to view Full text

... tools, and Textile machinery. Among all the sub sectors Process plant equipment and Electrical equipment segments have been the engines of growth of the global capital goods industry and growth of this sector plays a very important role for a growing economy like India. Considering the recent state ...

... tools, and Textile machinery. Among all the sub sectors Process plant equipment and Electrical equipment segments have been the engines of growth of the global capital goods industry and growth of this sector plays a very important role for a growing economy like India. Considering the recent state ...

Consumer finances today

... Tax on inertia: paying the invisible penalty Many people are paying more than they should for inappropriate financial products, and haven’t made the best choices when it comes to planning for the future. In many cases this is simply because it’s easier to carry on as you are than take action. Many p ...

... Tax on inertia: paying the invisible penalty Many people are paying more than they should for inappropriate financial products, and haven’t made the best choices when it comes to planning for the future. In many cases this is simply because it’s easier to carry on as you are than take action. Many p ...

How mobile is capital within the European Union?

... The definition of FDI positions in EUROSTAT is broader than that used in Hines (1996): it comprises all assets rather than only PPE. However, at least part of EUROSTAT FDI should precipitate as PPE because of the lasting interest of the direct investor, operationalised by the ten percent ownership r ...

... The definition of FDI positions in EUROSTAT is broader than that used in Hines (1996): it comprises all assets rather than only PPE. However, at least part of EUROSTAT FDI should precipitate as PPE because of the lasting interest of the direct investor, operationalised by the ten percent ownership r ...

Experience - Berkshire Asset Management, LLC

... For illustrative purposes only. Holdings, sector weightings, market capitalization and portfolio characteristics are based on representative portfolio and are subject to change at any time. Holdings, sector weightings, market capitalization and portfolio characteristics of individual client portfoli ...

... For illustrative purposes only. Holdings, sector weightings, market capitalization and portfolio characteristics are based on representative portfolio and are subject to change at any time. Holdings, sector weightings, market capitalization and portfolio characteristics of individual client portfoli ...

Portfolio agency name - Department of Health

... transparency of Government spending and performance, as Programs represent the primary means by which agencies address and achieve Government Outcomes. ...

... transparency of Government spending and performance, as Programs represent the primary means by which agencies address and achieve Government Outcomes. ...

The Aggregate Demand Schedule

... A = M/P + (P B /P)B , but Ricardian Equivalence (Barro: government bonds are not net wealth) would suggest just including real money balances. The Pigou effect is also known as the real balance effect. I How does the Pigou effect operate? I A reduction in the price level raises consumers’ net real w ...

... A = M/P + (P B /P)B , but Ricardian Equivalence (Barro: government bonds are not net wealth) would suggest just including real money balances. The Pigou effect is also known as the real balance effect. I How does the Pigou effect operate? I A reduction in the price level raises consumers’ net real w ...

Key Investor Information

... Currency risk: The fund can be exposed to different currencies. Changes in foreign exchange rates could create losses. Derivatives risk: A derivative may not perform as expected, and may create losses greater than the cost of the derivative. Equity risk: Equity prices fluctuate daily, based on many ...

... Currency risk: The fund can be exposed to different currencies. Changes in foreign exchange rates could create losses. Derivatives risk: A derivative may not perform as expected, and may create losses greater than the cost of the derivative. Equity risk: Equity prices fluctuate daily, based on many ...

Review of the Transport Situation and Emerging Trends

... that the extra tax amounts should be returned to those who paid them or be invested to their benefit, e.g. for developing or maintaining the road transport network. 19. The redistribution or use of such additional revenues is the responsibility of governments. Ideally, the authorities would use the ...

... that the extra tax amounts should be returned to those who paid them or be invested to their benefit, e.g. for developing or maintaining the road transport network. 19. The redistribution or use of such additional revenues is the responsibility of governments. Ideally, the authorities would use the ...

Chapter One : Introduction - Pakistan Institute of Development

... system of subsidies for agriculture and industries. The outcome was a lack of fiscal discipline, and the public services fostered (thus diminishing economy’s ability to grow) endemic inefficiencies in the process of intervening in the market pricing process. Educational, social and health services w ...

