THE DEBATE ON THE INTERNATIONAL FINANCIAL

... supervision while efforts have been piecemeal or absent in the more important areas addressing systemic instability and its consequences. With stronger-than-expected recovery in East Asia, the containment of the damage in Russia and Brazil, and rebound of Western stock markets, emphasis has increasi ...

... supervision while efforts have been piecemeal or absent in the more important areas addressing systemic instability and its consequences. With stronger-than-expected recovery in East Asia, the containment of the damage in Russia and Brazil, and rebound of Western stock markets, emphasis has increasi ...

The Backing of the Currency and Economic Stability

... Gold Robbery”). In fact, the Gold Reserve Act of 1934 altered the definition of a dollar such that an ounce of gold, previously worth $20.67, was now worth $35.00 (Stockman). This opened the door for massive inflation, allowing the government to expand the money supply by almost 50% at will. The Uni ...

... Gold Robbery”). In fact, the Gold Reserve Act of 1934 altered the definition of a dollar such that an ounce of gold, previously worth $20.67, was now worth $35.00 (Stockman). This opened the door for massive inflation, allowing the government to expand the money supply by almost 50% at will. The Uni ...

Macro Glossary File

... current account: - a subcategory of the balance of payments that shows the income or expenditures related to exports and imports. cyclical unemployment: - occurs as a result of the recessionary phase of the business cycle. cyclically balanced budget fiscal policy: - the use of countercyclical fiscal ...

... current account: - a subcategory of the balance of payments that shows the income or expenditures related to exports and imports. cyclical unemployment: - occurs as a result of the recessionary phase of the business cycle. cyclically balanced budget fiscal policy: - the use of countercyclical fiscal ...

Chapter 22

... excess comovement across countries in asset returns, whether debt or equity. The comovement is said to be excessive if it persists even after common fundamentals, as well as idiosyncratic factors, have been controlled for. 3. A recent variant to this approach is presented in Arias, Haussmann, and Ri ...

... excess comovement across countries in asset returns, whether debt or equity. The comovement is said to be excessive if it persists even after common fundamentals, as well as idiosyncratic factors, have been controlled for. 3. A recent variant to this approach is presented in Arias, Haussmann, and Ri ...

Examine the factors which affect the international

... These measures not only directly impact exports but also limit technology transfer to developing countries through restricting imports. However the difference in Unit Labour Cost levels across countries always depends on the source from which the change came from. For example an increase in labour c ...

... These measures not only directly impact exports but also limit technology transfer to developing countries through restricting imports. However the difference in Unit Labour Cost levels across countries always depends on the source from which the change came from. For example an increase in labour c ...

Chapter 26. Fiscal Policy: A Summing Up

... affect economic activity. For example, given unchanged government spending, a tax cut today implies a tax increase of equal present value in the future. Therefore, consumer wealth is unchanged, and (according to the benchmark consumption theory presented in Chapter 16) private consumption is unaffec ...

... affect economic activity. For example, given unchanged government spending, a tax cut today implies a tax increase of equal present value in the future. Therefore, consumer wealth is unchanged, and (according to the benchmark consumption theory presented in Chapter 16) private consumption is unaffec ...

The basic paradigms of EU economic policy

... undertake renewed attempts at fiscal consolidation. Those attempts, however, did not always succeed (as proven in 2003 when the French and German governments initiated a ‘reinterpretation’ of the Stability and Growth Pact). The reason for the difficulties of implementing fiscal consolidation in low- ...

... undertake renewed attempts at fiscal consolidation. Those attempts, however, did not always succeed (as proven in 2003 when the French and German governments initiated a ‘reinterpretation’ of the Stability and Growth Pact). The reason for the difficulties of implementing fiscal consolidation in low- ...

Implications of the Dollar as the World Reserve Currency

... In the following we will recall the determinants of an international currency. From these relationships we derive a simple graphical model which highlights some of the benefits for an economy with a currency with reserve currency status. Our model exhibits the relationship between the foreign exchan ...

... In the following we will recall the determinants of an international currency. From these relationships we derive a simple graphical model which highlights some of the benefits for an economy with a currency with reserve currency status. Our model exhibits the relationship between the foreign exchan ...

