Cash Flow Statement for the year ended 31st March, 2016

... 3. CASH AND CASH EQUIVALENTS: Cash and cash equivalents as above Other bank balances Unrealised Gain/(Loss) on Foreign Currency Cash and cash equivalents Cash and bank balances (Note 16) ...

... 3. CASH AND CASH EQUIVALENTS: Cash and cash equivalents as above Other bank balances Unrealised Gain/(Loss) on Foreign Currency Cash and cash equivalents Cash and bank balances (Note 16) ...

The European Central Bank as a lender of last resort

... The ECB has been unduly influenced by the theory that inflation should be the only concern of a central bank. It is becoming increasingly clear that financial stability should also be on the radar screen of a central bank. In fact, most central banks have been created to solve an endemic problem of ...

... The ECB has been unduly influenced by the theory that inflation should be the only concern of a central bank. It is becoming increasingly clear that financial stability should also be on the radar screen of a central bank. In fact, most central banks have been created to solve an endemic problem of ...

Data/hora: 20/04/2017 01:27:08 Provedor de dados: 31 País: United

... Resumo: Average net farm income rebounded to $70,007 in 2002 for the 188 farms included in this annual report of the Southwestern Minnesota Farm Business Management Association. This is a sharp increase (91%) from the average net farm income of $36,614 in 2001. As in previous years, the actual profi ...

... Resumo: Average net farm income rebounded to $70,007 in 2002 for the 188 farms included in this annual report of the Southwestern Minnesota Farm Business Management Association. This is a sharp increase (91%) from the average net farm income of $36,614 in 2001. As in previous years, the actual profi ...

1 Ford Research Paper: Ford Motor Company Timothy Gnadt GB550

... generate positive income form its revenue streams. (See Enclosure 1 for the total debt to equity ration for the year ending 2006). Ford had taken on a great deal of debt and while this was a well-timed strategic maneuver the company had assumed a great deal of risk by doing so. Both business and fin ...

... generate positive income form its revenue streams. (See Enclosure 1 for the total debt to equity ration for the year ending 2006). Ford had taken on a great deal of debt and while this was a well-timed strategic maneuver the company had assumed a great deal of risk by doing so. Both business and fin ...

FOR IMMEDIATE RELEASE May 2, 2017 PINNACLE WEST

... actual results may differ materially from expectations, we caution readers not to place undue reliance on these statements. A number of factors could cause future results to differ materially from historical results, or from outcomes currently expected or sought by Pinnacle West or APS. These factor ...

... actual results may differ materially from expectations, we caution readers not to place undue reliance on these statements. A number of factors could cause future results to differ materially from historical results, or from outcomes currently expected or sought by Pinnacle West or APS. These factor ...

sygnia skeleton worldwide flexible fund

... without the investment limitations of Regulation 28 of the Pension Funds Act. The risk profile of the Sygnia Skeleton Worldwide Flexible Fund is medium-tohigh, with an unconstrained allocation to South African and global equities. It is also suited to individual investors seeking higher returns whil ...

... without the investment limitations of Regulation 28 of the Pension Funds Act. The risk profile of the Sygnia Skeleton Worldwide Flexible Fund is medium-tohigh, with an unconstrained allocation to South African and global equities. It is also suited to individual investors seeking higher returns whil ...

FIN 534 FIN534 Quiz 9 - Welcome to homeworks.16mb.com!

... cash budget. If a firm has a relatively aggressive current asset financing policy vis-à-vis other firms in its industry, then its current ratio will probably be relatively high. 2 points Question 9 1. Which of the following statements is CORRECT? Answer Under normal conditions, a firm’s expected RO ...

... cash budget. If a firm has a relatively aggressive current asset financing policy vis-à-vis other firms in its industry, then its current ratio will probably be relatively high. 2 points Question 9 1. Which of the following statements is CORRECT? Answer Under normal conditions, a firm’s expected RO ...

download

... dozens of countries, via an intranet. Cisco’s infrastructure will permit information sharing almost instantly. Cisco is implementing such a system for itself. Closing the quarterly accounts used to take up to 10 days. Within 4 years, the chief financial officer worked the close down to 2 days (and s ...

