Using Candlestick Charts to Trade Forex copy

... The “shadows” or “wicks” of the candle consist of a line protruding up from the top that visually indicates the high point of the time period, as well as a line protruding down from the bottom of the body that shows the low point of the time period. These shadows show how much the currency pair’s ex ...

... The “shadows” or “wicks” of the candle consist of a line protruding up from the top that visually indicates the high point of the time period, as well as a line protruding down from the bottom of the body that shows the low point of the time period. These shadows show how much the currency pair’s ex ...

21 CANDLESTICKS EVERY TRADER SHOULD KNOW

... From 10075 the Dow advanced over the next month to a peak just below 10600. For almost a month, in what must have seemed like an eternity for traders, the Dow vacillated in an excruciatingly narrow range between 10400 and 10600. When it finally got beyond resistance at 10600, it formed three dojilik ...

... From 10075 the Dow advanced over the next month to a peak just below 10600. For almost a month, in what must have seemed like an eternity for traders, the Dow vacillated in an excruciatingly narrow range between 10400 and 10600. When it finally got beyond resistance at 10600, it formed three dojilik ...

Catching falling knives: speculating on market overreaction

... Computerization has enabled market participants to quickly access and process data on prices and order flows, and to base their trading on this information. Between 1996 and 2002, the impact on prices of pressure coming from order imbalances has dramatically declined due to countervailing trades by ...

... Computerization has enabled market participants to quickly access and process data on prices and order flows, and to base their trading on this information. Between 1996 and 2002, the impact on prices of pressure coming from order imbalances has dramatically declined due to countervailing trades by ...

Technical Analysis

... through recognition of chart patterns. Technical analysis stands in contrast to the fundamental analysis approach to security and stock analysis. Technical analysis analyses price, volume and other market information, whereas fundamental analysis looks at the actual facts of the company, market, cur ...

... through recognition of chart patterns. Technical analysis stands in contrast to the fundamental analysis approach to security and stock analysis. Technical analysis analyses price, volume and other market information, whereas fundamental analysis looks at the actual facts of the company, market, cur ...

Strategic Informed Trades, Diversification, and Expected Returns*

... of informed traders is small, they trade less aggressively on their private information so as to limit the information that uninformed traders can learn from price. This lowers the average precision of information and increases the risk borne by uninformed traders, which raises cost of capital. In ...

... of informed traders is small, they trade less aggressively on their private information so as to limit the information that uninformed traders can learn from price. This lowers the average precision of information and increases the risk borne by uninformed traders, which raises cost of capital. In ...

Liquidity Provision, Information, and Inventory - cfr

... incremental execution costs on earnings announcements days, when information uncertainty and the value of private information are high. Bloomfield et al. (2005) show that, in an experimental set-up, informed traders use market orders when the value of information is high. Results here show that info ...

... incremental execution costs on earnings announcements days, when information uncertainty and the value of private information are high. Bloomfield et al. (2005) show that, in an experimental set-up, informed traders use market orders when the value of information is high. Results here show that info ...

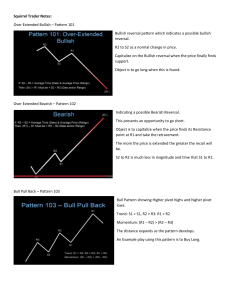

Squirrel Trader Notes: Over Extended Bullish – Pattern 101 Bullish

... This Pattern illustrates slowing bullish momentum because the distance between the pivot Highs decreases as the pattern develops. Notice that an official break in support has not occurred at this point and support is still trending upward. The Objective of this pattern is to capitalize on the previo ...

... This Pattern illustrates slowing bullish momentum because the distance between the pivot Highs decreases as the pattern develops. Notice that an official break in support has not occurred at this point and support is still trending upward. The Objective of this pattern is to capitalize on the previo ...

