the 2016 election: clinton vs. trump voters on american

... Among Trump voters, 40% favor repealing it completely, and another 20% favor scaling the law back and turning power over to each state to design or control its own plan. Only 22% of Trump voters prefer the actual Republican legislation in Congress, House Speaker Paul Ryan’s (R-WI) plan that proposes ...

... Among Trump voters, 40% favor repealing it completely, and another 20% favor scaling the law back and turning power over to each state to design or control its own plan. Only 22% of Trump voters prefer the actual Republican legislation in Congress, House Speaker Paul Ryan’s (R-WI) plan that proposes ...

Frequently Asked Questions

... made in increments of 10 payments each of one-half the annual award. DANY Physician Practice Support – Awardees may receive up to $100,000 over 2 years payable upon execution and submission and verification of the expenditures, physician’s service commitment, and education debt (if funds were receiv ...

... made in increments of 10 payments each of one-half the annual award. DANY Physician Practice Support – Awardees may receive up to $100,000 over 2 years payable upon execution and submission and verification of the expenditures, physician’s service commitment, and education debt (if funds were receiv ...

Budget - Government of Manitoba

... Our first year has been spent listening to Manitobans who came forward during our pre-budget consultation to give us their views on how to repair our services, fix Manitoba’s finances and rebuild our economy. We received advice from Manitobans from all walks of life and from all across the province, ...

... Our first year has been spent listening to Manitobans who came forward during our pre-budget consultation to give us their views on how to repair our services, fix Manitoba’s finances and rebuild our economy. We received advice from Manitobans from all walks of life and from all across the province, ...

RTF

... The self-employment trend is important to Revenue Canada because of its impact on compliance. Overall, compliance with Canada’s tax system is high. For example, in 1995, over 95% of Canadians 18 years of age or older who should have filed an income tax return did so voluntarily. This has increased f ...

... The self-employment trend is important to Revenue Canada because of its impact on compliance. Overall, compliance with Canada’s tax system is high. For example, in 1995, over 95% of Canadians 18 years of age or older who should have filed an income tax return did so voluntarily. This has increased f ...

Issue Brief

... Predicting health care costs 20 or 30—let alone 50 or 75—years into the future is an inexact science, at best.9 The costs of providing care depend on future innovations in technology, the value of such innovations to beneficiaries and to taxpayers, and the supply of and demand for health care servic ...

... Predicting health care costs 20 or 30—let alone 50 or 75—years into the future is an inexact science, at best.9 The costs of providing care depend on future innovations in technology, the value of such innovations to beneficiaries and to taxpayers, and the supply of and demand for health care servic ...

Submission can be found here.

... CPRA calls upon the Federal government to work collaboratively within a shared mandate to immediately develop a dedicated national recreation and sport infrastructure program to address the facility repair, replacement or rehabilitation needs of communities across Canada. The CPRA recommends that th ...

... CPRA calls upon the Federal government to work collaboratively within a shared mandate to immediately develop a dedicated national recreation and sport infrastructure program to address the facility repair, replacement or rehabilitation needs of communities across Canada. The CPRA recommends that th ...

Measuring progressivity of health care payments

... burden of all direct and indirect taxes is relevant where, as is commonly true, some health care is financed from general government revenues. Social insurance contributions should also be considered. One source of revenue, foreign aid, is not relevant since the purpose is to evaluate the distributi ...

... burden of all direct and indirect taxes is relevant where, as is commonly true, some health care is financed from general government revenues. Social insurance contributions should also be considered. One source of revenue, foreign aid, is not relevant since the purpose is to evaluate the distributi ...

Consultant in Public Health/Public Health Medicine – Health

... 4.1 The post holder will be managerially responsible for a team of 15 staff of whom four are directly line managed by the consultant, including recruitment, allocation of duties, appraisals, disciplinary and grievance responsibilities. 4.2 The post holder will manage a budget of £570,000 per annum a ...

... 4.1 The post holder will be managerially responsible for a team of 15 staff of whom four are directly line managed by the consultant, including recruitment, allocation of duties, appraisals, disciplinary and grievance responsibilities. 4.2 The post holder will manage a budget of £570,000 per annum a ...

