Competition and regulation in banking∗

... and investors obtain noisy private signals on the realization of the fundamentals. This leads to a unique equilibrium in which a bank run occurs when the fundamentals are below some critical level. Importantly, despite being determined by fundamentals, runs can be also driven by bad expectations. De ...

... and investors obtain noisy private signals on the realization of the fundamentals. This leads to a unique equilibrium in which a bank run occurs when the fundamentals are below some critical level. Importantly, despite being determined by fundamentals, runs can be also driven by bad expectations. De ...

NBER WORKING PAPER SERIES STOCK AND BOND RETURNS WITH MOODY INVESTORS

... alluded to above, we test how well the model fares with respect to these puzzles. Our model generates a bond-stock return correlation that is somewhat too high relative to the data but it matches the predictability evidence. Third, to convert from model output to the data, we use inflation as a stat ...

... alluded to above, we test how well the model fares with respect to these puzzles. Our model generates a bond-stock return correlation that is somewhat too high relative to the data but it matches the predictability evidence. Third, to convert from model output to the data, we use inflation as a stat ...

CHAPTER– 5 THE NEGATIVE EFFECTS OF MONEY LAUNDERING

... transfers, suddenly and without notification, causing liquidity problems and possible bank runs. Generally, this is done due to non-market forces such as investigations or inquiries by the authorities. Further, cases have been documented where criminal activity was the main cause for bank failure. T ...

... transfers, suddenly and without notification, causing liquidity problems and possible bank runs. Generally, this is done due to non-market forces such as investigations or inquiries by the authorities. Further, cases have been documented where criminal activity was the main cause for bank failure. T ...

optimal capital structure

... We have studied three companies within the real estate industry due to comparable issues. Our result reveals that the companies do not use any mathematical model when deciding their capital structure but they do consider many important factors. The business and financial risk have the largest impact ...

... We have studied three companies within the real estate industry due to comparable issues. Our result reveals that the companies do not use any mathematical model when deciding their capital structure but they do consider many important factors. The business and financial risk have the largest impact ...

contents - Wrexham County Borough Council

... Factor (CEF) Score’, a percentage determining the building’s level of risk. This is based on an assessment of the building’s condition, its individual rate of deterioration and the building’s occupancy level. The condition of each Listed Building has been determined based upon a detailed appraisal o ...

... Factor (CEF) Score’, a percentage determining the building’s level of risk. This is based on an assessment of the building’s condition, its individual rate of deterioration and the building’s occupancy level. The condition of each Listed Building has been determined based upon a detailed appraisal o ...

When and how US dollar shortages evolved into the full crisis

... In addition, exact dates of such structural changes in the financial markets are unknown a priori in most cases, even though there would be large-scale visible events like the bankruptcy of major institutions.6 It is due to the fact that market conditions tend to start deteriorating before major eve ...

... In addition, exact dates of such structural changes in the financial markets are unknown a priori in most cases, even though there would be large-scale visible events like the bankruptcy of major institutions.6 It is due to the fact that market conditions tend to start deteriorating before major eve ...

Question:What will be the price of a 5 year

... Question:The market value of the firm is equal to the total market value of equity and total market value of debt and is independent of the degree of leverage. This relates to : Proposition I Proposition II Proposition III None Question:What is the meant by arbitrage? It is the process of buying a s ...

... Question:The market value of the firm is equal to the total market value of equity and total market value of debt and is independent of the degree of leverage. This relates to : Proposition I Proposition II Proposition III None Question:What is the meant by arbitrage? It is the process of buying a s ...

The Crisis Aftermath: New Regulatory Paradigms

... About the Contributors Mathias Dewatripont holds a Ph.D. in Economics from Harvard University, 1986. Before joining in 2011 the Executive Board of the National Bank of Belgium (in charge of Prudential Policy and Financial Stability), he was Professor of Economics at the Solvay Brussels School of Ec ...

... About the Contributors Mathias Dewatripont holds a Ph.D. in Economics from Harvard University, 1986. Before joining in 2011 the Executive Board of the National Bank of Belgium (in charge of Prudential Policy and Financial Stability), he was Professor of Economics at the Solvay Brussels School of Ec ...

Modeling the Effect of Macroeconomic Factors on Corporate Default

... NBER recession indicator); those related to the direction in which the economy is moving (e.g., real GDP growth and the change in consumer sentiment); and a remaining set loosely categorized as indicators of financial market conditions (e.g., interest rates and stock market returns). The last group ...

... NBER recession indicator); those related to the direction in which the economy is moving (e.g., real GDP growth and the change in consumer sentiment); and a remaining set loosely categorized as indicators of financial market conditions (e.g., interest rates and stock market returns). The last group ...

A big leap forward

... ATR Kim Eng, conducted the first Maybank Economic Briefing for top clients. Entitled “Return of the Dragon: Reinvesting in Asia,” the forum provided insights on investing in the region and the Philippines. Resource persons were from Maybank ATRKE, Maybank IB and Global Markets of Maybank Singapore. ...

... ATR Kim Eng, conducted the first Maybank Economic Briefing for top clients. Entitled “Return of the Dragon: Reinvesting in Asia,” the forum provided insights on investing in the region and the Philippines. Resource persons were from Maybank ATRKE, Maybank IB and Global Markets of Maybank Singapore. ...

Corporate capital structure choice: does

... male CEO’s or not? As far as borrowed capital puts the company under the greater risk than owner’s capital, we are particularly interested in whether female managers tend to borrow less than male or not. Taking into consideration the point that women may be less likely to run a company than men beca ...

