposal for a Directive on insurance mediation

... An Intermediary should prepare a statement of the reasons why a product is considered suitable for the client and why a transaction is considered to be in the best interests of the client. A copy of this statement should be given to the client and the firm should retain a copy. The Intermediary shou ...

... An Intermediary should prepare a statement of the reasons why a product is considered suitable for the client and why a transaction is considered to be in the best interests of the client. A copy of this statement should be given to the client and the firm should retain a copy. The Intermediary shou ...

Research Bulletin 2014 - Central Bank of Ireland

... Leverage can be defined as the ratio of a bank’s total assets to its equity capital. A number of papers in recent years have presented two related features of leverage: leverage growth and asset growth move in the same direction; and consequently changes in leverage tend to move in the same directio ...

... Leverage can be defined as the ratio of a bank’s total assets to its equity capital. A number of papers in recent years have presented two related features of leverage: leverage growth and asset growth move in the same direction; and consequently changes in leverage tend to move in the same directio ...

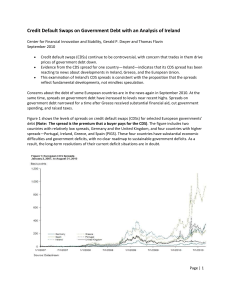

Credit Default Swaps on Government Debt with an Analysis of Ireland

... 78 basis points. This fall occurred on the Monday after the weekend when the European Union's finance ministers agreed to assist Greece if requested to do so. As would be expected, the effect on Greece's CDS spread was bigger; it decreased by 362 basis points—from 939 basis points to 577 basis point ...

... 78 basis points. This fall occurred on the Monday after the weekend when the European Union's finance ministers agreed to assist Greece if requested to do so. As would be expected, the effect on Greece's CDS spread was bigger; it decreased by 362 basis points—from 939 basis points to 577 basis point ...

Securitisation in Ireland

... Securitisation activity accelerated despite freezing of market post-crisis “Internal securitisations” used to create eligible assets for refinancing operations ...

... Securitisation activity accelerated despite freezing of market post-crisis “Internal securitisations” used to create eligible assets for refinancing operations ...

Newsletter - House of Scotland

... If Mr Brown had done a better job of looking after the country's finances while he was chancellor, the fiscal outlook now would be less dire. But he allowed deficits to persist even in years when the economy was growing strongly, as in 2006-07. As a result, forecasters are now sharpening their red p ...

... If Mr Brown had done a better job of looking after the country's finances while he was chancellor, the fiscal outlook now would be less dire. But he allowed deficits to persist even in years when the economy was growing strongly, as in 2006-07. As a result, forecasters are now sharpening their red p ...

Irish Economic Transformation

... Europe accounting for 10% of workforce However, current crisis has seen the return of unemployment now at 14% and the re-emergence of emigration ...

... Europe accounting for 10% of workforce However, current crisis has seen the return of unemployment now at 14% and the re-emergence of emigration ...

Fergal McCann SMEs in Ireland

... Countries in Europe with weaker demand or higher leverage have higher probability that SMEs are rejected for credit. ...

... Countries in Europe with weaker demand or higher leverage have higher probability that SMEs are rejected for credit. ...

simone doran irish institute

... Economy slowing down but still strong • GNP Growth forecasts range between 1.6% and 2.8% • Debt/GNP ratio end 2007 was 26% • Unemployment 4.5% (participation rate 69% - target 70%) ...

... Economy slowing down but still strong • GNP Growth forecasts range between 1.6% and 2.8% • Debt/GNP ratio end 2007 was 26% • Unemployment 4.5% (participation rate 69% - target 70%) ...

Post-2008 Irish economic downturn

The post-2008 Irish economic downturn, coincided with a series of banking scandals, followed the 1990s and 2000s Celtic Tiger period of rapid real economic growth fuelled by foreign direct investment, a subsequent property bubble which rendered the real economy uncompetitive, and an expansion in bank lending in the early 2000s. An initial slowdown in economic growth amid the international financial crisis of 2007–08 greatly intensified in late 2008 and the country fell into recession for the first time since the 1980s. Emigration, as did unemployment (particularly in the construction sector), escalated to levels not seen since that decade.The Irish Stock Exchange (ISEQ) general index, which reached a peak of 10,000 points briefly in April 2007, fell to 1,987 points—a 14-year low—on 24 February 2009 (the last time it was under 2,000 being mid-1995). In September 2008, the Irish government—a Fianna Fáil-Green coalition—officially acknowledged the country's descent into recession; a massive jump in unemployment occurred in the following months. Ireland was the first state in the eurozone to enter recession, as declared by the Central Statistics Office (CSO). By January 2009, the number of people living on unemployment benefits had risen to 326,000—the highest monthly level since records began in 1967—and the unemployment rate rose from 6.5% in July 2008 to 14.8% in July 2012. The slumping economy drew 100,000 demonstrators onto the streets of Dublin on 21 February 2009, amid further talk of protests and industrial action.With the banks ""guaranteed"", and the National Asset Management Agency (NAMA) established on the evening of 21 November 2010, then Taoiseach Brian Cowen confirmed on live television that the EU/ECB/IMF troika would be involving itself in Ireland's financial affairs. Support for the Fianna Fáil party, dominant for much of the previous century, then crumbled; in an unprecedented event in the nation's history, it fell to third place in an opinion poll conducted by The Irish Times—placing behind Fine Gael and the Labour Party, the latter rising above Fianna Fáil for the first time. On 22 November, the Greens called for an election the following year. The 2011 general election replaced the ruling coalition with another one, between Fine Gael and Labour. This coalition continues with the same austerity policies of the previous coalition, as the country's larger parties all favour a similar agenda.Official statistics showed a drop in most crimes coinciding with the economic downturn. Burglaries, however, rose by approximately 10% and recorded prostitution offences more than doubled from 2009 to 2010. In late 2014 the unemployment rate was 11.0% on the seasonally adjusted measure, still over double the lows of the mid-2000s but down from a peak of 15.1% in early 2012.