The art of Japanese candlestick charting

... It has been rumored that candlestick charts were first introduced near the beginning of the Meiji era (around 1870) by an Englishman and were used primarily for the silver market in Yokohama. However, the most widely accepted theory as to how candlesticks were introduced into Japanese culture is tha ...

... It has been rumored that candlestick charts were first introduced near the beginning of the Meiji era (around 1870) by an Englishman and were used primarily for the silver market in Yokohama. However, the most widely accepted theory as to how candlesticks were introduced into Japanese culture is tha ...

The Art of Japanese Candlestick Charting By Brett Fogle

... It has been rumored that candlestick charts were first introduced near the beginning of the Meiji era (around 1870) by an Englishman and were used primarily for the silver market in Yokohama. However, the most widely accepted theory as to how candlesticks were introduced into Japanese culture is tha ...

... It has been rumored that candlestick charts were first introduced near the beginning of the Meiji era (around 1870) by an Englishman and were used primarily for the silver market in Yokohama. However, the most widely accepted theory as to how candlesticks were introduced into Japanese culture is tha ...

THE MAJOR CANDLESTICKS SIGNALS

... Bearish Engulfing Signal A simple description of the Bearish Engulfing signal reveals why the signal works very well as a candlestick sell signal. This is the stock market data that an investor should be using for both technical analysis as well as fundamental analysis. The information conveyed in t ...

... Bearish Engulfing Signal A simple description of the Bearish Engulfing signal reveals why the signal works very well as a candlestick sell signal. This is the stock market data that an investor should be using for both technical analysis as well as fundamental analysis. The information conveyed in t ...

PeteKyle_TaoLin_2002..

... others, but traders agree to disagree about which signal is most important. Traders do not share a common prior. Assuming exponential utility and normally distributed random variables, a simple closed-form solution exists in which the price is a linear combination of the current dividend and the ave ...

... others, but traders agree to disagree about which signal is most important. Traders do not share a common prior. Assuming exponential utility and normally distributed random variables, a simple closed-form solution exists in which the price is a linear combination of the current dividend and the ave ...

the az guide to e-mini futures trading

... Accumulative Swing Index When to use Accumulative Swing Index: Used as a trading tool to attempt to determine a long-term trend of a market. Simply put, if the Index is higher, generally the trend is also higher and on the inverse, should the Index point down, the market could be headed the same di ...

... Accumulative Swing Index When to use Accumulative Swing Index: Used as a trading tool to attempt to determine a long-term trend of a market. Simply put, if the Index is higher, generally the trend is also higher and on the inverse, should the Index point down, the market could be headed the same di ...

Trading Dynamics between Informed and Noise Traders

... Financial economists who want to carry out an empirical test on the hypothesis generally resort to econometric analysis so that the significance of the variables of interest can be identified or some kind of causality between variables can be hoped to tease out. Though the testing model is straightf ...

... Financial economists who want to carry out an empirical test on the hypothesis generally resort to econometric analysis so that the significance of the variables of interest can be identified or some kind of causality between variables can be hoped to tease out. Though the testing model is straightf ...

12 Signals to Master any Market

... Bearish Engulfing Signal A simple description of the Bearish Engulfing signal reveals why the signal works very well as a candlestick sell signal. This is the stock market data that an investor should be using for both technical analysis as well as fundamental analysis. The information conveyed in ...

... Bearish Engulfing Signal A simple description of the Bearish Engulfing signal reveals why the signal works very well as a candlestick sell signal. This is the stock market data that an investor should be using for both technical analysis as well as fundamental analysis. The information conveyed in ...

Chapter Eight Japanese Candle Chart Candle chart (also called

... Candle chart (also called candlestick) analysis has been used since the 18 century by Japanese rice traders to predict the rice price’s movement. According to sources, a famous trader named Homma has discovered that studying market emotions could be useful to determine future trends and has develope ...

... Candle chart (also called candlestick) analysis has been used since the 18 century by Japanese rice traders to predict the rice price’s movement. According to sources, a famous trader named Homma has discovered that studying market emotions could be useful to determine future trends and has develope ...