... male CEO’s or not? As far as borrowed capital puts the company under the greater risk than owner’s capital, we are particularly interested in whether female managers tend to borrow less than male or not. Taking into consideration the point that women may be less likely to run a company than men beca ...

Key Credit Factors For The Regulated Utilities

... near-essential infrastructure product, commodity, or service with little or no practical substitute (mainly electricity, water, and gas), a business model that is shielded from competition (naturally, by law, shadow regulation, or by government policies and oversight), and is subject to comprehensiv ...

... near-essential infrastructure product, commodity, or service with little or no practical substitute (mainly electricity, water, and gas), a business model that is shielded from competition (naturally, by law, shadow regulation, or by government policies and oversight), and is subject to comprehensiv ...

1 - Rutgers University

... and Lee argued that (2009) Black’s theoretically elegant model has never been empirically tested for its implications in dynamic asset pricing. theoretically extend Black’s CAPM. ...

... and Lee argued that (2009) Black’s theoretically elegant model has never been empirically tested for its implications in dynamic asset pricing. theoretically extend Black’s CAPM. ...

Accounting vs. Market-based Measures of Firm Performance

... community (Abbasi et al., 2015; Masa’deh, 2013), as it is not only helps firms realize the potential benefits from investments in IT (Alenezi et al, 2015; Tarhini et al., 2015a, b), but also enhances business performance (Chan et al., 1997; Croteauet al., 2001; Masa’deh, 2012, 2013, Abu-Shanab, 2014 ...

... community (Abbasi et al., 2015; Masa’deh, 2013), as it is not only helps firms realize the potential benefits from investments in IT (Alenezi et al, 2015; Tarhini et al., 2015a, b), but also enhances business performance (Chan et al., 1997; Croteauet al., 2001; Masa’deh, 2012, 2013, Abu-Shanab, 2014 ...

UNISDR Case Study Report

... The role of insurance in society is often misunderstood by policymakers. Ignoring insurance’s unique business model and its social and economic impacts is detrimental to disaster reduction strategies. Broad insurance coverage enables countries’ economies to recover in shorter periods than underinsur ...

... The role of insurance in society is often misunderstood by policymakers. Ignoring insurance’s unique business model and its social and economic impacts is detrimental to disaster reduction strategies. Broad insurance coverage enables countries’ economies to recover in shorter periods than underinsur ...

here - Levy Economics Institute of Bard College

... them are in Dodd-Frank; some are not. But it’s not rocket science. I would say it’s more criminal law than rocket science, if you will. . . . So: radically decrease leverage, decrease synthetic leverage in terms of derivatives, develop a system of systemic risk regulatory apparatus to avoid contagio ...

... them are in Dodd-Frank; some are not. But it’s not rocket science. I would say it’s more criminal law than rocket science, if you will. . . . So: radically decrease leverage, decrease synthetic leverage in terms of derivatives, develop a system of systemic risk regulatory apparatus to avoid contagio ...

Results of DNB investment surveys into alternative investments by

... via the outsourcing relationship to bring the service provider's remuneration policy into line with these principles.4 It is not sufficient for pension funds investing in alternative investments to merely provide a simple risk measure or an ex post control environment in their risk management. In th ...

... via the outsourcing relationship to bring the service provider's remuneration policy into line with these principles.4 It is not sufficient for pension funds investing in alternative investments to merely provide a simple risk measure or an ex post control environment in their risk management. In th ...

Guidance on the Critical Functions Report

... functions. First, institutions are required to perform a self-assessment when drawing-up recovery plans. Second, resolution authorities shall critically review the recovery plans to ensure consistency and coherence across approaches used by individual institutions. Resolution authorities will theref ...

... functions. First, institutions are required to perform a self-assessment when drawing-up recovery plans. Second, resolution authorities shall critically review the recovery plans to ensure consistency and coherence across approaches used by individual institutions. Resolution authorities will theref ...

Consolidated Profit and Loss Account

... Turkey based PST Pastacilik Gida, a branded provider of sweet ingredient solutions to the fine bakery, confectionery, ice cream and foodservice sectors in Turkey and the Middle East, was acquired in July. Market conditions in Sub-Saharan Africa remained highly competitive. In South Africa, an increa ...

... Turkey based PST Pastacilik Gida, a branded provider of sweet ingredient solutions to the fine bakery, confectionery, ice cream and foodservice sectors in Turkey and the Middle East, was acquired in July. Market conditions in Sub-Saharan Africa remained highly competitive. In South Africa, an increa ...

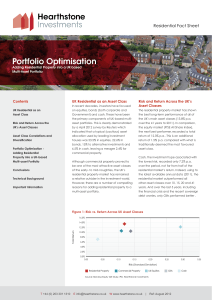

Portfolio Optimisation - Hearthstone Investments

... provided both a higher average total return and a lower level of risk than most other asset types. This in itself is counter-intuitive as it would be expected that in order to achieve a higher level of return, an investor must take additional risk. As shown in figure 1, however, this does not prove ...

... provided both a higher average total return and a lower level of risk than most other asset types. This in itself is counter-intuitive as it would be expected that in order to achieve a higher level of return, an investor must take additional risk. As shown in figure 1, however, this does not prove ...

Report 52 - Fixed Maturity EUR Industrial Bond Funds

... This composite report is part of the collection of composite reports of the Global Investment Performance Standards (GIPS) compliant firm Petercam Institutional Asset Management. Petercam claims compliance with the Global Investment Performance Standards (GIPS®) and ...

... This composite report is part of the collection of composite reports of the Global Investment Performance Standards (GIPS) compliant firm Petercam Institutional Asset Management. Petercam claims compliance with the Global Investment Performance Standards (GIPS®) and ...