... dozens of countries, via an intranet. Cisco’s infrastructure will permit information sharing almost instantly. Cisco is implementing such a system for itself. Closing the quarterly accounts used to take up to 10 days. Within 4 years, the chief financial officer worked the close down to 2 days (and s ...

chapter 12 practice questions

... a. instalment method should be used. b. revenue should be recognized at the completion date. c. percentage-of-completion method should be used. d. contract should not be accepted. ...

... a. instalment method should be used. b. revenue should be recognized at the completion date. c. percentage-of-completion method should be used. d. contract should not be accepted. ...

Quantitative Stock Selection: Dynamic Factor Weights

... flag the sectors where the factor works well (or works very poorly). The scoring screen will take that information into account. ...

... flag the sectors where the factor works well (or works very poorly). The scoring screen will take that information into account. ...

Are your bonds really `green`?

... To build the Solactive Green Bond EUR USD IG Index (Bloomberg: SGREENIG), we start with an eligible universe of green bonds that have either received direct certification from the CBI, or their accreditation. From there, quality, liquidity and maturity filters are applied to ensure the index is inve ...

... To build the Solactive Green Bond EUR USD IG Index (Bloomberg: SGREENIG), we start with an eligible universe of green bonds that have either received direct certification from the CBI, or their accreditation. From there, quality, liquidity and maturity filters are applied to ensure the index is inve ...

Policies start to shift direction

... agreement just means the automatic across-the-board budget cuts, spanned over 10 years, will be triggered in 2013. The cuts will be split equally between defense and non-defense programs (such as education and public housing programs). Meanwhile, programs such as Children’s Health Programs, Social S ...

... agreement just means the automatic across-the-board budget cuts, spanned over 10 years, will be triggered in 2013. The cuts will be split equally between defense and non-defense programs (such as education and public housing programs). Meanwhile, programs such as Children’s Health Programs, Social S ...

Fund Profile - nab asset management

... Returns are not guaranteed and actual returns may vary from any target returns described in this document. Any projection or other forward looking statement (‘Projection’) in this report is provided for information purposes only. No representation is made as to the accuracy or reasonableness of any ...

... Returns are not guaranteed and actual returns may vary from any target returns described in this document. Any projection or other forward looking statement (‘Projection’) in this report is provided for information purposes only. No representation is made as to the accuracy or reasonableness of any ...

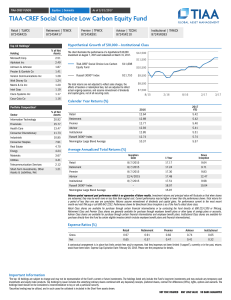

TIAA-CREF Social Choice Low Carbon Equity Fund

... Social Governance (ESG) guidelines. As a result, the universe of investments available to the Fund will be more limited than other funds that do not apply such guidelines. ESG criteria risk is the risk that because the Fund’s ESG criteria exclude securities of certain issuers for nonfinancial reason ...

... Social Governance (ESG) guidelines. As a result, the universe of investments available to the Fund will be more limited than other funds that do not apply such guidelines. ESG criteria risk is the risk that because the Fund’s ESG criteria exclude securities of certain issuers for nonfinancial reason ...

BALANCE ESTRUCTURAL

... Such change implied moving from the provision of classical public goods to become massive service providers Today 3/4 of government activity is providing services Yet service provision from governments is supposed to happen in a transparent, objective way This results in government organizations hav ...

... Such change implied moving from the provision of classical public goods to become massive service providers Today 3/4 of government activity is providing services Yet service provision from governments is supposed to happen in a transparent, objective way This results in government organizations hav ...

