Floating rate Term Deposits

... benchmark. When interest rate increases, the outflow on the housing loan will be higher, but so will the inflow from the floating rate deposit. Banks normally do not offer such products, as they do not have the technology to support them. The reason that floating rate of interest is now being offere ...

... benchmark. When interest rate increases, the outflow on the housing loan will be higher, but so will the inflow from the floating rate deposit. Banks normally do not offer such products, as they do not have the technology to support them. The reason that floating rate of interest is now being offere ...

The Financial Holding Company (FHC)

... Banking’s Principal Competitors • Banking’s principal competitors – credit unions, savings associations, finance companies, insurance firms, pension fund and mutual fund companies, security dealers, hedge funds, investment banks and other financial firms. • It’s all becoming blurry in many ways to k ...

... Banking’s Principal Competitors • Banking’s principal competitors – credit unions, savings associations, finance companies, insurance firms, pension fund and mutual fund companies, security dealers, hedge funds, investment banks and other financial firms. • It’s all becoming blurry in many ways to k ...

growth and profitability of commercial bank

... profitability is essential and crucial to all stakeholders and the stability of the economy. The banking sector in any economy serves as a catalyst for economic growth and development from the perspective of the supply-leading hypothesis of the relationship between finance and economic growth. Banks ...

... profitability is essential and crucial to all stakeholders and the stability of the economy. The banking sector in any economy serves as a catalyst for economic growth and development from the perspective of the supply-leading hypothesis of the relationship between finance and economic growth. Banks ...

Chapter 17

... Systemic risks in crisis • This credit crisis is through freeze of liquidity in the banking system, different from the traditional deposit runs – Deposit insurance effectively stopped the bank runs by depositors – But modern banking depends more on money markets for sources of funding ...

... Systemic risks in crisis • This credit crisis is through freeze of liquidity in the banking system, different from the traditional deposit runs – Deposit insurance effectively stopped the bank runs by depositors – But modern banking depends more on money markets for sources of funding ...

The Broken Bank White Paper_v10

... evolved businesses must take responsibility for this change and demand a better way of banking. Radical innovation from emerging financial technology or “fintech” companies is taking root. Fintech leverages technology to craft modern systems and solutions to the antiquated banking business model, brin ...

... evolved businesses must take responsibility for this change and demand a better way of banking. Radical innovation from emerging financial technology or “fintech” companies is taking root. Fintech leverages technology to craft modern systems and solutions to the antiquated banking business model, brin ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... banks into the banking industry. As a result of alternative interest rate on deposits and loans, credits were given out indiscriminately without proper credit appraisal (Philip, 1994). The resultant effects were that many of these loans turn out to be bad. It is therefore not surprising to find bank ...

... banks into the banking industry. As a result of alternative interest rate on deposits and loans, credits were given out indiscriminately without proper credit appraisal (Philip, 1994). The resultant effects were that many of these loans turn out to be bad. It is therefore not surprising to find bank ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... reform are able to increase cost efficiency and eventually to offer cheaper services to clients. Banks from nonmember EU countries are less cost efficient but experienced much higher total productivity growth level, and large sized banks are much more cost efficient than medium and small banks, whil ...

... reform are able to increase cost efficiency and eventually to offer cheaper services to clients. Banks from nonmember EU countries are less cost efficient but experienced much higher total productivity growth level, and large sized banks are much more cost efficient than medium and small banks, whil ...

Were Banks Special Intermediaries in the Late Nineteenth Century

... Eugene N. White is a professor of economics at Rutgers University. The author thanks Michael Bordo, Per Hansen, Naomi Lamoreaux, David Weil, David Wheelock, and the other participants in the Federal Reserve Bank of St. Louis’ Twenty-Second Annual Economic Policy Conference ...

... Eugene N. White is a professor of economics at Rutgers University. The author thanks Michael Bordo, Per Hansen, Naomi Lamoreaux, David Weil, David Wheelock, and the other participants in the Federal Reserve Bank of St. Louis’ Twenty-Second Annual Economic Policy Conference ...

Lessons from a collapse of a financial system

... The rapid rise of the Icelandic banks is unprecedented in the recent history of banking. This was a nation with no history of international banking where a recently privatised banking system and liberalised capital markets allowed perfect capital mobility for the first time in its history. The pace ...

