Islamic Insurance takaful

... cooperation, mutuality and shared responsibility among participants who have agreed to share defined losses to be paid out of defined assets. Takaful is Islamic insurance based on the principle of mutual assistance and protection of assets and property. It implies an agreement among a group of mem ...

... cooperation, mutuality and shared responsibility among participants who have agreed to share defined losses to be paid out of defined assets. Takaful is Islamic insurance based on the principle of mutual assistance and protection of assets and property. It implies an agreement among a group of mem ...

City Deposits and Investments

... Different funds would not be eligible for separate FDIC insurance coverage simply because the funds are kept in separate accounts. Thus, if a city has a special account for its municipal liquor store, an account for the police department, and an account for the general fund, these accounts would be ...

... Different funds would not be eligible for separate FDIC insurance coverage simply because the funds are kept in separate accounts. Thus, if a city has a special account for its municipal liquor store, an account for the police department, and an account for the general fund, these accounts would be ...

Please consider the charges, risks, expenses

... Investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund. Please consider the charges, r ...

... Investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund. Please consider the charges, r ...

Certificates of Deposit - Federal Reserve Bank of New York

... guided both by interest rate considerations and by bank- originally issued and in the rates at which they trade customer relationships. Many corporations prefer to place in the secondary market. Smaller commercial banks are funds only with banks at which they maintain working obligcd to offer certif ...

... guided both by interest rate considerations and by bank- originally issued and in the rates at which they trade customer relationships. Many corporations prefer to place in the secondary market. Smaller commercial banks are funds only with banks at which they maintain working obligcd to offer certif ...

Full PDF - International Journal of Management Science

... financial statements of insurance companies, In Nigeria the national insurance Commission (NAICOM) (2013) has carried out a detailed review of the subject and the findings show that, Insurance companies have continued to report huge amounts of outstanding premium while at the same time making large ...

... financial statements of insurance companies, In Nigeria the national insurance Commission (NAICOM) (2013) has carried out a detailed review of the subject and the findings show that, Insurance companies have continued to report huge amounts of outstanding premium while at the same time making large ...

Life Insurance in a Goals-Based Framework

... insolvent. As policies are subject to the claims-paying abilities of their issuers, there’s some risk claims may not be paid. The exposure of life insurance to credit risk can, however, be mitigated through diversification of coverage across different insurance companies. This is effectively the sam ...

... insolvent. As policies are subject to the claims-paying abilities of their issuers, there’s some risk claims may not be paid. The exposure of life insurance to credit risk can, however, be mitigated through diversification of coverage across different insurance companies. This is effectively the sam ...

draft - American Bar Association

... instruction directing the Bank to continue, at the end of each investment period of the Sweep Investment, to re-deposit in the Deposit Account funds that were withdrawn by the Bank from the Deposit Account and invested in the Sweep Investment, less any loss of funds suffered by the investment and th ...

... instruction directing the Bank to continue, at the end of each investment period of the Sweep Investment, to re-deposit in the Deposit Account funds that were withdrawn by the Bank from the Deposit Account and invested in the Sweep Investment, less any loss of funds suffered by the investment and th ...

INSURANCE CODE TITLE 4. REGULATION OF SOLVENCY

... class of the same issuer may be merged and held in bulk, in the name of a nominee of the clearing corporation, with any other securities deposited with the clearing corporation by any person, regardless of the ownership of the securities. ...

... class of the same issuer may be merged and held in bulk, in the name of a nominee of the clearing corporation, with any other securities deposited with the clearing corporation by any person, regardless of the ownership of the securities. ...

THE EFFECT OF INSURANCE PORTFOLIO INVESTMENT ON

... serves as profit to the organization Omoke (2011) In Nigeria, we have two types of insurance business Life and Non Life insurance which results into the accumulation of funds by insurance companies depends on the method of operation and there is usually a considerable time lag between payment of pre ...

... serves as profit to the organization Omoke (2011) In Nigeria, we have two types of insurance business Life and Non Life insurance which results into the accumulation of funds by insurance companies depends on the method of operation and there is usually a considerable time lag between payment of pre ...

memorandum of charge and deposit

... be construed and take effect so as to give the Bank hereunder a security for the moneys owing from such firm and every member thereof or from such company or corporation or committee or association or other unincorporated body as identical or analogous as may be with or to that which would have been ...