B04 Chapter 04 Japanese Candlesticks 1.

... and trendlines can be added to it in order to decide on entrance and exit points, and at what prices to place stops. All these charts can also be displayed on an arithmetic or logarithmic scale. The types of charts and the scale used depends on what information the technical analyst considers to be ...

... and trendlines can be added to it in order to decide on entrance and exit points, and at what prices to place stops. All these charts can also be displayed on an arithmetic or logarithmic scale. The types of charts and the scale used depends on what information the technical analyst considers to be ...

PPTX - DocDroid

... difference of even a single pip can render the signal useless, especially since they tell the user not only what course of action to take but also when they should do it. To this effect, Binary Options Signal providers thus use certain delivery methods to get the information across to their clients, ...

... difference of even a single pip can render the signal useless, especially since they tell the user not only what course of action to take but also when they should do it. To this effect, Binary Options Signal providers thus use certain delivery methods to get the information across to their clients, ...

Stock Trading Using Analytics - American Institute of Science

... buy/sell order is placed. The second strategy is based on the volume average weighted prices in which the weighted prices for the entire market is computed and compared with the average price for the first orders in the buy book. Based on the higher/lower than the threshold hold value buy/sell order ...

... buy/sell order is placed. The second strategy is based on the volume average weighted prices in which the weighted prices for the entire market is computed and compared with the average price for the first orders in the buy book. Based on the higher/lower than the threshold hold value buy/sell order ...

short term patterns

... An Inside Bar (Bullish) indicates a possible reversal of the current downtrend to a new uptrend. This pattern is an indication of a financial instrument's SHORT-TERM outlook. Two-bar patterns reflect changes in investor psychology that have a very short-term influence on future prices - typically le ...

... An Inside Bar (Bullish) indicates a possible reversal of the current downtrend to a new uptrend. This pattern is an indication of a financial instrument's SHORT-TERM outlook. Two-bar patterns reflect changes in investor psychology that have a very short-term influence on future prices - typically le ...

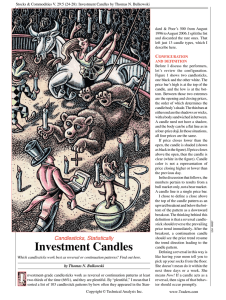

Investment Candles I

... one black and the other white. The price bar’s high is at the top of the candle, and the low is at the bottom. Between those two extremes are the opening and closing prices, the order of which determines the candle body’s shade. The thin bars at either end are the shadows or wicks, with a body sandw ...

... one black and the other white. The price bar’s high is at the top of the candle, and the low is at the bottom. Between those two extremes are the opening and closing prices, the order of which determines the candle body’s shade. The thin bars at either end are the shadows or wicks, with a body sandw ...

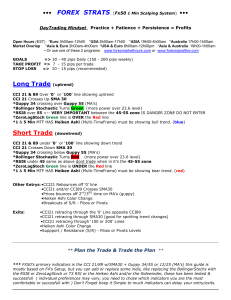

Long Trade (uptrend) Short Trade (downtrend)

... and it will likely continue. Here, the trader will have a hands-off approach to profits while strongly considering adding on to the position. Positive candles (blue) containing shadows or wicks: Strength continues to support the price action higher. At this point, with upside potential still present ...

... and it will likely continue. Here, the trader will have a hands-off approach to profits while strongly considering adding on to the position. Positive candles (blue) containing shadows or wicks: Strength continues to support the price action higher. At this point, with upside potential still present ...

On a long-term chart, trend lines drawn with closing price are more

... There has been much debate on the Chart Forum over the years as to whether trendlines should be drawn on log scale or normal scale charts. The case for log scale has been summarized by Alsoran as: ...

... There has been much debate on the Chart Forum over the years as to whether trendlines should be drawn on log scale or normal scale charts. The case for log scale has been summarized by Alsoran as: ...