... The rapid rise of the Icelandic banks is unprecedented in the recent history of banking. This was a nation with no history of international banking where a recently privatised banking system and liberalised capital markets allowed perfect capital mobility for the first time in its history. The pace ...

Economic gowth and stability is positive related to well

... source of this study is the annual financial statements of the commercial banks listed in Karachi Stock Exchange. Total listed commercial banks are 39; out of which 29 are private banks, 9 are state-owned and remaining one is public. Eleven banks have to be disqualified form original sample; most o ...

... source of this study is the annual financial statements of the commercial banks listed in Karachi Stock Exchange. Total listed commercial banks are 39; out of which 29 are private banks, 9 are state-owned and remaining one is public. Eleven banks have to be disqualified form original sample; most o ...

FA1 examiner`s report December 2016

... charges of $500, and a BACS receipt from a customer of $700. In addition, there are uncleared lodgements of ...

... charges of $500, and a BACS receipt from a customer of $700. In addition, there are uncleared lodgements of ...

From low to negative rates

... estimate a panel model to study the effects of prolonged low interest rates on banks in Austria. It shows that the profitability of banks declines in times of low interest rate environments. However, we are skeptical of extrapolating these findings to the negative environment. In a negative environm ...

... estimate a panel model to study the effects of prolonged low interest rates on banks in Austria. It shows that the profitability of banks declines in times of low interest rate environments. However, we are skeptical of extrapolating these findings to the negative environment. In a negative environm ...

Degree of Leverage Ratio Analysis in the Iranian Banking Network

... There are several factors that affect the formation of funding structure within a project. Some are internal based on the use of a combination of funding which includes external debt and common and preferred shares, according to these projects needs’ of funding in addition to the quality of availabl ...

... There are several factors that affect the formation of funding structure within a project. Some are internal based on the use of a combination of funding which includes external debt and common and preferred shares, according to these projects needs’ of funding in addition to the quality of availabl ...

model answers and marking scheme

... this risk whenever assets owned or claims issued can change following broad economic factors e.g. interest rates and foreign exchange rates. Therefore, banks put in place mechanisms to track, monitor and limit their exposure to assets and liabilities that are affected by these variables. Other forms ...

... this risk whenever assets owned or claims issued can change following broad economic factors e.g. interest rates and foreign exchange rates. Therefore, banks put in place mechanisms to track, monitor and limit their exposure to assets and liabilities that are affected by these variables. Other forms ...

Existing proposals for taming procyclicality

... • Some variables, both macroeconomic and bank-specific, had statistically significant effect on the size of the loan loss provisions. • As expected, the coefficient on GDP growth was generally negative (though often not significant), indicating that provisioning is higher during economic downswings ...

... • Some variables, both macroeconomic and bank-specific, had statistically significant effect on the size of the loan loss provisions. • As expected, the coefficient on GDP growth was generally negative (though often not significant), indicating that provisioning is higher during economic downswings ...

Bail-in or bail-out: The case of Spain Philipp Bagus, Juan Ramón

... European Investment Bank have preference over claims from large corporations, giving room for considerable discretionary action. Third, secured liabilities such as covered bonds are excluded. This exclusion means that the ECB is protected from losses, because its refinancing operations to the bankin ...

... European Investment Bank have preference over claims from large corporations, giving room for considerable discretionary action. Third, secured liabilities such as covered bonds are excluded. This exclusion means that the ECB is protected from losses, because its refinancing operations to the bankin ...

Foreign banks in Latin America

... The financial reforms introduced in Latin America during the last two decades differed from country to country, not only in terms of when the reforms were implemented but also in their intensity and scope. To simplify the analysis, however, they can be divided into two phases, in some cases overlapp ...

... The financial reforms introduced in Latin America during the last two decades differed from country to country, not only in terms of when the reforms were implemented but also in their intensity and scope. To simplify the analysis, however, they can be divided into two phases, in some cases overlapp ...

GROW... - Amerisource Funding

... total cost of a Cash Advance. With Cash Advance, the client gets the advance paid directly into their checking account. The client then has to start making daily repayments (deducted directly from their checking account) to pay off the Advance in 3 – 6 months. Many clients, after only a short time, ...