... be construed and take effect so as to give the Bank hereunder a security for the moneys owing from such firm and every member thereof or from such company or corporation or committee or association or other unincorporated body as identical or analogous as may be with or to that which would have been ...

Actuaries in the Capital Markets

... needs are pushing the envelope, challenging actuaries to expand into new and less traditional areas. While there is no doubt actuaries will continue to play their vital traditional role in the insurance industry, there is a fast-growing realization in other financial services industries—particularly ...

... needs are pushing the envelope, challenging actuaries to expand into new and less traditional areas. While there is no doubt actuaries will continue to play their vital traditional role in the insurance industry, there is a fast-growing realization in other financial services industries—particularly ...

Integration of Financial Services

... regulation. Typical banking risks (default risk, currency risk, liquidity etc.) can be attributed to the asset side of the balance sheet, hence, the capital adequacy of a bank is assessed by weighting the assets and applying the “Cooke Ratio” which requires that 8% of the weighted assets plus certai ...

... regulation. Typical banking risks (default risk, currency risk, liquidity etc.) can be attributed to the asset side of the balance sheet, hence, the capital adequacy of a bank is assessed by weighting the assets and applying the “Cooke Ratio” which requires that 8% of the weighted assets plus certai ...

Savings Accounts

... It’s easy to open a savings account, and most institutions allow you access to your account through ATMs, so you can make deposits and withdrawals virtually whenever you like. Savings accounts are highly liquid because you aren’t subject to penalties for withdrawals as you would be if you made early ...

... It’s easy to open a savings account, and most institutions allow you access to your account through ATMs, so you can make deposits and withdrawals virtually whenever you like. Savings accounts are highly liquid because you aren’t subject to penalties for withdrawals as you would be if you made early ...

NABARD

... NBFCs started in a small way in the sixties and the seventies and tried to serve the needs of the savers and investors whose needs remained unfulfilled by the Banking system. In the eighties, there was virtually a boom, when entrepreneurs suddenly woke up to the tremendous possibilities offered in a ...

... NBFCs started in a small way in the sixties and the seventies and tried to serve the needs of the savers and investors whose needs remained unfulfilled by the Banking system. In the eighties, there was virtually a boom, when entrepreneurs suddenly woke up to the tremendous possibilities offered in a ...

Details

... certificate of deposit as financial products and explains their features. Teacher describes the characteristics of financial ...

... certificate of deposit as financial products and explains their features. Teacher describes the characteristics of financial ...

How to Shop for Term Insurance.

... you will pay higher premiums in the early years and lower prices in the later years than with premiums that increase either annually or periodically every 5 or 10 years. Level premiums are most often guaranteed. However, you will pay more than necessary if you end up canceling or replacing the level ...

... you will pay higher premiums in the early years and lower prices in the later years than with premiums that increase either annually or periodically every 5 or 10 years. Level premiums are most often guaranteed. However, you will pay more than necessary if you end up canceling or replacing the level ...

AIDA/ADC Investment

... The custodial agreement shall provide securities held by the bank or trust company, or agent of and custodian for the local government, will be kept separate and apart from the general assets of the custodial bank or trust company and will not, in any circumstances, be commingled with or become part ...

... The custodial agreement shall provide securities held by the bank or trust company, or agent of and custodian for the local government, will be kept separate and apart from the general assets of the custodial bank or trust company and will not, in any circumstances, be commingled with or become part ...

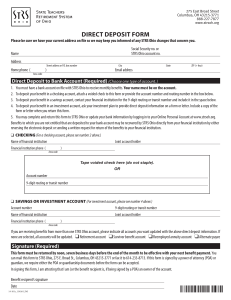

direct deposit form

... To deposit your benefit in a checking account, attach a voided check to this form or provide the account number and routing number in the box below. To deposit your benefit in a savings account, contact your financial institution for the 9-digit routing or transit number and include it in the space ...

... To deposit your benefit in a checking account, attach a voided check to this form or provide the account number and routing number in the box below. To deposit your benefit in a savings account, contact your financial institution for the 9-digit routing or transit number and include it in the space ...

