Eco120Int_Lecture13

... of goods and services to foreigners (exports), the payments for goods and services bought from foreigners (imports), and also property income (such as interest and profits) and current transfers (such as gifts) received from and paid to foreigner. •Capital account is a summary of country’s asset tra ...

... of goods and services to foreigners (exports), the payments for goods and services bought from foreigners (imports), and also property income (such as interest and profits) and current transfers (such as gifts) received from and paid to foreigner. •Capital account is a summary of country’s asset tra ...

The Euro: Past and Future

... Motivated the European Economic Community to create a monetary system not dependant on the US dollar. ...

... Motivated the European Economic Community to create a monetary system not dependant on the US dollar. ...

CHAPTER 16

... If the American Dollar depreciates in relation to another country’s currency, then this country will want more dollars and will purchase more of our goods because they can get more American merchandise for fewer of their own “dollars” If our currency appreciates in value in relation to foreign cur ...

... If the American Dollar depreciates in relation to another country’s currency, then this country will want more dollars and will purchase more of our goods because they can get more American merchandise for fewer of their own “dollars” If our currency appreciates in value in relation to foreign cur ...

Balance of Payment (BOP)

... Increases debtedness – larger volume of loans might have been taken to develop the economy. This will lead to deficit in the capital and financial market. Repayment of loans with the larger interest for longer period of repayment. ...

... Increases debtedness – larger volume of loans might have been taken to develop the economy. This will lead to deficit in the capital and financial market. Repayment of loans with the larger interest for longer period of repayment. ...

Guyana_en.pdf

... Growth prospects for 2014 in most of the key agricultural sectors are good, in part due to favourable international commodity prices and weather conditions. The sugar sector is expected to rebound to 2012 levels in 2014 after a very poor performance in 2013. Record rice yields are expected, in part ...

... Growth prospects for 2014 in most of the key agricultural sectors are good, in part due to favourable international commodity prices and weather conditions. The sugar sector is expected to rebound to 2012 levels in 2014 after a very poor performance in 2013. Record rice yields are expected, in part ...

Current account (CA)

... The National Income Accounts Gross national product (GNP) • The market value of all final goods and services produced by a country’s factors of production in a year, whether in the country or abroad. ...

... The National Income Accounts Gross national product (GNP) • The market value of all final goods and services produced by a country’s factors of production in a year, whether in the country or abroad. ...

Chapter 13 (12 in 8 th edition) Balance of Payments Accounting

... Year End, 2005 and 2006 (millions of dollars) ...

... Year End, 2005 and 2006 (millions of dollars) ...

What`s Ahead for the World economy

... process by keeping its currency cheap, which raises the domestic price of traded goods relative to others. • Thus productivity growth in the world is doubly endangered. In the rich world it is threatened by a lack of resources for innovation, & in the developing world it is threatened by the loss of ...

... process by keeping its currency cheap, which raises the domestic price of traded goods relative to others. • Thus productivity growth in the world is doubly endangered. In the rich world it is threatened by a lack of resources for innovation, & in the developing world it is threatened by the loss of ...

Lecture 6 (POWER POINT)

... • Surprisingly in Feb of this year, China ran a deficit of $23 billion. The surplus for the first quarter of 2014 was only $7.2 billion ($28.8 billion at annual rate). • More private investment in China than Chinese investment abroad • Official reserve holdings declined to $387.8 billion in 2011, an ...

... • Surprisingly in Feb of this year, China ran a deficit of $23 billion. The surplus for the first quarter of 2014 was only $7.2 billion ($28.8 billion at annual rate). • More private investment in China than Chinese investment abroad • Official reserve holdings declined to $387.8 billion in 2011, an ...

1. The Balance of Payments

... The current account is a statistical record of the trade in goods and services between a country and the rest of the world. The current account consists of the goods balance, the service balance, the income balance, and the unilateral transfer balance. Goods Balance: (the trade balance) it is a reco ...

... The current account is a statistical record of the trade in goods and services between a country and the rest of the world. The current account consists of the goods balance, the service balance, the income balance, and the unilateral transfer balance. Goods Balance: (the trade balance) it is a reco ...

BCA + BKA

... entries that are needed to balance, in the accounting sense, any entries for the foregoing transactions and changes which are not mutually offsetting. • ---- adapted from Balance of Payment Statistics Yearbook 1989, IMF ...

... entries that are needed to balance, in the accounting sense, any entries for the foregoing transactions and changes which are not mutually offsetting. • ---- adapted from Balance of Payment Statistics Yearbook 1989, IMF ...

International Trade - Madison County Schools

... • Determines how equilibrium prices/quantities of exports and imports are determined • Amount of a good or service a nation will export or import depends on differences between the equilibrium world price and the equilibrium domestic price • In absence of trade, the domestic prices in a closed econo ...

... • Determines how equilibrium prices/quantities of exports and imports are determined • Amount of a good or service a nation will export or import depends on differences between the equilibrium world price and the equilibrium domestic price • In absence of trade, the domestic prices in a closed econo ...

Republic of Korea

... When the global financial crisis hit Asia-Pacific towards the end of 2008, GDP growth in the Republic of Korea decelerated markedly. It contracted by 4.2% in the first quarter of 2009, the worst contraction since the Asian financial crisis in 1998. The annual GDP growth dropped from 2.2% in 2008 to ...

... When the global financial crisis hit Asia-Pacific towards the end of 2008, GDP growth in the Republic of Korea decelerated markedly. It contracted by 4.2% in the first quarter of 2009, the worst contraction since the Asian financial crisis in 1998. The annual GDP growth dropped from 2.2% in 2008 to ...