... total cost of a Cash Advance. With Cash Advance, the client gets the advance paid directly into their checking account. The client then has to start making daily repayments (deducted directly from their checking account) to pay off the Advance in 3 – 6 months. Many clients, after only a short time, ...

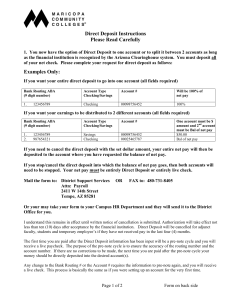

Direct Deposit Instructions Please Read Carefully Examples Only:

... Or your may take your form to your Campus HR Department and they will send it to the District Office for you. I understand this remains in effect until written notice of cancellation is submitted. Authorization will take effect not less than ten (10) days after acceptance by the financial institutio ...

... Or your may take your form to your Campus HR Department and they will send it to the District Office for you. I understand this remains in effect until written notice of cancellation is submitted. Authorization will take effect not less than ten (10) days after acceptance by the financial institutio ...

Slide sem título - World Bank Group

... reduction in profitability from 2001 to 2004 being basically due to the appreciation of the Brazilian currency (Real) • Remaining government institutions were restructured and significantly improved their earnings performance • Domestic private banks confirm their good phase with a leap in profits f ...

... reduction in profitability from 2001 to 2004 being basically due to the appreciation of the Brazilian currency (Real) • Remaining government institutions were restructured and significantly improved their earnings performance • Domestic private banks confirm their good phase with a leap in profits f ...

Growth in Agricultural Loan Market Share for

... The percentage change in agricultural loanto-deposit ratio (PCALDR) measures the change in the portfolio decision of a commercial bank. Commercial banks service all sectors of the economy, and a decision must be made as to what proportion of the loan fhnds will be allocated to ...

... The percentage change in agricultural loanto-deposit ratio (PCALDR) measures the change in the portfolio decision of a commercial bank. Commercial banks service all sectors of the economy, and a decision must be made as to what proportion of the loan fhnds will be allocated to ...

Narrow banking with modern depository institutions: Is there a

... wishes to make a payment to be done at another bank, this payment is usually done with reserves. The second reason is to satisfy reserve requirements wherever these requirements are in place. Thus, reserve demand is driven both by regulation as well as by the netting of payments derived from the lo ...

... wishes to make a payment to be done at another bank, this payment is usually done with reserves. The second reason is to satisfy reserve requirements wherever these requirements are in place. Thus, reserve demand is driven both by regulation as well as by the netting of payments derived from the lo ...

Hanke - 1 The Fed: The Great Enabler By

... real or perceived economic trouble and provide emergency relief. It does this by pushing interest rates below where the market would have set them. With interest rates artificially low, consumers reduce savings in favor of consumption, and entrepreneurs increase their rates of investment spending. T ...

... real or perceived economic trouble and provide emergency relief. It does this by pushing interest rates below where the market would have set them. With interest rates artificially low, consumers reduce savings in favor of consumption, and entrepreneurs increase their rates of investment spending. T ...

Ch 18 - Money and Banking

... services they offer. Explain how banks create money and identify the means by which they are regulated. Explain the functions of the Bank of Canada and describe the tools it uses to control the money supply. Identify ways in which the banking industry is changing. Understand some of the activities i ...

... services they offer. Explain how banks create money and identify the means by which they are regulated. Explain the functions of the Bank of Canada and describe the tools it uses to control the money supply. Identify ways in which the banking industry is changing. Understand some of the activities i ...

Bank

A bank is a financial intermediary that creates credit by lending money to a borrower, thereby creating a corresponding deposit on the bank's balance sheet. Lending activities can be performed either directly or indirectly through capital markets. Due to their importance in the financial system and influence on national economies, banks are highly regulated in most countries. Most nations have institutionalized a system known as fractional reserve banking under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, known as the Basel Accords.Banking in its modern sense evolved in the 14th century in the rich cities of Renaissance Italy but in many ways was a continuation of ideas and concepts of credit and lending that had their roots in the ancient world. In the history of banking, a number of banking dynasties — notably, the Medicis, the Fuggers, the Welsers, the Berenbergs and the Rothschilds — have played a central role over many centuries. The oldest existing retail bank is Monte dei Paschi di Siena, while the oldest existing merchant bank is Berenberg Bank.