FINANCIAL RISK TOLERANCE: A STATE OR A TRAIT?

... Risk studies on age differences indicate that older people are more risk adverse and are less likely to engage in risky behaviours or make risky decisions (Brown 1990; Bakshi and Chen 1994; Grable 2000). Practitioners and researchers have long believed that age was negatively related to risk toleran ...

... Risk studies on age differences indicate that older people are more risk adverse and are less likely to engage in risky behaviours or make risky decisions (Brown 1990; Bakshi and Chen 1994; Grable 2000). Practitioners and researchers have long believed that age was negatively related to risk toleran ...

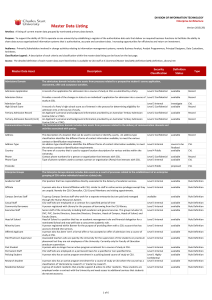

Master Data Listing

... Identifies any courses or subjects associated to a particular University Prize. Provides a summary of university prize recipients. Describes the different types of prizes awarded for academically related or other achievements. For example, university or faculty medals, or special distinctions. ...

... Identifies any courses or subjects associated to a particular University Prize. Provides a summary of university prize recipients. Describes the different types of prizes awarded for academically related or other achievements. For example, university or faculty medals, or special distinctions. ...

NBER WORKING PAPER SERIES INTERGENERATIONAL REDISTRIBUTION IN THE GREAT RECESSION Andrew Glover

... and net worth (see Table 1). These profiles are constructed by averaging (using the SCF sample weights) across households partitioned into 10-year age groups. We divide total income into an asset-type income component, and a residual non-asset-income component which we call labor income.2 We make tw ...

... and net worth (see Table 1). These profiles are constructed by averaging (using the SCF sample weights) across households partitioned into 10-year age groups. We divide total income into an asset-type income component, and a residual non-asset-income component which we call labor income.2 We make tw ...

EFFECT OF BEHAVIOURAL BIASES ON INVESTMENT DECISIONS

... often depend on their nature, intuitions, and habits, cognitive or emotional biases hidden deeply at the back of one‟s mind. The new discipline – behavioural finance have began to develop after gathering enough information that confirm particular human behaviour which is contrary to traditional fina ...

... often depend on their nature, intuitions, and habits, cognitive or emotional biases hidden deeply at the back of one‟s mind. The new discipline – behavioural finance have began to develop after gathering enough information that confirm particular human behaviour which is contrary to traditional fina ...

Download attachment

... the system produces better returns than public funds because of the market discipline of competition between AFPs on the basis that participants can choose to switch their fund from one to another. Moreover, since the participants have information on the size of their individual fund the system mili ...

... the system produces better returns than public funds because of the market discipline of competition between AFPs on the basis that participants can choose to switch their fund from one to another. Moreover, since the participants have information on the size of their individual fund the system mili ...

Creating value from intellectual assets

... the impact of intellectual assets on economic performance at the economy and firm level needs to be more fully developed, especially as regards the value of different intellectual assets, the interaction among them and how to effectively exploit potential synergies to support innovation. Better info ...

... the impact of intellectual assets on economic performance at the economy and firm level needs to be more fully developed, especially as regards the value of different intellectual assets, the interaction among them and how to effectively exploit potential synergies to support innovation. Better info ...

New Tax Rules for Offshore Portfolio Investment in Shares

... list” investments mostly on a revenue account basis (dividends and realised gains) because they were normally in the business of trading in shares. As was the case with investment in New Zealand companies, collective investment vehicles faced a tax disadvantage under the previous tax rules for offsh ...

... list” investments mostly on a revenue account basis (dividends and realised gains) because they were normally in the business of trading in shares. As was the case with investment in New Zealand companies, collective investment vehicles faced a tax disadvantage under the previous tax rules for offsh ...

VALUE -OR iE NTED iN VESTMENTMANAGEMENT Fox Asset

... Fox is a wholly owned, indirect subsidiary of Eaton Vance Corp. Eaton Vance Management (“Eaton Vance”) and Boston Management and Research (“BMR”) are also wholly owned subsidiaries of Eaton Vance Corp. EVM and BMR are each registered as an investment adviser with the SEC. Eaton Vance and BMR are eac ...

