Journal of Personal Finance

... 4 percent withdrawal rate rule. This rule suggests that retirees can safely sustain retirement withdrawals for at least 30 years by initially withdrawing 4 percent of their savings and adjusting this amount for inflation in subsequent years. But, the time period covered in these studies represents a ...

... 4 percent withdrawal rate rule. This rule suggests that retirees can safely sustain retirement withdrawals for at least 30 years by initially withdrawing 4 percent of their savings and adjusting this amount for inflation in subsequent years. But, the time period covered in these studies represents a ...

PPT Presentation [ - 1.37 MB ]

... Saving helps make your future financially secure A savings plan based on regular contributions lets you accumulate money Compound interest grows your savings faster Start early to give your savings time to grow ...

... Saving helps make your future financially secure A savings plan based on regular contributions lets you accumulate money Compound interest grows your savings faster Start early to give your savings time to grow ...

Starting Investing at Age 50

... • 30% say they will have to work into 80s to retire; however, 22.5% between 60-84 report employment disability • Start with the goal and work backwards – expenses in retirement and how much you have to save to get there http://www.hullfinancialplanning.com http://www.pewsocialtrends.org/2007/01/04/m ...

... • 30% say they will have to work into 80s to retire; however, 22.5% between 60-84 report employment disability • Start with the goal and work backwards – expenses in retirement and how much you have to save to get there http://www.hullfinancialplanning.com http://www.pewsocialtrends.org/2007/01/04/m ...

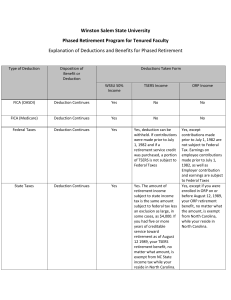

Explanation of Deductions and Benefits for Phased Retirement

... subject to state income tax is the same amount subject to federal tax less an exclusion as large, in some cases, as $4,000. If you had five or more years of creditable service toward retirement as of August 12 1989, your TSERS retirement benefit, no matter what amount, is exempt from NC State income ...

... subject to state income tax is the same amount subject to federal tax less an exclusion as large, in some cases, as $4,000. If you had five or more years of creditable service toward retirement as of August 12 1989, your TSERS retirement benefit, no matter what amount, is exempt from NC State income ...

Los Angeles Based Financial Advisor Providing FREE Financial

... and their personal lives. Because ACap works primarily with medical professionals, we better understand the unique needs and circumstances of our clients, and provide highly personalized and professional service. Our clients are highly skilled professionals with busy careers, many have little time t ...

... and their personal lives. Because ACap works primarily with medical professionals, we better understand the unique needs and circumstances of our clients, and provide highly personalized and professional service. Our clients are highly skilled professionals with busy careers, many have little time t ...

tcrs- legacy

... Each year that you are actively employed, TCRS will prepare an annual statement for you. The statement will show the salaries reported to TCRS, the amount of service credit you have with TCRS, your vesting This brochure is intended to provide a general introduction to some of the provisions applicab ...

... Each year that you are actively employed, TCRS will prepare an annual statement for you. The statement will show the salaries reported to TCRS, the amount of service credit you have with TCRS, your vesting This brochure is intended to provide a general introduction to some of the provisions applicab ...

Pension systems and financial crisis

... • While fall in wages and employment will eventually translate into lower future benefits and expenditure, transitional fiscal gap can be large and are policy dependent ...

... • While fall in wages and employment will eventually translate into lower future benefits and expenditure, transitional fiscal gap can be large and are policy dependent ...

Personal Financial Coaching

... comfortable retirement seems to be of universal concern. However, Duffy reports that specific “goal setting is the most often overlooked component of financial education programs…” 15 Most have some idea of the activities they would like to pursue in their golden years such as travel, leisure, time ...

... comfortable retirement seems to be of universal concern. However, Duffy reports that specific “goal setting is the most often overlooked component of financial education programs…” 15 Most have some idea of the activities they would like to pursue in their golden years such as travel, leisure, time ...

Preparing for Retirement

... • However, do not put your retirement at risk to help with your children’s education • Do not borrow against your retirement assets or your home to help with children’s education expenses! • 4. Get serious about retirement planning • Get the budget in place • Reduce both fixed and variable expenses ...

... • However, do not put your retirement at risk to help with your children’s education • Do not borrow against your retirement assets or your home to help with children’s education expenses! • 4. Get serious about retirement planning • Get the budget in place • Reduce both fixed and variable expenses ...

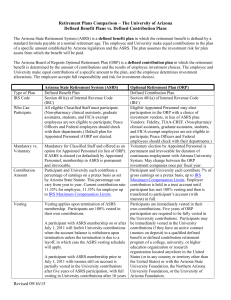

Retirement Plans Comparison - Human Resources

... coverage that will pay a monthly benefit when participant is disabled and unable to work for an extended period of time, generally six months or more. LTD coverage will pay up to 66% of predisability monthly earnings during disability. The current employee contribution is 0.12% of gross earnings. Th ...

... coverage that will pay a monthly benefit when participant is disabled and unable to work for an extended period of time, generally six months or more. LTD coverage will pay up to 66% of predisability monthly earnings during disability. The current employee contribution is 0.12% of gross earnings. Th ...

Addressing savings inefficiencies and deficiencies in

... broad range of stakeholders, of which our clients are a very important one." "We hold the savings and investments of the nation in our hands and we need to be successful in order to enable South Africans to retire with dignity," Van der Merwe added. Regulation with wide impact on the industry is the ...

... broad range of stakeholders, of which our clients are a very important one." "We hold the savings and investments of the nation in our hands and we need to be successful in order to enable South Africans to retire with dignity," Van der Merwe added. Regulation with wide impact on the industry is the ...

Article Title: How to Make Your Savings into Investments Author

... While she realized that her saving account getting her 5% return, is really with no risk and her financial advisor asking her to look for returns of 12 % over 20 years period was, in her opinion, was asking for too much risk, as she understood it initially. So, she started reading about risk versus ...

... While she realized that her saving account getting her 5% return, is really with no risk and her financial advisor asking her to look for returns of 12 % over 20 years period was, in her opinion, was asking for too much risk, as she understood it initially. So, she started reading about risk versus ...

Discussion Paper Proposal Form

... population. Furthermore, prior researcher claim that soft factors as time for the family is also an important factor if it comes to early retirement. However, it also says that individuals need a task to give their live a meaning, even beyond retirement. The aim is to find out what kind of meaning t ...

... population. Furthermore, prior researcher claim that soft factors as time for the family is also an important factor if it comes to early retirement. However, it also says that individuals need a task to give their live a meaning, even beyond retirement. The aim is to find out what kind of meaning t ...

![PPT Presentation [ - 1.37 MB ]](http://s1.studyres.com/store/data/013861489_1-933a2e2cdb1f2e99ba519c431dd25a9f-300x300.png)