... system of subsidies for agriculture and industries. The outcome was a lack of fiscal discipline, and the public services fostered (thus diminishing economy’s ability to grow) endemic inefficiencies in the process of intervening in the market pricing process. Educational, social and health services w ...

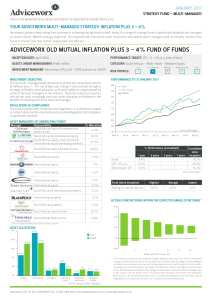

adviceworx old mutual inflation plus 3

... • You should ideally see unit trusts as a medium- to long-term investment. The fluctuations of particular investment strategies affect how a fund performs. Your fund value may go up or down. Therefore, we cannot guarantee the investment capital or return of your investment. How a fund has performed ...

... • You should ideally see unit trusts as a medium- to long-term investment. The fluctuations of particular investment strategies affect how a fund performs. Your fund value may go up or down. Therefore, we cannot guarantee the investment capital or return of your investment. How a fund has performed ...

search for yield

... larger credit and liquidity risk. In recent years, the US non-financial corporate sector has issued increasing volumes of high-yield bonds and high-yield syndicated loans (see Figures 5 and 6). In the euro area, where companies have tried to a greater extent to reduce their substantial leverage and ...

... larger credit and liquidity risk. In recent years, the US non-financial corporate sector has issued increasing volumes of high-yield bonds and high-yield syndicated loans (see Figures 5 and 6). In the euro area, where companies have tried to a greater extent to reduce their substantial leverage and ...

Menendez FY 14 Appropriations Request Letter

... distressed urban and rural communities by investing in and growing Community Development Financial Institutions (CDFIs) across the country. CDFIs, are community-based, mission-driven financial institutions that specialize in delivering affordable credit, capital, and financial services to residents ...

... distressed urban and rural communities by investing in and growing Community Development Financial Institutions (CDFIs) across the country. CDFIs, are community-based, mission-driven financial institutions that specialize in delivering affordable credit, capital, and financial services to residents ...

Document

... 2006 – IPO of KazMunayGas Exploration and Production shares with the use of KASE settlement system 2006 – secondary distribution of KAZAKHMYS PLC (UK) shares with the use of KASE settlement system 2007 – special trading floor of the Regional Financial Center of Almaty city was founded on the base of ...

... 2006 – IPO of KazMunayGas Exploration and Production shares with the use of KASE settlement system 2006 – secondary distribution of KAZAKHMYS PLC (UK) shares with the use of KASE settlement system 2007 – special trading floor of the Regional Financial Center of Almaty city was founded on the base of ...

KASE Standard Presentation dated November 1, 2007

... 2006 – IPO of KazMunayGas Exploration and Production shares with the use of KASE settlement system 2006 – secondary distribution of KAZAKHMYS PLC (UK) shares with the use of KASE settlement system 2007 – special trading floor of the Regional Financial Center of Almaty city was founded on the base of ...

... 2006 – IPO of KazMunayGas Exploration and Production shares with the use of KASE settlement system 2006 – secondary distribution of KAZAKHMYS PLC (UK) shares with the use of KASE settlement system 2007 – special trading floor of the Regional Financial Center of Almaty city was founded on the base of ...

Q2 - Aristotle Funds

... The Aristotle/Saul Global Opportunities Fund returned 4.12% in the first half of 2014, with 28.7% of the portfolio invested in U.S. equities and 54.2% invested in non-U.S. equities, 11% in bonds and 2% in platinum on average, during the period. 1H2014 Leaders and Laggards ...

... The Aristotle/Saul Global Opportunities Fund returned 4.12% in the first half of 2014, with 28.7% of the portfolio invested in U.S. equities and 54.2% invested in non-U.S. equities, 11% in bonds and 2% in platinum on average, during the period. 1H2014 Leaders and Laggards ...

West Thames HR Exchange Club 11th April 2002

... “A curious time to talk Strategy” • The heroes of the economy are the purchasers of DVD’s and Per Una! • But we all need to save more for retirement • If we all did, then the economy could plummet! ...

... “A curious time to talk Strategy” • The heroes of the economy are the purchasers of DVD’s and Per Una! • But we all need to save more for retirement • If we all did, then the economy could plummet! ...

