Style 1* Title Slide

... Prudent debt management in the years before the crisis played a role in enhancing EM resilience to the crisis. (sometimes requiring difficult cost-risk tradeoffs) During the crisis, debt managers had room to maneuver and were able to adapt quickly – absorbed some risk from the market. The avai ...

... Prudent debt management in the years before the crisis played a role in enhancing EM resilience to the crisis. (sometimes requiring difficult cost-risk tradeoffs) During the crisis, debt managers had room to maneuver and were able to adapt quickly – absorbed some risk from the market. The avai ...

UCI Group Strategy A. Profumo, CEO of

... Dedicated Credit Risk Management units within the parent company and each separate legal entity, responsible for the development and the implementation of credit risk tools, as well as for monitoring and reporting the overall risk within each portfolio Internal RATING SYSTEM1 differentiated by b ...

... Dedicated Credit Risk Management units within the parent company and each separate legal entity, responsible for the development and the implementation of credit risk tools, as well as for monitoring and reporting the overall risk within each portfolio Internal RATING SYSTEM1 differentiated by b ...

Slide 1

... crisis is the possibility for contagion across borders UBS and the “too big to save” problem The international community needs to do much more to coordinate crisis management The crisis has provided many examples of lack of cooperation ...

... crisis is the possibility for contagion across borders UBS and the “too big to save” problem The international community needs to do much more to coordinate crisis management The crisis has provided many examples of lack of cooperation ...

Pew Urges House of Representatives to Support Investment in

... critical flood hazard information and helping state and local governments act to reduce risks from flooding. FEMA National Pre-Disaster Mitigation Program: The National Pre-Disaster Mitigation Program (PDM) provides competitive and formula grants to states, territories, federally-recognized tribes, ...

... critical flood hazard information and helping state and local governments act to reduce risks from flooding. FEMA National Pre-Disaster Mitigation Program: The National Pre-Disaster Mitigation Program (PDM) provides competitive and formula grants to states, territories, federally-recognized tribes, ...

The benefits of growth with lower volatility

... Multi-asset, lower-volatility growth portfolios often include a range of investments that are difficult for other portfolios to access. For instance, among these might be relative value strategies across both equities and interest rates. Positions like these rely on traditional assets but, by taking ...

... Multi-asset, lower-volatility growth portfolios often include a range of investments that are difficult for other portfolios to access. For instance, among these might be relative value strategies across both equities and interest rates. Positions like these rely on traditional assets but, by taking ...

L21-23. - Harvard Kennedy School

... emerging markets than they could domestically. • Households can smooth consumption over time. • In the presence of uncertainty, investors can diversify away some risks. ...

... emerging markets than they could domestically. • Households can smooth consumption over time. • In the presence of uncertainty, investors can diversify away some risks. ...

2.2 - Financial Markets Relevant to Business

... Primary markets are concerned with the formation of new securities. For example, when a company is formed and the shares are first issued, this takes place in the primary market. Later, some of these shares may be sold on to other investors. These activities take place in what is called the secondar ...

... Primary markets are concerned with the formation of new securities. For example, when a company is formed and the shares are first issued, this takes place in the primary market. Later, some of these shares may be sold on to other investors. These activities take place in what is called the secondar ...

The case of a Dominican toll road

... actually attract more visitors. Then in 2006, MIGA agreed to a partial guarantee of 51 percent of the 144a bond issue, including breach of contract coverage, representing first-time four-point cover (expropriation, breach of contract, transfer restriction, and war and civil disturbance) of a capital ...

... actually attract more visitors. Then in 2006, MIGA agreed to a partial guarantee of 51 percent of the 144a bond issue, including breach of contract coverage, representing first-time four-point cover (expropriation, breach of contract, transfer restriction, and war and civil disturbance) of a capital ...

CH06 - Class Index

... Define “return” and state its two components. Explain the relationship between return and risk. Identify the sources of risk. Describe the different methods of measuring returns. • Describe the different methods of measuring risk. • Discuss the returns and risks from investing in major financial ass ...

... Define “return” and state its two components. Explain the relationship between return and risk. Identify the sources of risk. Describe the different methods of measuring returns. • Describe the different methods of measuring risk. • Discuss the returns and risks from investing in major financial ass ...

possible uses of credit registers for measuring credit risk

... – However, those seeking capital injection from Danamodal must sell their NPLs (in excess of 10%) ...

... – However, those seeking capital injection from Danamodal must sell their NPLs (in excess of 10%) ...

THE CFO`S 10-STEP GUIDE TO SLEEPING

... provides solutions to the challenges with an estimated return on investment for each. ...

... provides solutions to the challenges with an estimated return on investment for each. ...

Chapter 6 - Extra Materials

... This risk is associated with a lack of a deep market with many buyers and sellers, and frequent transactions The less liquid a market is, the more likely price concessions are offered by the seller Real estate is a less liquid form of investment when compared with other investments due to the time i ...

... This risk is associated with a lack of a deep market with many buyers and sellers, and frequent transactions The less liquid a market is, the more likely price concessions are offered by the seller Real estate is a less liquid form of investment when compared with other investments due to the time i ...

Boosting Infrastructure Financing through Risk Mitigation Instruments Financing Sources

... E1.Estimate based on Global Insights GDP growth forecast in 2014-2025, ranging from 5,1% to 6%. All data are in real base 2013 2 An additional ~US$ 277 bn (1.5-2% GDP) would be needed to include capex depreciation ...

... E1.Estimate based on Global Insights GDP growth forecast in 2014-2025, ranging from 5,1% to 6%. All data are in real base 2013 2 An additional ~US$ 277 bn (1.5-2% GDP) would be needed to include capex depreciation ...

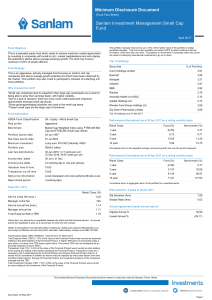

Mutual Funds - McDonaldMath

... -generally require a minimum of $1000 investment -your return is a share of the dividends and/or capital gains/losses -Purchase through brokerage such as Merrill Lynch, TD Waterhouse ...

... -generally require a minimum of $1000 investment -your return is a share of the dividends and/or capital gains/losses -Purchase through brokerage such as Merrill Lynch, TD Waterhouse ...