Balance of Payments

... • Change in Relative Interest Rates- impacts short-term capital flows • Example: and increase in the interest rate will increase demand for bonds in that country by foreigners. This will show up as a capital inflow on the capital account, and a strengthening of the exchange rate. • Countries must be ...

... • Change in Relative Interest Rates- impacts short-term capital flows • Example: and increase in the interest rate will increase demand for bonds in that country by foreigners. This will show up as a capital inflow on the capital account, and a strengthening of the exchange rate. • Countries must be ...

Slajd 1 - Warsaw School of Economics

... The cost of reserve maintainance- the appreciation of the remninbi increases the value of liabilities and decreases the value of the assets held in USD The costs of interventions- high levels of reserves cause credit expansion and inflationary pressure despite sterilization Cost for Chinese st ...

... The cost of reserve maintainance- the appreciation of the remninbi increases the value of liabilities and decreases the value of the assets held in USD The costs of interventions- high levels of reserves cause credit expansion and inflationary pressure despite sterilization Cost for Chinese st ...

Chapter 33: International Finance

... relative to the neverback. Of course, since there’s already a large trade deficit, this may not be a viable option. b. Holders of neverbacks will demand foreign currencies (increase supply of neverbacks) since the return on neverback assets has declined. This is shown as a rightward shift in the sup ...

... relative to the neverback. Of course, since there’s already a large trade deficit, this may not be a viable option. b. Holders of neverbacks will demand foreign currencies (increase supply of neverbacks) since the return on neverback assets has declined. This is shown as a rightward shift in the sup ...

Chapter 33: International Finance

... relative to the neverback. Of course, since there’s already a large trade deficit, this may not be a viable option. b. Holders of neverbacks will demand foreign currencies (increase supply of neverbacks) since the return on neverback assets has declined. This is shown as a rightward shift in the sup ...

... relative to the neverback. Of course, since there’s already a large trade deficit, this may not be a viable option. b. Holders of neverbacks will demand foreign currencies (increase supply of neverbacks) since the return on neverback assets has declined. This is shown as a rightward shift in the sup ...

Macro Economic Issues In International Business (1)

... Broadening & deepening capital markets Securing best price possible for sale ...

... Broadening & deepening capital markets Securing best price possible for sale ...

BALANCE OF PAYMENT

... between the residents of a country and the rest of the world. It presents a classified record of all receipts on account of goods exported, services rendered and capital received by residents and payments made by theme on account of goods imported and services received from the capital transferred t ...

... between the residents of a country and the rest of the world. It presents a classified record of all receipts on account of goods exported, services rendered and capital received by residents and payments made by theme on account of goods imported and services received from the capital transferred t ...

Economics R. Glenn Hubbard, Anthony Patrick O`Brien, 2e.

... National Saving = Private Saving + Public Saving S = Sprivate + Spublic S = [I + (G - T) + NX] + (T - G) = I + NFI A country that saves a lot has positive NX and invests abroad -NFI = I - S = I - Sprivate - (T - G) = (I - Sprivate) + (G - T) = - NX ...

... National Saving = Private Saving + Public Saving S = Sprivate + Spublic S = [I + (G - T) + NX] + (T - G) = I + NFI A country that saves a lot has positive NX and invests abroad -NFI = I - S = I - Sprivate - (T - G) = (I - Sprivate) + (G - T) = - NX ...

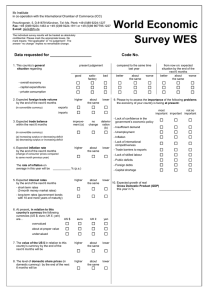

WES Questionnaire (PDF, 25 KB)

... (a) increasing surplus or decreasing deficit (b) decreasing surplus or increasing deficit ...

... (a) increasing surplus or decreasing deficit (b) decreasing surplus or increasing deficit ...

ECB and EMU Exchange Rates

... amounts of their foreign reserves to intervene on the international markets to maintain the value of the currency at the fixed rate. Governments may have to implement policies which are detrimental to the requirements of their own economy. ...

... amounts of their foreign reserves to intervene on the international markets to maintain the value of the currency at the fixed rate. Governments may have to implement policies which are detrimental to the requirements of their own economy. ...

Income Determination - University of Texas at Austin

... Government expenditure Government taxes Monetary policy manipulation of money supply ...

... Government expenditure Government taxes Monetary policy manipulation of money supply ...

Asian Currency Crisis 1997-1998

... Output Growth: Large current account deficits were perceived to be sustainable with high economic growth (1980 debt crisis); Asian growth rates averaged more than 7% of GDP at the time. However, these high rates caused overly-optimistic expectations, downplayed the riskiness of investments, and resu ...

... Output Growth: Large current account deficits were perceived to be sustainable with high economic growth (1980 debt crisis); Asian growth rates averaged more than 7% of GDP at the time. However, these high rates caused overly-optimistic expectations, downplayed the riskiness of investments, and resu ...

Lq Ec Economic Activity

... Also discuss the three classifications of economic development of a country (15 marks) There are three ways of measuring economic growth: 1. Gross national Income –GNI or Gross National Product -GNP and Gross Domestic Product- GDP are accepted as broad-based measure of a country’s overall economic o ...

... Also discuss the three classifications of economic development of a country (15 marks) There are three ways of measuring economic growth: 1. Gross national Income –GNI or Gross National Product -GNP and Gross Domestic Product- GDP are accepted as broad-based measure of a country’s overall economic o ...