Analysis of Non-Interest Income of Commercial Banks in Ghana

... economic press but also research studies have documented this issue as bank income is increasingly generated through nontraditional activities (Tortosa-Ausina, 2003). Fee income is among the most rapidly growing sources of revenue for depository institutions [Rose and Hudgins (2008)]. Since the 1980 ...

... economic press but also research studies have documented this issue as bank income is increasingly generated through nontraditional activities (Tortosa-Ausina, 2003). Fee income is among the most rapidly growing sources of revenue for depository institutions [Rose and Hudgins (2008)]. Since the 1980 ...

search for yield

... to increased risk taking Since the financial crisis 2008-2009, the policy rates in several advanced economies have been at historically-low levels during relatively long periods of time (see Figure 1). Moreover, central banks in the United States, the euro area and the United Kingdom, among others, ...

... to increased risk taking Since the financial crisis 2008-2009, the policy rates in several advanced economies have been at historically-low levels during relatively long periods of time (see Figure 1). Moreover, central banks in the United States, the euro area and the United Kingdom, among others, ...

financial liberalization, multinational banks and credit supply

... economy is gradually improving (Annual Reports; NBP, Information Bulletin, various issues). With the reorientation of domestic bank activities away from enterprise credit in the face of more international financial competition and persistently low capital levels, it is noteworthy that less loans by ...

... economy is gradually improving (Annual Reports; NBP, Information Bulletin, various issues). With the reorientation of domestic bank activities away from enterprise credit in the face of more international financial competition and persistently low capital levels, it is noteworthy that less loans by ...

Financial System Classification

... Also the problems of moral hazard, asymmetric information and vague accounting have come to play the first role during this crisis. Stiglitz (2003) asserts that increased corruption within top-management and rating agencies undermines the very heart of market-based financial system – its information ...

... Also the problems of moral hazard, asymmetric information and vague accounting have come to play the first role during this crisis. Stiglitz (2003) asserts that increased corruption within top-management and rating agencies undermines the very heart of market-based financial system – its information ...

PSF Conservative Balanced Portfolio

... Investors should consider the contract and the underlying portfolios’ investment objectives, risks, and charges and expenses carefully before investing. The contract’s prospectus and the underlying portfolios’ prospectus contain this and other important information. Read them carefully before invest ...

... Investors should consider the contract and the underlying portfolios’ investment objectives, risks, and charges and expenses carefully before investing. The contract’s prospectus and the underlying portfolios’ prospectus contain this and other important information. Read them carefully before invest ...

power consistency - Voya Investment Management

... A fund may invest in securities guaranteed by the U.S. government as to timely payment of interest and principal, but a fund’s shares are Not Insured or Guaranteed. Bonds have fixed principal and return if held to maturity, but may fluctuate in the interim. Generally, when interest rates rise, bond ...

... A fund may invest in securities guaranteed by the U.S. government as to timely payment of interest and principal, but a fund’s shares are Not Insured or Guaranteed. Bonds have fixed principal and return if held to maturity, but may fluctuate in the interim. Generally, when interest rates rise, bond ...

Financial Engineering in the U.S.

... Bernanke in cajoling outside institution into acquiring Bear Stearns, Merrill Lynch, Washington Mutual, Wachovia, and more has yet to fully play out. The most troubled ...

... Bernanke in cajoling outside institution into acquiring Bear Stearns, Merrill Lynch, Washington Mutual, Wachovia, and more has yet to fully play out. The most troubled ...

Large American Banks and Economic Recovery

... These hits directly damaged the financial sector, but their effects were felt in numerous industries which relied on loan-giving institutions in order to maintain cash flows and perform daily business operations (Havemann). The housing crisis helped fuel the collapse of the banking and financial se ...

... These hits directly damaged the financial sector, but their effects were felt in numerous industries which relied on loan-giving institutions in order to maintain cash flows and perform daily business operations (Havemann). The housing crisis helped fuel the collapse of the banking and financial se ...

The Global Crisis and the Remedial Actions

... “quasi-rents” as determined by profits and losses in the short run (Davidson 1999, pp. 91-92). With availability of credit and information technology which make for fast communications, perceptions are also prone to quick revisions. This explains the bandwagon effects often observed in the financial ...

... “quasi-rents” as determined by profits and losses in the short run (Davidson 1999, pp. 91-92). With availability of credit and information technology which make for fast communications, perceptions are also prone to quick revisions. This explains the bandwagon effects often observed in the financial ...

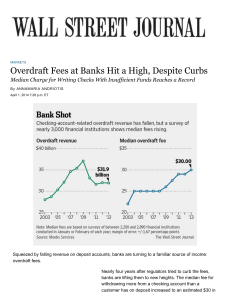

Overdraft fees at banks make a comeback, hitting a record.

... The 2010 Fed regulation required customers to give banks permission to allow overdrafts for debit-card and ATM transactions. Those who don't opt in aren't able to use their debit cards or make withdrawals if they don't have the available funds. Overdraft fees linked to checks and some online bill pa ...

... The 2010 Fed regulation required customers to give banks permission to allow overdrafts for debit-card and ATM transactions. Those who don't opt in aren't able to use their debit cards or make withdrawals if they don't have the available funds. Overdraft fees linked to checks and some online bill pa ...

Document

... • take into consideration risks that are not defined under Pillar 1such as, market risk (capital charges for price and FX risk,) liquidity risk (no capital charge, additional arrangements) ...

... • take into consideration risks that are not defined under Pillar 1such as, market risk (capital charges for price and FX risk,) liquidity risk (no capital charge, additional arrangements) ...

Quantifying Domestic Effects of Foreign Bank Shocks in the Great

... Global banks actively allocate funds across their banking organizations, in normal times and in stress periods (Cetorelli and Goldberg forthcoming). During the Great Recession, some foreign locations of U.S. banks were “core investment markets” that continued as destinations for funding, while other ...

... Global banks actively allocate funds across their banking organizations, in normal times and in stress periods (Cetorelli and Goldberg forthcoming). During the Great Recession, some foreign locations of U.S. banks were “core investment markets” that continued as destinations for funding, while other ...

federally-insured money market funds and narrow

... which enables companies to access the ultimate source of funds, the capital markets, without going through banks or other financial intermediaries.”); Bossone, supra (“it is undoubtedly the case that in the advanced economies nonbank quasi-money and financing products are taking increasing business ...

... which enables companies to access the ultimate source of funds, the capital markets, without going through banks or other financial intermediaries.”); Bossone, supra (“it is undoubtedly the case that in the advanced economies nonbank quasi-money and financing products are taking increasing business ...

Delta Strategy Group Summary of Open Meeting (October 13, 2016)

... Commission staff said reforms would modernize reporting in a more structured format. The data collected will give the SEC a better ability to effectively monitor and understand changes in the asset management industry. New disclosures will help inform investors, the Commission, and other stakeholde ...

... Commission staff said reforms would modernize reporting in a more structured format. The data collected will give the SEC a better ability to effectively monitor and understand changes in the asset management industry. New disclosures will help inform investors, the Commission, and other stakeholde ...

4. definitions/terminologies

... Financial asset resulting from the delivery of cash or other assets by a lender to a borrower in return for an obligation to repay on a specified date or dates, or on demand, usually with mark-up or interest. They include repurchase arrangements not included in national broad money definitions (Repo ...

... Financial asset resulting from the delivery of cash or other assets by a lender to a borrower in return for an obligation to repay on a specified date or dates, or on demand, usually with mark-up or interest. They include repurchase arrangements not included in national broad money definitions (Repo ...