Dollarization: Controlling Risk Is Key

... risks of dollarization have become more apparent. Nevertheless, dollarization remains widespread and has even intensified in some countries. More recently, other foreign currencies, such as the euro, are being used. While these countries have in effect euroized, the term dollarization is often used ...

... risks of dollarization have become more apparent. Nevertheless, dollarization remains widespread and has even intensified in some countries. More recently, other foreign currencies, such as the euro, are being used. While these countries have in effect euroized, the term dollarization is often used ...

Slide 1

... Monetary easing through RR only marginally reduces negative impact of the crisis on real sector Net exports improve (imports decrease more than exports) Interest rate increases significantly ...

... Monetary easing through RR only marginally reduces negative impact of the crisis on real sector Net exports improve (imports decrease more than exports) Interest rate increases significantly ...

Presentation

... (a) Macro-Policy : If real appreciation is required either permanently higher inflation or appreciating exchange rates & price stability. ...

... (a) Macro-Policy : If real appreciation is required either permanently higher inflation or appreciating exchange rates & price stability. ...

An explanation of accounting jargon

... Money you owe to others. These can be current (payable within one year) or long-term. Net Current Assets This is a figure that appears in the Balance Sheet. It comprises the current assets less the current liabilities. It can be a very important figure. For example, you may have total assets of £1,0 ...

... Money you owe to others. These can be current (payable within one year) or long-term. Net Current Assets This is a figure that appears in the Balance Sheet. It comprises the current assets less the current liabilities. It can be a very important figure. For example, you may have total assets of £1,0 ...

Section B - Business

... welcomed the import tariff reductions which commence today. Tariffs applying to passenger motor vehicles and parts components will be cut from 10% to 5%. Overall tariffs applying to Textiles, clothing and footwear (TCF) goods will also be cut, with tariffs for clothing reduced from 17.5% to 10%, and ...

... welcomed the import tariff reductions which commence today. Tariffs applying to passenger motor vehicles and parts components will be cut from 10% to 5%. Overall tariffs applying to Textiles, clothing and footwear (TCF) goods will also be cut, with tariffs for clothing reduced from 17.5% to 10%, and ...

Oman: Strong economic data - Report

... Cautionary Note Regarding Forward-Looking Statements: Certain of the statements contained herein may be statements of future expectations and other forward-looking statements that are based on management's current views and assumptions and involve known and unknown risks and uncertainties that could ...

... Cautionary Note Regarding Forward-Looking Statements: Certain of the statements contained herein may be statements of future expectations and other forward-looking statements that are based on management's current views and assumptions and involve known and unknown risks and uncertainties that could ...

Document

... JPY/USD. The dollar may weaken to 1.26 USD/EUR by year-end, Durrant said. “The dollar pared losses after it weakened to USD 1.2420 per euro, where some traders placed automatic orders to buy the dollar,” said Chris Melendez, president of currency hedge fund Tempest Asset Management in Newport Beach, ...

... JPY/USD. The dollar may weaken to 1.26 USD/EUR by year-end, Durrant said. “The dollar pared losses after it weakened to USD 1.2420 per euro, where some traders placed automatic orders to buy the dollar,” said Chris Melendez, president of currency hedge fund Tempest Asset Management in Newport Beach, ...

protectionism and free trade

... Some lawyers are better typists than their secretaries. Should such a lawyer fire his secretary and do his own typing? Not likely. Though the lawyer may be better than the secretary at both arguing cases and typing, he will fare better by concentrating his energies on the practice of law and leavi ...

... Some lawyers are better typists than their secretaries. Should such a lawyer fire his secretary and do his own typing? Not likely. Though the lawyer may be better than the secretary at both arguing cases and typing, he will fare better by concentrating his energies on the practice of law and leavi ...

Slide 1

... • To lend in the foreign currency, I must convert domestic currency into foreign currency. For each unit of domestic currency I have, I receive, 1/St units of the foreign currency. ...

... • To lend in the foreign currency, I must convert domestic currency into foreign currency. For each unit of domestic currency I have, I receive, 1/St units of the foreign currency. ...

Economics Paper- Powlmao and Loapowm

... (C) Firms supplying public goods cannot exclude those who are unwilling to pay for them (D) Consumers do not demand public goods, so few are supplied by the market. ...

... (C) Firms supplying public goods cannot exclude those who are unwilling to pay for them (D) Consumers do not demand public goods, so few are supplied by the market. ...

SECTION 5: The Financial Sector Need to Know

... So the US receives inflows of funds—foreign savings that finance investment spending in the US. The US also generates outflows of funds—domestic savings that finance investment spending in ...

... So the US receives inflows of funds—foreign savings that finance investment spending in the US. The US also generates outflows of funds—domestic savings that finance investment spending in ...

7: INTERNATIONAL TRADE VOCABULARY (with some additional

... Suppose incomes rise in the U.S. due to an economic boom. Consumers will be willing and able to buy more U.S. and Japanese goods. An increase in U.S. demand for Japanese goods will increase the demand for yen and raise the dollar price for yen (how much each yen cost). If the equilibrium exchange ra ...

... Suppose incomes rise in the U.S. due to an economic boom. Consumers will be willing and able to buy more U.S. and Japanese goods. An increase in U.S. demand for Japanese goods will increase the demand for yen and raise the dollar price for yen (how much each yen cost). If the equilibrium exchange ra ...

Trade Deficits Aren`t as Bad as You Think

... this view, these unbalanced trade flows have two benefits: They shift worldwide production to its most productive location, and they allow individuals to smooth out their consumption over the business cycle. According to this view, the trade balance declines, or moves into deficit, when a country’s ...

