* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Consumption & Investment

Survey

Document related concepts

Internal rate of return wikipedia , lookup

Private equity secondary market wikipedia , lookup

Financial economics wikipedia , lookup

Negative gearing wikipedia , lookup

Present value wikipedia , lookup

Public finance wikipedia , lookup

Land banking wikipedia , lookup

Stock valuation wikipedia , lookup

Private equity in the 1980s wikipedia , lookup

Business valuation wikipedia , lookup

Financialization wikipedia , lookup

Stock selection criterion wikipedia , lookup

Early history of private equity wikipedia , lookup

Investment fund wikipedia , lookup

Global saving glut wikipedia , lookup

Transcript

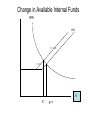

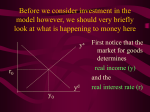

Consumption & Investment Supplement Multiplier Effect An exogenous change in demand has a larger effect on total demand, the larger is the effect of current GDP on consumption of domestic goods. If budget constraints or precautionary savings are important then mpc may be high and mpd high. If economy is very open, like HK mpim may be high and mpd low. Conclusion Consumption is major component of demand and moves closely with business cycle. Perfect Lending Markets suggest: Consumption Choice should depend on the present value of lifetime income. Future changes in income should have roughly same impact as future income. Permanent increases in income should have a stronger impact on consumption than temporary increases (which should be largely saved). Permanent Income Hypothesis suggests: Households consume annuity value of the sum of their financial wealth plus their human wealth. This explains: Small Wealth Effect Demographic Behavior of savings. Conclusion pt. 2 Borrowing constraints and precautionary savings suggest that consumption should respond more to business cycle changes in income than PIH argues. Interest Rates have ambiguous theoretical impact on consumption and savings. Empirically, the effect of interest rates on savings is positive, but small. Degree of impact of current income on consumption of domestic goods determines multiplier Real Estate Chapter 23 Example A taxi agency can produce a certain amount of revenue with larger numbers of taxis (K = # of Taxis). Assume earnings (revenues minus wages minus costs) per year is given by the 3 schedule $200,000 4 K Assume that the purchase price of a new taxi (with license) is $1,000,000. The borrowing interest cost is 4% and a taxi’s value depreciates by 8% per year. We assume that taxi’s prices increase by 2% per year. Optimal Capital: Example Solve for Optimal Level of Capital PMPK $150, 000 1 4 (.04 .08 .02) $1, 000, 000 K $150, 000 14 * K K * 1.54 5.0625 $100, 000 MPK rck K K* MPK MPK’ rck K K* K** MPK rck’ rck K K** K* Tax Rates Corporations frequently must pay taxes on earnings. Define tax rate, . Corporations also receive deductions for costs of capital Define deduction rates = (s1, s2, s3, ….) Maximize after-tax profits implies that after-tax marginal product of capital = after-tax cost of capital. PK (1 ) PMPKt (1 s1 )i (1 s2 ) (1 s3 ) g Pt K , NEW Tax Wedge, tw, is defined as the extra cost of capital beyond the interest rate. PMPK t i g MPK t r g PK pK tw Pt K , NEW tw ptK Property the ultimate non-traded asset! Cost of Capital Theory & Real Estate Constructing New Buildings has long lead times. For a fixed stock of buildings we can use cost of capital theory (y = ckRE) to derive prices as a function of rents. R ck P RE 1 (i c tw g 1 (i c tw Pt RE 1 Pt RE 1 ) R P RE ) R Real Estate Pricing 1 (i c tw Pt RE 1 Pt RE 45% PRE P* 1 ) R Calculating q: China Steel 2000 Market Capitalization = Stock Price × # of Shares Proxy for Replacement Value of Capital – Book Value of PP&E. Proxy for Firm Value = Market Capitalization + Book Value of Total Debt Caveat: Intangible Assets (i.e. Technology) May Be Large for Some Firms (e.g. Acer Inc. has a 2000 q > 4). Caveat: Book value of PP&E may underestimate replacement costs of capital as it does not adjust for inflation. Firm Balance Sheets. Stock Price # of Shares Market Cap Book Value of PPE Total Debt Firm Value q $19.5 8,748,363,000 $170,593,078,500 $118,415,993,000 $38,228,396,000 $208,821,474,500 1.763456685 The Financial Accelerator Adverse Economic Shock Fire sales of commercial property to pay back bank loans leading to further declines in prices Falling collateral values and worsening bank balance sheets lead to declining bank loans Declining corporate net worth Lower investment and reduced demand for real estate Falling Real Estate Prices MPK rck K K* Change in Available Internal Funds MPK rck K K* K** Conclusion Cost of capital includes interest costs plus depreciation costs plus capital losses plus tax wedge. Capital stock that maximizes profits sets the marginal product of capital equal to the cost of capital. Business cycle fluctuations of capital investment are due to fluctuations in productivity and cost of capital. Investment is volatile because capital is large relative to investment in any given period. Small fluctuations in optimal capital have large effects on investment. Conclusion pt. 2 Optimal Capital Theory implies Corporate Investment is a function of q (market value of firm relative to the replacement value of capital). Real Estate prices are determined by rent divided by the determinants of the cost of capital. In reality, internal funds are the dominant source of finance for investment. External Financing interest costs may depend on the state of firms balance sheets. Firms’ balance sheets are an additional channel of business cycle volatility.