Government Expenditures to Lead Long

... current account deficit (that may be decreasing too) • DD curve will shift out in small increments over the long run until full employment is reached • At this point, unemployment will be lower, the rand appreciated, output increased and perhaps even an indirect decrease in current account deficit • ...

... current account deficit (that may be decreasing too) • DD curve will shift out in small increments over the long run until full employment is reached • At this point, unemployment will be lower, the rand appreciated, output increased and perhaps even an indirect decrease in current account deficit • ...

Document

... principle that allows nations to gain from trade. Comparative advantage means that each nation specializes in a product for which its opportunity cost is lower in terms of the production of another product and then nations trade. ...

... principle that allows nations to gain from trade. Comparative advantage means that each nation specializes in a product for which its opportunity cost is lower in terms of the production of another product and then nations trade. ...

Empirical Relation between Real Exchange Rate and Current

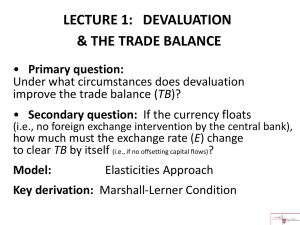

... The positive impacts of devaluation of national currency on current account deficit are one of the main arguments in international economic theory. Basic idea is that countries easily increase their exports and have current account surplus by simply reduce the international value of home currency. T ...

... The positive impacts of devaluation of national currency on current account deficit are one of the main arguments in international economic theory. Basic idea is that countries easily increase their exports and have current account surplus by simply reduce the international value of home currency. T ...

Honduras_en.pdf

... economic slowdown combined with falling international prices for food and petroleum. The year-on-year rate to December fell from 10.8% in 2008 to 3.5% in 2009. Urban unemployment rose from 4.1% in 2008 to 4.9% in May 2009. In January 2009 there was an increase (unprecedented in the country’s recent ...

... economic slowdown combined with falling international prices for food and petroleum. The year-on-year rate to December fell from 10.8% in 2008 to 3.5% in 2009. Urban unemployment rose from 4.1% in 2008 to 4.9% in May 2009. In January 2009 there was an increase (unprecedented in the country’s recent ...

Chapter 28 Exchange Rates and Macroeconomic Policy

... investment and consumption spending, which shifts the AD curve rightward from AD1 to AD2 in panel (b). The lower interest rate also shifts the supply of pounds curve leftward, and the demand for pounds curve rightward in panel (c). The price per pound measured in U.S. dollars rises, and this dollar ...

... investment and consumption spending, which shifts the AD curve rightward from AD1 to AD2 in panel (b). The lower interest rate also shifts the supply of pounds curve leftward, and the demand for pounds curve rightward in panel (c). The price per pound measured in U.S. dollars rises, and this dollar ...

Chapter 16 Exchange Rates and Macroeconomic Policy

... investment and consumption spending, which shifts the AD curve rightward from AD1 to AD2 in panel (b). The lower interest rate also shifts the supply of pounds curve leftward, and the demand for pounds curve rightward in panel (c). The price per pound measured in U.S. dollars rises, and this dollar ...

... investment and consumption spending, which shifts the AD curve rightward from AD1 to AD2 in panel (b). The lower interest rate also shifts the supply of pounds curve leftward, and the demand for pounds curve rightward in panel (c). The price per pound measured in U.S. dollars rises, and this dollar ...

Review, Chapters 15-17

... unemployment (NAIRU) The unemployment rate at which the inflation rate has no tendency to increase or decrease. Equilibrium unemploy “Natural” unemploymt ...

... unemployment (NAIRU) The unemployment rate at which the inflation rate has no tendency to increase or decrease. Equilibrium unemploy “Natural” unemploymt ...

Suriname_en.pdf

... expenditures narrowed owing to restrained public sector spending combined with strong revenues dominated by transfers from the mineral sector, especially oil and gold receipts. The high price for gold will push revenues up to 25.6% of GDP in 2011, while expenditures are expected to be about 27.8% of ...

... expenditures narrowed owing to restrained public sector spending combined with strong revenues dominated by transfers from the mineral sector, especially oil and gold receipts. The high price for gold will push revenues up to 25.6% of GDP in 2011, while expenditures are expected to be about 27.8% of ...

Turkey Presentation - Wharton Finance Department

... Tight Fiscal & Monetary Policy Structural Reforms Comprehensive disinflation program that uses predetermined exchange rate as a nominal anchor ...

... Tight Fiscal & Monetary Policy Structural Reforms Comprehensive disinflation program that uses predetermined exchange rate as a nominal anchor ...

Unit 1.12 - Economic Threats

... Governments try to protect the balance of payments by adjusting exchange rates (through interest rate changes) ...

... Governments try to protect the balance of payments by adjusting exchange rates (through interest rate changes) ...

Globalization

... guarantees, risk management products, and analytical and advisory services Raises most funds on international capital markets Original institution of World Bank ...

... guarantees, risk management products, and analytical and advisory services Raises most funds on international capital markets Original institution of World Bank ...

Barbados_en.pdf

... (from a deficit of 10% of GDP in 2008 to a projected deficit of approximately 5% in 2009), as imports fell by 27.9% between January and June 2009. Exports also declined by 17%, while travel credits from services fell by 10%. The capital and financial account surplus also suffered a 20% reduction whe ...

