Want to feel good at tax time? Want to feel good at tax time? Want to

... $ The time commitment is up to you. ...

... $ The time commitment is up to you. ...

Document

... • We did not impose restrictions on transfers that relate to property rights of individuals. • If all endowments are divided over individuals and all rights need to be respected, then we seem to be back in the Negishi format, where there is no room from redistribution and uniqueness is lost • Howeve ...

... • We did not impose restrictions on transfers that relate to property rights of individuals. • If all endowments are divided over individuals and all rights need to be respected, then we seem to be back in the Negishi format, where there is no room from redistribution and uniqueness is lost • Howeve ...

Choice, Change, Challenge, and Opportunity

... – How do changes in farm output affect the prices of farm products and farm revenues? – How might farmers be helped by intervention in markets for farm products? ...

... – How do changes in farm output affect the prices of farm products and farm revenues? – How might farmers be helped by intervention in markets for farm products? ...

Chapter 14

... • Incidence depends on how prices are determined • Incidence depends on the disposition of tax revenues – Balanced-Budget tax incidence – Differential tax incidence – Lump-sum tax – Absolute tax incidence ...

... • Incidence depends on how prices are determined • Incidence depends on the disposition of tax revenues – Balanced-Budget tax incidence – Differential tax incidence – Lump-sum tax – Absolute tax incidence ...

Chapter 14

... • Incidence depends on how prices are determined • Incidence depends on the disposition of tax revenues – Balanced-Budget tax incidence – Differential tax incidence – Lump-sum tax – Absolute tax incidence ...

... • Incidence depends on how prices are determined • Incidence depends on the disposition of tax revenues – Balanced-Budget tax incidence – Differential tax incidence – Lump-sum tax – Absolute tax incidence ...

AS/ECON 4070 3.0AF Answers to Midterm Exam October 2005 Q1

... industry is likely to fall mostly on labour (in general). Q3. If a person’s preferences could be represented by the utility function ...

... industry is likely to fall mostly on labour (in general). Q3. If a person’s preferences could be represented by the utility function ...

Taxes and equity

... share of the tax paid by the consumer. How effective are cigarette taxes at ...

... share of the tax paid by the consumer. How effective are cigarette taxes at ...

29 Public Choice

... -- Failure due to inefficiency from certain characteristics of the public sector. -- Special interests: small group trying to get specific outcomes. -- Rent: payment beyond what’s necessary to keep a resource supplied; securing favorable gov’t policies that result in rent (higher profit or income) t ...

... -- Failure due to inefficiency from certain characteristics of the public sector. -- Special interests: small group trying to get specific outcomes. -- Rent: payment beyond what’s necessary to keep a resource supplied; securing favorable gov’t policies that result in rent (higher profit or income) t ...

29 Public Choice _ Taxation

... -- Failure due to inefficiency from certain characteristics of the public sector. -- Special interests: small group trying to get specific outcomes. -- Rent: payment beyond what’s necessary to keep a resource supplied; securing favorable gov’t policies that result in rent (higher profit or income) t ...

... -- Failure due to inefficiency from certain characteristics of the public sector. -- Special interests: small group trying to get specific outcomes. -- Rent: payment beyond what’s necessary to keep a resource supplied; securing favorable gov’t policies that result in rent (higher profit or income) t ...

adam smith - WordPress.com

... the marketplace. Individuals can make profit, and maximize it without the need for government intervention. It has come to capture his important claim that individuals' efforts to maximize their own gains in a free market may benefit society. Smith assumed that individuals try to maximize their own ...

... the marketplace. Individuals can make profit, and maximize it without the need for government intervention. It has come to capture his important claim that individuals' efforts to maximize their own gains in a free market may benefit society. Smith assumed that individuals try to maximize their own ...

Central Carolina Community College Program Planning Guide

... This course introduces the relevant laws governing business and fiduciary income taxes. Topics include tax law relating to business organizations, electronic research and methodologies, and the use of technology for the preparation of business tax returns. Upon completion, students should be able to ...