Circular 5 of 2010 - Financial Services Board

... specified future date or dates, and where such minimum is ascertainable in Rand terms at inception; disability, health and life policies that provide risk benefits as contemplated in the Regulations under the Long-term Insurance Act, 1998,and have a guaranteed investment value or a materially equiva ...

... specified future date or dates, and where such minimum is ascertainable in Rand terms at inception; disability, health and life policies that provide risk benefits as contemplated in the Regulations under the Long-term Insurance Act, 1998,and have a guaranteed investment value or a materially equiva ...

Scott Albraccio

... CUNA Mutual Group is the marketing name for CUNA Mutual Holding Company, a mutual insurance holding company, its subsidiaries and affiliates. Proprietary insurance is underwritten by CMFG Life Insurance Company. Proprietary and brokered insurance is sold by CUNA Mutual Insurance Agency, Inc., a whol ...

... CUNA Mutual Group is the marketing name for CUNA Mutual Holding Company, a mutual insurance holding company, its subsidiaries and affiliates. Proprietary insurance is underwritten by CMFG Life Insurance Company. Proprietary and brokered insurance is sold by CUNA Mutual Insurance Agency, Inc., a whol ...

Whole Life Insurance

... Death benefit is paid to the beneficiary upon the insured’s demise during the term of the policy Term policies contain an expiration date terminating all coverage ...

... Death benefit is paid to the beneficiary upon the insured’s demise during the term of the policy Term policies contain an expiration date terminating all coverage ...

MS-Word, RTF - Maine Legislature

... The Treasurer of State may deposit the money, including trust funds of the State, in any national bank or in any banking institution, trust company, state or federal savings and loan association or, mutual savings bank or state-chartered or federally chartered credit union organized under the laws o ...

... The Treasurer of State may deposit the money, including trust funds of the State, in any national bank or in any banking institution, trust company, state or federal savings and loan association or, mutual savings bank or state-chartered or federally chartered credit union organized under the laws o ...

P6466 - iii Template

... Erosion of recent reforms is a certainty (already happening) Innumerable legislative initiatives will create opportunities to undermine existing reforms and develop new theories and channels of liability Torts twice the overall rate of inflation Influence personal and commercial lines, esp. ...

... Erosion of recent reforms is a certainty (already happening) Innumerable legislative initiatives will create opportunities to undermine existing reforms and develop new theories and channels of liability Torts twice the overall rate of inflation Influence personal and commercial lines, esp. ...

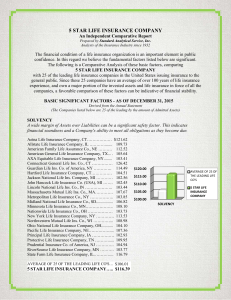

5 STAR LIFE INSURANCE COMPANY

... intended to imply that the company featured will be as successful or is better than the companies making up the aggregate averages, nor is it a recommendation or analysis of the specific policy provisions, rates or claims practices of the organization featured. Its use for all companies, stock, mutu ...

... intended to imply that the company featured will be as successful or is better than the companies making up the aggregate averages, nor is it a recommendation or analysis of the specific policy provisions, rates or claims practices of the organization featured. Its use for all companies, stock, mutu ...

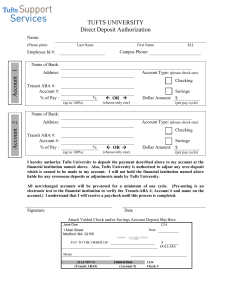

Direct Deposit Authorization form - Access Tufts

... Authorization Notice required by the Credit Union. The form must be authorized by the Credit Union so that they will have updated records for any changes that you request. This form should be sent directly to the University Credit Union, 846 Commonwealth Avenue, Boston, MA 02215. How to Change Your ...

... Authorization Notice required by the Credit Union. The form must be authorized by the Credit Union so that they will have updated records for any changes that you request. This form should be sent directly to the University Credit Union, 846 Commonwealth Avenue, Boston, MA 02215. How to Change Your ...

Deposit insurance

Explicit deposit insurance is a measure implemented in many countries to protect bank depositors, in full or in part, from losses caused by a bank's inability to pay its debts when due. Deposit insurance systems are one component of a financial system safety net that promotes financial stability.