Dialoguing with the IFIs at the National and International Level

... mortgage debts of home-owners holding loans that exceed home values ...

... mortgage debts of home-owners holding loans that exceed home values ...

Globalization: What does it mean

... including sharp depreciations of regional currencies, rising risk premia on financial assets which caused further currency weakness, and subsequent impacts on macro variables such as the decline in investment and consumption, and a sharp move to current account surpluses. Their analysis argued that ...

... including sharp depreciations of regional currencies, rising risk premia on financial assets which caused further currency weakness, and subsequent impacts on macro variables such as the decline in investment and consumption, and a sharp move to current account surpluses. Their analysis argued that ...

Deficit Topic Analysis

... First, it’s necessary to clarify some relevant economic concepts for those who may not be as familiar with them. A budget deficit occurs when the total amount of money spent by the government exceeds the amount it brings in, through instruments such as taxes. A common analogy is to think of governme ...

... First, it’s necessary to clarify some relevant economic concepts for those who may not be as familiar with them. A budget deficit occurs when the total amount of money spent by the government exceeds the amount it brings in, through instruments such as taxes. A common analogy is to think of governme ...

TxLOR - Texas Digital Library

... 1. Ben would like to have $60,000 available for college in 18 years. a. If an account exists earning 7% annual interest compounded annually, how much should be deposited now to have the $60,000 in 18 years? ...

... 1. Ben would like to have $60,000 available for college in 18 years. a. If an account exists earning 7% annual interest compounded annually, how much should be deposited now to have the $60,000 in 18 years? ...

Australian Federal Government deficits, debt and

... also at its lowest level) but interest costs have risen sharply as the debt level has risen since 2008. However, the current interest burden (at less than 1% of GDP and around 3-4% of tax receipts) is no higher now than it was in the 1950s to the 1970s. This is partly due to the relatively low level ...

... also at its lowest level) but interest costs have risen sharply as the debt level has risen since 2008. However, the current interest burden (at less than 1% of GDP and around 3-4% of tax receipts) is no higher now than it was in the 1950s to the 1970s. This is partly due to the relatively low level ...

Aggregate Demand

... comes from four general sources, and we have already seen these components when we describe how total production is measured in the economy. • GDPr=C+I+G+(X-M) ...

... comes from four general sources, and we have already seen these components when we describe how total production is measured in the economy. • GDPr=C+I+G+(X-M) ...

How to say and write the correct phraseology for FOREX

... How to say and write the correct phraseology for FOREX “If the interest rate in the U.S. INCREASES relative to the Rest of the World (ROW), U.S. financial assets become more desirable. The demand for the dollars INCREASES and APPRECIATES the value of the dollar internationally. “ Effect on Exports: ...

... How to say and write the correct phraseology for FOREX “If the interest rate in the U.S. INCREASES relative to the Rest of the World (ROW), U.S. financial assets become more desirable. The demand for the dollars INCREASES and APPRECIATES the value of the dollar internationally. “ Effect on Exports: ...

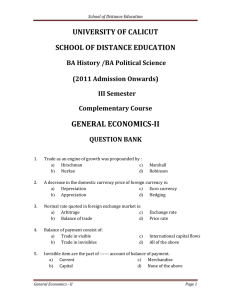

GENERAL ECONOMICSII UNIVERSITY OF CALICUT SCHOOL OF DISTANCE EDUCATION

... 18. An economic transaction is entered in the balance of payment as a credit, if it leads to: a) Receipt of payment from foreigners b) Either the receipt of payment or making of payment c) A payment to foreigners d) Neither the receipt nor making of a payment ...

... 18. An economic transaction is entered in the balance of payment as a credit, if it leads to: a) Receipt of payment from foreigners b) Either the receipt of payment or making of payment c) A payment to foreigners d) Neither the receipt nor making of a payment ...

This PDF is a selection from a published volume from... National Bureau of Economic Research

... 1910–1950,” Pedro Lains provides a comparison of Mexico’s and Portugal’s economic growth during the first half of the twentieth century. He argues that what makes these countries particularly interesting is that they experienced solid growth in the interwar years, a period when most of the world was ...

