No Slide Title

... Strengths: The UK has a particularly good legal and policy environment, ranking better than any other country. Among its most significant advantages in this area are an extremely flexible labour market and a government which is very encouraging of private equity. Alongside its favourable regulatory ...

... Strengths: The UK has a particularly good legal and policy environment, ranking better than any other country. Among its most significant advantages in this area are an extremely flexible labour market and a government which is very encouraging of private equity. Alongside its favourable regulatory ...

Slide 1

... Divergence also within Emerging Europe with some countries getting large capital inflows ...

... Divergence also within Emerging Europe with some countries getting large capital inflows ...

O poder corporativo mundial

... corporations affects global market competition and financial stability. So far, only small national samples were studied and there was no appropriate methodology to assess control globally. We present the first investigation of the architecture of the international ownership network, along with the ...

... corporations affects global market competition and financial stability. So far, only small national samples were studied and there was no appropriate methodology to assess control globally. We present the first investigation of the architecture of the international ownership network, along with the ...

5-10

... Stand-alone risk is not important to a welldiversified investor. Rational, risk-averse investors are concerned with σp, which is based upon market risk. There can be only one price (the market return) for a given security. No compensation should be earned for holding unnecessary, diversifiable risk. ...

... Stand-alone risk is not important to a welldiversified investor. Rational, risk-averse investors are concerned with σp, which is based upon market risk. There can be only one price (the market return) for a given security. No compensation should be earned for holding unnecessary, diversifiable risk. ...

1. General Economic and Financial Environment Current view of the

... consecutive quarters, starting from 2Q/09. Fixed investments is set to drop severely (by real 18.4% yoy subtracting 6.1 pp of GDP) in response to the more difficult access to financing and looming risks of spare production capacities in the post crisis ...

... consecutive quarters, starting from 2Q/09. Fixed investments is set to drop severely (by real 18.4% yoy subtracting 6.1 pp of GDP) in response to the more difficult access to financing and looming risks of spare production capacities in the post crisis ...

The demise of neoliberalism? Bill Lucarelli

... 1950s and 1960s to almost 50 per cent in 2001 (Crotty, 2005: 85). Another indicator of the degree of financialisation is the level of private debt or the relative size of the US credit market. In 1981, for instance, the value of the US credit market was estimated at 168 per cent of GDP. By 2007, thi ...

... 1950s and 1960s to almost 50 per cent in 2001 (Crotty, 2005: 85). Another indicator of the degree of financialisation is the level of private debt or the relative size of the US credit market. In 1981, for instance, the value of the US credit market was estimated at 168 per cent of GDP. By 2007, thi ...

CIS March 2013 Exam Diet Examination Paper 2.1:

... the financial statements are prepared according to the going concern convention. B. Prepaid expenses and accrued liabilities are recognized in the financial statements due to the convention of accrual basis of accounting. C. Revenues are recognized as soon as probable and expenses are recognized whe ...

... the financial statements are prepared according to the going concern convention. B. Prepaid expenses and accrued liabilities are recognized in the financial statements due to the convention of accrual basis of accounting. C. Revenues are recognized as soon as probable and expenses are recognized whe ...

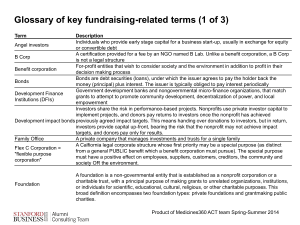

Glossary of Key Fundraising

... A PRI is a low-cost loan (or sometimes an equity investment or a guarantee), provided at belowmarket rates, to strengthen the recipient’s mission-focused work. The lending foundation is reasonably confident of repayment of its full principal amount with some limited returns. The goal of the PRI is f ...

... A PRI is a low-cost loan (or sometimes an equity investment or a guarantee), provided at belowmarket rates, to strengthen the recipient’s mission-focused work. The lending foundation is reasonably confident of repayment of its full principal amount with some limited returns. The goal of the PRI is f ...

Sao Tome and Principe

... Civil Society Oversight. The four domain scores are weighted and combined and a risk penalty is added for individual domain scores that exceed the overall country risk score. Each country is given a score from 1 to 100 for each domain, and for the total bribery risk. A higher score indicates a highe ...

... Civil Society Oversight. The four domain scores are weighted and combined and a risk penalty is added for individual domain scores that exceed the overall country risk score. Each country is given a score from 1 to 100 for each domain, and for the total bribery risk. A higher score indicates a highe ...

Seeing the positive - The Business Times

... the past years, and Asian investors have been particularly keen on Asian fixed income. We ask David Tan, Allianz Global Investors chief investment officer, Asia Pacific, to share his views. Q. What do you see as the major themes or underpinnings (structural or cyclical) that would benefit Asian fixe ...

... the past years, and Asian investors have been particularly keen on Asian fixed income. We ask David Tan, Allianz Global Investors chief investment officer, Asia Pacific, to share his views. Q. What do you see as the major themes or underpinnings (structural or cyclical) that would benefit Asian fixe ...

Document

... macroprudential frameworks are maximised. In order to do so, jurisdictions must develop appropriate institutional frameworks or regulatory architecture. While these may differ across countries due to national circumstances, some important features can be defined. First, is it important that clear ma ...

... macroprudential frameworks are maximised. In order to do so, jurisdictions must develop appropriate institutional frameworks or regulatory architecture. While these may differ across countries due to national circumstances, some important features can be defined. First, is it important that clear ma ...

TAIEX_use_test_v2

... Fit to the business The modelling approaches reflect the nature, scale and complexity of the risks inherent in the business of the undertaking which are within the scope of IM. The outputs of IM and the content of the internal and external reporting of the undertaking are consistent. IM is ca ...

... Fit to the business The modelling approaches reflect the nature, scale and complexity of the risks inherent in the business of the undertaking which are within the scope of IM. The outputs of IM and the content of the internal and external reporting of the undertaking are consistent. IM is ca ...

Hannover Life Reassurance Company of America

... as to the accuracy, completeness or updated status of such information. Some of the statements in this presentation may be forward-looking statements or statements of future expectations based on currently available information. Such statements naturally are subject to risks and uncertainties. Facto ...

... as to the accuracy, completeness or updated status of such information. Some of the statements in this presentation may be forward-looking statements or statements of future expectations based on currently available information. Such statements naturally are subject to risks and uncertainties. Facto ...

Innovative Financial Instruments for First-of-a-Kind commercial

... projects appears to require a number of approaches Grants - for project preparation / Front-end Engineering & Design (FEED) studies and construction phase only Equity - alongside other investors, especially to help smaller sponsors to fill gaps Loans - for sponsors who can bring equity and for ...

... projects appears to require a number of approaches Grants - for project preparation / Front-end Engineering & Design (FEED) studies and construction phase only Equity - alongside other investors, especially to help smaller sponsors to fill gaps Loans - for sponsors who can bring equity and for ...