Inflation is

... The Modigliani–Miller theorem (of Franco Modigliani, Merton Miller) forms the basis for modern thinking on capital structure. The basic theorem states that, under a certain market price process (the classical random walk), in the absence of taxes, bankruptcy costs, and asymmetric information, and in ...

... The Modigliani–Miller theorem (of Franco Modigliani, Merton Miller) forms the basis for modern thinking on capital structure. The basic theorem states that, under a certain market price process (the classical random walk), in the absence of taxes, bankruptcy costs, and asymmetric information, and in ...

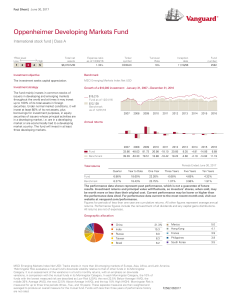

Oppenheimer Developing Markets Fund - Vanguard

... market as a whole. Smaller, less-seasoned companies may be subject to increased liquidity risk compared with mid- and large-cap companies and may experience greater price volatility than do those securities because of limited product lines, management experience, market share, or financial resources ...

... market as a whole. Smaller, less-seasoned companies may be subject to increased liquidity risk compared with mid- and large-cap companies and may experience greater price volatility than do those securities because of limited product lines, management experience, market share, or financial resources ...

Import Substitution Industrialization (ISI)

... •Depositors panic and bank runs occur •Depositors panic and bank runs occur •Inflation shoots up due to higher import prices •Nominal interest rates increase •Huge increases in interest payments •Sharp deterioration and collapse of financial and non-financial B/S •Contraction in lending and severe e ...

... •Depositors panic and bank runs occur •Depositors panic and bank runs occur •Inflation shoots up due to higher import prices •Nominal interest rates increase •Huge increases in interest payments •Sharp deterioration and collapse of financial and non-financial B/S •Contraction in lending and severe e ...

AMH ppt

... Contrary to EMH arbitrage do exist from time to time As profit opportunities come to light, they are exploited and disappear New opportunities appear as older opportunities die out ...

... Contrary to EMH arbitrage do exist from time to time As profit opportunities come to light, they are exploited and disappear New opportunities appear as older opportunities die out ...

Capital Markets Institutions, Instruments, and Risk

... Asset-Backed CP 639 Defaults in the CP Market and the Recent Financial Crisis 640 Yields on CP 641 Non-U.S. CP Markets 642 Large-Denomination Negotiable Certificates of Deposit 642 CD Issuers 643 CD Yields 643 Banker's Acceptances 644 Illustration of the Creation of a BA 645 Accepting Banks 646 Elig ...

... Asset-Backed CP 639 Defaults in the CP Market and the Recent Financial Crisis 640 Yields on CP 641 Non-U.S. CP Markets 642 Large-Denomination Negotiable Certificates of Deposit 642 CD Issuers 643 CD Yields 643 Banker's Acceptances 644 Illustration of the Creation of a BA 645 Accepting Banks 646 Elig ...

Housing Finance in Emerging Markets: Policy and

... Collect data on employment, deposits, income, credit, assets and liabilities Centralized credit bureau an important component of modern mortgage markets Electronic credit information facilitates automated underwriting ...

... Collect data on employment, deposits, income, credit, assets and liabilities Centralized credit bureau an important component of modern mortgage markets Electronic credit information facilitates automated underwriting ...

Role of financial institutions

... adequate knowledge about complicated investment affairs. Oreover their resources are small. So they are exposed to great risk which constrain them from investing their savings. Financial institutions take care of these problems. The investment policies of these institutions centre on dversification ...

... adequate knowledge about complicated investment affairs. Oreover their resources are small. So they are exposed to great risk which constrain them from investing their savings. Financial institutions take care of these problems. The investment policies of these institutions centre on dversification ...

Twelve Commandments of Investment

... Market access and non-discrimination. Investors will gauge the degree to which foreign governments will interfere with the company’s ability to enter the market and compete fairly with domestic or other foreign providers. In some cases joint ventures are a condition of market entry. These can incr ...