Pricing models of covered bonds—a Nordic study

... Covered bonds are an alternative way of investing indirectly in the debt side of real estate, which is beneficial for investors looking for alternatives to government or corporate bonds. Due to the dual nature of the protection offered by covered bonds, they have a justified place in investors’ port ...

... Covered bonds are an alternative way of investing indirectly in the debt side of real estate, which is beneficial for investors looking for alternatives to government or corporate bonds. Due to the dual nature of the protection offered by covered bonds, they have a justified place in investors’ port ...

Midterm Exam

... consumption in period 1 when savings is equal to that solved under certainty in part a. When savings is zero, consumption must be equal to income which is either 50 or 150. Marginal utility is either (1000-50= 950) or (1000-150) = 850. The average or expected value of these two outcomes is 900. c. I ...

... consumption in period 1 when savings is equal to that solved under certainty in part a. When savings is zero, consumption must be equal to income which is either 50 or 150. Marginal utility is either (1000-50= 950) or (1000-150) = 850. The average or expected value of these two outcomes is 900. c. I ...

Democratic Commissioners’ Views Is America’s trade deficit sustainable? The

... to maintain high levels of current account deficits longer, because higher levels of net foreign debt can be accumulated without the debt-to-GDP ratio rising. The service on the debt is lower if the interest rate on debt obligations is lower or if a higher share of the debt is in the form of equity ...

... to maintain high levels of current account deficits longer, because higher levels of net foreign debt can be accumulated without the debt-to-GDP ratio rising. The service on the debt is lower if the interest rate on debt obligations is lower or if a higher share of the debt is in the form of equity ...

Saving and Investing in the New Economy

... opportunities. The ―mortgage- backed securities‖ and ―collateralized debt obligations‖ that have been discussed in the news during the past few years represent a small number of financial products that have emerged over the last two decades. The economy has been further complicated by the increased ...

... opportunities. The ―mortgage- backed securities‖ and ―collateralized debt obligations‖ that have been discussed in the news during the past few years represent a small number of financial products that have emerged over the last two decades. The economy has been further complicated by the increased ...

Robo Advisors: Looking Beyond the Low-Cost

... • Large allocation of assets to emerging markets algorithms cannot comprehend these real-life situations. And what about the value of com• Lack of small-cap and value tilts that can passion and empathy when it comes to helping increase returns over the long term someone navigate life? Compassion and ...

... • Large allocation of assets to emerging markets algorithms cannot comprehend these real-life situations. And what about the value of com• Lack of small-cap and value tilts that can passion and empathy when it comes to helping increase returns over the long term someone navigate life? Compassion and ...

Finance 534 week 10 quiz 9 Question 1 Which of the following

... Accruals are "free" in the sense that no explicit interest is paid on these funds. A conservative approach to working capital management will result in most if not all permanent current operating assets being financed with long-term capital. The risk to a firm that borrows with short-term credit is ...

... Accruals are "free" in the sense that no explicit interest is paid on these funds. A conservative approach to working capital management will result in most if not all permanent current operating assets being financed with long-term capital. The risk to a firm that borrows with short-term credit is ...

Microcredit: Conceptual Aspects Asymmetry of Information

... overcome, foregoing costly searches and monitoring. However, the poor’s assets are not, in general, valid guarantees for loans, as they do not have regularized properties nor verifiable income flow. This way, the poor’s problem is not only the need of assets or opportunities, but also the low quali ...

... overcome, foregoing costly searches and monitoring. However, the poor’s assets are not, in general, valid guarantees for loans, as they do not have regularized properties nor verifiable income flow. This way, the poor’s problem is not only the need of assets or opportunities, but also the low quali ...

Municipal Bonds - Village of Homer Glen

... can be issued at a fixed rate or a variable rate, or a combination thereof. A typical bond is issued at a fixed rate for the term of the bond and usually subject to redemption (call) after a period of 7 years which allows the bond to be refunded at a lower rate if the market allows. Because variable ...

... can be issued at a fixed rate or a variable rate, or a combination thereof. A typical bond is issued at a fixed rate for the term of the bond and usually subject to redemption (call) after a period of 7 years which allows the bond to be refunded at a lower rate if the market allows. Because variable ...