Candlestick Patterns

... and push the price back down. It finally closes at or near the lows for the day. The close has negated most of the previous days gains. The bulls are now concerned. They obviously see that the uptrend may have stopped. This signal makes for a good short, with a stop being the high of the black candl ...

... and push the price back down. It finally closes at or near the lows for the day. The close has negated most of the previous days gains. The bulls are now concerned. They obviously see that the uptrend may have stopped. This signal makes for a good short, with a stop being the high of the black candl ...

Answer Key

... reduction would result in lower price and higher quantity. However, at the same time, demand reduces, meaning that at every price level, the quantity demanded becomes lower. This effect ...

... reduction would result in lower price and higher quantity. However, at the same time, demand reduces, meaning that at every price level, the quantity demanded becomes lower. This effect ...

Slide 1 - Acsu Buffalo

... (quoted spread). The quoted spread gives an estimation of the remuneration of the service provided by dealers to traders. The remuneration increases with the spread. Dealers make money by buying low and selling high. They lose money when market conditions lead them to buy at high prices and sell ...

... (quoted spread). The quoted spread gives an estimation of the remuneration of the service provided by dealers to traders. The remuneration increases with the spread. Dealers make money by buying low and selling high. They lose money when market conditions lead them to buy at high prices and sell ...

Price action trading

The concept of price action trading embodies the analysis of basic price movement as a methodology for financial speculation, as used by many retail traders and often institutionally where algorithmic trading is not employed. Since it ignores the fundamental factors of a security and looks primarily at the security's price history — although sometimes it considers values derived from that price history — it is a form of technical analysis. What differentiates it from most forms of technical analysis is that its main focus is the relation of a security's current price to its past prices as opposed to values derived from that price history. This past history includes swing highs and swing lows, trend lines, and support and resistance levels.At its most simplistic, it attempts to describe the human thought processes invoked by experienced, non-disciplinary traders as they observe and trade their markets. Price action is simply how prices change - the action of price. It is readily observed in markets where liquidity and price volatility are highest, but anything that is bought or sold freely in a market will per se demonstrate price action. Price action trading can be included under the umbrella of technical analysis but is covered here in a separate article because it incorporates the behavioural analysis of market participants as a crowd from evidence displayed in price action - a type of analysis whose academic coverage isn't focused in any one area, rather is widely described and commented on in the literature on trading, speculation, gambling and competition generally. It includes a large part of the methodology employed by floor traders and tape readers. It can also optionally include analysis of volume and level 2 quotes.The trader observes the relative size, shape, position, growth (when watching the current real-time price) and volume (optionally) of the bars on an OHLC bar or candlestick chart, starting as simple as a single bar, most often combined with chart formations found in broader technical analysis such as moving averages, trend lines or trading ranges. The use of price action analysis for financial speculation doesn't exclude the simultaneous use of other techniques of analysis, and on the other hand, a minimalist price action trader can rely completely on the behavioural interpretation of price action to build a trading strategy.The various authors who write about price action, e.g. Brooks, Duddella, give names to the price action chart formations and behavioural patterns they observe, which may or may not be unique to that author and known under other names by other authors (more investigation into other authors to be done here). These patterns can often only be described subjectively and the idealized formation or pattern can in reality appear with great variation.This article attempts to outline most major candlestick bars, patterns, chart formations, behavioural observations and trade setups that are used in price action trading. It covers the way that they are interpreted by price action traders, whether they signal likely future market direction, and how the trader would place orders correspondingly to profit from that (and where protective exit orders would be placed to minimise losses when wrong). Since price action traders combine bars, patterns, formations, behaviours and setups together with other bars, patterns, formations etc. to create further setups, many of the descriptions here will refer to other descriptions in the article. The layout of descriptions here is linear, but there is no one perfect sequence - they appear here loosely in the sequence: behavioural observations, trends, reversals and trading ranges. This editing approach reflects the nature of price action, sub-optimal as it might appear.