... This course introduces the relevant laws governing business and fiduciary income taxes. Topics include tax law relating to business organizations, electronic research and methodologies, and the use of technology for the preparation of business tax returns. Upon completion, students should be able to ...

Credential: Income Tax Preparer Certificate (C25100T0)

... This course introduces the relevant laws governing business and fiduciary income taxes. Topics include tax law relating to business organizations, electronic research and methodologies, and the use of technology for the preparation of business tax returns. Upon completion, students should be able to ...

... This course introduces the relevant laws governing business and fiduciary income taxes. Topics include tax law relating to business organizations, electronic research and methodologies, and the use of technology for the preparation of business tax returns. Upon completion, students should be able to ...

Practice problems on Chapter 8

... 1. A tax levied on the buyers of a good shifts the a. supply curve upward (or to the left). b. supply curve downward (or to the right). c. demand curve downward (or to the left). d. demand curve upward (or to the right). 2. Buyers of a product will bear the larger part of the tax burden, and sellers ...

... 1. A tax levied on the buyers of a good shifts the a. supply curve upward (or to the left). b. supply curve downward (or to the right). c. demand curve downward (or to the left). d. demand curve upward (or to the right). 2. Buyers of a product will bear the larger part of the tax burden, and sellers ...

Ed Dolan, Soda Taxes, April 13, 2010

... Terms of Use: You are free to use these slides as a resource for your economics classes together with whatever textbook you are using. If you like the slides, you may also want to take a look at my textbook, Introduction to Economics, from BVT Publishers. ...

... Terms of Use: You are free to use these slides as a resource for your economics classes together with whatever textbook you are using. If you like the slides, you may also want to take a look at my textbook, Introduction to Economics, from BVT Publishers. ...

Chapter 8 Questions

... would still have a consumer surplus even if he had to take all of the tax. If the tax was placed on Robert the transaction would no longer take place since the total cost is above his willingness to pay with the distribution of the tax ...

... would still have a consumer surplus even if he had to take all of the tax. If the tax was placed on Robert the transaction would no longer take place since the total cost is above his willingness to pay with the distribution of the tax ...

Who is economically hurt when the following person is taxed…

... (a) Elastic Supply, Inelastic Demand Price 1. When supply is more elastic than demand . . . Price buyers pay Supply ...

... (a) Elastic Supply, Inelastic Demand Price 1. When supply is more elastic than demand . . . Price buyers pay Supply ...

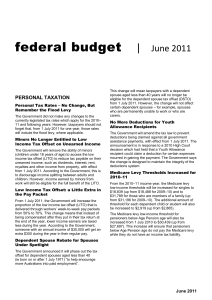

Federal Budget June 2011

... The Government did not make any changes to the currently legislated tax rates which apply for the 2010– 11 and following years. However, taxpayers should not forget that, from 1 July 2011 for one year, those rates will include the flood levy, where applicable. ...

... The Government did not make any changes to the currently legislated tax rates which apply for the 2010– 11 and following years. However, taxpayers should not forget that, from 1 July 2011 for one year, those rates will include the flood levy, where applicable. ...

Figure 8-4

... c. the supply of the product is more elastic than the demand for the product. d. the demand for the product is more elastic than the supply of the product. ...

... c. the supply of the product is more elastic than the demand for the product. d. the demand for the product is more elastic than the supply of the product. ...

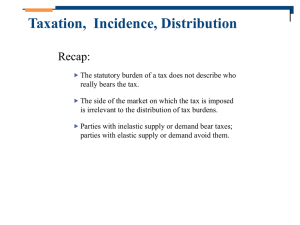

Taxation, Incidence, Distribution

... above and beyond the tax revenues collected. • also refer as welfare cost or deadweight loss • Other Key Concepts: – Consumer surplus, social surplus ...

... above and beyond the tax revenues collected. • also refer as welfare cost or deadweight loss • Other Key Concepts: – Consumer surplus, social surplus ...

indirect taxes and subsidies File

... The product below (corn) receives a generous government subsidy. Show the effect on the diagram. ...

... The product below (corn) receives a generous government subsidy. Show the effect on the diagram. ...