The GreaT DebaTe: Income vs . ToTal reTurn

... high to offset low income levels or whether to seek securities and those formed on the basis of dividends may be related that provide higher income. and have historically out-performed the broad market. One of the contested issues in financial planning is whether income generated by investments matt ...

... high to offset low income levels or whether to seek securities and those formed on the basis of dividends may be related that provide higher income. and have historically out-performed the broad market. One of the contested issues in financial planning is whether income generated by investments matt ...

Maybe more room to grow?

... corporate and municipal bond issues. Standard & Poor’s rates the creditworthiness of bonds from AAA (highest) to D (lowest). Ratings from A to CCC may be modified by the addition of a plus (+) or minus (-) sign to show relative standing within the ratings categories. Moody’s rates the creditworthine ...

... corporate and municipal bond issues. Standard & Poor’s rates the creditworthiness of bonds from AAA (highest) to D (lowest). Ratings from A to CCC may be modified by the addition of a plus (+) or minus (-) sign to show relative standing within the ratings categories. Moody’s rates the creditworthine ...

Disclosure of G-SIB indicators

... Section 4 - Intra-Financial System Liabilities a. Funds deposited by or borrowed from other financial institutions: (1) Deposits due to depository institutions (2) Deposits due to non-depository financial institutions (3) Loans obtained from other financial institutions b. Unused portion of committe ...

... Section 4 - Intra-Financial System Liabilities a. Funds deposited by or borrowed from other financial institutions: (1) Deposits due to depository institutions (2) Deposits due to non-depository financial institutions (3) Loans obtained from other financial institutions b. Unused portion of committe ...

Asian High Yield Outlook

... Fidelity Worldwide Investment refers to the group of companies which form the global investment management organisation that provides information on products and services in designated jurisdictions outside of North America. Fidelity Worldwide Investment does not offer investment advice based on ind ...

... Fidelity Worldwide Investment refers to the group of companies which form the global investment management organisation that provides information on products and services in designated jurisdictions outside of North America. Fidelity Worldwide Investment does not offer investment advice based on ind ...

frbsf weekly lettea - Federal Reserve Bank of San Francisco

... inflation has declined to alow level compared to the prior decade. The difficulty in choosing between these two opposing views on the effects of budget deficits ...

... inflation has declined to alow level compared to the prior decade. The difficulty in choosing between these two opposing views on the effects of budget deficits ...

Schroders Multi-Asset Investments - View and Insights: September 2015

... Important Information: For professional investors and advisers only. This document is not suitable for retail clients. These are the views of the Schroders’ Multi-Asset Investments team, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or f ...

... Important Information: For professional investors and advisers only. This document is not suitable for retail clients. These are the views of the Schroders’ Multi-Asset Investments team, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or f ...

Low Volatility Equity Fact Sheet

... failure of the other party to the instrument to meet its obligations. Stock prices may fall or fail to rise over time for several reasons, including general financial market conditions and factors related to a specific company, issuer or sector. There may be times when stocks in the fund’s portfolio ...

... failure of the other party to the instrument to meet its obligations. Stock prices may fall or fail to rise over time for several reasons, including general financial market conditions and factors related to a specific company, issuer or sector. There may be times when stocks in the fund’s portfolio ...

Dreyfus Emerging Markets Debt U.S. Dollar Fund

... Bond Risk: Bonds are subject generally to interest rate, credit, liquidity, call and market risks, to varying degrees. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes and rate increases can cause price declines. Derivatives Risk: A small investmen ...

... Bond Risk: Bonds are subject generally to interest rate, credit, liquidity, call and market risks, to varying degrees. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes and rate increases can cause price declines. Derivatives Risk: A small investmen ...

1 SECURITIES AND EXCHANGE COMMISSION WASHINGTON

... reclassification will reduce the operating income of the industrial gases segment by $12.3 million. For the three months ended 31 December 1993, corporate and other includes an expense of $2.3 million for the charitable contribution of the remaining shares of a stock investment in an insurance compa ...