... 1910–1950,” Pedro Lains provides a comparison of Mexico’s and Portugal’s economic growth during the first half of the twentieth century. He argues that what makes these countries particularly interesting is that they experienced solid growth in the interwar years, a period when most of the world was ...

document

... Links changes in exchange rates with differences in inflation rates and the purchasing power of each nation’s currency. In the long run, exchange rates adjust so that the purchasing power of each currency tends to be the same. Exchange rate changes tend to reflect international differences in in ...

... Links changes in exchange rates with differences in inflation rates and the purchasing power of each nation’s currency. In the long run, exchange rates adjust so that the purchasing power of each currency tends to be the same. Exchange rate changes tend to reflect international differences in in ...

Preview Sample 1

... A. lesser stability in a country's balance of trade B. changes in the factors of the PESTEL model C. changes in a country’s balance of trade D. greater stability in a country's balance of trade While these events could contribute to less stability in a country's balance of trade, there is know way o ...

... A. lesser stability in a country's balance of trade B. changes in the factors of the PESTEL model C. changes in a country’s balance of trade D. greater stability in a country's balance of trade While these events could contribute to less stability in a country's balance of trade, there is know way o ...

Midterm 2 - Fall 2014

... (B) Suppose that fiscal policy is used to increase actual real GDP to natural real GDP. This requires two actions: (i) the average tax rate (t) be cut by 0.02 to 0.16.; (ii) G be increased by ...

... (B) Suppose that fiscal policy is used to increase actual real GDP to natural real GDP. This requires two actions: (i) the average tax rate (t) be cut by 0.02 to 0.16.; (ii) G be increased by ...

BBCN BANK: DETECTING LATERAL MOVEMENT AND SERVICE

... full-service branches and Loan Production Offices throughout the nation. With more than $7.8 billion in assets, the strength of BBCN lies in its experienced management team and our focus on responsible risk management practices. The organization’s expertise in small business lending, C&I lending, an ...

... full-service branches and Loan Production Offices throughout the nation. With more than $7.8 billion in assets, the strength of BBCN lies in its experienced management team and our focus on responsible risk management practices. The organization’s expertise in small business lending, C&I lending, an ...

Budget and External Deficits: Not Twins but the Same Family an

... The twin-deficits case involves an increase in discretionary US government spending with no monetary accommodation.10 Government saving decreases because of the expenditure expansion, and the net inflow of foreign saving increases (current account deficit widens) because the boost to income sucks i ...

... The twin-deficits case involves an increase in discretionary US government spending with no monetary accommodation.10 Government saving decreases because of the expenditure expansion, and the net inflow of foreign saving increases (current account deficit widens) because the boost to income sucks i ...

- SlideBoom

... • Will become smaller • Will become larger • Might increase or might decrease • Will be unaffected 6 Using the expenditure approach, gross domestic product equals: • The sum of consumption, investment, government purchases, and net exports • Gross national product minus net exports • The sum of cons ...

... • Will become smaller • Will become larger • Might increase or might decrease • Will be unaffected 6 Using the expenditure approach, gross domestic product equals: • The sum of consumption, investment, government purchases, and net exports • Gross national product minus net exports • The sum of cons ...

Equity Strategy

... - Caught between two evils, overvalued currency and overshooting inflation target, the Central Bank has to go for the latter. With a large credibility gap of 300bps, the Central Bank has to keep policy rates high in the foreseeable future. - In our view, economic and social consequences of an overva ...

... - Caught between two evils, overvalued currency and overshooting inflation target, the Central Bank has to go for the latter. With a large credibility gap of 300bps, the Central Bank has to keep policy rates high in the foreseeable future. - In our view, economic and social consequences of an overva ...

English

... Bank balance sheets weakened as a result of : •Exchange rate depreciations—channeled primarily via exposure to indirect currency risk •Deterioration in overall economic activity ...

... Bank balance sheets weakened as a result of : •Exchange rate depreciations—channeled primarily via exposure to indirect currency risk •Deterioration in overall economic activity ...