... Fox is a wholly owned, indirect subsidiary of Eaton Vance Corp. Eaton Vance Management (“Eaton Vance”) and Boston Management and Research (“BMR”) are also wholly owned subsidiaries of Eaton Vance Corp. EVM and BMR are each registered as an investment adviser with the SEC. Eaton Vance and BMR are eac ...

Money Market Funds - Fort Pitt Capital Group

... your actual costs may be higher or lower, based on these assumptions your costs would be: Class A 1 year ...

... your actual costs may be higher or lower, based on these assumptions your costs would be: Class A 1 year ...

Annual Financial Statements and Combined

... business clients through our modern e-Banking platform. Furthermore, we have placed an ...

... business clients through our modern e-Banking platform. Furthermore, we have placed an ...

Do Market Efficiency Measures Yield Correct Inferences?

... U.S. and U.K., have some of the lowest trading costs, while smaller emerging markets have some of the highest. For similar-sized large and medium cap firms, LOT trading costs are nearly twice as large in the typical emerging market. Moreover, for most size quintiles, trading costs have decreased dra ...

... U.S. and U.K., have some of the lowest trading costs, while smaller emerging markets have some of the highest. For similar-sized large and medium cap firms, LOT trading costs are nearly twice as large in the typical emerging market. Moreover, for most size quintiles, trading costs have decreased dra ...

"Al. I. CUZA" UNIVERSITY of IAŞI DOCTORAL SCHOOL

... funding relationships and creditors must deal with more trust companies with financial difficulties, imposing bank creditors a better understanding of their role in financing. This paper was intended to be a starting point for further research of credit risk in the context of restructuring firms. In ...

... funding relationships and creditors must deal with more trust companies with financial difficulties, imposing bank creditors a better understanding of their role in financing. This paper was intended to be a starting point for further research of credit risk in the context of restructuring firms. In ...

Rural Microenterprise Finance Project in Philippines

... microfinance nongovernment organizations (NGO). The regulatory framework for microfinance formulated by the National Credit Council merely encourages NGOs that have collected savings beyond the compensating balance (i.e., greater than the amount of loans outstanding) to transform themselves into for ...

... microfinance nongovernment organizations (NGO). The regulatory framework for microfinance formulated by the National Credit Council merely encourages NGOs that have collected savings beyond the compensating balance (i.e., greater than the amount of loans outstanding) to transform themselves into for ...

Budget Blueprint: How Lessons from Canada`s

... promptly and deliberately to eliminate deficits, which leads to surpluses and reduced debt, which allow interest costs to decline, leading to yet more surpluses and less debt, and so on. The study also describes the vicious cycle that can emerge—and emerge quickly—when deficits are not dealt with: a ...

... promptly and deliberately to eliminate deficits, which leads to surpluses and reduced debt, which allow interest costs to decline, leading to yet more surpluses and less debt, and so on. The study also describes the vicious cycle that can emerge—and emerge quickly—when deficits are not dealt with: a ...

Financial Development in Sub-Saharan Africa

... and discusses how financial development can boost economic growth and make it more inclusive and less volatile. Building on a chapter in the April 2016 Regional Economic Outlook for sub-Saharan Africa, this paper provides an up-to-date panorama of various facets of financial development and how it h ...

... and discusses how financial development can boost economic growth and make it more inclusive and less volatile. Building on a chapter in the April 2016 Regional Economic Outlook for sub-Saharan Africa, this paper provides an up-to-date panorama of various facets of financial development and how it h ...

Enron Corporation

... • It is a legal entity created to fulfill narrow, special or temporary objectives . They are used to hide debt, ownership mostly in real market. • These shell firms were created by a sponsor, but managed by independent equity investor and debt financing. • Enron used SPE to manage risks associated w ...

... • It is a legal entity created to fulfill narrow, special or temporary objectives . They are used to hide debt, ownership mostly in real market. • These shell firms were created by a sponsor, but managed by independent equity investor and debt financing. • Enron used SPE to manage risks associated w ...

NBER WORKING PAPER SERIES DO FIRMS IN COUNTRIES WITH POOR PROTECTION

... controlling shareholder simply took a substantial sum from the firm’s accounts, i.e., the firm’s liquid assets. The court did not force him to give the money back after he was sued by the minority shareholders. Fixed assets can be traced - a plant cannot disappear, but cash can. We construct a model ...