... reclassification will reduce the operating income of the industrial gases segment by $12.3 million. For the three months ended 31 December 1993, corporate and other includes an expense of $2.3 million for the charitable contribution of the remaining shares of a stock investment in an insurance compa ...

Maximize Your Charitable Giving by

... 1. This assumes all realized gains are subject to the maximum federal long-term capital gain tax rate of 20% and the Medicare surtax of 3.8%. 2. The property included in this example is not considered a personal residence for tax purposes. Assumes no unrelated business taxable income (UBIT) and top ...

... 1. This assumes all realized gains are subject to the maximum federal long-term capital gain tax rate of 20% and the Medicare surtax of 3.8%. 2. The property included in this example is not considered a personal residence for tax purposes. Assumes no unrelated business taxable income (UBIT) and top ...

Is the weakness of formal rural finance a supply

... A majority of farmers in Piura and Huancayo claim having access to formal loans ...

... A majority of farmers in Piura and Huancayo claim having access to formal loans ...

SME`s and Africa

... but growth is now at risk of stalling as export markets slow and commodity prices especially oil – fall governments be held more accountable for the responsible use of funds by national institutions, development agencies and investors so that funds are used wisely to continue sub-Saharan Africa’s ...

... but growth is now at risk of stalling as export markets slow and commodity prices especially oil – fall governments be held more accountable for the responsible use of funds by national institutions, development agencies and investors so that funds are used wisely to continue sub-Saharan Africa’s ...

Applications of Quantile Regression

... Total asset turnover=Net sales/total assets (TAT is a measure of how well assets are being used to produce revenue) Current ratio=Current assets/current liability (Current ratio is an indication of a company's ability to meet short-term debt obligations; the higher the ratio, the more liquid the com ...

... Total asset turnover=Net sales/total assets (TAT is a measure of how well assets are being used to produce revenue) Current ratio=Current assets/current liability (Current ratio is an indication of a company's ability to meet short-term debt obligations; the higher the ratio, the more liquid the com ...

msc macro lecture slides

... • high level of scrutiny of CB needed - openness of how decisions are reached - subject to scrutiny / questioning by elected body • increasing emphasis placed on controlling interest rates - less emphasis on controlling money supply - use open market operations to control interest rates • accurate ...

... • high level of scrutiny of CB needed - openness of how decisions are reached - subject to scrutiny / questioning by elected body • increasing emphasis placed on controlling interest rates - less emphasis on controlling money supply - use open market operations to control interest rates • accurate ...

Budgets!

... • Unfortunately the cost savings in fuel and energy are less than the increase in mortgage and rent. ...

... • Unfortunately the cost savings in fuel and energy are less than the increase in mortgage and rent. ...

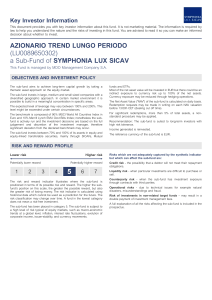

AZIONARIO TREND LUNGO PERIODO (LU0089650302) a Sub

... The sub-fund aims to achieve long-term capital growth by taking a thematic asset approach on the equity market. The sub-fund invests in large, medium and small sized companies with a diversified geographic approach. In certain market environment it is possible to build in a meaningful concentration ...

... The sub-fund aims to achieve long-term capital growth by taking a thematic asset approach on the equity market. The sub-fund invests in large, medium and small sized companies with a diversified geographic approach. In certain market environment it is possible to build in a meaningful concentration ...

Chapter 7 PPP

... Assets: what the company owns (i.e. cash, inventory, accounts receivable, equipment, buildings, land) Liabilities: what the company owes (i.e. bills, debt) Equity: capital the stockholders have invested in the company ...

... Assets: what the company owns (i.e. cash, inventory, accounts receivable, equipment, buildings, land) Liabilities: what the company owes (i.e. bills, debt) Equity: capital the stockholders have invested in the company ...