Healthcare

... • In healthcare, the market consumption decision is not voluntary, but forced by an external event such as becoming sick. • There are three type of health events: – First, there’s the flow of ordinary healthcare expenses when you are young and middle-aged. – Second, there’s the relatively rare catas ...

... • In healthcare, the market consumption decision is not voluntary, but forced by an external event such as becoming sick. • There are three type of health events: – First, there’s the flow of ordinary healthcare expenses when you are young and middle-aged. – Second, there’s the relatively rare catas ...

Who Pays and Who Benefits from Health Care Reforms?

... taxes” fund the premium subsidy of the poor simply shifts the burden of paying from LGU contributions to fully nationally-funded premium subsidies for the same benefit package. Thirdly, the lack of information as well as operational and procedural barriers prevent the premium subsidies to be transla ...

... taxes” fund the premium subsidy of the poor simply shifts the burden of paying from LGU contributions to fully nationally-funded premium subsidies for the same benefit package. Thirdly, the lack of information as well as operational and procedural barriers prevent the premium subsidies to be transla ...

What Are the Implications for Medicare of the American Health Care

... hospital, skilled nursing facility, home health and hospice benefits. Under current law, Part A is financed primarily through a 2.9% tax on earnings paid by employers and employees (1.45% each). The ACA increased the payroll tax for a minority of taxpayers with relatively high incomes—those earning ...

... hospital, skilled nursing facility, home health and hospice benefits. Under current law, Part A is financed primarily through a 2.9% tax on earnings paid by employers and employees (1.45% each). The ACA increased the payroll tax for a minority of taxpayers with relatively high incomes—those earning ...

The Health Care Systems Of China And India

... care in 2003, up from 36 percent in 1993.8 Of those who did not seek care, 38 percent reported financial difficulties as their primary reason for not doing so, up from 33 percent in 1993.9 Notably, the proportion of ill people not seeking care because of financial hardship varies considerably by inc ...

... care in 2003, up from 36 percent in 1993.8 Of those who did not seek care, 38 percent reported financial difficulties as their primary reason for not doing so, up from 33 percent in 1993.9 Notably, the proportion of ill people not seeking care because of financial hardship varies considerably by inc ...

Nine fallacies of Obamacare

... of control — people act rationally according to the incentive system they are in — and why Obama is looking for ways to control costs. As long as those programs exist, he won’t be able control costs without bureaucratic rationing of services one way or another. If the “reformers” get their way, some ...

... of control — people act rationally according to the incentive system they are in — and why Obama is looking for ways to control costs. As long as those programs exist, he won’t be able control costs without bureaucratic rationing of services one way or another. If the “reformers” get their way, some ...

IT`S TIME FOR OUR ACTIONS TO CATCH UP TO OUR WORDS

... Psychotherapy, also referred to as talk therapy, is recognized as an effective intervention for treating mental illness. Many community organizations are already providing psychotherapy as part of their treatment programs. The challenge they have is attracting and retaining qualified professionals t ...

... Psychotherapy, also referred to as talk therapy, is recognized as an effective intervention for treating mental illness. Many community organizations are already providing psychotherapy as part of their treatment programs. The challenge they have is attracting and retaining qualified professionals t ...

NATIONAL COMMISSION OF AUDIT COVER SHEET FOR SUBMISSIONS Dr

... (and costs). Importantly, the Commonwealth is only obliged to contribute to what an independent arbiter (the Independent Hospital Pricing Authority, IHPA), determines are the costs that an ‘efficient’ hospital would take to provide that additional activity. This is done by IHPA establishing the ‘Nat ...

... (and costs). Importantly, the Commonwealth is only obliged to contribute to what an independent arbiter (the Independent Hospital Pricing Authority, IHPA), determines are the costs that an ‘efficient’ hospital would take to provide that additional activity. This is done by IHPA establishing the ‘Nat ...

Econ 149: Health Economics Problem Set I Answer Key 1. Name

... is important when we’re thinking about incentives for consuming health care, since we don’t pay the full price up front. (b) When you buy a surfboard, you probably can gauge its basic quality and you and the shop owner will generally have the same information about the surfboard. In health care, the ...

... is important when we’re thinking about incentives for consuming health care, since we don’t pay the full price up front. (b) When you buy a surfboard, you probably can gauge its basic quality and you and the shop owner will generally have the same information about the surfboard. In health care, the ...