... (from a deficit of 10% of GDP in 2008 to a projected deficit of approximately 5% in 2009), as imports fell by 27.9% between January and June 2009. Exports also declined by 17%, while travel credits from services fell by 10%. The capital and financial account surplus also suffered a 20% reduction whe ...

Course # and Course Name

... The history of XRs in the U.S. The different types of XR regimes What the Federal Reserve is What the Euro is How the FX market operates ...

... The history of XRs in the U.S. The different types of XR regimes What the Federal Reserve is What the Euro is How the FX market operates ...

F570 International Corporate Finance

... Md is negatively related to i: Higher interest rates increase the opportunity cost of holding cash, so that demand for money falls Md is positively related to Y: Higher income leads to higher demand for money, so money demand rises ...

... Md is negatively related to i: Higher interest rates increase the opportunity cost of holding cash, so that demand for money falls Md is positively related to Y: Higher income leads to higher demand for money, so money demand rises ...

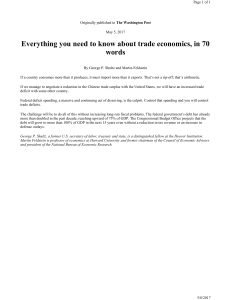

Everything you need to know about trade economics, in 70 words

... By George P. Shultz and Martin Feldstein If a country consumes more than it produces, it must import more than it exports. That’s not a rip-off; that’s arithmetic. If we manage to negotiate a reduction in the Chinese trade surplus with the United States, we will have an increased trade deficit with ...

... By George P. Shultz and Martin Feldstein If a country consumes more than it produces, it must import more than it exports. That’s not a rip-off; that’s arithmetic. If we manage to negotiate a reduction in the Chinese trade surplus with the United States, we will have an increased trade deficit with ...

Saving and Investment in the Open Economy

... We do not know what will adjust in the future to assure that the budget constraint holds. Or in some cases we cannot be sure that the government will not end up failing to adjust future policy and defaulting on debt. For now, assume the government is sure to repay. ...

... We do not know what will adjust in the future to assure that the budget constraint holds. Or in some cases we cannot be sure that the government will not end up failing to adjust future policy and defaulting on debt. For now, assume the government is sure to repay. ...

Word Document

... net factor income from abroad (NFIA) – one country is paid income by another, in compensation for labor, capital, and land (e.g., wages, interest, dividends); net unilateral transfers (NUT) – net amount of transfers the country receives from the rest of the world gross national disposable inco ...

... net factor income from abroad (NFIA) – one country is paid income by another, in compensation for labor, capital, and land (e.g., wages, interest, dividends); net unilateral transfers (NUT) – net amount of transfers the country receives from the rest of the world gross national disposable inco ...

Adobe Acrobat

... • net factor income from abroad (NFIA) – one country is paid income by another, in compensation for labor, capital, and land (e.g., wages, interest, dividends); • net unilateral transfers (NUT) – net amount of transfers the country receives from the rest of the world • gross national disposable i ...

... • net factor income from abroad (NFIA) – one country is paid income by another, in compensation for labor, capital, and land (e.g., wages, interest, dividends); • net unilateral transfers (NUT) – net amount of transfers the country receives from the rest of the world • gross national disposable i ...

a presentation on factors affecting economic growth in

... sustenance and a country’s development cannot be overemphasized. To a nation employment is not only a catalyst to growth but also a means to poverty reduction. The unemployment level stood at 2.8% in 1984 and increased to 10.4% in 2000. After a short fall of 6.5% in 2008, it later moved to 8.5% in 2 ...

... sustenance and a country’s development cannot be overemphasized. To a nation employment is not only a catalyst to growth but also a means to poverty reduction. The unemployment level stood at 2.8% in 1984 and increased to 10.4% in 2000. After a short fall of 6.5% in 2008, it later moved to 8.5% in 2 ...

Aggregate Demand

... • The questions you have been asked to consider are: – What happens to UK exports if the pound falls in value against other currencies – What happens to imports if the pound falls in value against other currencies – What happens to imports if the government cuts income taxes – What happens to export ...

... • The questions you have been asked to consider are: – What happens to UK exports if the pound falls in value against other currencies – What happens to imports if the pound falls in value against other currencies – What happens to imports if the government cuts income taxes – What happens to export ...

Bahamas_en.pdf

... 50% of GDP, well above the medium-term objective of 30% to 35% of GDP. Domestic debt accounted for 86% of the total. A fiscal deficit of 3.3% of GDP is projected for fiscal year 2009/10 with demand remaining weak at least into the early months of 2010 and some fiscal stimulus being maintained to spu ...

... 50% of GDP, well above the medium-term objective of 30% to 35% of GDP. Domestic debt accounted for 86% of the total. A fiscal deficit of 3.3% of GDP is projected for fiscal year 2009/10 with demand remaining weak at least into the early months of 2010 and some fiscal stimulus being maintained to spu ...

Does an increased budget deficit imply an increased deficit of the

... f. A U.S.-owned factory in Britain uses local earnings to buy additional machinery. 2. The British economy has a large current account deficit (about 5%) but its currency is appreciating. What could be the explanation? 3. A new government is elected and announces that once it is inaugurated, it will ...

... f. A U.S.-owned factory in Britain uses local earnings to buy additional machinery. 2. The British economy has a large current account deficit (about 5%) but its currency is appreciating. What could be the explanation? 3. A new government is elected and announces that once it is inaugurated, it will ...