1 - TestbankU

... you use: a credit union, a pension fund, or an investment bank? You would likely use a credit union if you were a member, since their primary business is consumer loans. In some cases it is possible to borrow directly from pension funds, but it can come with high borrowing costs and tax implications ...

... you use: a credit union, a pension fund, or an investment bank? You would likely use a credit union if you were a member, since their primary business is consumer loans. In some cases it is possible to borrow directly from pension funds, but it can come with high borrowing costs and tax implications ...

Threadneedle UK Select Fund

... Corporate credit quality is still improving relative to sovereign quality Source (left hand chart) Merrill Lynch, JPMorgan as at September 2012. European Spread used is the HPS2 Index. US Spread is H0A0 Index; (right hand table): Merrill Lynch and Threadneedle as at January 2013. ...

... Corporate credit quality is still improving relative to sovereign quality Source (left hand chart) Merrill Lynch, JPMorgan as at September 2012. European Spread used is the HPS2 Index. US Spread is H0A0 Index; (right hand table): Merrill Lynch and Threadneedle as at January 2013. ...

State of Competition Regime in Ghana Preliminary

... to cut production costs to enable them stay in the markets. Government has been supporting domestic private enterprises with financial incentives to make them more competitive. However, manufacturers contend that the country’s tariff structure places local producers at a competitive disadvantage com ...

... to cut production costs to enable them stay in the markets. Government has been supporting domestic private enterprises with financial incentives to make them more competitive. However, manufacturers contend that the country’s tariff structure places local producers at a competitive disadvantage com ...

Chapter 23 Possible Futures - Social Science Computing Cooperative

... Creating a genuine public health care system The capitalist market has proven an inadequate mechanism for producing high quality health care universally accessible. Rather than having a basically private system of health care delivery, with public provision filling gaps and dealing with the most ser ...

... Creating a genuine public health care system The capitalist market has proven an inadequate mechanism for producing high quality health care universally accessible. Rather than having a basically private system of health care delivery, with public provision filling gaps and dealing with the most ser ...

Eduardo Cavallo

... It is necessary that lender (and borrower)-oflast-resort functions, similar to those that governments perform in developed economies, be recreated for LAC by multilateral institutions, so that liquidity concerns are kept at bay. ...

... It is necessary that lender (and borrower)-oflast-resort functions, similar to those that governments perform in developed economies, be recreated for LAC by multilateral institutions, so that liquidity concerns are kept at bay. ...

Sample Memo to Client

... withdrawals until after age 70½, you may need to access money from taxable accounts. In that case, the first step should be to sell stocks and mutual funds that carry unrealized capital losses. Such losses can produce a $3,000 annual deduction against ordinary income that is taxed at a high tax rate ...

... withdrawals until after age 70½, you may need to access money from taxable accounts. In that case, the first step should be to sell stocks and mutual funds that carry unrealized capital losses. Such losses can produce a $3,000 annual deduction against ordinary income that is taxed at a high tax rate ...

THE FINANCIAL TREND MONITORING SYSTEM

... The organizational factors are the responses the government makes to changes in the environmental factors. It may be assumed in theory that any government can remain in good financial condition if it makes the proper organizational response to adverse conditions by reducing services, increasing eff ...

... The organizational factors are the responses the government makes to changes in the environmental factors. It may be assumed in theory that any government can remain in good financial condition if it makes the proper organizational response to adverse conditions by reducing services, increasing eff ...

CLTL - PowerShares Treasury Collateral Portfolio fund in

... traditional investments and are subject to market, interest rate, credit, leverage, counterparty and management risks. An investment in a derivative could lose more than the cash amount invested. The Fund may engage in frequent trading of its portfolio securities in connection with the rebalancing o ...

... traditional investments and are subject to market, interest rate, credit, leverage, counterparty and management risks. An investment in a derivative could lose more than the cash amount invested. The Fund may engage in frequent trading of its portfolio securities in connection with the rebalancing o ...