... controlling shareholder simply took a substantial sum from the firm’s accounts, i.e., the firm’s liquid assets. The court did not force him to give the money back after he was sued by the minority shareholders. Fixed assets can be traced - a plant cannot disappear, but cash can. We construct a model ...

The effect of working capital management on

... of applying the methods which remove the risk and lack of ability in paying short term commitments in one side and prevent over investment in these assets in the other side by planning and controlling current assets and liabilities (Lazaridis & Tryfonidis, 2006). ...

... of applying the methods which remove the risk and lack of ability in paying short term commitments in one side and prevent over investment in these assets in the other side by planning and controlling current assets and liabilities (Lazaridis & Tryfonidis, 2006). ...

December 2016

... poverty. Economic sustainability implies a system of production that satisfies present consumption levels without compromising future needs. The economic growth would bring the technological capacity to replenish natural resources destroyed in the production process (Basiago, 1999). According to the ...

... poverty. Economic sustainability implies a system of production that satisfies present consumption levels without compromising future needs. The economic growth would bring the technological capacity to replenish natural resources destroyed in the production process (Basiago, 1999). According to the ...

Author`s Note, Crash Proof 2.0

... of the previous two years and offering various theories about the future. With all due respect to my fellow authors, however, most of them were writing after the fact and starting from the premise that the present crisis could not have been predicted. More important, while most believe that the econ ...

... of the previous two years and offering various theories about the future. With all due respect to my fellow authors, however, most of them were writing after the fact and starting from the premise that the present crisis could not have been predicted. More important, while most believe that the econ ...

An Analysis of Default Risk in the Home Equity Conversion

... liquidity constraints, and poor financial management are likely more important. Further, the way in which borrowers structure their withdrawals of equity from reverse mortgages, principally the proportion of funds distributed as a lump sum at closing, may exacerbate or reduce default risk. Our analy ...

... liquidity constraints, and poor financial management are likely more important. Further, the way in which borrowers structure their withdrawals of equity from reverse mortgages, principally the proportion of funds distributed as a lump sum at closing, may exacerbate or reduce default risk. Our analy ...

Treasury Wine Estates Annual 2016 financial result

... F15 comparatives have been restated to reflect minor reclassifications of selling and IT related costs Unless otherwise stated all percentage or Dollar movements from prior periods are pre any material items and on a constant currency basis Earnings before interest, tax, SGARA and material items 10 ...

... F15 comparatives have been restated to reflect minor reclassifications of selling and IT related costs Unless otherwise stated all percentage or Dollar movements from prior periods are pre any material items and on a constant currency basis Earnings before interest, tax, SGARA and material items 10 ...

Ambac Receives Consent to Extend Period to Satisfy Condition to

... Reorganization Plan NEW YORK--(BUSINESS WIRE)--Mar. 7, 2013-- Ambac Financial Group, Inc. (“Ambac”) has received consent from the United States Department of Justice on behalf of the Internal Revenue Service (the “IRS”) to extend the date by which a condition to the effectiveness of Ambac’s Fifth Am ...

... Reorganization Plan NEW YORK--(BUSINESS WIRE)--Mar. 7, 2013-- Ambac Financial Group, Inc. (“Ambac”) has received consent from the United States Department of Justice on behalf of the Internal Revenue Service (the “IRS”) to extend the date by which a condition to the effectiveness of Ambac’s Fifth Am ...

How Ownership Structure Affects Capital Structure and Firm

... firms. In contrast, presence of Cronyman is rather low among the non-family owned firms in both countries, especially in Indonesia. The separation of voting rights from cash flow rights is another important feature of East Asian corporations. In particular, voting rights are higher in more than half ...

... firms. In contrast, presence of Cronyman is rather low among the non-family owned firms in both countries, especially in Indonesia. The separation of voting rights from cash flow rights is another important feature of East Asian corporations. In particular, voting rights are higher in more than half ...

Banking structures report, October 2014

... The findings in this article suggest that the activation and calibration of policy measures such as the systemic risk buffer (SRB) should be mindful of the cyclical position of the banking system. In addition, the results confirm that the activation and calibration of counter-cyclical policy measure ...

... The findings in this article suggest that the activation and calibration of policy measures such as the systemic risk buffer (SRB) should be mindful of the cyclical position of the banking system. In addition, the results confirm that the activation and calibration of counter-cyclical policy measure ...