... Market access and non-discrimination. Investors will gauge the degree to which foreign governments will interfere with the company’s ability to enter the market and compete fairly with domestic or other foreign providers. In some cases joint ventures are a condition of market entry. These can incr ...

Syllabus B Com Sem-6 FC302B Personal Financial Planning

... The concept of Time Value of Money and its application in financial planning Unit – II Personal tax planning – basics of tax assessment for an individual, deductions and reliefs available to an individual, avenues for tax savings for an individual Unit – III Life insurance – tools for financial plan ...

... The concept of Time Value of Money and its application in financial planning Unit – II Personal tax planning – basics of tax assessment for an individual, deductions and reliefs available to an individual, avenues for tax savings for an individual Unit – III Life insurance – tools for financial plan ...

Slides session 7 - Prof. Dr. Dennis Alexis Valin Dittrich

... equipment, and computers. They also make consumer goods. Let’s consider a case where the countries in question 7 devote 25% of GDP to making investment goods (so γ, gamma, = 0.25). What is the amount of savings in these three countries? In which countries ...

... equipment, and computers. They also make consumer goods. Let’s consider a case where the countries in question 7 devote 25% of GDP to making investment goods (so γ, gamma, = 0.25). What is the amount of savings in these three countries? In which countries ...

of households

... Eastern European countries) and within countries (e.g. most vulnerable groups in each country, such as the long-term unemployed, indebted households). ...

... Eastern European countries) and within countries (e.g. most vulnerable groups in each country, such as the long-term unemployed, indebted households). ...

Innovations in managing catastrophic Risk in Agri. Financing-PPAF

... Mitigating information asymmetry and moral hazard issues through automated claim settlement and involvement of Communities ...

... Mitigating information asymmetry and moral hazard issues through automated claim settlement and involvement of Communities ...

Diversification. - Principal Financial Group

... through a group annuity contract with Principal Life Insurance Company. See the group annuity contract for the full name of the Separate Account. Principal Life Insurance Company reserves the right to defer payments or transfers from Principal Life Separate Accounts as permitted by the group annuity ...

... through a group annuity contract with Principal Life Insurance Company. See the group annuity contract for the full name of the Separate Account. Principal Life Insurance Company reserves the right to defer payments or transfers from Principal Life Separate Accounts as permitted by the group annuity ...

Market Insights - Quarterly outlook

... by almost 7%. Even more unusually, these returns have been delivered with record low volatility. Starting in October, the S&P 500 saw not a single day with a decline greater than 1% through mid-March, which was almost a record run. How could this happen? Q1 delivered an equity friendly mix of improv ...

... by almost 7%. Even more unusually, these returns have been delivered with record low volatility. Starting in October, the S&P 500 saw not a single day with a decline greater than 1% through mid-March, which was almost a record run. How could this happen? Q1 delivered an equity friendly mix of improv ...

Government bond yields and risk aversion

... Notes: Standard errors in parentheses * significant at 10%; ** significant at 5%; *** significant at 1% Coefficients estimated using panel-corrected standard errors assuming first-order autocorrelation in disturbance terms based on the Durbin Watson approach ...

... Notes: Standard errors in parentheses * significant at 10%; ** significant at 5%; *** significant at 1% Coefficients estimated using panel-corrected standard errors assuming first-order autocorrelation in disturbance terms based on the Durbin Watson approach ...

Financial Institution Supplement - Philadelphia Insurance Companies

... Loan Committee Audit Committee Other (describe)________________________ 4. Does your firm have a policy prohibiting any member from acting as a director or officer of a financial institution No If no, please provide an explanation._______________________ which is also a client of the firm? Yes _____ ...

... Loan Committee Audit Committee Other (describe)________________________ 4. Does your firm have a policy prohibiting any member from acting as a director or officer of a financial institution No If no, please provide an explanation._______________________ which is also a client of the firm? Yes _____ ...