Ontario Fiscal Policy - Ontario Health Coalition

... and is significantly below the average. • Hospitals and home care are shrinking, not growing as a proportion of health spending. • Ontario has engaged in the most prolonged and deepest tax cuts of any province in Canada. These cuts have not resulted in business investment. ...

... and is significantly below the average. • Hospitals and home care are shrinking, not growing as a proportion of health spending. • Ontario has engaged in the most prolonged and deepest tax cuts of any province in Canada. These cuts have not resulted in business investment. ...

Analysis of foreign healthcare systems

... Health insurance in the US is difficult and very complex to understand. The beneficiaries of the Affordable Care Act (ACA) are those that have an income below poverty, to be eligible the income should be less than $28,725 for an individual and for a family of three $48,000. Population with an income ...

... Health insurance in the US is difficult and very complex to understand. The beneficiaries of the Affordable Care Act (ACA) are those that have an income below poverty, to be eligible the income should be less than $28,725 for an individual and for a family of three $48,000. Population with an income ...

questions to ask federal candidates

... The use of evidence-based research on various medical practices and prescription drugs has been shown to save money, yet provide quality care. What should the government do to promote the use of evidence-based research by doctors, hospitals and other health providers? As President, how would you ens ...

... The use of evidence-based research on various medical practices and prescription drugs has been shown to save money, yet provide quality care. What should the government do to promote the use of evidence-based research by doctors, hospitals and other health providers? As President, how would you ens ...

Comparing rail health care benefits to other industries

... Rail union employees pay less in out-of-pocket expenses such as co-payments, deductibles and coinsurance and get far more generous coverage than the vast majority of American workers. In fact, out-of-pocket expenses for rail union employees reflect only 7 percent of the total costs of the health ...

... Rail union employees pay less in out-of-pocket expenses such as co-payments, deductibles and coinsurance and get far more generous coverage than the vast majority of American workers. In fact, out-of-pocket expenses for rail union employees reflect only 7 percent of the total costs of the health ...

What You Eat Is Your Business

... 8) How are this author’s and Zinczenko’s positions similar or different? ...

... 8) How are this author’s and Zinczenko’s positions similar or different? ...

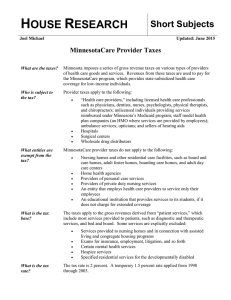

MinnesotaCare Provider Taxes - Minnesota House of Representatives

... No, the revenues from applying the insurance premiums tax to health maintenance organizations (HMOs) and nonprofit health services corporations (such as Blue Cross) are deposited in the health care access fund and used to pay for MinnesotaCare. In addition, other revenues from the program, such as p ...

... No, the revenues from applying the insurance premiums tax to health maintenance organizations (HMOs) and nonprofit health services corporations (such as Blue Cross) are deposited in the health care access fund and used to pay for MinnesotaCare. In addition, other revenues from the program, such as p ...

Lyme Disease Petition

... WHEREAS, the tick-borne illness known as Chronic Lyme Disease, which mimics many catastrophic illnesses, such as Multiple Sclerosis, Crohn’s, Alzheimer’s, arthritic diabetes, depression, Chronic Fatigue and Fibromyalgia is increasingly endemic in Canada, but the scientifically validated diagnostic t ...

... WHEREAS, the tick-borne illness known as Chronic Lyme Disease, which mimics many catastrophic illnesses, such as Multiple Sclerosis, Crohn’s, Alzheimer’s, arthritic diabetes, depression, Chronic Fatigue and Fibromyalgia is increasingly endemic in Canada, but the scientifically validated diagnostic t ...

sample exchange notice letter for employees not offered health

... could choose to purchase insurance through the Health Insurance Marketplace. In the state of Wisconsin, you can access a federal-based Marketplace. If your household income (“adjusted gross income” or “total income” as shown on your federal income tax form) is between 100% and 400% of the federal po ...

... could choose to purchase insurance through the Health Insurance Marketplace. In the state of Wisconsin, you can access a federal-based Marketplace. If your household income (“adjusted gross income” or “total income” as shown on your federal income tax form) is between 100% and 400% of the federal po ...