Market Commentary

... The S&P/ASX 200 Accumulation Index climbed 3.4% during the quarter and closed December on its highs for the year. Over 2009, the Australian sharemarket added 37%, compared to a fall of 38% in 2008 and 16% in 2007. While economic conditions have brightened and equity valuations have increased, howeve ...

... The S&P/ASX 200 Accumulation Index climbed 3.4% during the quarter and closed December on its highs for the year. Over 2009, the Australian sharemarket added 37%, compared to a fall of 38% in 2008 and 16% in 2007. While economic conditions have brightened and equity valuations have increased, howeve ...

Crowding Out Redefined: The Role of Reserve Accumulation Alan M. Taylor COmmenTaRY

... stage for both a policy that redirects government borrowing toward the domestic market and a central bank that strives to build a foreign exchange war chest as a financial stability policy tool.” The paper is asking us to think about the possible downsides to this response in the emerging economies, ...

... stage for both a policy that redirects government borrowing toward the domestic market and a central bank that strives to build a foreign exchange war chest as a financial stability policy tool.” The paper is asking us to think about the possible downsides to this response in the emerging economies, ...

Capitalism After the Crisis

... he economic cr isis of the past year, centered as it has been in the financial sector that lies at the heart of American capitalism, is bound to leave some lasting marks. Financial regulation, the role of large banks, and the relationships between the government and key players in the market will ne ...

... he economic cr isis of the past year, centered as it has been in the financial sector that lies at the heart of American capitalism, is bound to leave some lasting marks. Financial regulation, the role of large banks, and the relationships between the government and key players in the market will ne ...

Atlantic City`s Casino Closings Have Far

... Boardwalk and features a Rain Forest Cafe, announced they expect to close around mid-September. These recent closing announcements could bring the total casino count from twelve at the end of 2013 to eight by the end of 2014. If all four casinos close, Atlantic City faces a loss of about one-third o ...

... Boardwalk and features a Rain Forest Cafe, announced they expect to close around mid-September. These recent closing announcements could bring the total casino count from twelve at the end of 2013 to eight by the end of 2014. If all four casinos close, Atlantic City faces a loss of about one-third o ...

Opportunities for Small Life Insurance Companies to Improve Asset

... asset allocation decisions and risk tolerance levels. With the exception of the 2008 crisis period, overall bond yields have declined meaningfully over the last decade, and opportunities to invest for yield have diminished. Looking at Figure 7, we can see smaller companies’ net yield has been impact ...

... asset allocation decisions and risk tolerance levels. With the exception of the 2008 crisis period, overall bond yields have declined meaningfully over the last decade, and opportunities to invest for yield have diminished. Looking at Figure 7, we can see smaller companies’ net yield has been impact ...

Apple - Tajfan.com

... players, software, and many other products that have advanced technology from what it used to be, as well as creating new needs from the consumers. ...

... players, software, and many other products that have advanced technology from what it used to be, as well as creating new needs from the consumers. ...

The Role of the Financial Sector

... Guarantees are better suited for tackling credit constraints, and are particularly efficient when private banks are excessively risk averse and the guarantor has superior enforcement capacity or information on collateral value. Cheap funding is ideal for targeting firms that generate positive spillo ...

... Guarantees are better suited for tackling credit constraints, and are particularly efficient when private banks are excessively risk averse and the guarantor has superior enforcement capacity or information on collateral value. Cheap funding is ideal for targeting firms that generate positive spillo ...

Understanding The Changing Farm Economy:

... some might mean simply changing repayment terms on existing debt. For other farm businesses, restructuring may mean sale of farmland to reduce debt as well as the elimination of specific production enterprises. Certainly some farm families will choose to sell out and leave farming. The most vulnerab ...

... some might mean simply changing repayment terms on existing debt. For other farm businesses, restructuring may mean sale of farmland to reduce debt as well as the elimination of specific production enterprises. Certainly some farm families will choose to sell out and leave farming. The most vulnerab ...