October 2014 - Markets May Head Higher, But

... remarkable “seasonal benefit” where markets are typically strong most years from November to April and secondly, the very well studied and consistent Four Year Presidential Cycle overlay. History has shown that Year 1 & 2 of every Presidential Cycle are repeatedly weak for the equity markets (the av ...

... remarkable “seasonal benefit” where markets are typically strong most years from November to April and secondly, the very well studied and consistent Four Year Presidential Cycle overlay. History has shown that Year 1 & 2 of every Presidential Cycle are repeatedly weak for the equity markets (the av ...

Controversy On The Income Tax

... the minerals could be increased to pass on to the customer the cost of a tax on the land, which would make it indirect. There could also be an excise tax on the minerals sold, which, by the above analysis, would be indirect. But now suppose the taxpayer is allowed to deduct the costs of production, ...

... the minerals could be increased to pass on to the customer the cost of a tax on the land, which would make it indirect. There could also be an excise tax on the minerals sold, which, by the above analysis, would be indirect. But now suppose the taxpayer is allowed to deduct the costs of production, ...

Financial Services Value Proposition

... Canada has one of the strongest financial services sectors in the world, comprised of banks, trust and loan companies, insurance companies, credit unions, securities dealers, finance and leasing companies, pension fund managers, mutual fund companies and independent insurance agents and brokers. Fin ...

... Canada has one of the strongest financial services sectors in the world, comprised of banks, trust and loan companies, insurance companies, credit unions, securities dealers, finance and leasing companies, pension fund managers, mutual fund companies and independent insurance agents and brokers. Fin ...

Recent Development and Outlook: ASEAN+3 Economies Reza Siregar Group Head/Lead Economist

... Local corporates take advantage of ample global liquidity and issue more international debt in recent years. ...

... Local corporates take advantage of ample global liquidity and issue more international debt in recent years. ...

Ch. 1 Auditing and the Public Accounting Profession

... 3. Which of the following is not an economic benefit of a financial statement audit? A. Access to Capital Markets B. Lower Cost of Capital C. Control and Operational Improvements D. Maintain Fair Competition D. Maintain Fair Competition ...

... 3. Which of the following is not an economic benefit of a financial statement audit? A. Access to Capital Markets B. Lower Cost of Capital C. Control and Operational Improvements D. Maintain Fair Competition D. Maintain Fair Competition ...

BM18_14TrusteeReport_Presentation_en

... The return shown above for 2002 to 2004 is for the total Trust Funds (includes GFATM). CY08 return is not annualised and is for the period to 30 September 2008. ...

... The return shown above for 2002 to 2004 is for the total Trust Funds (includes GFATM). CY08 return is not annualised and is for the period to 30 September 2008. ...

Weekly Commentary 09-23-13 PAA

... told Bloomberg the Fed may decide to begin buying fewer bonds at its next meeting in October. This surprised some as analysts already had predicted it wouldn’t happen until December which caused markets to slump a bit last Friday. It’s possible that, by mid-October, the Fed’s ‘lather-rinse-repeat’ c ...

... told Bloomberg the Fed may decide to begin buying fewer bonds at its next meeting in October. This surprised some as analysts already had predicted it wouldn’t happen until December which caused markets to slump a bit last Friday. It’s possible that, by mid-October, the Fed’s ‘lather-rinse-repeat’ c ...

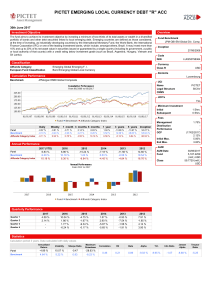

pictet emerging local currency debt "r" acc

... The fund aims to achieve its investment objective by investing a minimum of two-thirds of its total assets or wealth in a diversified portfolio of bonds and other debt securities linked to local emerging debt. Emerging countries are defined as those considered, at the time of investing, as industria ...

... The fund aims to achieve its investment objective by investing a minimum of two-thirds of its total assets or wealth in a diversified portfolio of bonds and other debt securities linked to local emerging debt. Emerging countries are defined as those considered, at the time of investing, as industria ...

recources for marketing and international activities

... prognosis for 5 years experts within 18 months assess political stability, political regime and economic politic • Beri Index (Political Risk Index) prognosis for 10 years political spectrum is evaluated, racial structure, corruption, strikes, social aspect 15 criterions, allocation of weight ...

... prognosis for 5 years experts within 18 months assess political stability, political regime and economic politic • Beri Index (Political Risk Index) prognosis for 10 years political spectrum is evaluated, racial structure, corruption, strikes, social aspect 15 criterions, allocation of weight ...

Weekly Advisor Analysis 06-24-13 PAA

... Despite the large declines in the equity markets on Wednesday and Thursday of last week, the effects of a potential change in Federal Reserve policy on the fixed income market have been much harsher. The yield on the 10-year U.S. Treasury bond has now soared from 1.6 percent at the beginning of May ...

... Despite the large declines in the equity markets on Wednesday and Thursday of last week, the effects of a potential change in Federal Reserve policy on the fixed income market have been much harsher. The yield on the 10-year U.S. Treasury bond has now soared from 1.6 percent at the beginning of May ...

Uninsured Risks, Social Policies and Productivity

... From Public Finance Theory: Government Spending can be classified in (Harris 2002): ...

... From Public Finance Theory: Government Spending can be classified in (Harris 2002): ...

