* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

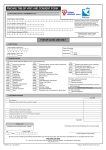

Download notes to the financial statements

Survey

Document related concepts

Land banking wikipedia , lookup

Negative gearing wikipedia , lookup

Business valuation wikipedia , lookup

Present value wikipedia , lookup

Investment fund wikipedia , lookup

Systemic risk wikipedia , lookup

Global financial system wikipedia , lookup

Investment management wikipedia , lookup

Financial economics wikipedia , lookup

Financial literacy wikipedia , lookup

Global saving glut wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Financial Crisis Inquiry Commission wikipedia , lookup

Financial crisis wikipedia , lookup

Systemically important financial institution wikipedia , lookup

Transcript