... this view, these unbalanced trade flows have two benefits: They shift worldwide production to its most productive location, and they allow individuals to smooth out their consumption over the business cycle. According to this view, the trade balance declines, or moves into deficit, when a country’s ...

monetary policy

... external balance will be far more difficult than our theoretical analysis has suggested; The relative effectiveness of fiscal and monetary policies is very much dependent upon the choice of exchange-rate regime; The most significant contribution of the model is that it focuses on the important role ...

... external balance will be far more difficult than our theoretical analysis has suggested; The relative effectiveness of fiscal and monetary policies is very much dependent upon the choice of exchange-rate regime; The most significant contribution of the model is that it focuses on the important role ...

Chart

... Figure 1.12. General Government Fiscal Balances and Public Debt (Percent of GDP unless noted otherwise) Fiscal deficits and public debt are very high in many advanced economies. Although policy became much less stimulatory in 2010, real GDP growth picked up, suggesting a handoff from public to priva ...

... Figure 1.12. General Government Fiscal Balances and Public Debt (Percent of GDP unless noted otherwise) Fiscal deficits and public debt are very high in many advanced economies. Although policy became much less stimulatory in 2010, real GDP growth picked up, suggesting a handoff from public to priva ...

SU12_Econ 2630_Study..

... -What could cause supply or demand to shift -How a change of supply or demand affects exchange rates -Fixed exchange rates -Why a country maintains would maintain fixed exchange rate -The impact of an over- or under-valued currency and how they’re maintained -International Trade -Who benefits and wh ...

... -What could cause supply or demand to shift -How a change of supply or demand affects exchange rates -Fixed exchange rates -Why a country maintains would maintain fixed exchange rate -The impact of an over- or under-valued currency and how they’re maintained -International Trade -Who benefits and wh ...

The Global Financial Crisis and Eastern Europe

... Economic Crisis and Developing Competitive Economies, Sarajevo, 24-25 February 2010 ...

... Economic Crisis and Developing Competitive Economies, Sarajevo, 24-25 February 2010 ...

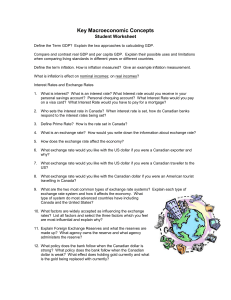

2-1-2 Key Macroeconomic Concepts - Student

... 7. What exchange rate would you like with the US dollar if you were a Canadian traveller to the US? 8. What exchange rate would you like with the Canadian dollar if you were an American tourist travelling in Canada? 9. What are the two most common types of exchange rate systems? Explain each type of ...

... 7. What exchange rate would you like with the US dollar if you were a Canadian traveller to the US? 8. What exchange rate would you like with the Canadian dollar if you were an American tourist travelling in Canada? 9. What are the two most common types of exchange rate systems? Explain each type of ...

International FRQs answers

... (c) How will the change in the price of the dollar you indicated in part (b) (ii) affect the net exports of the United States? Explain. Increase in price of dollar causes net exports to decrease (US imports from Japan increase and US exports to Japan decrease) (d) Using a correctly labeled demand an ...

... (c) How will the change in the price of the dollar you indicated in part (b) (ii) affect the net exports of the United States? Explain. Increase in price of dollar causes net exports to decrease (US imports from Japan increase and US exports to Japan decrease) (d) Using a correctly labeled demand an ...

International

... (c) How will the change in the price of the dollar you indicated in part (b) (ii) affect the net exports of the United States? Explain. Increase in price of dollar causes net exports to decrease (US imports from Japan increase and US exports to Japan decrease) (d) Using a correctly labeled demand an ...

... (c) How will the change in the price of the dollar you indicated in part (b) (ii) affect the net exports of the United States? Explain. Increase in price of dollar causes net exports to decrease (US imports from Japan increase and US exports to Japan decrease) (d) Using a correctly labeled demand an ...

Sabse Bada Rupaiya

... Another important factor is the interest rate in different countries. If Indian interest rates rise relative to other countries, Indian interest-bearing products become more attractive; this will once again increase demand for the rupee. For instance, if the rate of interest in the US is only 4 per ...

... Another important factor is the interest rate in different countries. If Indian interest rates rise relative to other countries, Indian interest-bearing products become more attractive; this will once again increase demand for the rupee. For instance, if the rate of interest in the US is only 4 per ...

Main Issues

... • The complementary roles of other macroeconomic policies: It is established that restrictive trade and fixed exchange rate policies mitigate the effectiveness of monetary and fiscal polices, and aggravate the impact of Dutch Disease • The role of institutions especially Central Bank and Monetary Un ...

... • The complementary roles of other macroeconomic policies: It is established that restrictive trade and fixed exchange rate policies mitigate the effectiveness of monetary and fiscal polices, and aggravate the impact of Dutch Disease • The role of institutions especially Central Bank and Monetary Un ...

The Future of the U.S. Dollar and its Competition with the Euro

... unrecognized. Devaluation then left financial institutions facing massive losses, or insolvency. Once the cushion of foreign capital was removed, the weaknesses of domestic banking systems were revealed—as was the impact on economic performance. The Asian crisis also underlined that the benefits of ...

... unrecognized. Devaluation then left financial institutions facing massive losses, or insolvency. Once the cushion of foreign capital was removed, the weaknesses of domestic banking systems were revealed—as was the impact on economic performance. The Asian crisis also underlined that the benefits of ...

TRADE SURPLUS

... – Americans invest the difference in our financial markets • They can’t use Cdn$ in theirs, and more Cdn$ are available than Americans want in order to buy Cdn goods ...

... – Americans invest the difference in our financial markets • They can’t use Cdn$ in theirs, and more Cdn$ are available than Americans want in order to buy Cdn goods ...