Measuring banking sector development

... This index, reflecting the legal rights of borrowers and lenders, measures the degree to which collateral and bankruptcy laws facilitate lending. It is based on data collected through study of collateral and insolvency laws, supported by the responses to the survey on secured transactions laws. The ...

... This index, reflecting the legal rights of borrowers and lenders, measures the degree to which collateral and bankruptcy laws facilitate lending. It is based on data collected through study of collateral and insolvency laws, supported by the responses to the survey on secured transactions laws. The ...

Document

... up by 6% as compared to the previous year, thus registering a record high level. The report explained that the record level is due to the credit expansion, which resulted in increased consumption and boosted interior supply. Bulgaria's industry has marked a boost two times bigger than the one seen b ...

... up by 6% as compared to the previous year, thus registering a record high level. The report explained that the record level is due to the credit expansion, which resulted in increased consumption and boosted interior supply. Bulgaria's industry has marked a boost two times bigger than the one seen b ...

June 13th 2008 - Neil H. Gendreau, CFP

... income producing agent. While less than investment grade corporate credit has a higher chance of default than investment grade debt, default risk can be more effectively managed through a mutual fund rather than purchasing individual bonds. 2. Loan Participation Notes – Issued by banks to non-public ...

... income producing agent. While less than investment grade corporate credit has a higher chance of default than investment grade debt, default risk can be more effectively managed through a mutual fund rather than purchasing individual bonds. 2. Loan Participation Notes – Issued by banks to non-public ...

Short Duration Income Fund Commentary

... compared with the previous two quarters. For the most part, investors continued to favor riskier assets. The Federal Open Market Committee (FOMC) raised rates 25 basis points at its June meeting, the third increase since December. However, expectations of increased economic stimulus in the United St ...

... compared with the previous two quarters. For the most part, investors continued to favor riskier assets. The Federal Open Market Committee (FOMC) raised rates 25 basis points at its June meeting, the third increase since December. However, expectations of increased economic stimulus in the United St ...

Getting Initial Money to Go from Nothing to Something

... They Looked At Customer As a Transaction ...

... They Looked At Customer As a Transaction ...

Document

... should also enable public administrations to develop policies for growth and investment strategies for next generation ICT for public services. This research will also address innovative ICT solutions that build on Web2.0/Web3.0 and social networking, crowd-sourcing and collaborative technologies. T ...

... should also enable public administrations to develop policies for growth and investment strategies for next generation ICT for public services. This research will also address innovative ICT solutions that build on Web2.0/Web3.0 and social networking, crowd-sourcing and collaborative technologies. T ...

Farm and Ranch Business Management Functions

... Identifying and placing people in positions Filling positions with the best person available Understand the responsibilities of each position Job description is critical ...

... Identifying and placing people in positions Filling positions with the best person available Understand the responsibilities of each position Job description is critical ...

issues to correctly assess the investment climate and its risks.

... developing economies is enormous. Remembering that credit markets lend based on cash flow and asset values, one can rightly assume that lenders around the world are very nervous as they see commodity prices collapse by 50–70%. The situation is similar to 2007, when we knew that housing prices were f ...

... developing economies is enormous. Remembering that credit markets lend based on cash flow and asset values, one can rightly assume that lenders around the world are very nervous as they see commodity prices collapse by 50–70%. The situation is similar to 2007, when we knew that housing prices were f ...

Technical Market Overview

... This “chasing gains” strategy often introduces volatile portfolio movement without sustainable progress. I believe a process by which an investor truly establishes how much risk they are willing to accept in a portfolio and then focuses on extracting as much profit from that risk profile as the mar ...

... This “chasing gains” strategy often introduces volatile portfolio movement without sustainable progress. I believe a process by which an investor truly establishes how much risk they are willing to accept in a portfolio and then focuses on extracting as much profit from that risk profile as the mar ...

brexit: european equities positioning

... James’s Place (the latter is effectively a wealth manager). We believe however that the greater risk is posed by companies which are sensitive to the UK financial system (specifically the banks) and also exporters of products where there could be restrictions on trade. We have little exposure to the ...

... James’s Place (the latter is effectively a wealth manager). We believe however that the greater risk is posed by companies which are sensitive to the UK financial system (specifically the banks) and also exporters of products where there could be restrictions on trade. We have little exposure to the ...

key facts

... finances. Until now, investment capital that is needed to create jobs has failed to materialise because investors fear that the BiH authorities may raise taxes sharply in order to raise funds to pay off frozen foreign currency holders. By contrast, the amendments to the law are impracticable and pot ...

... finances. Until now, investment capital that is needed to create jobs has failed to materialise because investors fear that the BiH authorities may raise taxes sharply in order to raise funds to pay off frozen foreign currency holders. By contrast, the amendments to the law are impracticable and pot ...

ECONOMIES IN CRISIS

... • For much of the last 20 years, central bankers have used monetary policy (setting interest rates) to control inflation. • But the inflation they should have been worried about was in the prices of assets such as houses and shares, not goods and services. • Deregulation (the removal of restrictions ...

... • For much of the last 20 years, central bankers have used monetary policy (setting interest rates) to control inflation. • But the inflation they should have been worried about was in the prices of assets such as houses and shares, not goods and services. • Deregulation (the removal of restrictions ...

3% in 2013

... - Strong growth in emerging economies, particularly in Asia, underpinned by domestic demand and gradual recovery in exports - Modest increase in global inflation ...

... - Strong growth in emerging economies, particularly in Asia, underpinned by domestic demand and gradual recovery in exports - Modest increase in global inflation ...